GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Is your trading experience at Apex Trader Funding nothing short of a woeful ride? Witnessing account bans and payout blocks? Have you been made to pay for an on-account evaluation? It seems you are with a scam forex broker. Many traders have expressed this concern on broker review platforms. Their growing concerns over a lack of ethical forex trading practices at Apex Trader Funding made us expose it. Read on to know what traders have been saying about this broker.

Is your trading experience at Apex Trader Funding nothing short of a woeful ride? Witnessing account bans and payout blocks? Have you been made to pay for an on-account evaluation? It seems you are with a scam forex broker. Many traders have expressed this concern on broker review platforms. Their growing concerns over a lack of ethical forex trading practices at Apex Trader Funding made us expose it. Read on to know what traders have been saying about this broker.

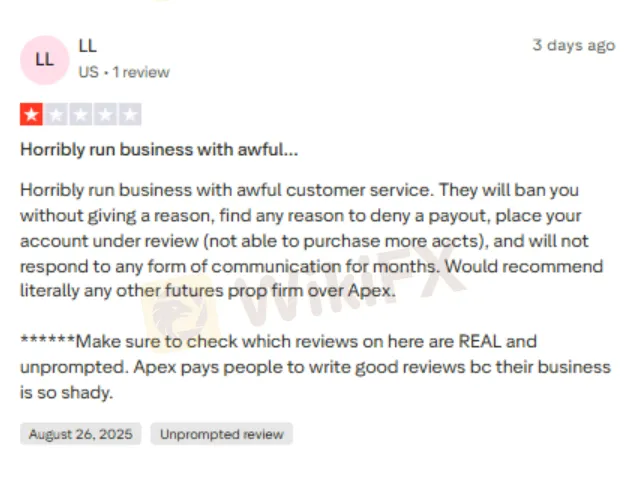

Trading issues can arise anywhere. However, as the customer support service helps resolve them, traders feel satisfied. However, nothing of that sort remains at Apex Trader Funding as traders do not find answers to their queries concerning account bans, payout denials, and more. Here is one screenshot wherein a trader has expressed concerns over the lack of effective customer support service.

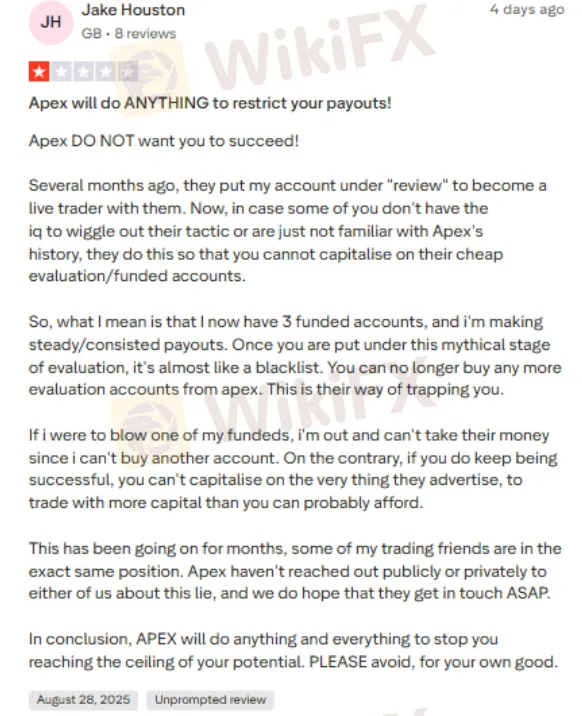

Traders constantly witness a myriad of issues concerning account evaluation. According to traders, it is one of the many scamming tactics the broker employs to defraud traders. It is like preventing traders from purchasing more evaluation accounts from Apex Trader Funding.

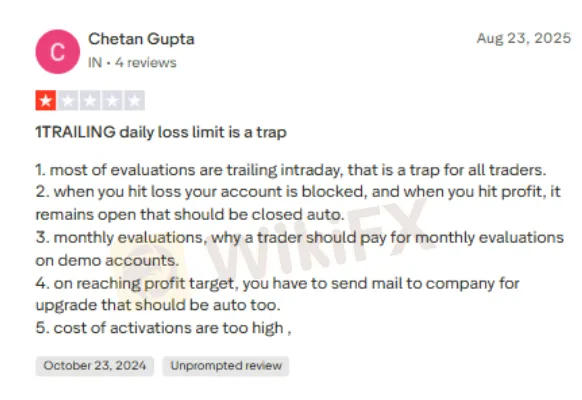

Apex Trader Funding constantly evaluates trading accounts, which may not be a bad thing. However, traders have to pay the evaluation charges. According to traders, if the account hits a loss, it gets blocked. Contrary to when profits happen, the account remains, which should be closed automatically. The activation pay remains high, which does not make traders any happier. Take a close look at this screenshot.

The red flag stems from the fact that it is an unlicensed forex broker, which allows it to stay free from the obligations of making trading practices transparent with traders. The US-based forex broker, which, despite being in this business for over two years, has failed to gain the regulatory nod. Therefore, the scam tactics mentioned by traders above are not a surprise. Considering the imminent trading risks, the WikiFX team has given Apex Trader Funding a score of 1.30 out of 10.

Want to Stay Updated About Latest Forex Scams & Other Financial Updates? Join WikiFX Masterminds

Here is how you can join it.

1. Scan the QR code placed right at the bottom.

2. Download the WikiFX Pro app.

3. Afterward, tap the ‘Scan’ icon placed at the top right corner

4. Scan the code again.

5. Congrats, you have become a community member.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact