Abstract:SEC warns against Fortune Wave Solution Hub OPC’s unlicensed investment schemes. Avoid Ponzi scams; verify licenses before investing in the Philippines.

The Securities and Exchange Commission (SEC) of the Philippines has recently cautioned the public about investment solicitations made by Fortune Wave Solution Hub OPC, Fortune Wave Trading, and Fortune Wave Trading PH. These companies do not hold the necessary licenses to offer investment products or solicit funds from the public, which constitutes a violation of the Securities Regulation Code (SRC).

About Fortune Wave Solution Hub OPC

Fortune Wave Solution Hub OPC is listed as a One-Person Corporation with the SEC. Despite this registration, the firm has not secured authorization to offer or sell any form of securities to investors. The related entities, Fortune Wave Trading and Fortune Wave Trading PH, are not registered with the SEC and have no legal capacity to solicit investments under Philippine regulations.

How the Scheme Is Promoted

Investigations by the SEC confirmed that these organizations have been pushing high-yield investment schemes across various online platforms. Examples include:

- A daily return of 3% for 60 days with a minimum capital of ₱1,000.

- A 200% return after 35 days for at least ₱5,000.

- A 330% return in 43 days for a minimum of ₱30,000.

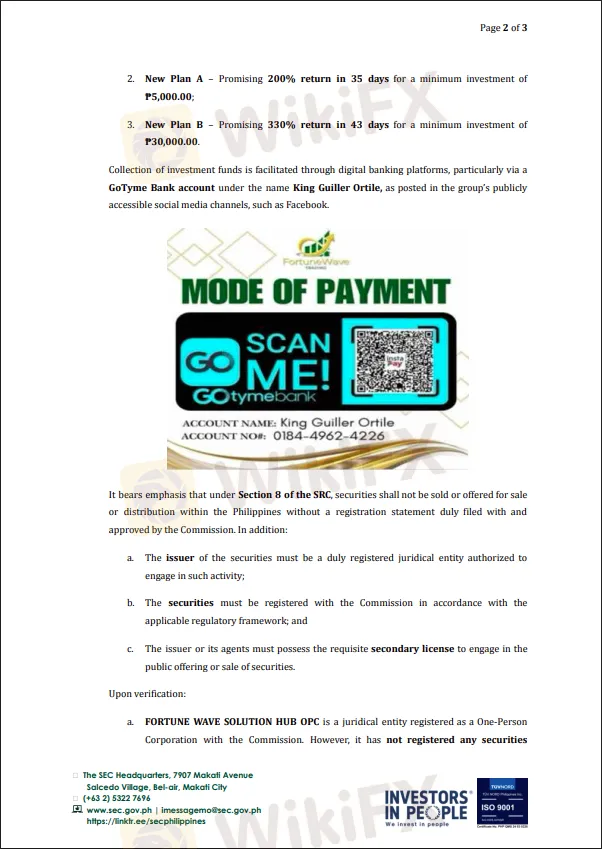

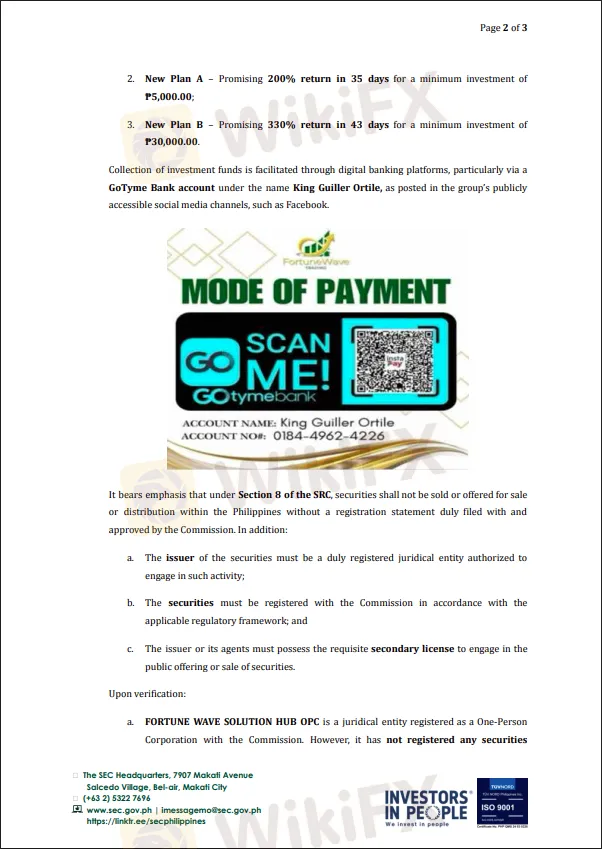

Investors are asked to transfer funds through digital banking channels, most notably via a GoTyme Bank account under the name King Guiller Ortile. The schemes are actively advertised on social media channels like Facebook.

Key Concerns for Investors

The SEC has identified these offerings as characteristic of a Ponzi scheme. In such arrangements, returns for initial investors are paid from the contributions of new participants, rather than from revenue generated by legitimate business operations. Investment scams using similar tactics are not considered legal securities and are not allowed under Philippine law.

Legal Consequences of Participation

Selling, offering, or promoting unregistered securities directly contravenes Section 8 of the SRC. Those acting as brokers, dealers, or agents for these schemes may also be prosecuted under Section 28, nd can be subject to sanctions outlined in Section 73 of the Code, including criminal liability.

Guidance from the SEC

The SEC strongly advises the public not to invest in schemes promoted by Fortune Wave Solution Hub OPC, Fortune Wave Trading, Fortune Wave Trading PH, and similar entities. The commission also encourages everyone to:

- Exercise caution and verify any investment proposals, especially those touting exceptionally high and low-risk returns.

- Report suspicious activities to the SEC's Enforcement and Investor Protection Department (EIPD) for further review.

Protecting Yourself from Investment Scams

Filipinos are reminded to always check the legitimacy of offering parties against the SECs list of authorized and licensed companies. Avoid aggressive solicitations that frequently use social media to spread false claims. It is important never to invest money that you cannot risk losing.

Investment fraud undermines trust in the financial system. The SECs continued warnings highlight the necessity for investors to remain vigilant and verify every opportunity before parting with funds.

For reporting suspicious activities, contact the SEC EIPD by email (epd@sec.gov.ph) or visit their office in Makati City.

Don't miss out the latest news and updates from PH SEC. Scan the QR code below to download and install the WikiFX app on your smartphone.