Abstract:Forex trading in Singapore has seen explosive growth in recent years. As a global financial hub, Singapore boasts one of the world’s deepest FX markets, regulated by the Monetary Authority of Singapore (MAS). To help you navigate this landscape, we’ve identified the five best MAS authorised brokers for 2025, ranking them by trustworthiness, platform features, and overall WikiFX score.

Forex trading in Singapore has seen explosive growth in recent years. As a global financial hub, Singapore boasts one of the world‘s deepest FX markets, regulated by the Monetary Authority of Singapore (MAS). Before any broker can accept local clients for forex or CFD trading, it must hold a MAS Capital Markets Services (CMS) licence—ensuring robust capital requirements, strict conduct standards, and segregation of client funds. To help you navigate this landscape, we’ve identified the five best MAS‑authorised brokers for 2025, ranking them by trustworthiness, platform features, and overall WikiFX score.

1. XM (WikiFX Score: 9.31/10)

Overview:

- Regulation: MAS (Singapore), CySEC (Cyprus), DFSA (UAE), FSC (Belize)

- Platforms: MetaTrader 4, MetaTrader 5, XM App

- Instruments: 1,400+ (forex, commodities, precious metals, shares, equity indices, energies, thematic indices)

Advantages:

- Global Footprint: Backed by multiple tier‑1 regulators, XM offers peace of mind for Singapore traders.

- Education & Research: Daily market analysis, webinars, and expert insights help both beginners and pros.

- Account Types: Micro, Standard, and Zero‑Spread accounts cater to all trading styles.

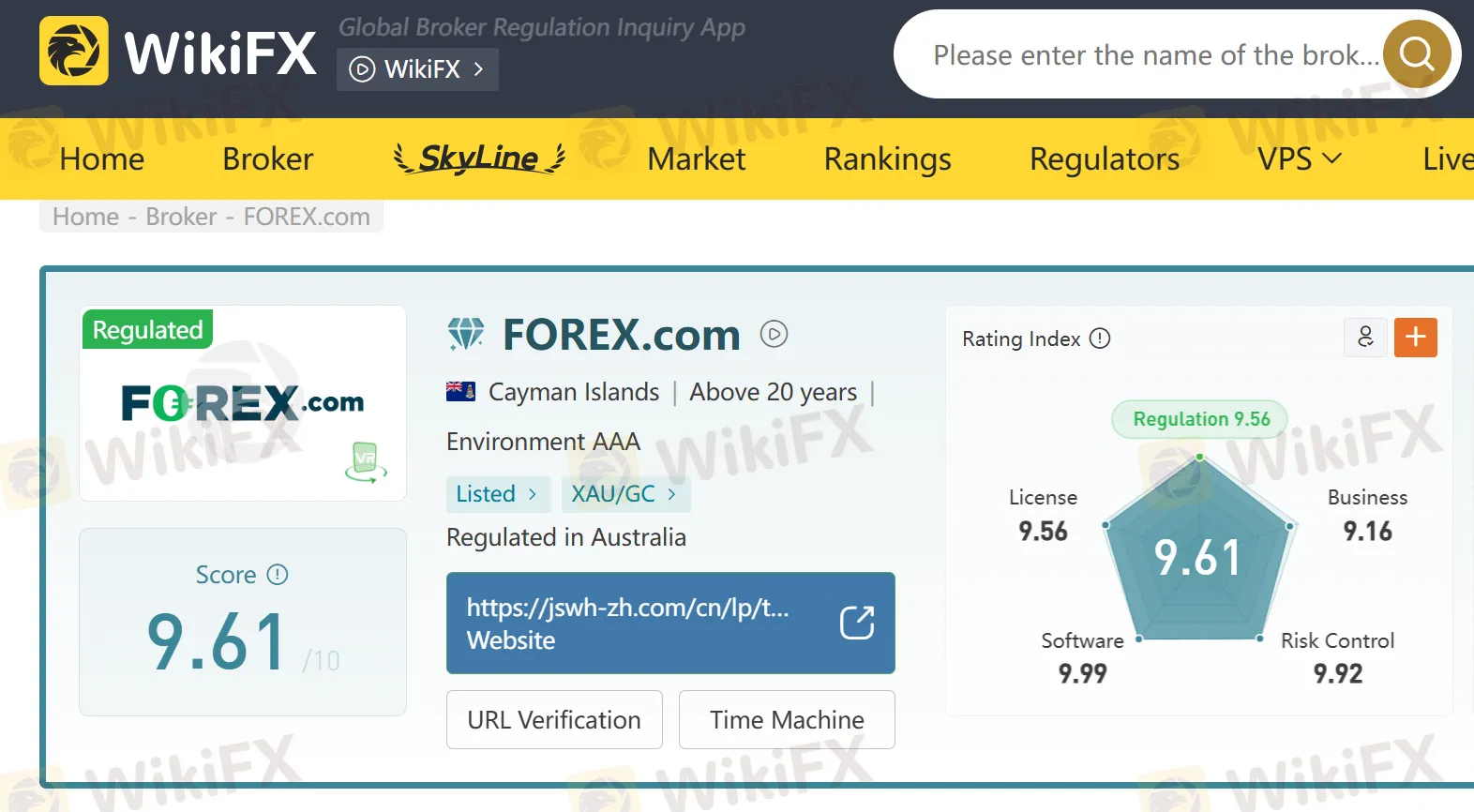

2. FOREX.com (WikiFX Score: 9.61/10)

Overview:

- Regulation: MAS (Singapore), ASIC (Australia), FCA (UK), FSA (Japan), NFA (USA), CIRO (Canada)

- Platforms: FOREX.com Web Trader, MetaTrader 4, TradingView integration

- Instruments: 80+ forex pairs, indices, commodities, cryptocurrencies

Advantages:

- Reputation: Established in 2001, FOREX.com is renowned for transparent pricing and deep liquidity.

- Research Hub: Proprietary tools like the FX Trade Signal, Economic Calendar, and MarketPulse News.

- Educational Resources: Interactive courses and one‑on‑one coaching for new traders.

3. IG (WikiFX Score: 8.47/10)

Overview:

- Regulation: MAS (Singapore), FCA (UK), CFTC/NFA (USA), ASIC (Australia)

- Platforms: L2 Dealer, ProRealTime, MetaTrader 4, TradingView

- Instruments: 17,000+ markets (forex, indices, shares, commodities, cryptocurrencies)

Advantages:

- Market Breadth: Unrivalled access to global markets beyond FX—including single‑stock CFDs and crypto.

- Professional Tools: Advanced charting with ProRealTime and Level II pricing on L2 Dealer.

- Risk Controls: Guaranteed Stop Loss Orders (GSLO) to cap maximum loss.

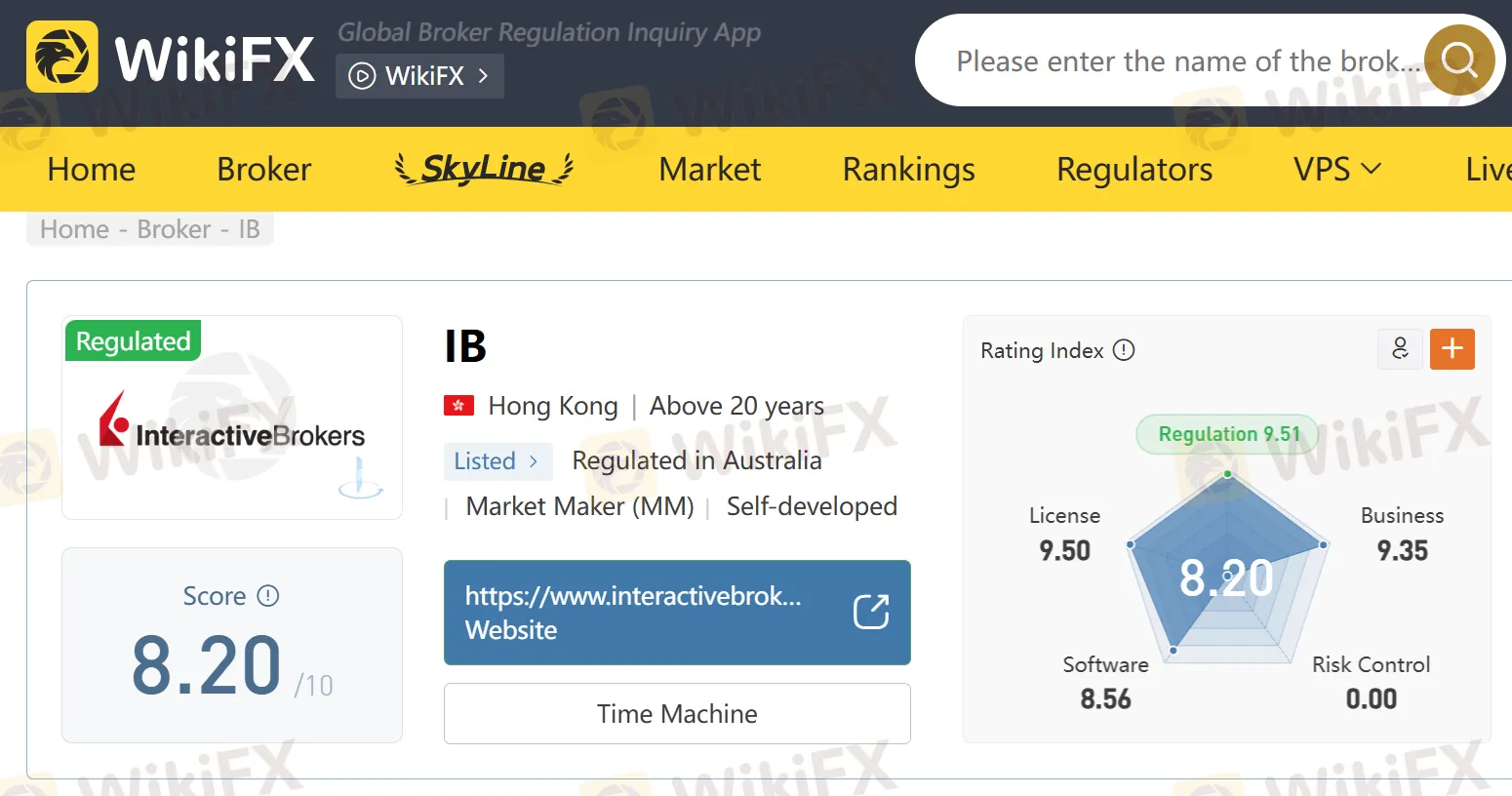

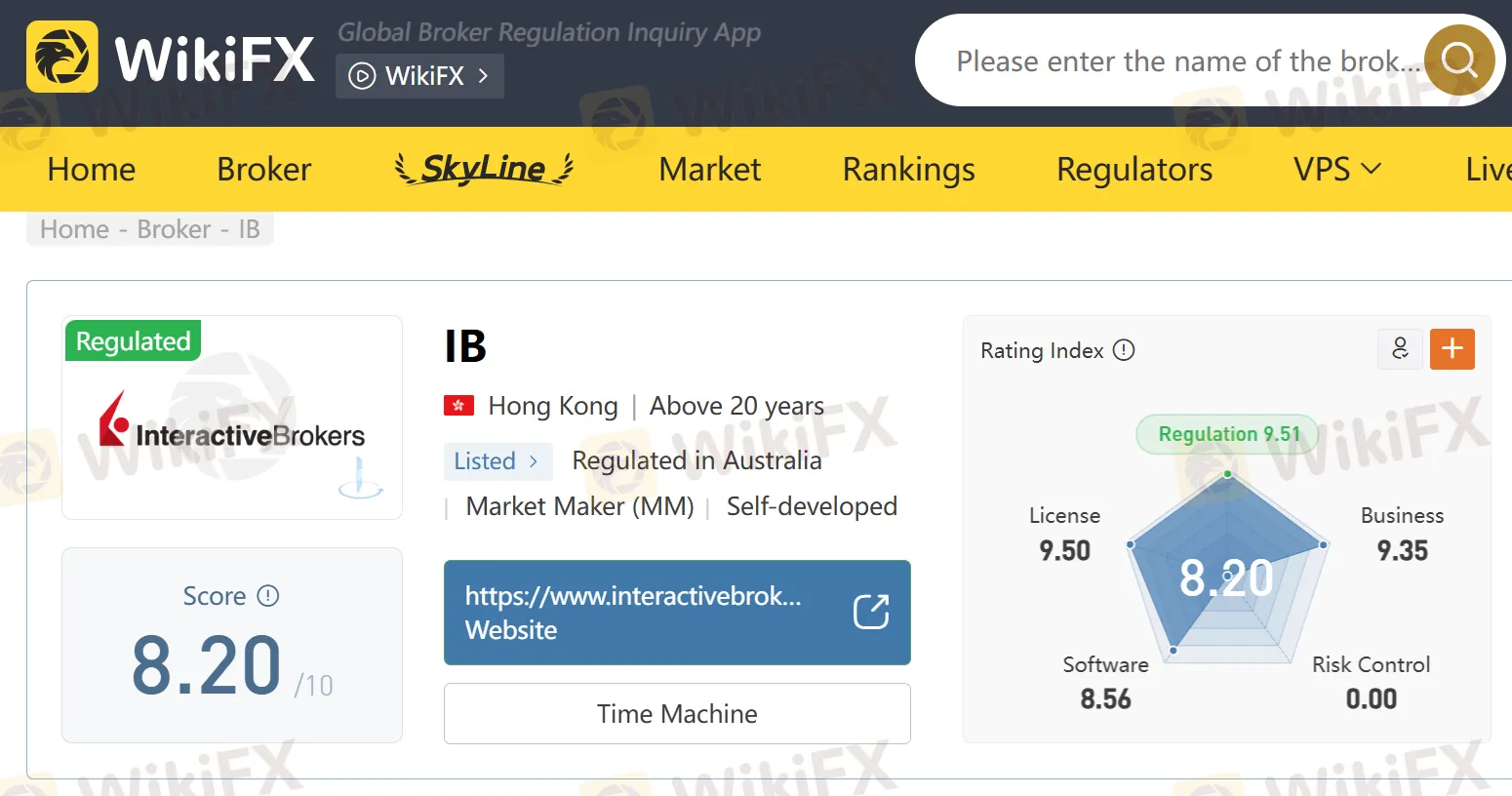

4. Interactive Brokers (WikiFX Score: 8.20/10)

Overview:

- Regulation: MAS (Singapore), SEC/FINRA (USA), FCA (UK), ASIC (Australia), SFC (Hong Kong)

- Platform: Trader Workstation (TWS), IBKR Mobile, Client Portal

- Instruments: 150+ markets (stocks, ETFs, options, futures, spot forex, bonds, mutual funds)

Advantages:

- Institutional‑Grade: Ultra‑low spreads and commissions for high‑volume traders.

- SmartRouting: Automatically seeks best prices across multiple venues.

- API Access: Algo‑traders can connect via FIX, Python, Java, or C++ APIs.

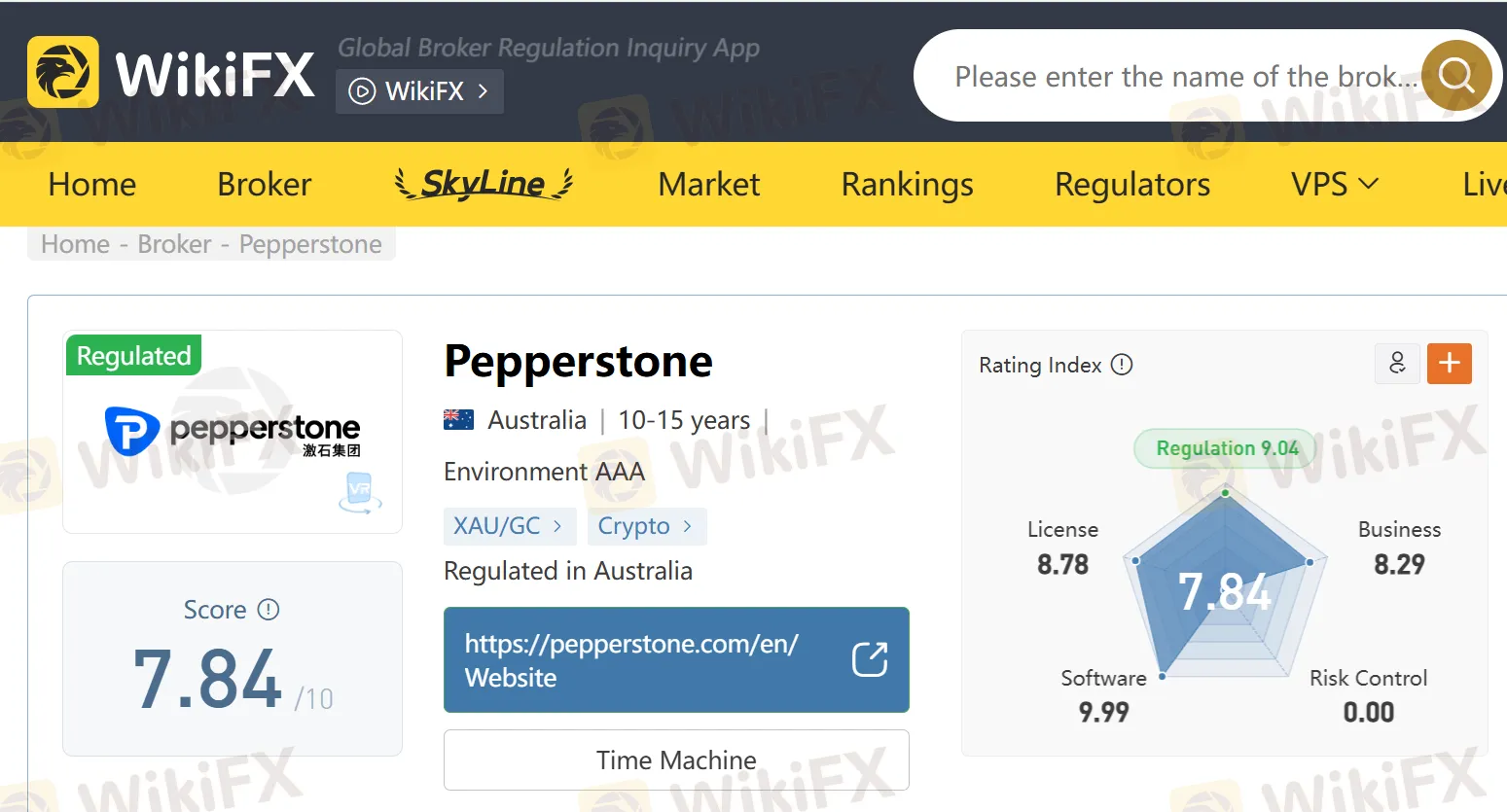

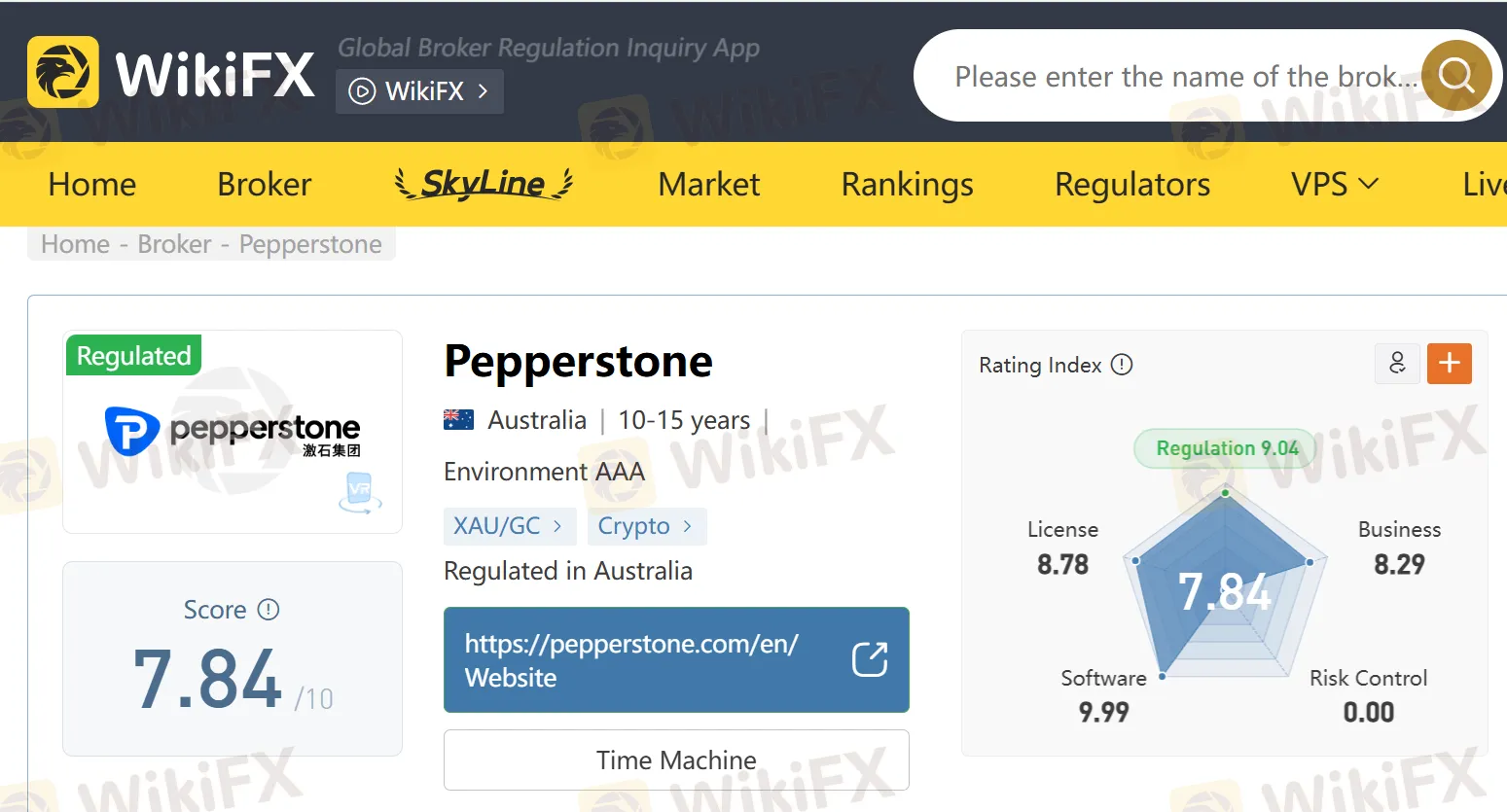

5. Pepperstone (WikiFX Score: 7.84/10)

Overview:

- Regulation: MAS (Singapore), ASIC (Australia), FCA (UK), DFSA (UAE)

- Platforms: MetaTrader 4, MetaTrader 5, cTrader, TradingView

- Instruments: Forex, commodities, indices, currency indices, cryptocurrencies, shares, ETFs

Advantages:

- Execution Speed: Average execution time under 30 ms via Equinix NY4 data centre.

- Competitive Pricing: Raw‑spread accounts start from 0.0 pips with a small commission.

- Copy Trading: Integrated with Myfxbook AutoTrade and DupliTrade.

How to Choose the Right Broker

Regulation & Trust: Always verify the MAS licence number on the MAS website.

Trading Costs: Compare spreads, commissions, overnight financing, and deposit/withdrawal fees.

Platform & Tools: Ensure the brokers platform suits your style—whether chart-based analysis, automated strategies, or mobile trading.

Customer Support: Look for 24/5 multilingual support via live chat, phone, and email.

Conclusion

Singapore‘s stringent regulatory regime and deep liquidity make it an ideal base for forex traders. By choosing one of these five MAS‑authorised brokers you’ll position yourself for a smoother trading experience in 2025. Always start with a demo account to test the waters before committing real capital, and remember: disciplined risk management is key to long-term success.