Abstract:When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about BingX and its licenses.

In the world of online trading, the absence of proper regulation is a significant red flag. BingX is a broker that currently holds no valid regulatory license, and user complaints about withdrawal issues add to the concern. Traders should not overlook these warning signs.

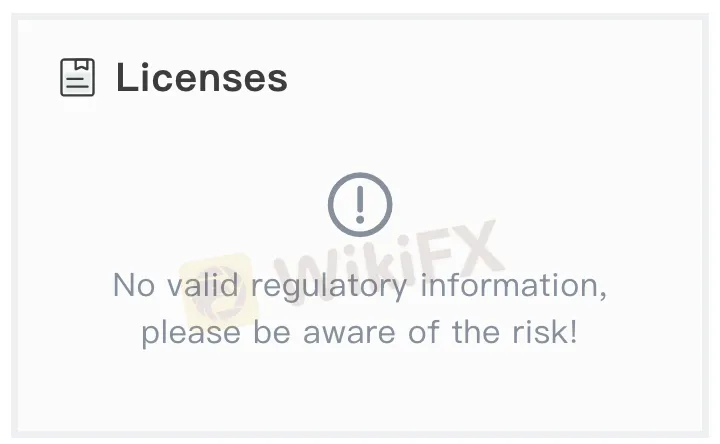

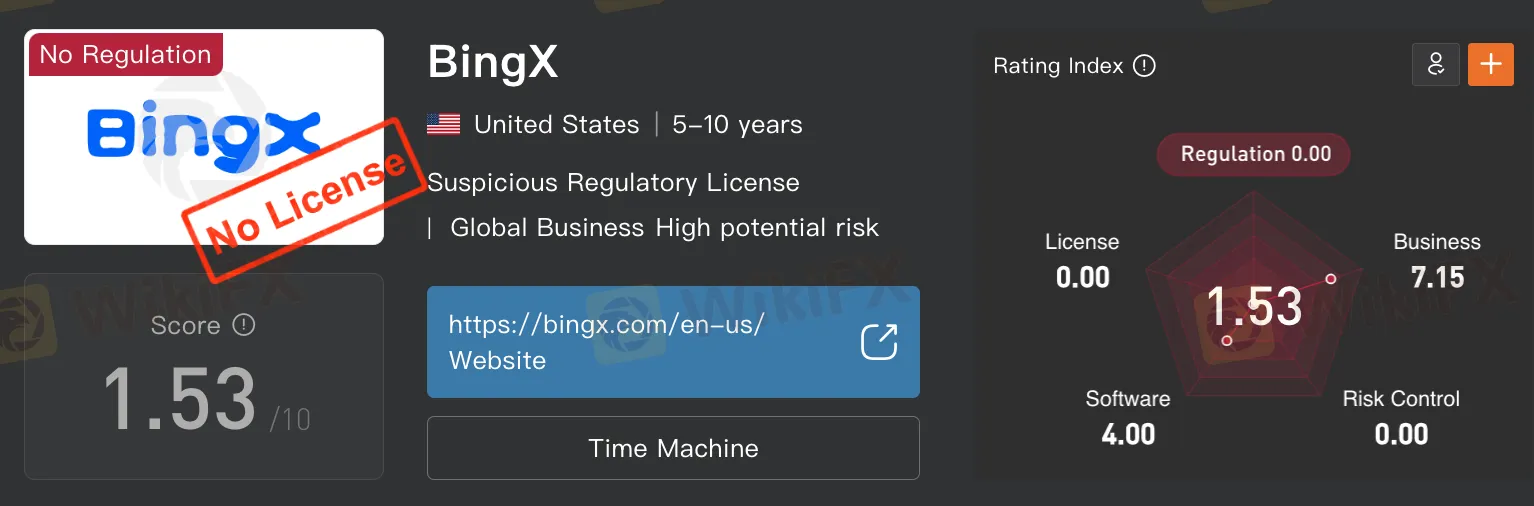

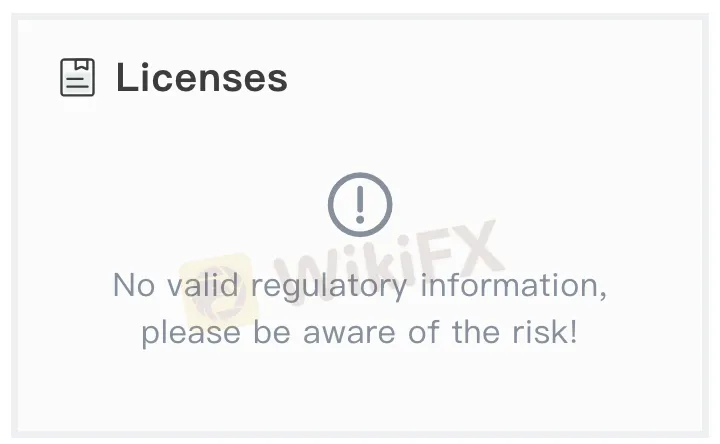

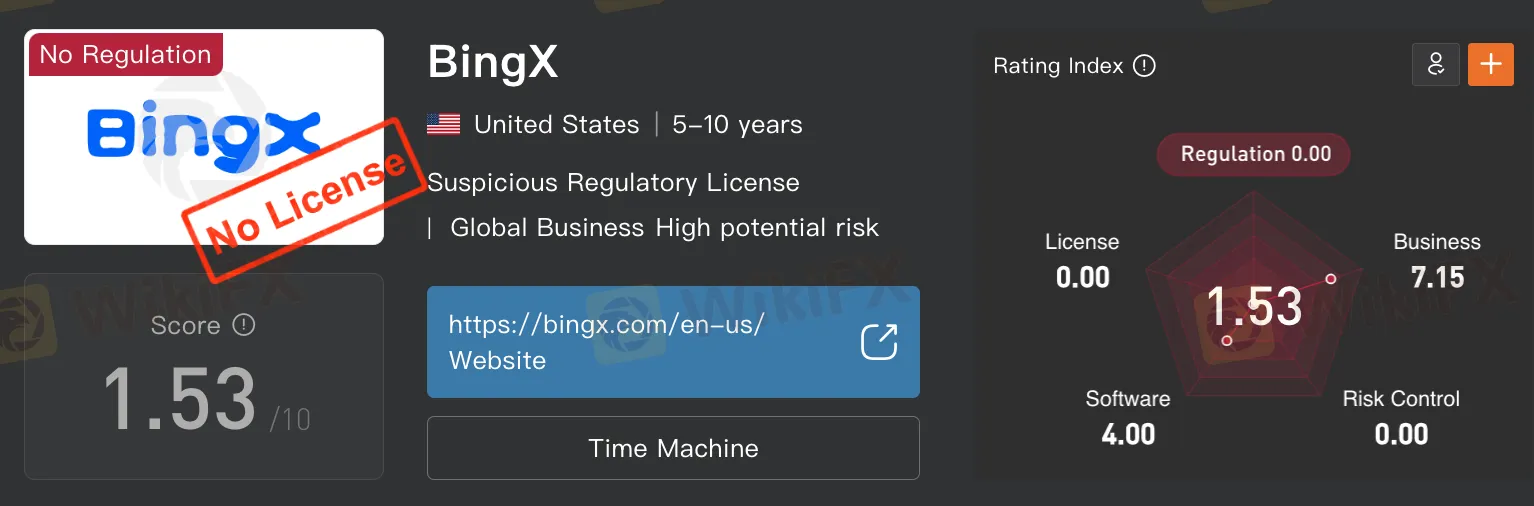

According to WikiFX, BingX has not been verified to hold any valid license from recognized regulatory authorities. The absence of regulatory oversight means that the broker is not subject to any formal standards related to customer protection, financial transparency, or operational conduct. This can create serious risks for traders, especially those relying on platforms to manage or hold client funds.

Being regulated typically requires brokers to follow strict rules, including maintaining minimum capital requirements, segregating client funds, and submitting to audits. Without a license, there is no independent body ensuring that these standards are met by BingX.

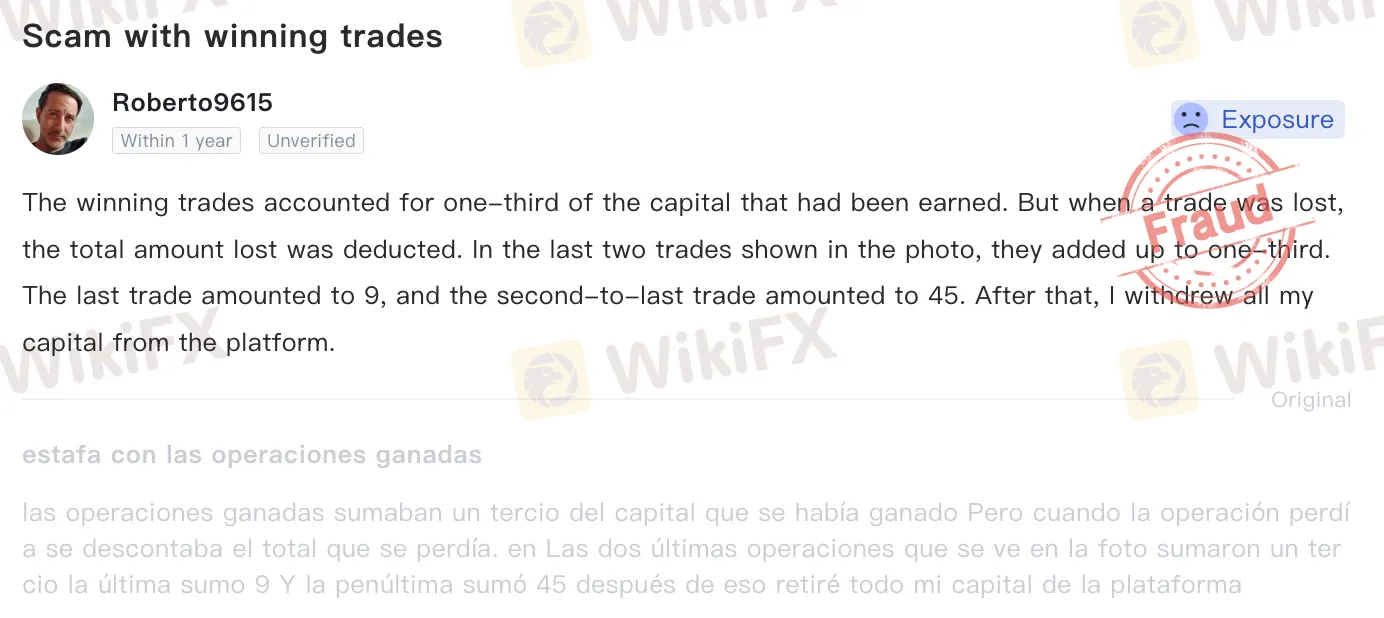

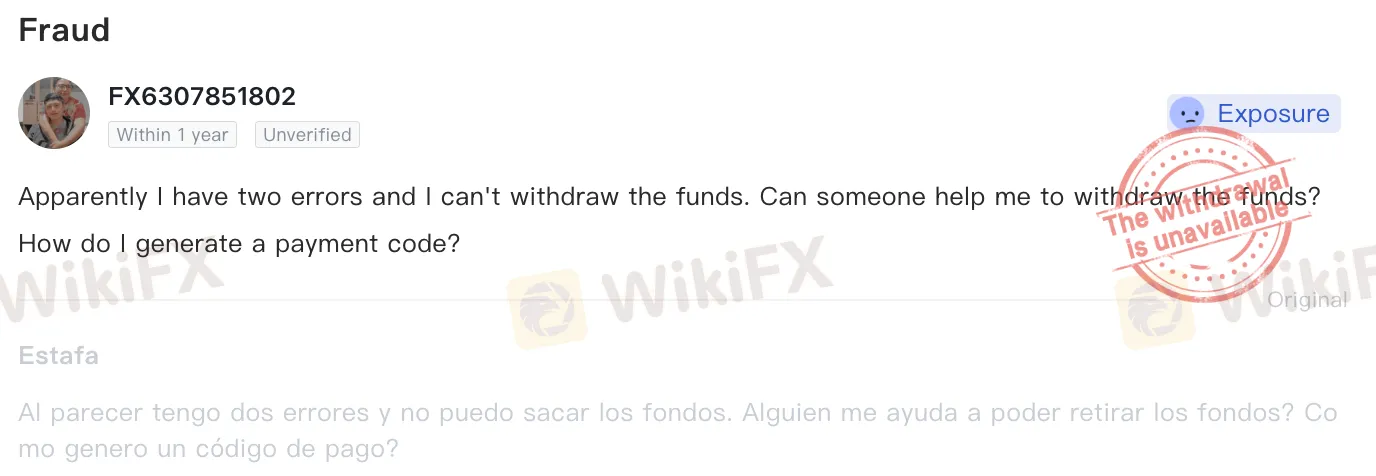

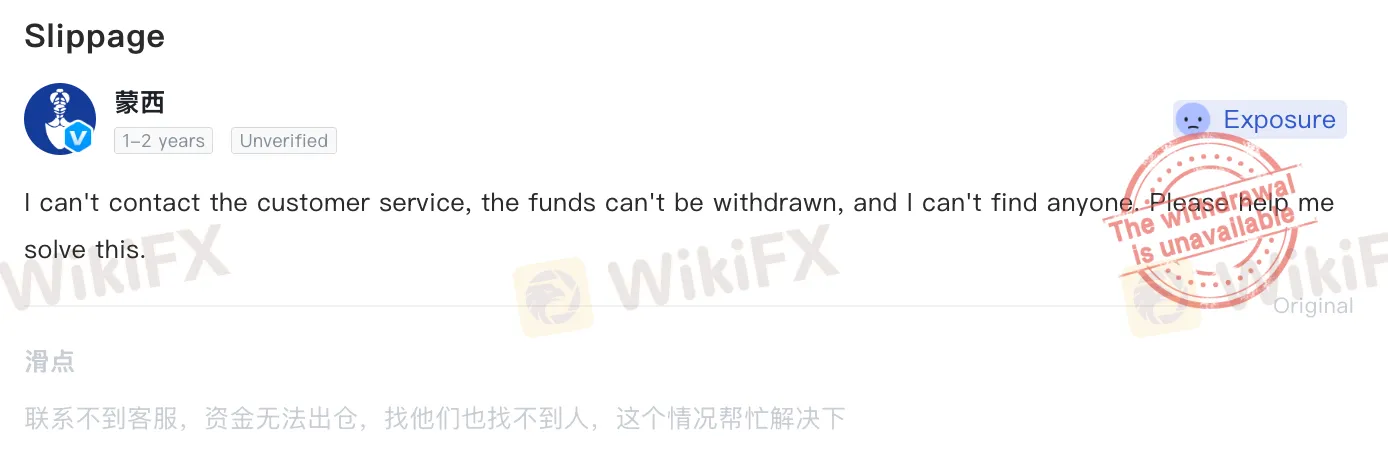

In addition to the regulatory gap, BingX has also received a number of complaints from users. A recurring issue raised by traders is that withdrawal requests go unprocessed, leaving users without access to their funds. These unresolved issues can create trust concerns and may indicate weaknesses in customer support or internal controls.

WikiFX, a global broker regulatory query platform, has given BingX a WikiScore of 1.53 out of 10. This score reflects a low rating based on multiple factors, including licensing status, operational transparency, risk management, platform performance, and user feedback. The low score may suggest that traders proceed with caution and consider verifying all details independently before opening an account.

BingX presents several important considerations for traders. The lack of regulation and the existence of unresolved complaints make it essential for potential users to thoroughly research and evaluate the platform. In the absence of formal oversight, traders may have limited recourse in the event of disputes or financial loss. Conducting due diligence and prioritizing safety should always be part of any decision-making process when selecting a trading broker.