Abstract:eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

eToro has officially expanded its services to Singapore after receiving and activating its Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS), the company announced today, July 16, 2025.

What the MAS Licence Means for Singapore Investors

With its CMS licence now in force, eToro can offer eligible retail investors in Singapore access to:

Stocks from more than 20 of the worlds leading stock exchanges

Exchange-traded funds (ETFs) spanning global markets

Derivatives, including CFDs on indices, commodities, and more

All of these products will be available through eToros award‑winning social investing platform, empowering users to trade, share, and learn in a single, intuitive interface.

Following our report in May that eToro had tapped ABN Amro and Essence Group alum Yaki Razmovich to head its new Asia hub in Singapore, Razmovich officially took the reins of the Singapore operation earlier this year. He will oversee the build‑out of eToros regional franchise and drive further expansion across Asia Pacific

About eToro

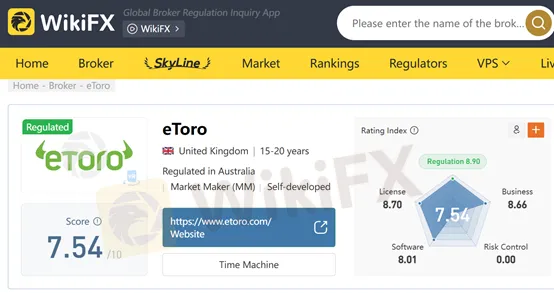

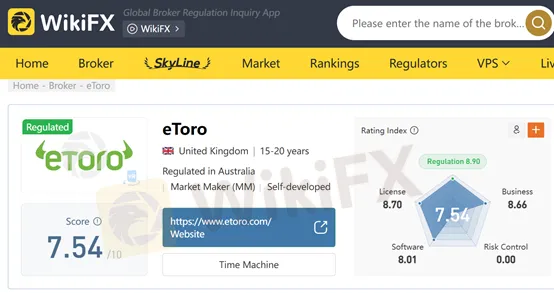

Founded in 2007, over the years, eToro has grown to support millions of registered users worldwide, offering a diverse range of financial instruments, including forex, stocks, ETFs, cryptocurrencies, and commodities. According to WikiFX, eToro holds a solid compliance and reliability rating, reflecting its commitment to regulatory standards and customer protection. For more information about this broker, you can go to WikiFX and search for yourself.