Abstract:A 70-year-old retiree from Muar, Malaysia, lost RM186,800 of his savings after falling for an online investment scam that was advertised on Facebook.

A 70-year-old retiree from Muar, Malaysia, lost RM186,800 of his savings after falling for an online investment scam that was advertised on Facebook.

According to Muar District Police Chief Assistant Commissioner Raiz Mukhliz Azman Aziz, the man had clicked on a Facebook ad in December 2024. It led him to what appeared to be a promising investment opportunity. Soon after, he was added to a WhatsApp Business Group, where he was given instructions and details about the investment.

The scheme claimed that investors would receive a 200% profit within three months. The man, believing the offer to be genuine, went on to make 14 payments into five different bank accounts between 25 January and 25 April 2025. The total amount he transferred came to RM186,800.

Later, he was sent a link showing that his supposed investment had grown to RM446,786. But when he tried to withdraw the money, he was told to pay another RM22,339.34. That demand made him suspicious, especially when he could no longer contact the person who had introduced the scheme to him.

Realising that he had likely been scammed, the man reported the case to the police. The investigation is ongoing under Section 420 of the Penal Code, which deals with cheating.

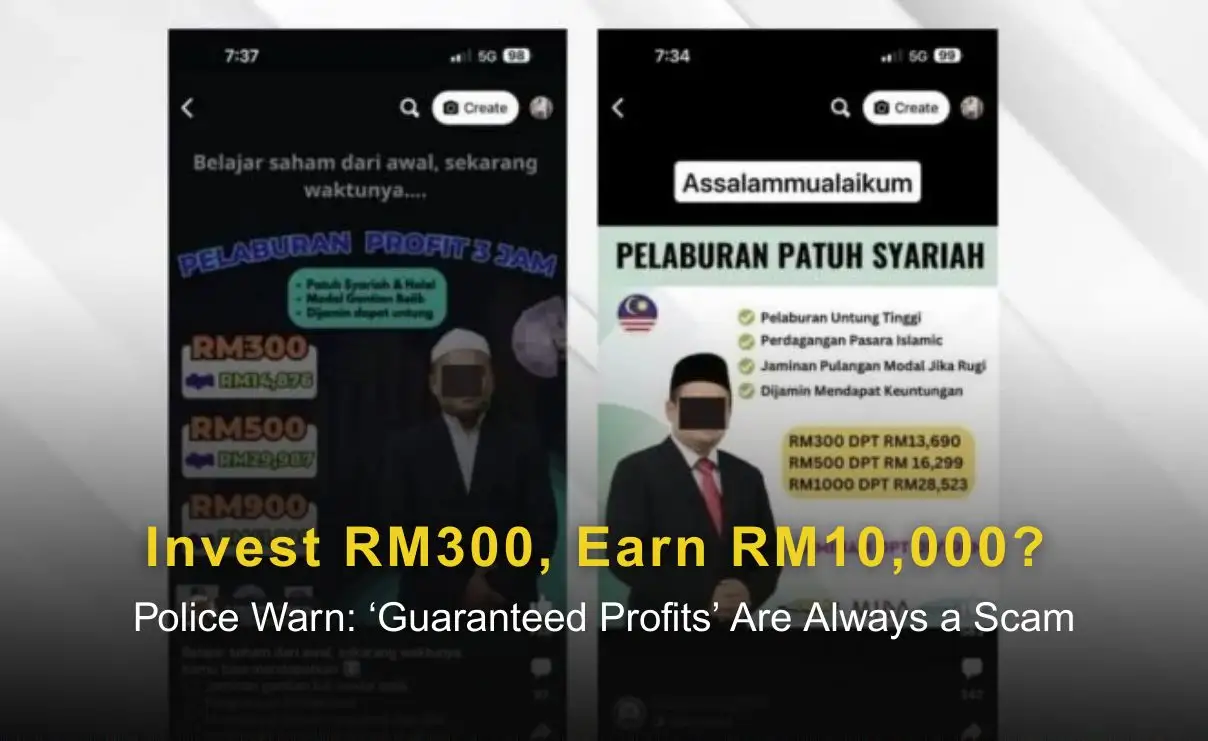

Assistant Commissioner Raiz Mukhliz reminded the public to be careful when it comes to money matters, especially when dealing with unknown people or investment offers seen online. He urged people not to trust any scheme that promises very high returns in a short time, especially if it comes from social media.

To help people avoid falling for such scams, tools like the WikiFX mobile app can be useful. This free app, available on Google Play and the App Store, helps users check if investment platforms are properly licensed. It also provides safety ratings, customer reviews, and warnings about risks. With this information, users can make better decisions and protect their savings.

Members of the public who suspect a scam can also use the Semak Mule platform or contact the Commercial Crime Investigation Departments Scam Response Centre. Help is available at 03-26101559 or 03-26101599. Scam victims are advised to call the National Scam Response Centre at 997 to report their case.