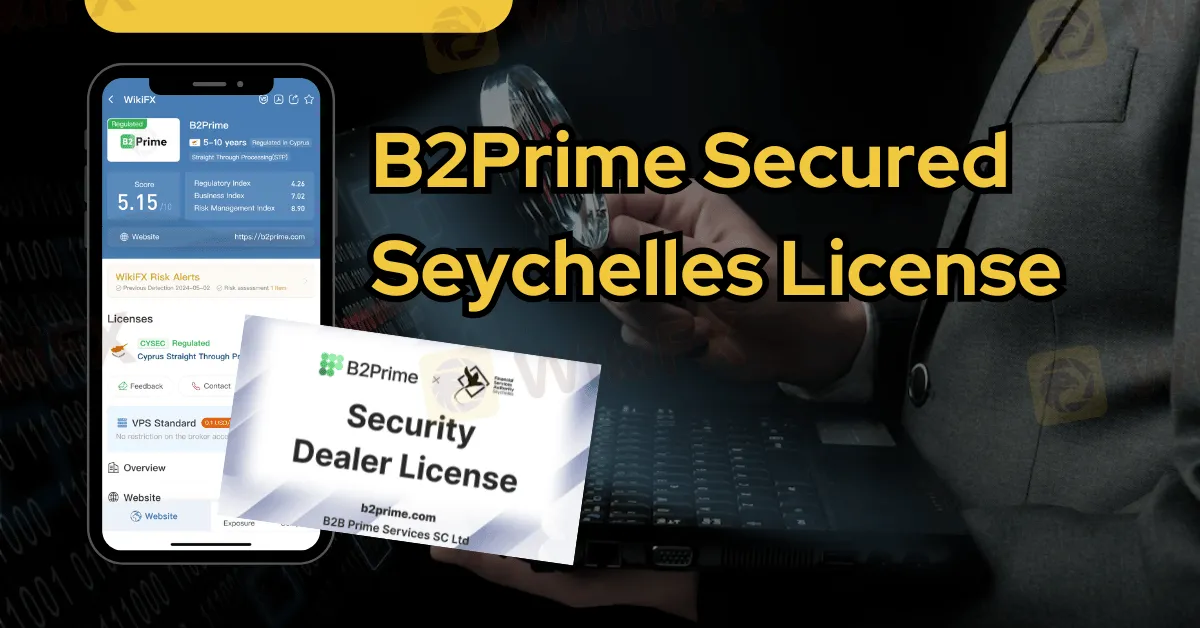

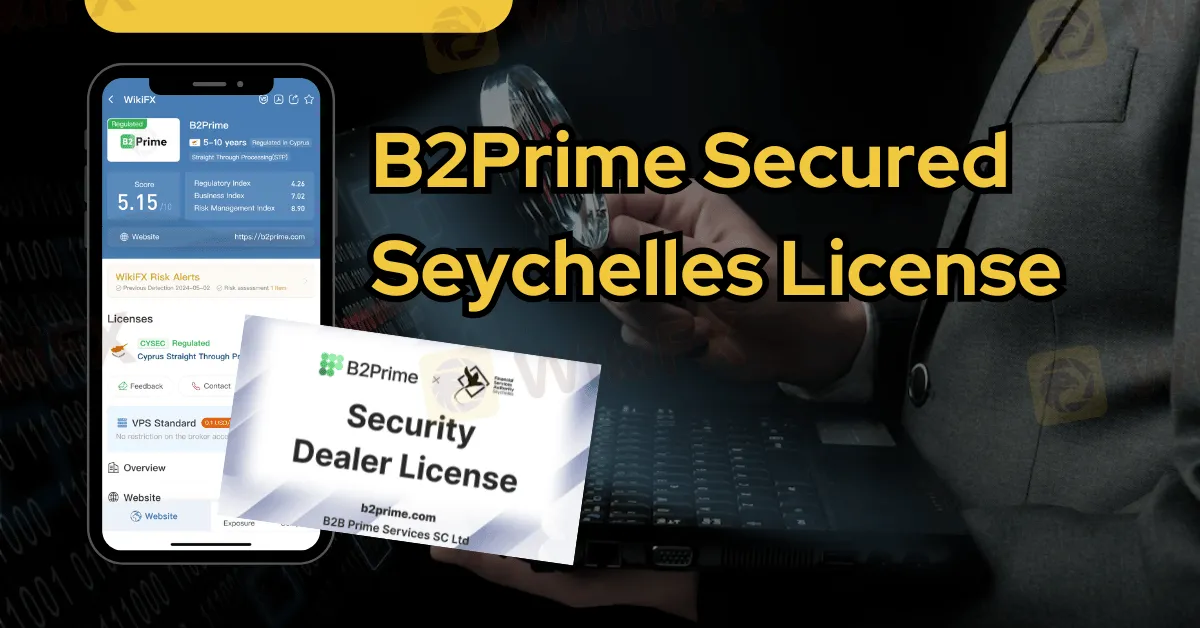

Abstract:B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius.

B2Prime, a liquidity provider offering services across multiple asset classes, has recently obtained a security dealer license in Seychelles, adding to its existing licenses in Cyprus and Mauritius. This regulatory milestone signifies B2Prime's expansion into new jurisdictions and its commitment to providing compliant services to its global clientele. The company also received initial approval for a Dubai VARA crypto license.

Seychelles, recognized as an offshore hub for brokers, provides B2Prime with a strategic platform to distribute liquidity locally to regulated entities. With the newly acquired security dealer license, B2Prime is authorized to engage in essential financial activities, including securities negotiation, portfolio management, and transaction handling on behalf of clients.

B2Prime offers over 225 instruments across six asset classes, including Forex, Cryptos, Spot Indices, Precious Metals, Commodities, and NDFs, accessible through a single margin account. Clients benefit from deep liquidity pools sourced from Tier-1 providers, ensuring competitive spreads and efficient execution. The platform also provides seamless connectivity options through various integration channels like oneZero, PXM, Centroid, T4B, FIX API, and cTrader.

Eugenia Mykulyak, Founder & Executive Director of B2Prime, stated the company's aim to provide financial services to local brokers, hedge funds, money managers, institutional clients, and liquidity providers. This move aligns with B2Prime's global growth strategy and enhances its ability to capitalize on opportunities in the global financial markets.

B2Prime recently disclosed financial results for its parent company, demonstrating growth in the first quarter of 2024. Total assets in Cyprus increased significantly, reflecting a 40.32% rise from the previous year. Client assets held for trading also experienced substantial growth, rising by 47.6% to €26,840,460.11.

Shareholders' equity increased by 8%, indicating growth across various financial metrics. Regulatory capital adequacy showed improvement, with B2Prime's own funds increasing nearly 600% to €2,728,000, exceeding regulatory requirements.

These financial results highlight B2Prime's commitment to financial stability and growth, positioning the company as a player in the global financial landscape. With plans to disclose the fiscal report for B2Prime Mauritius soon, the company continues to strengthen its presence as a service provider for clients worldwide.