Abstract:In this article, we will conduct a comprehensive examination of EPFX, delving into its key features, fees, safety measures, deposit and withdrawal options, trading platform, and customer service. WikiFX endeavours to provide you with the essential information required to make an informed decision about utilizing this platform.

Background:

Established in 2023, EPFX is an ECN forex broker registered in Australia, with its platform headquarters located in South Africa.

EPFX provides a diverse range of over 300 tradable assets, covering currency pairs, share CFDs, cryptocurrency CFDs, commodities, and global indices.

Meanwhile, EPFX features an introducing broker (IB) program, enabling individuals and businesses to earn multi-tiered commissions by referring new clients to the company.

It is important to note that, at present, EPFX does not extend its services to South Africa, the United States of America, Israel, New Zealand, Iran and North Korea.

Types of Accounts:

EPFX offers three account options: the Raw Spread account, the Zero Commission account, and the Hybrid account.

The Raw Spread account targets traders in pursuit of the narrowest spreads, commencing at 0.0 pips. It boasts nominal, standardized commissions and offers leverage up to 1:500, enabling traders to optimize their trading endeavours. This account facilitates trading US30 with 0.01 lots and supports hedging, appealing to those prioritizing minimal spreads and heightened leverage. Compatibility with both MT5 and cTrader platforms allows for the utilization of Expert Advisors (EAs), and with zero commissions, it presents an enticing choice for economically prudent traders.

For traders seeking competitive spreads without commission charges, the Zero Commission account delivers, with spreads initiating at 1.5 pips. Mirroring the Raw Spread account's leverage and trading capabilities, this account type enables hedging and EAs while remaining commission-free, catering to those favouring fee-free trading coupled with competitive spreads.

The Hybrid account strikes a balance between narrow spreads, commencing at 0.5 pips, and modest, flat-rate $7 commissions. Offering leverage up to 1:500 and facilitating trading of US30 with 0.01 lots, this account type accommodates hedging and EAs, ensuring compatibility with MT5 and cTrader platforms. Ideal for traders seeking competitive spreads alongside fixed commissions for effective cost management.

Deposits and Withdrawals:

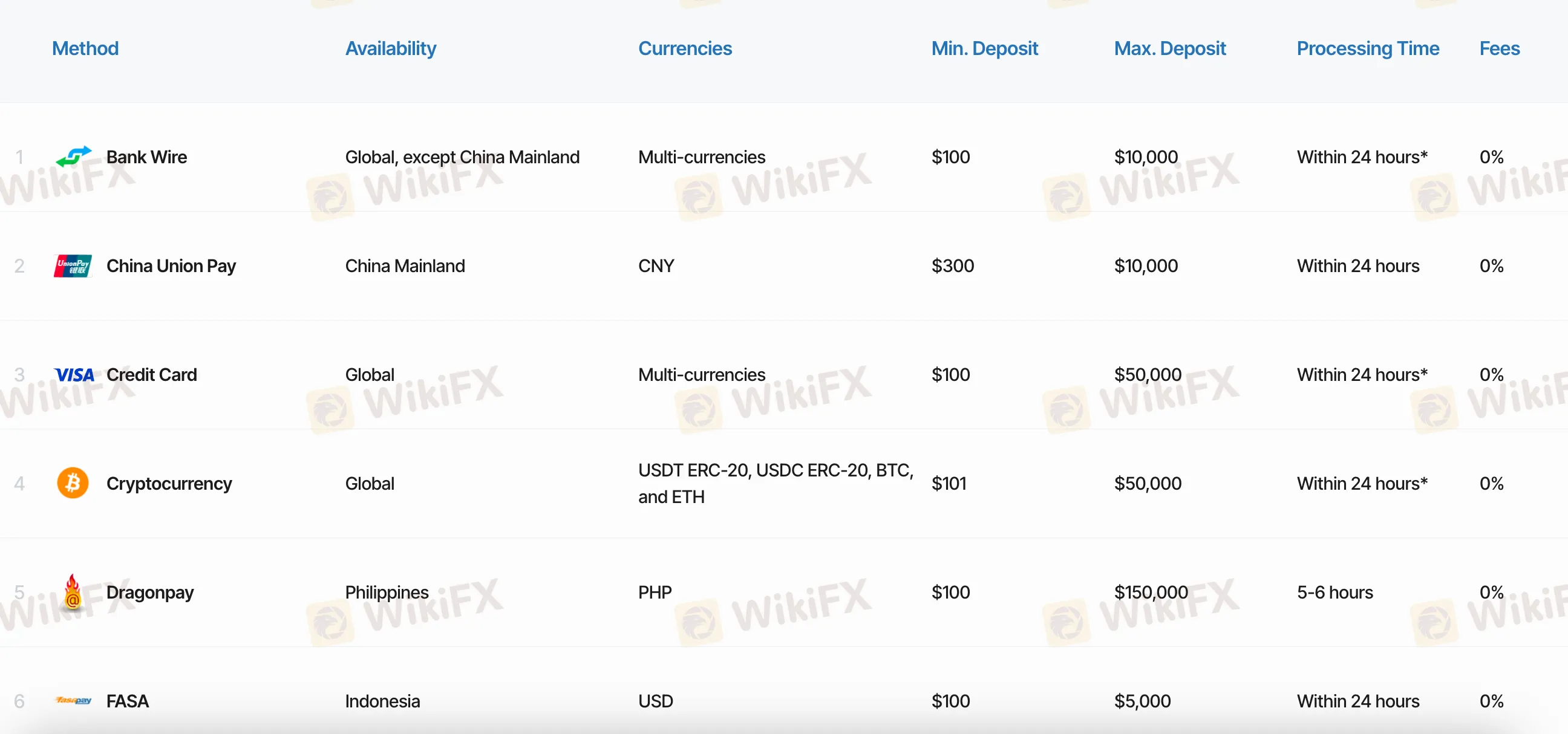

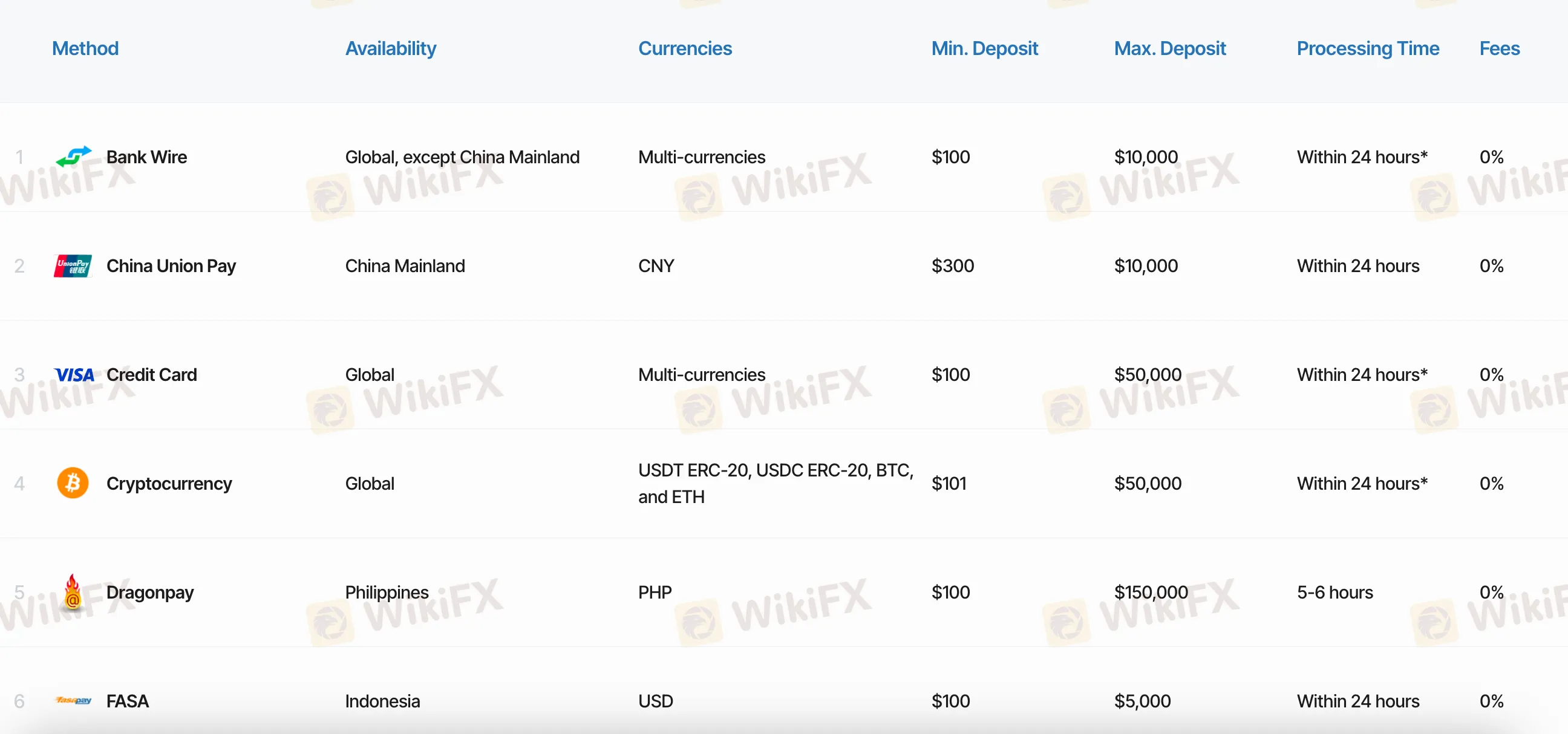

EPFX offers a range of payment options, including bank transfers, FasaPay, Skrill, cryptocurrencies, Visa, and additional methods.

The specifications for each deposit and withdrawal method can be referred to from the images below:

Trading Platforms:

EPFX provides two trading platforms:

- The MetaTrader 5 (MT5) trading platform, available on PC, mobile, and web, is renowned for its technological sophistication and provides access to a depth of market and various advanced solutions. It offers features such as buy and sell flexibility with six types of pending orders, 38 technical indicators, 44 analytical objects, and 21 timeframes, providing a customizable platform with numerous online tools for integration. Quick order execution, an economic calendar for tracking global macro-economic news, one-click trading, mobile trading capabilities, and an intuitive market search and grouping functionality contribute to the platform's comprehensive and user-friendly trading experience.

- cTrader, a leading multi-asset trading platform known for its innovative features and user-friendly interface, is designed to meet the diverse needs of traders. It offers a comprehensive suite of tools for trading various financial instruments, including forex, indices, commodities, and cryptocurrencies. With advanced charting capabilities, lightning-fast execution, and a customizable interface, cTrader provides traders with a powerful platform to execute their trading strategies with precision and efficiency.

Research and Education:

EPFX asserts that it provides an array of educational materials tailored to cater to traders at various skill levels, encompassing novice, intermediate, and advanced levels. Nonetheless, access to these resources is restricted solely to registered members of EPFX.

Customer Service:

EPFX provides customer service support in multiple languages, including English, Chinese, Japanese, Vietnamese, Portuguese, Spanish, and more. Clients can reach out to EPFX through email at support@epfx.com or by submitting an inquiry via the broker‘s enquiry form. No live chat service is available on EPFX’s official website. Additionally, trading clients have the option to contact EPFX by phone at +1 888 239 7924.

Conclusion:

To summarize, here's WikiFX's final verdict:

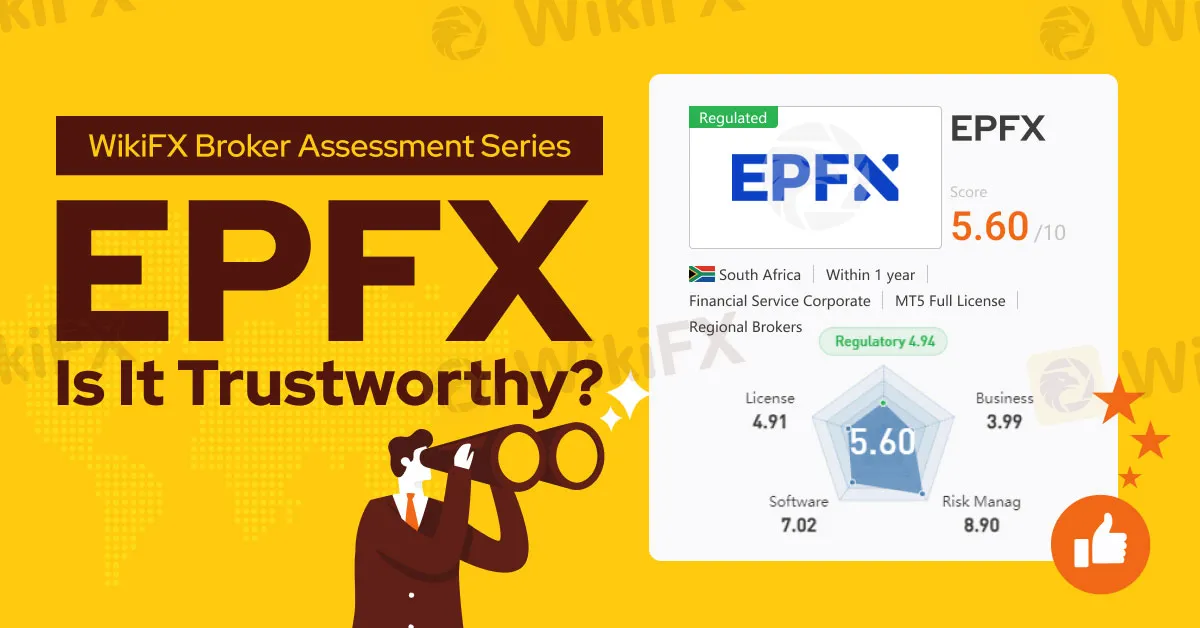

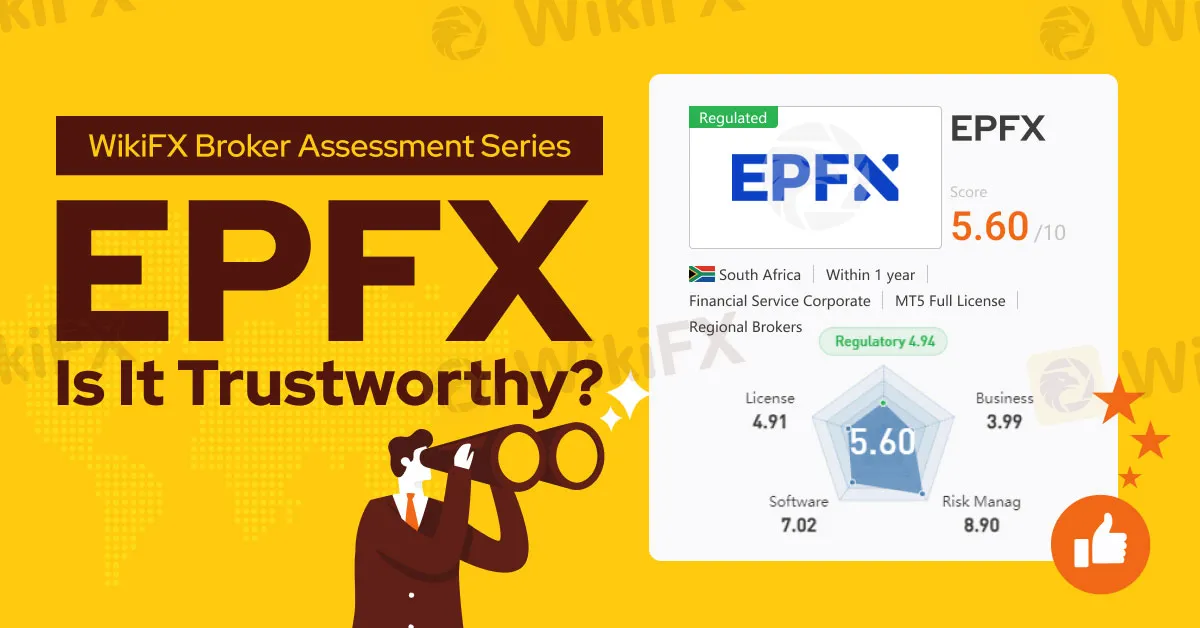

WikiFX, a global forex broker regulatory platform, has assigned EPFX a WikiScore of 5.60 out of 10.

Upon reviewing EPFXs licenses, WikiFX discovered that the brokerage is regulated by the Australian Securities and Investment Commission (ASIC) with license number 001308208.

However, the broker exceeds the business scope overseen by the South Africa FSCA, indicating its license number 53180 invalid.

WikiFX also found several complaints received from users worldwide, casting doubt on EPFXs trustworthiness:

Therefore, WikiFX would urge our users to opt for a broker that has a higher WikiScore for better protection.