Pocket Option Scam Alert: Real Trader Complaints

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

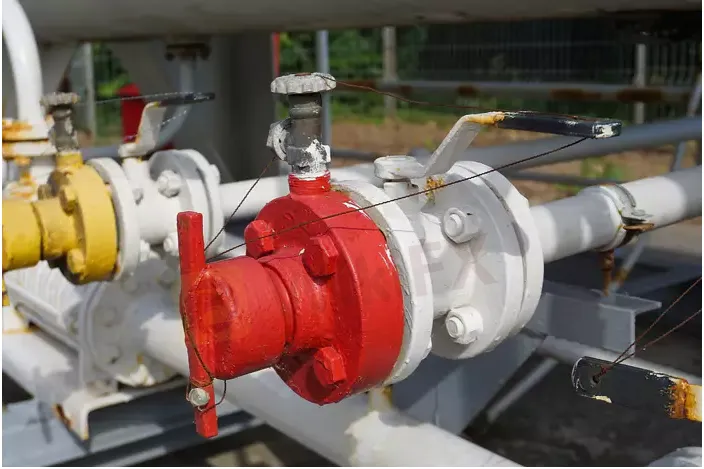

Abstract:Natural gas managed to settle above the $7.00 level.

Natural gas is moving higher while traders wait for the release of the EIA report.

The weather forecast remains unfavorable for high natural gas consumption.

A move above the resistance at $7.20 will push natural gas towards the 20 EMA at $7.35.

Natural gas prices continue to rebound ahead of the EIA report, which is expected to show that working gas in storage increased by 113 Bcf.

Interestingly, traders look ready to ignore rising inventories and are pushing natural gas prices towards recent highs. It should be noted that the weather forecast remains unfavorable for high natural gas demand.

In Europe, natural gas prices rebound despite resumption of Russian gas exports to Italy. Prices have been moving lower in recent weeks as demand for natural gas declined due to factory closures. However, demand should pick up relatively soon as temperatures get colder and the heating season begins.

In the U.S., the EIA report will determine natural gas price dynamics. At this point, it looks that the market is comfortable with the above-mentioned analyst consensus, which expects a build of 113 Bcf. However, natural gas prices may find themselves under significant pressure if the actual build is closer to the 120 Bcf level.

Natural gas managed to get above the $7.00 level and is moving towards the next resistance, which is located at $7.20. In case natural gas manages to settle above this level, it will head towards the next resistance, which is located at $7.35. A successful test of this level will push natural gas towards the resistance at $7.50.

On the support side, the previous resistance level at $6.90 will serve as the first support level for natural gas. If natural gas declines below this level, it will move towards the next support at $6.75. A move below the support at $6.75 will open the way to the test of the support at $6.55.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Pocket Option scam alert — real traders report blocked withdrawals, fake KYC, slippage, and sudden bans after profits. Read multiple 2025 complaints before you deposit.

Weltrade scam surge in August 2025: traders report fake prices, slippage manipulation, and delayed withdrawals. Protect your funds and think twice before trading.

Discover PU Prime’s new campaign, “The Grind,” and learn how trading discipline builds long-term success. Watch and start your trading journey today!

IG boosts FCA compliance by integrating Adclear’s AI tools. Learn how automation accelerates marketing approvals and ensures regulatory accuracy.