Abstract:FTSFX is an illegitimate broker operating in Hong Kong and the website is available in both English and Chinese.

It states its advantages - customer first, global market financial instruments, separated deposit of funds and strong financial regulation. Looking at the overall theme, the platform does look enticing. However, it just tries to mislead investors into thinking it is legit, while in fact, the best conditions including it claimed are just signs of a scam.

Domain age of about 100 days

Fraudulent forex entities create sites that are generally 1 to 2 years old and disappear to recreate another domain name. The domain age of the website(https://www.ftsfx.net/) was created just about 100 days ago and will expire on the same day in the next year. This is on purpose as after 6 to 12 months the company will then just move to a new website and continue to change its image for scamming. It's a common defrauding tactic used by fraudsters.

Claims to be regulated by a few global regulators

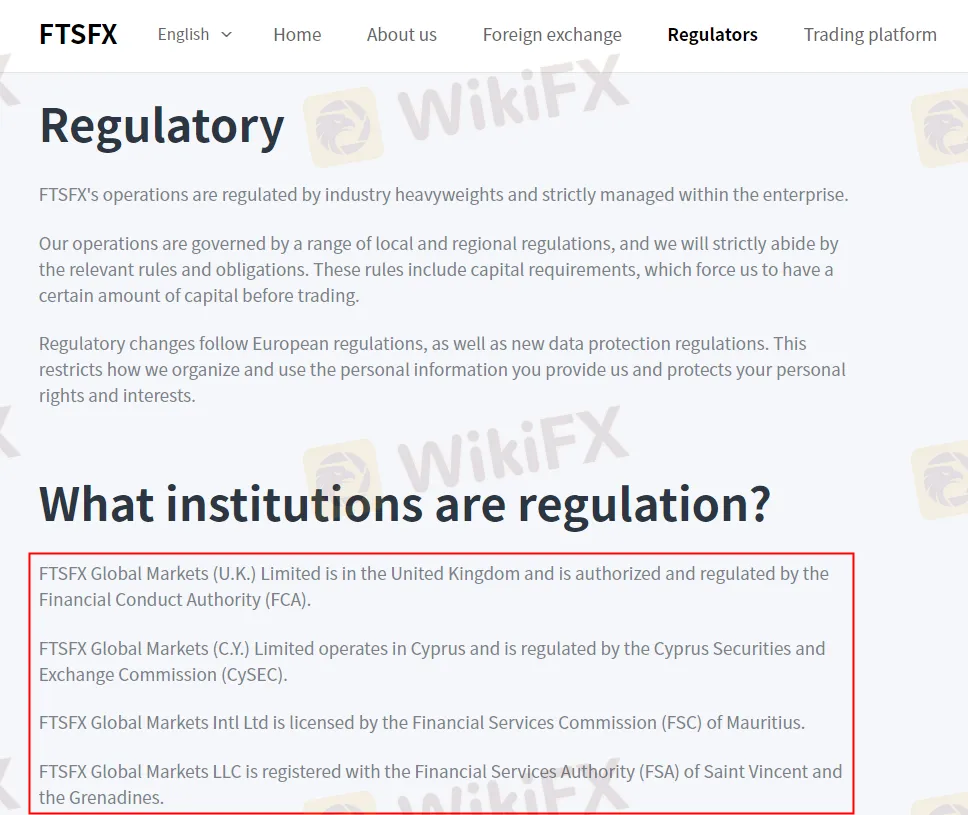

FTSFX offers multiple currency pairs on its online forex trading platform. The firm claims to be governed by a range of local and regional regulations to try and improve its credibility with unsuspecting investors:

· authorized by the Financial Conduct Authority (FCA).

· regulated by the Cyprus Securities and Exchange Commission (CySEC).

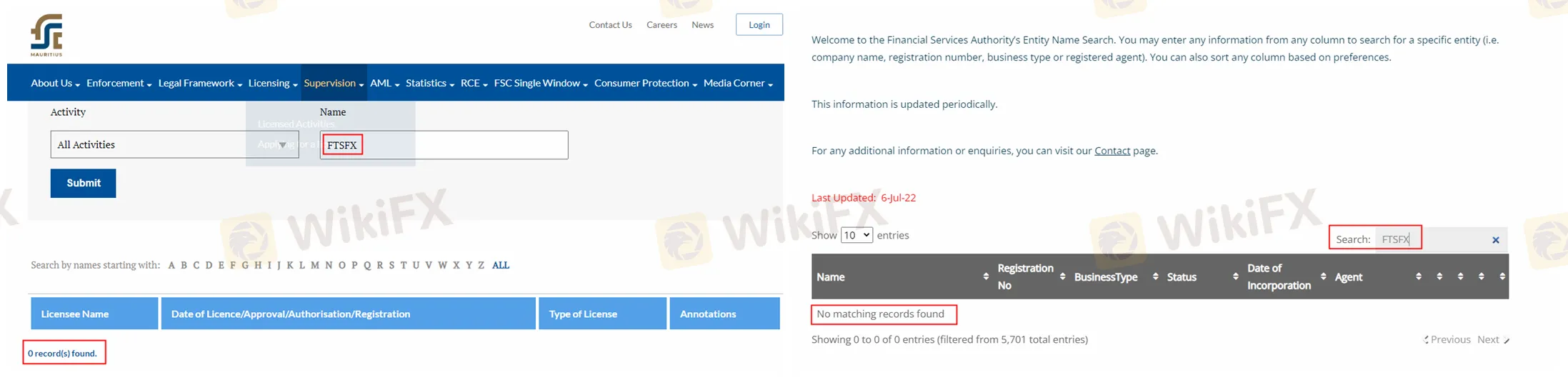

· licensed by the Financial Services Commission (FSC) of Mauritius.

· registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines.

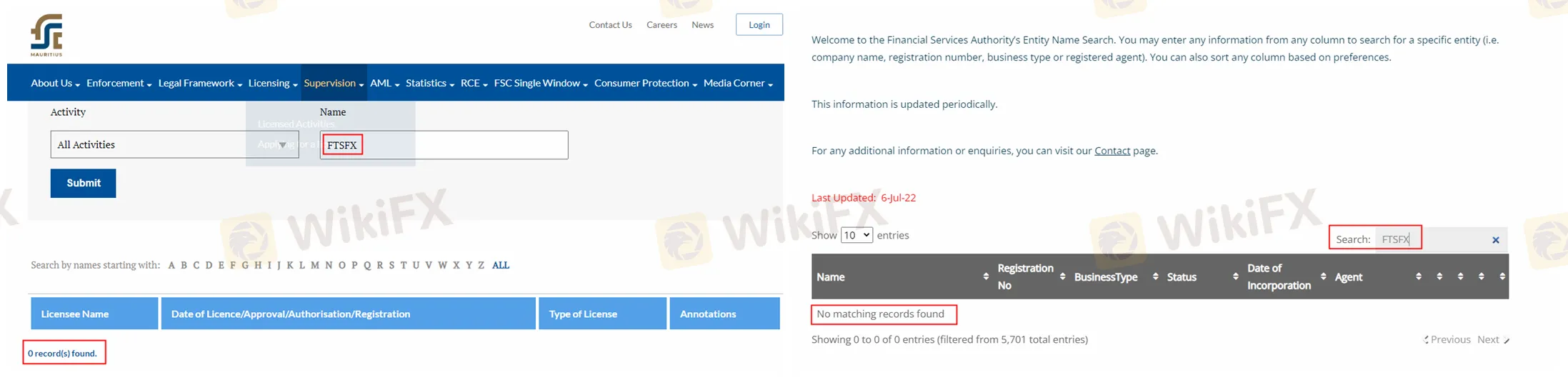

But we found no results matched with the entity in the database of the above four mentioned authorities regulated brokers list.

That is to say - FTSFX is telling lies and running without any regulatory license.

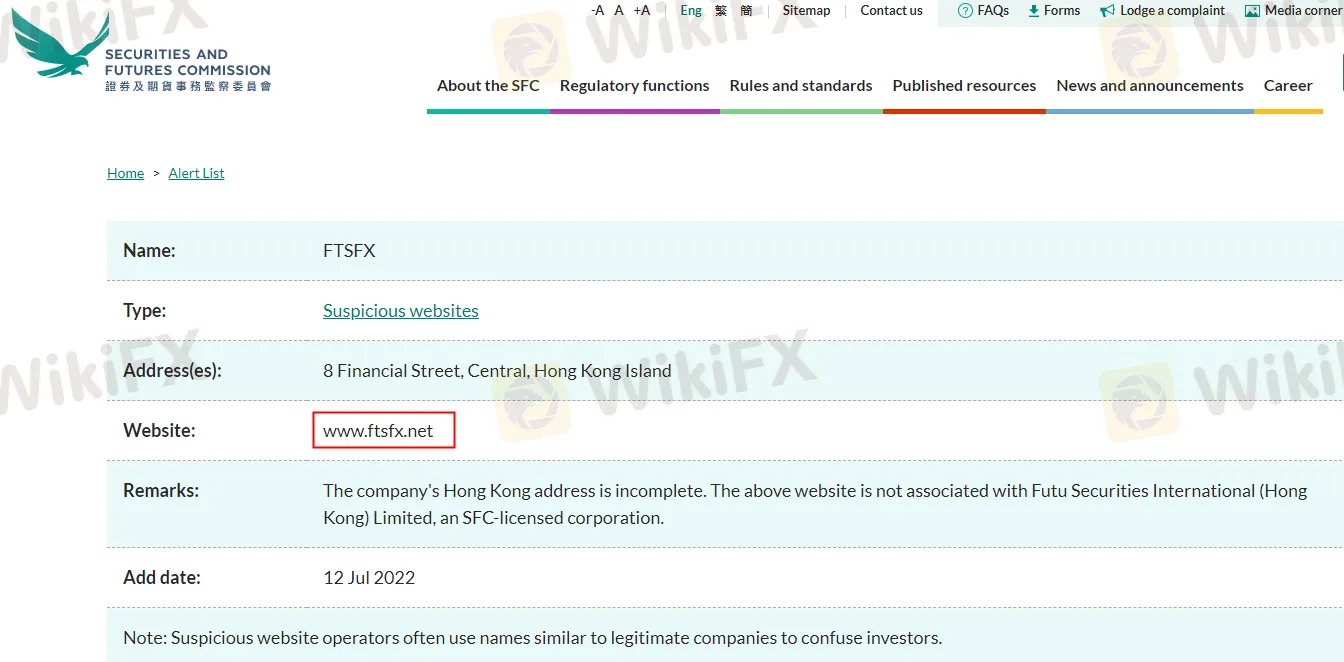

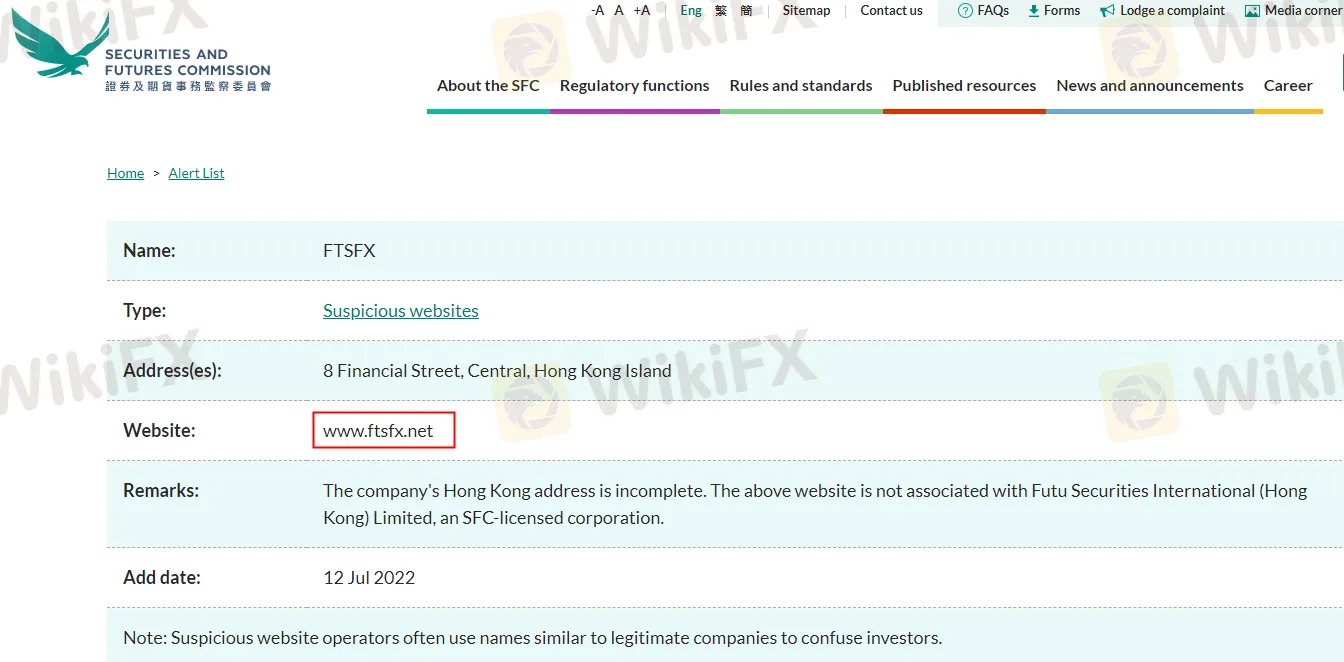

Added to the blacklist of Hong Kong financial regulator

The website cannot be legitimate because it is obviously breaching the laws and regulations governing companies that provide financial services. As you can see, the broker is in the blacklist of Hong Kong financial regulator - SFC. The authority warned public that FTSFX is a clone of a licensed company recently. Investors should not to transact any business with FTSFX because it is extremely risky.

Therefore, this broker is suspected to be a scam according to the above researches done by our team.

The problem with an unregulated company is that it will not follow the industry's practices, and thus consumers are likely to lose their money.