ACY Securities Review: $40k Profits Withheld in Singapore

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Fraudulent brokers create false images of themselves by telling lies, one and another. And the baseless statement sometimes may even confuse themselves, just like Cedar Signals.

The experience and regulations it claims are paradoxical, which makes the scam a joke.

30 Years of Experience?

About its years of experience, the scam has three different statements.

According to a banner on the website, Cedar Signals has been helping clients for over a decade.

Besides, the fraud claims it has 7-year-experience “since 2013”. And it also writes “30 YEARS EXPERIENCE” on the page.

After seeing all the paradoxical statements about its experience, we can not help asking: “ How many years on earth? ” Then we checked its domain and found the website had been created on 5 Nov 2021, less than a year ago. So how could the firm be an experienced forex broker? Here is a red flag.

Multiple Regulations?

The complicated regulations of the scammer also make you confusing.

According to its site, Cedar Signals is a UK-based®ulated entity that is related to Cedar Signals A/S - a Danish company. At the same time, it is an ASIC broker, also regulated in the USA.

To find out in which countries the company is regulated, we searched the four forex regulators in the countries - UK FCA, ASIC, NFA, and the Finanstilsynet (Danish FSA). The result is that Cedar Signals is not authorized to provide financial services in all four countries.

Scam Warning

The British Columbia Securities Commission (BCSC) has warned traders that Cedar Signals is not registered to trade in, or advise on, securities or derivatives in BC.

The liar describes its experience and regulations in the hype. However, it turns out that none of the descriptions is true.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

ACY Securities froze a Singapore trader’s $40k profits over “arbitrage.” Read the full case and check if your funds are safe. Learn more now.

Trust has always been a widely discussed topic in the forex industry. When genuine, rational voices are drowned out, market participants struggle to discern which information is trustworthy amid a sea of complex data. This difficulty in establishing trust has placed industry transparency at the forefront of attention.

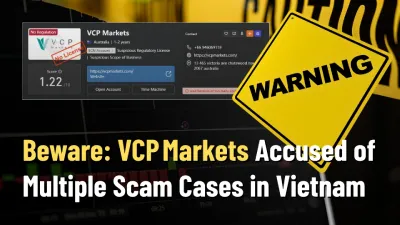

Beware, Vietnam traders! VCP Markets faces a surge in 2025 complaints about blocked withdrawals and losses. Check verified reports on WikiFX now.

Before thinking about ZarVista, you need to understand the complete picture. At first glance, ZarVista (which used to be called Zara FX) presents itself as a modern, feature-packed trading company. It advertises appealing trading terms, different account options, and the powerful MetaTrader 5 platform. However, our detailed research shows a completely different reality. This broker has major warning signs, an extremely low trust rating, and a high-risk business model. This ZarVista review will examine the broker's promises, comparing what it advertises with actual evidence. We will explore the ZarVista Pros and Cons by looking at its rules and regulations, platform features, and most importantly, the large number of user complaints that show a troubling pattern. This investigation is based on careful analysis of information from independent verification websites like WikiFX, giving you an objective and fact-based review to help you make a smart decision and protect your capital.