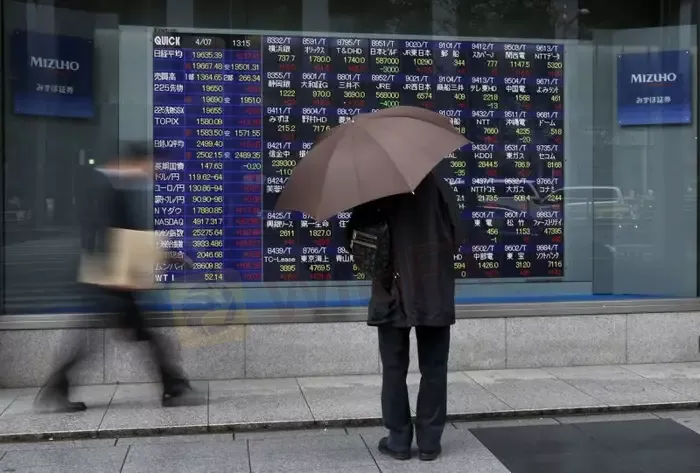

Abstract:Asian shares found some footing after a volatile session for U.S. equities, but the dollar remained at 20-year highs and global stocks near 18-month lows on worries about persistently high inflation and tightening central banks.

World stocks rose from the previous days 18-month lows and the dollar pulled back from 20-year highs on Friday, though investors remained nervous about high inflation and the impact of rising interest rates.

Markets are becoming anxious about the possibility of recession, with the S&P getting close to a bear market on Thursday, at nearly 20% off its January all-time high.

In an interview late on Thursday, U.S. Federal Reserve Chair Jerome Powell said the battle to control inflation would “include some pain”. Powell repeated his expectation of half-percentage-point interest rate rises at each of the Fed‘s next two policy meetings, while pledging that “we’re prepared to do more”.

The war in Ukraine has aggravated supply chain disruptions and inflationary pressures already in place after more than two years of the COVID-19 pandemic, but stocks enjoyed a bounce on Friday.

“There‘s an awful lot of negative sentiment out there, we’re looking at a 40% chance of recession,” said Patrick Spencer, vice chairman of equities at Baird Investment Bank.

“A lot of fund managers have cut their equity allocations and raised cash, though we think this is a correction rather than a bear market.”

MSCIs world equity index rose 0.32% after hitting its lowest since November 2020 on Thursday, though it was heading for a 4% fall on the week, its sixth straight week of losses.

S&P futures bounced 1.13% after the S&P index dropped 0.13% overnight, with the index also eyeing a sixth straight week of declines.

S&P 500 set for a sixth straight week of falls https://fingfx.thomsonreuters.com/gfx/mkt/zdpxoglxgvx/stx1305.PNG

European stocks rallied 0.96% and Britains FTSE 100 gained 1.17%.

The U.S. dollar eased 0.22% to 104.54 against a basket of currencies, but remained close to 20-year highs due to safe haven demand.

Russia has bristled over Finlands plan to apply for NATO membership, with Sweden potentially following suit.

Moscow called Finlands announcement hostile and threatened retaliation, including unspecified “military-technical” measures.

The dollar rose 0.36% to 128.76 yen, while the euro gained 0.3% to $1.0408, recovering from Thursdays five-year lows.

Cryptocurrency bitcoin also turned higher, cracking through $30,000 after the collapse of TerraUSD, a so-called stablecoin, drove it to a 16-month low of around $25,400 on Thursday.

“Some traders may see the sharp fall this month as an opportunity to buy the dip, but given the hugely volatile nature of the coins, the crypto house of cards could tumble further,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

The moves higher in equities were mirrored in U.S. Treasuries, with the benchmark U.S. 10-year yield edging up to 2.9221% from a close of 2.817% on Thursday.

The policy-sensitive 2-year yield was at 2.6006%, up from a close of 2.522%.

“Within the shape of the U.S. Treasury curve we are not seeing any particularly fresh recession/slowdown signal, just the same consistent marked slowing earmarked for H2 2023,” Alan Ruskin, macro strategist at Deutsche Bank, said in a note.

German 10-year government bond yields edged up to 0.9250%.

MSCI‘s broadest index of Asia-Pacific shares outside Japan was up almost 2% from Thursday’s 22-month closing low, trimming its losses for the week to less than 3%.

Australian shares gained 1.93%, while Japans Nikkei stock index jumped 2.64%.

In China, the blue-chip CSI300 index was up 0.75% and Hong Kong‘s Hang Seng rose 2.71%, encouraged by comments from Shangahi’s deputy mayor that the city may be able to start easing some tough COVID restrictions this month.

“We had some pretty big moves yesterday, and when you see those big moves it‘s only natural to get some retracement, especially since it’s Friday heading into the weekend. There‘s not really a new narrative that’s come through, ” said Matt Simpson, senior market analyst at City Index.

Oil prices were higher against the backdrop of a pending European Union ban on Russian oil, but were still set for their first weekly loss in three weeks, hit by concerns over inflation and Chinas lockdowns slowing global growth.

U.S. crude rose 0.75% to $106.97 a barrel, and global benchmark Brent crude was up 1.05% at $108.58 per barrel.

Spot gold, which had been driven to a three-month low by the soaring dollar, was up 0.2% at $1,824.61 per ounce.