Breaking: USD/JPY Breaks Through 1 Year Highs

USD/JPY just broke through 1-year highs earlier than expected.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

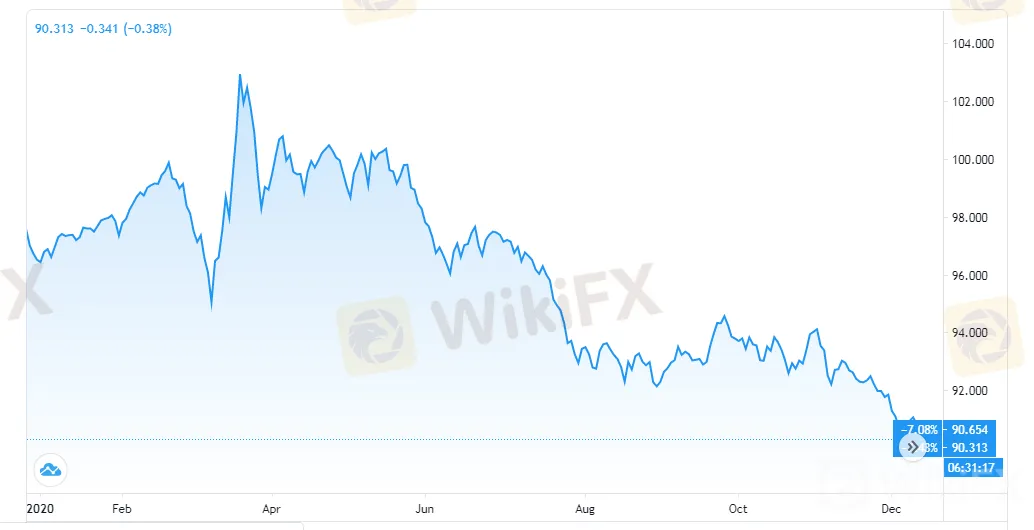

Abstract:The DXY is expected to continue on its downward trajectory in the upcoming 2021.

WikiFX News (26 Dec.) - The DXY is expected to continue on its downward trajectory in the upcoming 2021, amid the rising confidence in global recovery and the Fed's enduring accommodative stance of monetary policy.

The Fed has cut the Fed funds rate to near zero to bolster the economy during the coronavirus pandemic. With the introduction of a trillion-dollar coronavirus relief bill, the DXY has lost over 6% in 2020.

The Fed's sustained ultra-accommodative monetary policy would catalyze the next leg lower in the structural USD downtrend when viable, widely distributed vaccines hit the market, said Citibank.

“We forecast another 5-10% dollar decline through 2021 as the Fed allows the US economy to run hot,” ING chief economist Carsten Brzeski said.

Moreover, the growth gap between the US and other regions worldwide will continue to grow, which will weigh on the greenback.

This month, the DXY fall to 89.88, a fresh low since April 2018. Economists at Westpac forecast the DXY heading towards 88 in the first quarter of 2021.

All the above is provided by WikiFX, a platform world-renowned for forex information. For details, please download the WikiFX App: bit.ly/wikifxIN

Chart: Trend of the DXY

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

USD/JPY just broke through 1-year highs earlier than expected.

A Good Week For the US Dollar As It Gains Strongly Against Other Major Pairs.

Performance like this hasn't been seen since 2021

The EUR/USD pair ended the week in the red last week as many investors remained in a holiday mood. It was trading at 1.1720, down slightly from last year’s high of 1.1910 ahead of key events this week.