Abstract:Currently, a speculative atmosphere has been pervading US stocks. After the junk stocks such as bankruptcy concept stocks has been speculated, speculators begin to hype "black concept stocks".

WikiFX News (21 June)- Currently, a speculative atmosphere has been pervading US stocks. After the junk stocks such as bankruptcy concept stocks has been speculated, speculators begin to hype “black concept stocks”.

Whether because of living in an epidemic quarantine zone or having received a government subsidy that is higher than usual salary, retail investors in US stocks have been betting on stocks of listed companies that have filed for or are close to bankruptcy, playing against each other in a highly leveraged environment.

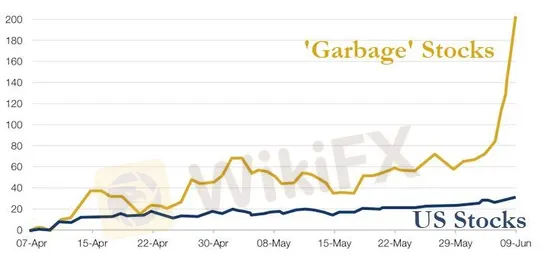

According to the “junk stock index” constructed by analysts, since April 7th, junk stocks have significantly outperformed the Morgan Stanley Capital International MSCI US Index (MSCI US Index), and stock prices seem to have completely deviated from the fundamentals.

In addition, the “BLM (Black Lives Matter.)” movement also seems to have affected US stocks. Traders try to show their virtues by greedily hyping “black concept stocks” and betting heavily on black-owned corporation. For example, the black-operated Carver Bancorp's bank has recently risen by nearly 800%.

The above information is provided by WikiFX, a world-renowned forex query provider that offers comprehensive information about forex brokers. For more information, please download the WikiFX App. bit.ly/WIKIFX

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.