Abstract:Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

WikiFX News (18 June) - Due to the fear of an epidemic resurgence and a constantly low Fed interest rate, US stocks have witnessed a fatigued late, bringing a strong momentum to the US dollar and meanwhile suppressing the rise in gold price.

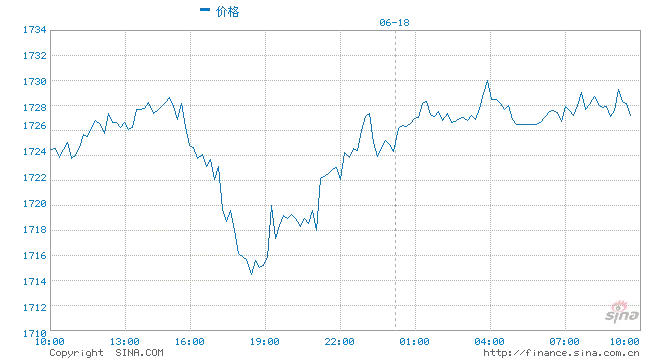

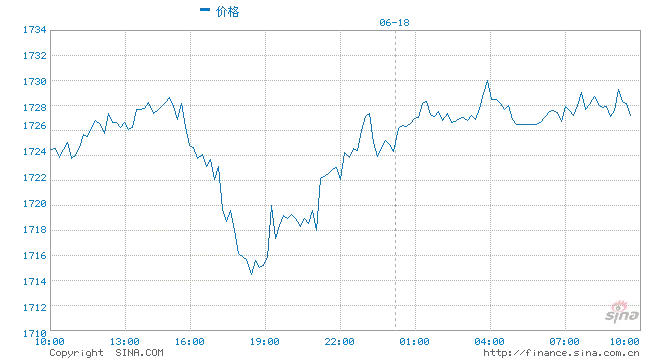

Yesterday, spot gold once rebounded by US$17, refreshing its daily high to US$1730.22 per ounce, but the US dollar later strengthened to suppress golds upward trend.

In terms of gold futures, the price of gold futures delivered on the New York Mercantile Exchange in August has fallen by 90 cents, a decline amount of 0.05%, closing at $1735.60 per ounce. Analysts said that gold prices have performed irregularly in the past few days, and gold futures price is not always negatively related to stock markets and debt yields.

According to Michael Matousek, chief trader of US Global Investors, gold prefers a long-term investment and it should be bought in when there is a slight correction in price. Prott CEO Peter Grosskopf says that it is time to buy gold in a large amount now, because the credit crisis has already broken out.

The above information is provided by WikiFX, a world-renowned foreign exchange information query provider. For more information, please download the WikiFX App. bit.ly/WIKIFX