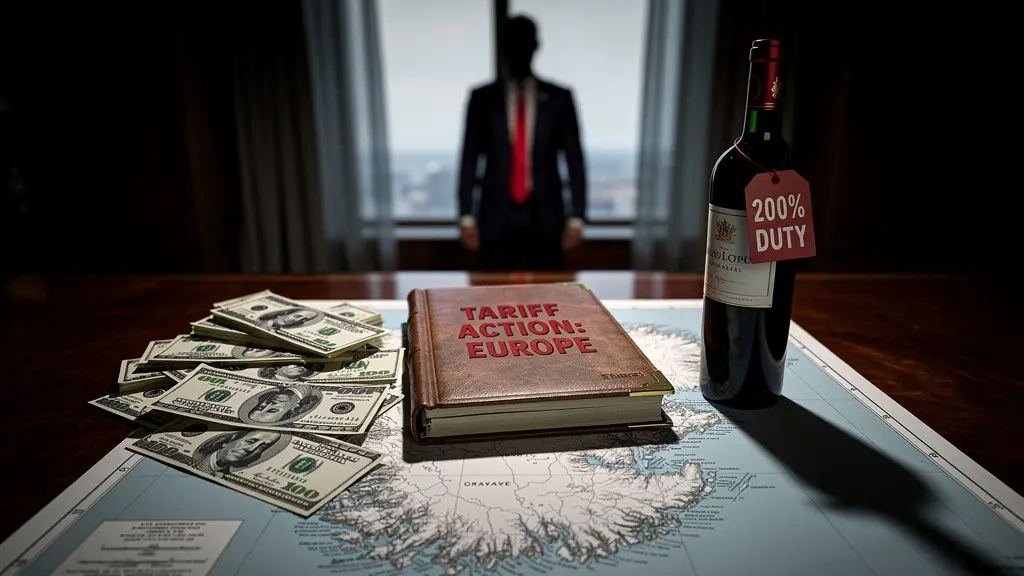

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Transatlantic tensions escalate as a Danish pension fund liquidates US Treasury holdings over 'Greenland' risks, while the EU prepares retaliation against looming US tariffs.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Transatlantic tensions escalate as a Danish pension fund liquidates US Treasury holdings over 'Greenland' risks, while the EU prepares retaliation against looming US tariffs.

Japan's bond market suffers its most chaotic day in years as aggressive fiscal promises from PM contender Sanae Takaichi trigger a 25 basis point spike in long-term yields, raising fears of a UK-style 'Truss Moment.'

Deutsche Bank warns that 2026 will be a "do or die" year for independent AI firms as infrastructure costs soar and Google/xAI consolidates power, threatening a market shakeout.

Japanese government bonds experienced their worst sell-off in years, pushing yields to record highs as markets lose confidence in Prime Minister Takaichi's aggressive fiscal expansion plans.

Spot Gold has breached the psychological $4,700 barrier, driven by safe-haven inflows amidst US-EU tensions and sticky inflation, while LME Copper faces a historic squeeze due to inventory disconnects.

Experts say the targeting of high-profile tycoons and active crackdown on business networks associated with scam compounds is a strategic move to rebuild Cambodia’s branding, as well as showcasing stability, which are key to stimulate investment

The US Dollar has retreated to the 98.50 level as President Trump's aggressive tariff threats regarding Greenland and the 'Peace Committee' ignite fears of a transatlantic trade war, prompting the EU to prepare a €93 billion retaliation package.

The People's Bank of China has kept the Loan Prime Rate unchanged for an eighth consecutive month, defying calls for broad-based easing. The central bank is prioritizing net interest margin stability over headline rate cuts.

Sterling has come under pressure after UK payrolls dropped by the largest amount since 2020 and wage growth slowed. The data reinforces expectations for further Bank of England rate cuts as the labor market cools.

Japanese Government Bond yields have spiked to historic highs as fears of unfunded tax cuts under a potential new administration spook investors. The 30-year yield surged to 3.875%, with markets questioning the sustainability of Japan's fiscal discipline.

Summary: A real post from a member of the Bitcoin Thai Community struck a chord this December — a crypto trader shared that he lost nearly 10 million Thai baht (about $270,000) trading futures. What began as quick gains spiraled into a complete account wipeout due to high leverage, frequent trading, and repeated top-ups fueled by overconfidence. This painful experience illustrates a timeless trading lesson: markets don’t ruin people — emotions and lack of discipline do.

According to a recent Chainalysis report, hackers linked to North Korea stole more than $2.02 billion in cryptocurrency over the past year — accounting for nearly 60% of all crypto theft worldwide. These attacks are becoming more sophisticated, including insider infiltration and laundering via smaller transactions. This highlights that crypto risks extend beyond price volatility to include system and human vulnerabilities, underscoring the need for traders to diversify risk and prioritize security alongside trading strategies.

Bank of America's latest fund manager survey reveals "extreme greed" in global markets, with investors piling into equities and betting heavily on a "no landing" economic scenario. However, cash levels have hit historic lows, and long Gold positions have become the most crowded trade.

Gold and Silver prices have surged to record highs above $4,700 as escalating trade tensions between the US and EU regarding Greenland trigger a flight to safety. Meanwhile, US Treasury Secretary Bessent attempts to calm fears of a retaliatory Euro-led sell-off of US Treasuries.

HEADWAY holds an FSCA license and a WikiFX score of 4.40, offering competitive spreads and unlimited leverage for high-risk strategies. However, the broker's safety rating is severely compromised by a massive volume of unresolved complaints regarding withdrawal denials and platform manipulation.

Did your deposited amount fail to reflect in the ForexDana forex trading account? Failed to receive an adequate response from the broker’s customer support officials? Do you think that it is a clone firm that cheats traders? Were you fascinated by the profit shown on the trading platform, but could not withdraw funds? Have you been lured into trading by a deposit bonus that does not work in real-time? In this ForexDana review article, we have investigated some complaints against the broker.

The study explores the integration of artificial intelligence in modern healthcare diagnostics, highlighting its potential to improve accuracy while noting significant ethical concerns regarding patient data privacy.

The IMF has upgraded its global growth forecasts led by US resilience, but BlackRock CEO Larry Fink warns that soaring US debt interest payments pose a systemic risk that markets are dangerously ignoring.

Global markets are reeling as President Trump threatens escalating tariffs on European allies over the acquisition of Greenland and a controversial 'Peace Committee,' pushing Gold to unprecedented highs above $4,700.

Have you witnessed a complete fund scam experience when trading with SOLIDARY PRIME? Did you have a PAMM account that disappeared suddenly on the broker’s trading platform? Is the SOLIDARY PRIME customer support team inept in handling your trading queries? Did the broker deceive you on binary options? These complaints are showing up on broker review platforms. In this SOLIDARY PRIME review article, we have investigated some of the complaints against the broker. Take a look!