Company Summary

General Information & Regulation of RK Global

RK Global was founded in New Delhi, India, in 1995 and opened its own retail brokerage service in 2000. RK Global provides a range of financial services to over 150 cities and 24 states across India, with the goal of earning customer trust and creating an efficient and transparent trading environment, providing customers with 24/7 customer service via email, wire transfer, web forms, and chat. No regulatory information is available on the RK Global website.

Safety Analysis

RK Global is not currently regulated as a stockbroker, which means that investors' trading activities and funds are not protected in any way.

Main Businesses

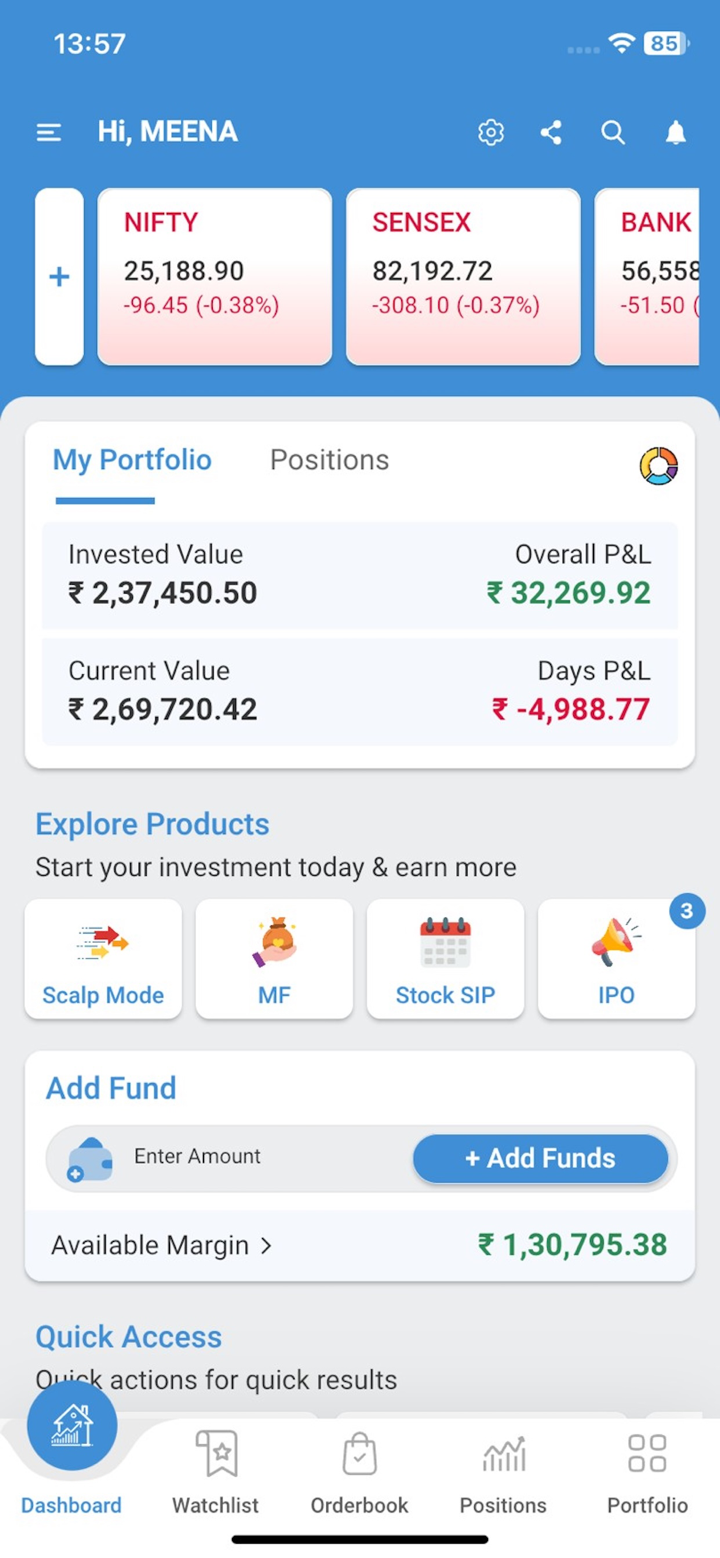

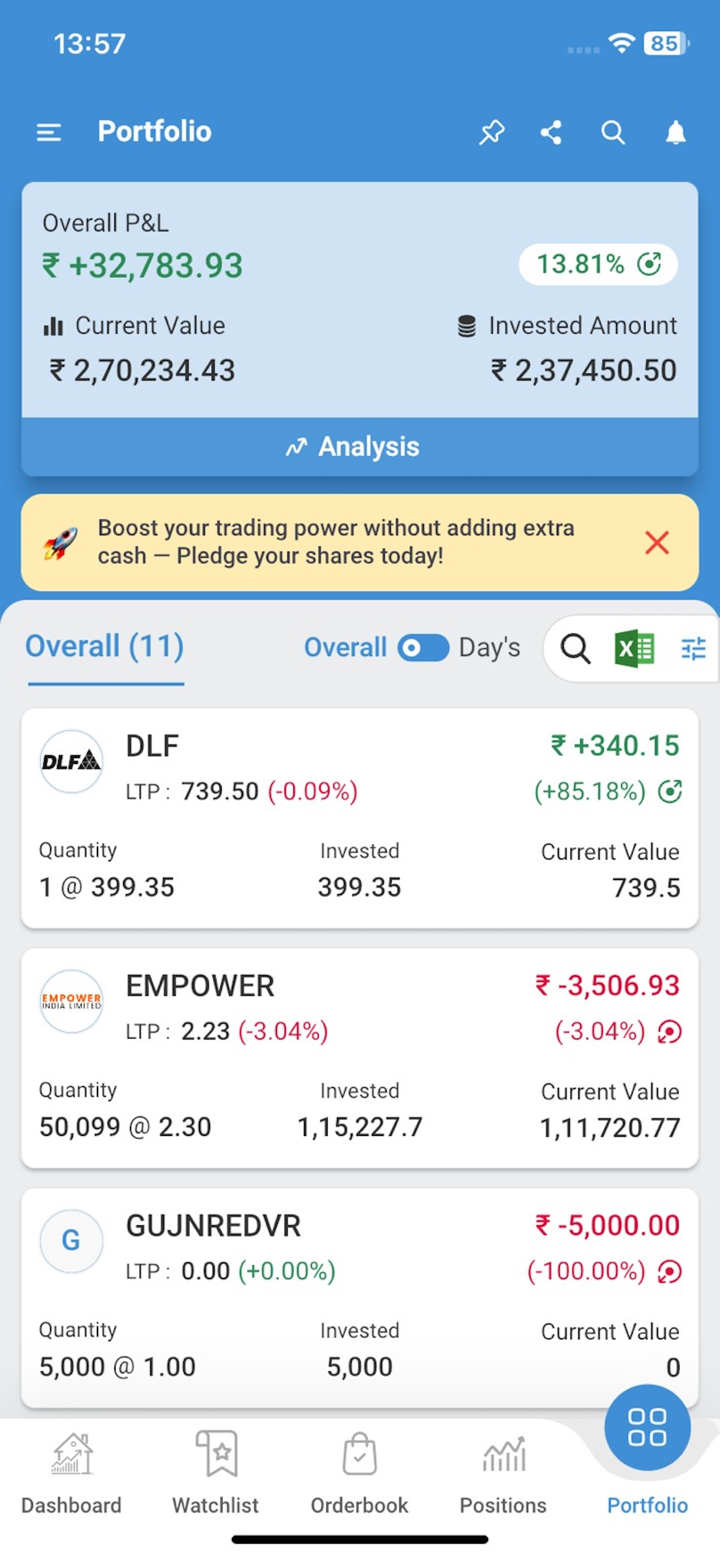

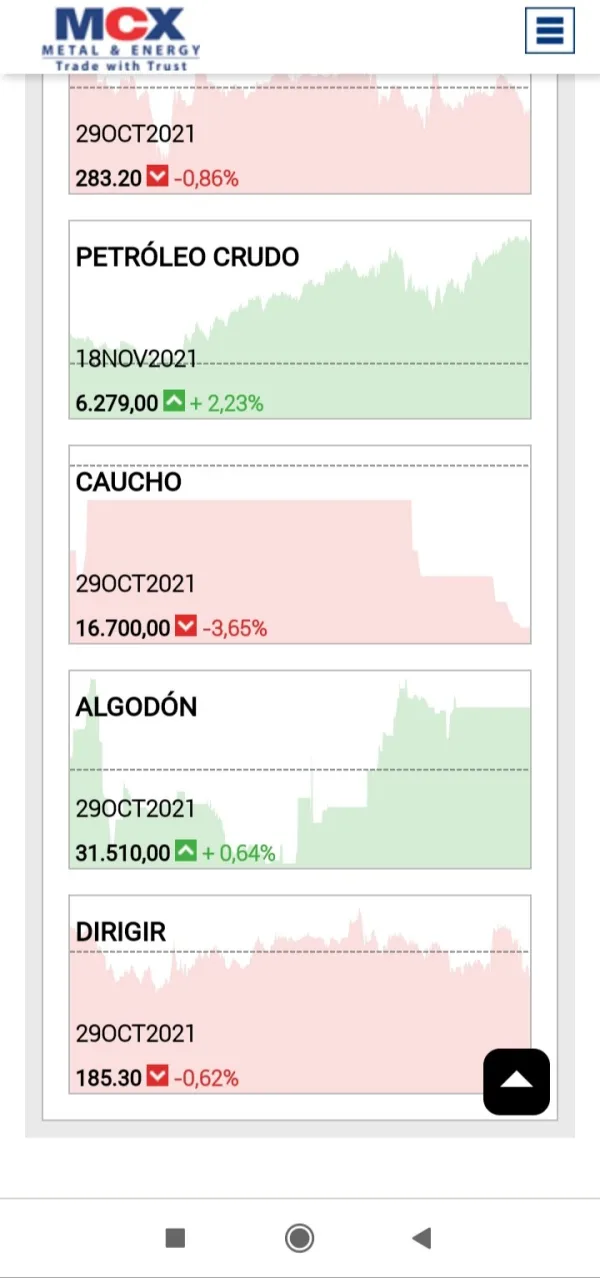

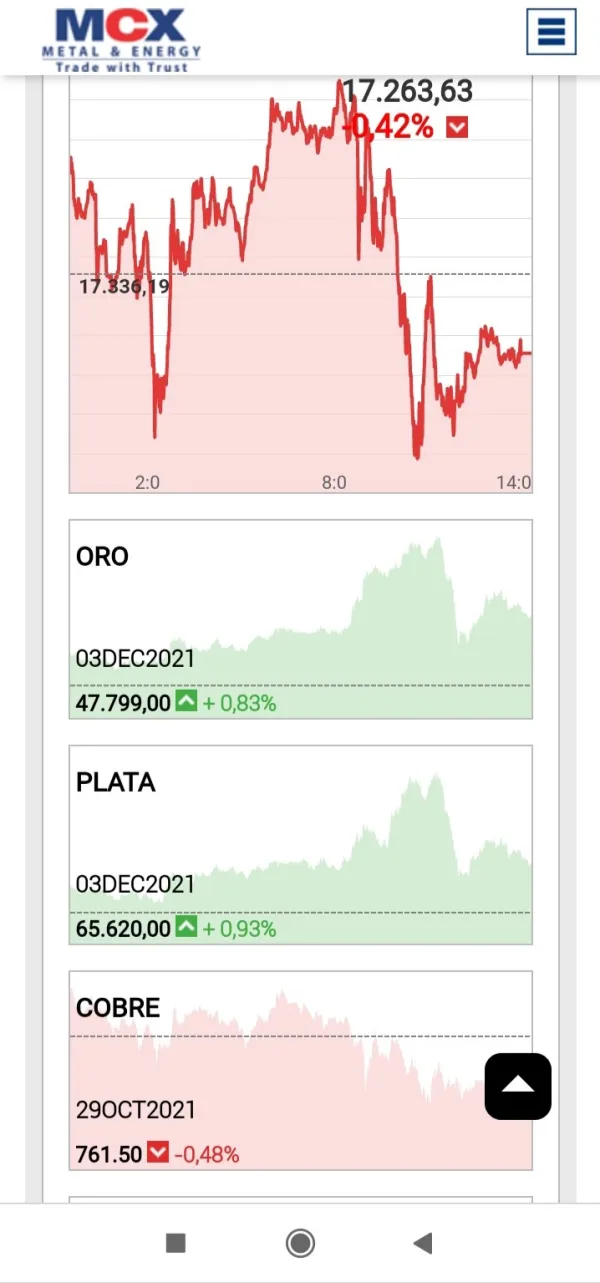

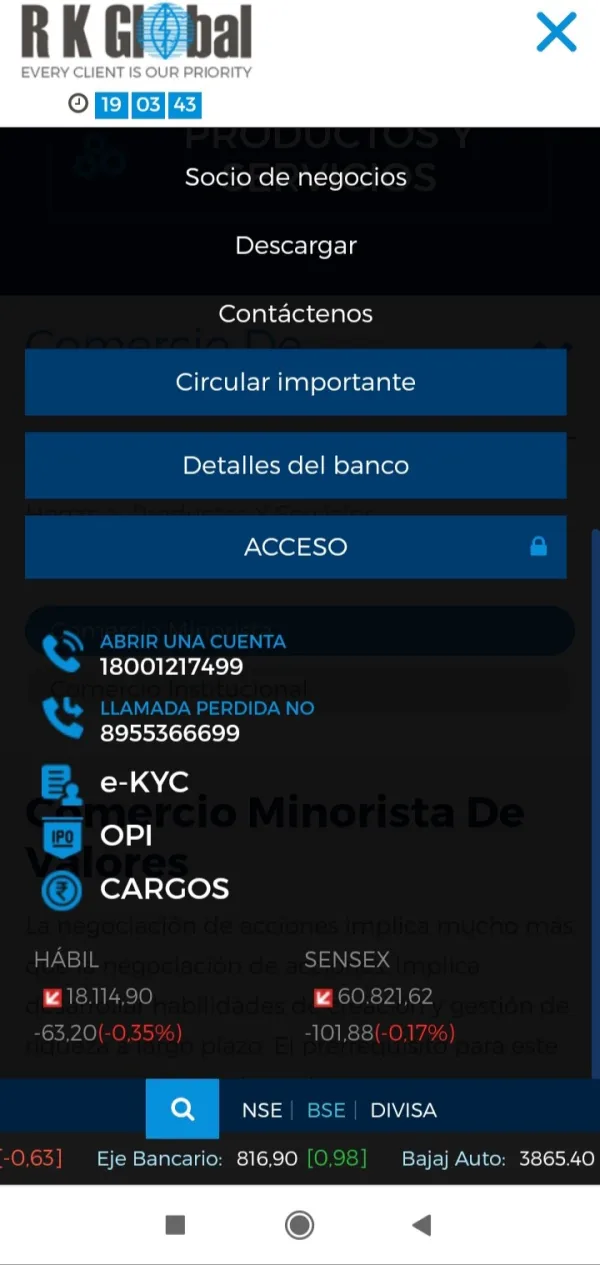

RK Global offers services in equities, IPOs/IPO's, derivatives, commodities, mutual funds, and currencies.

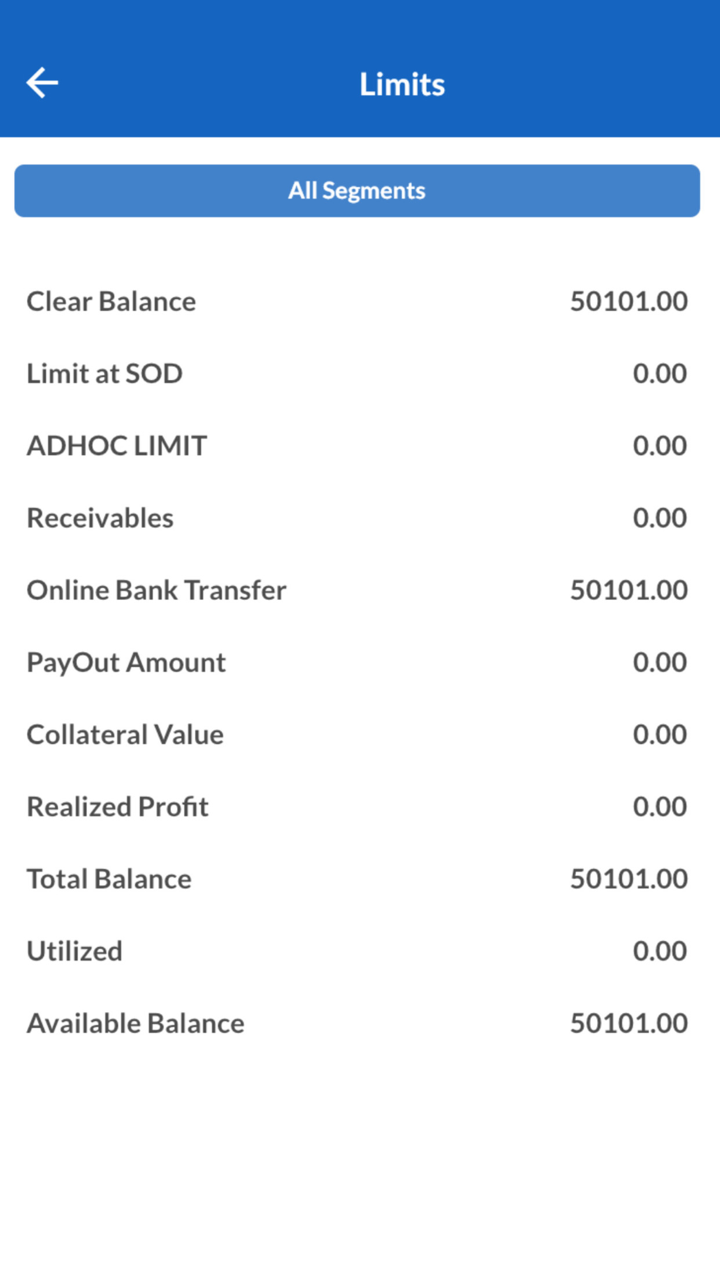

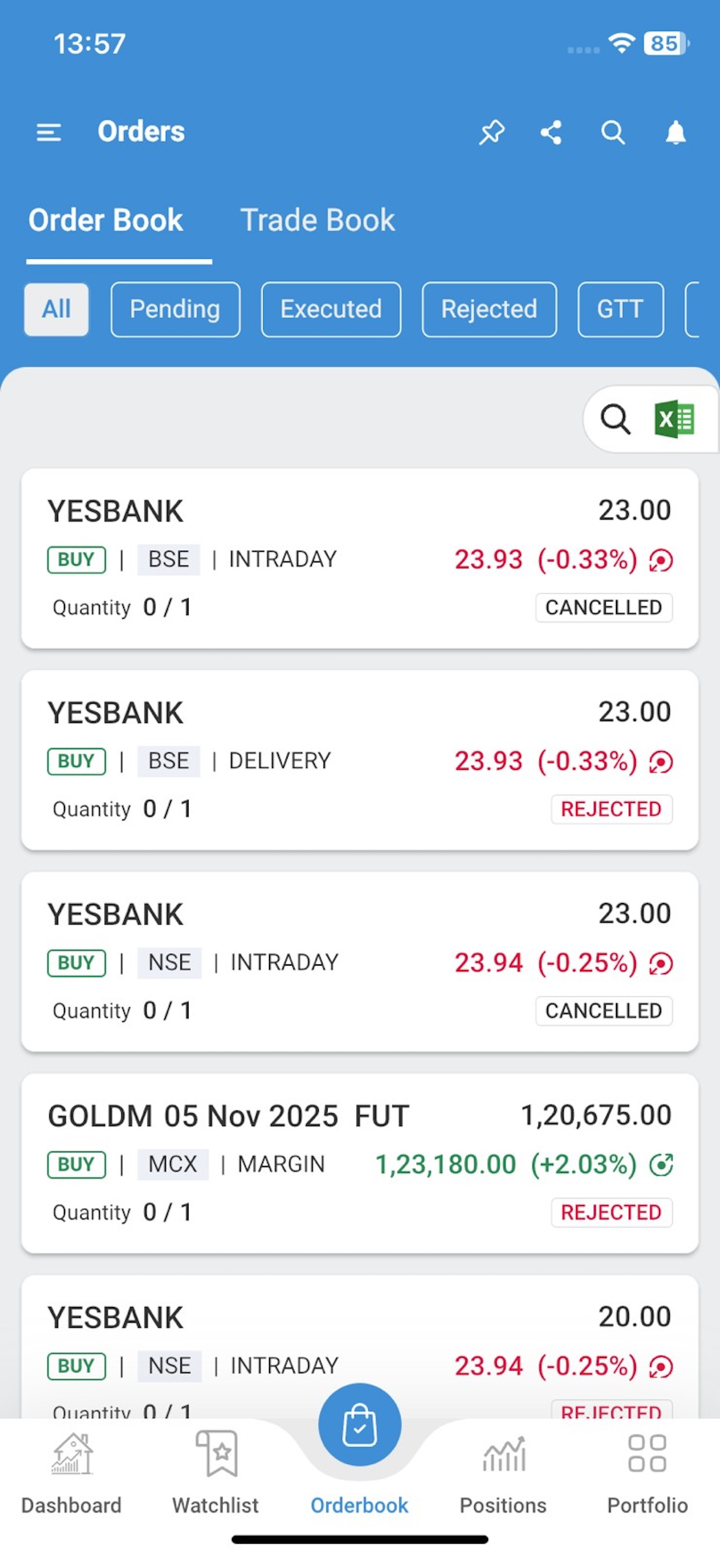

Fees of RK Global

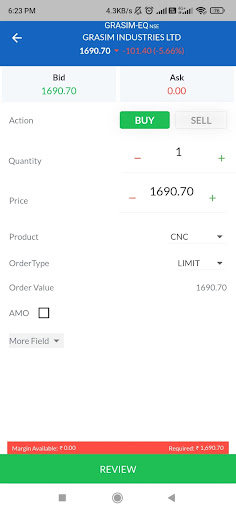

RK Global offers two schemes for the equity market and unlimited trading in derivatives for retail brokers in the NSE/BSE capital market segment. The commission for trading for retail clients other than those in the capital markets is Rs. 9 per lot. Other fees include DP fee for transaction-based equity sale based on the seller only - Rs. 12.5 per transaction, an additional fee of Rs. 25 for call transactions, digital contracts sent via email at an additional fee of Rs. 30 per contract for ordering a physical copy of a quick contract; Demat account opening fee (one-time) of Rs. 50.

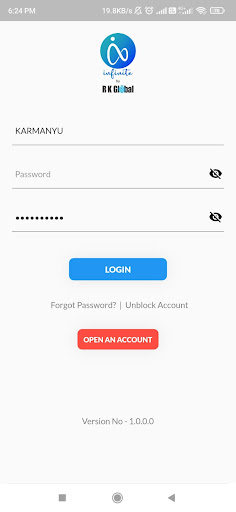

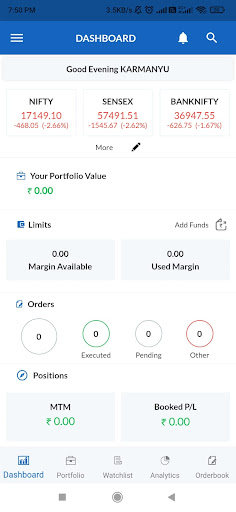

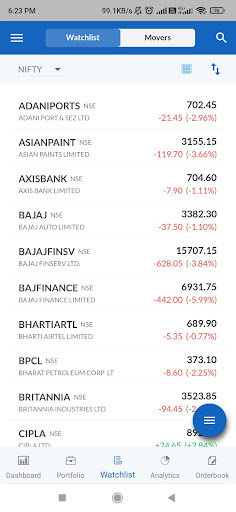

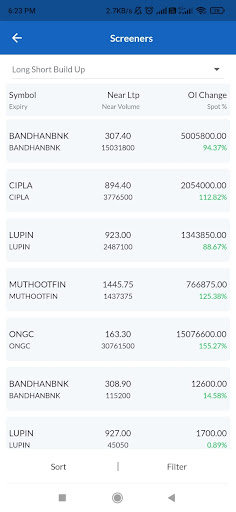

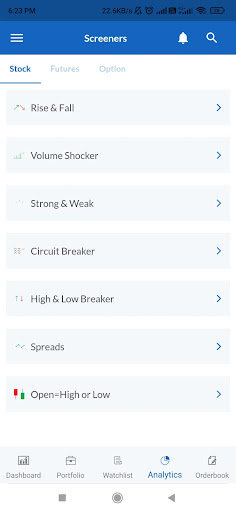

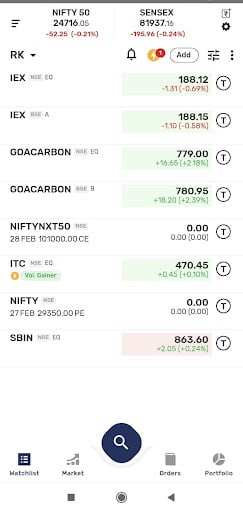

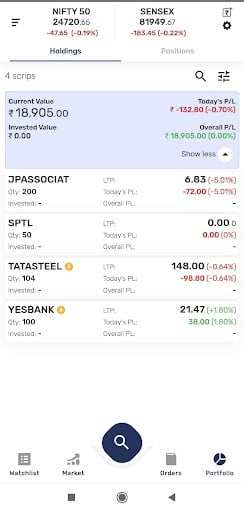

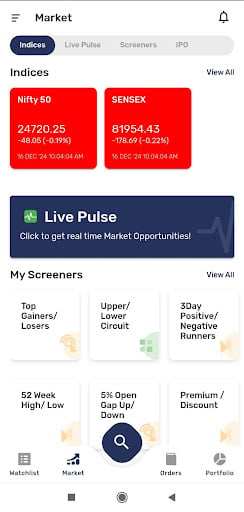

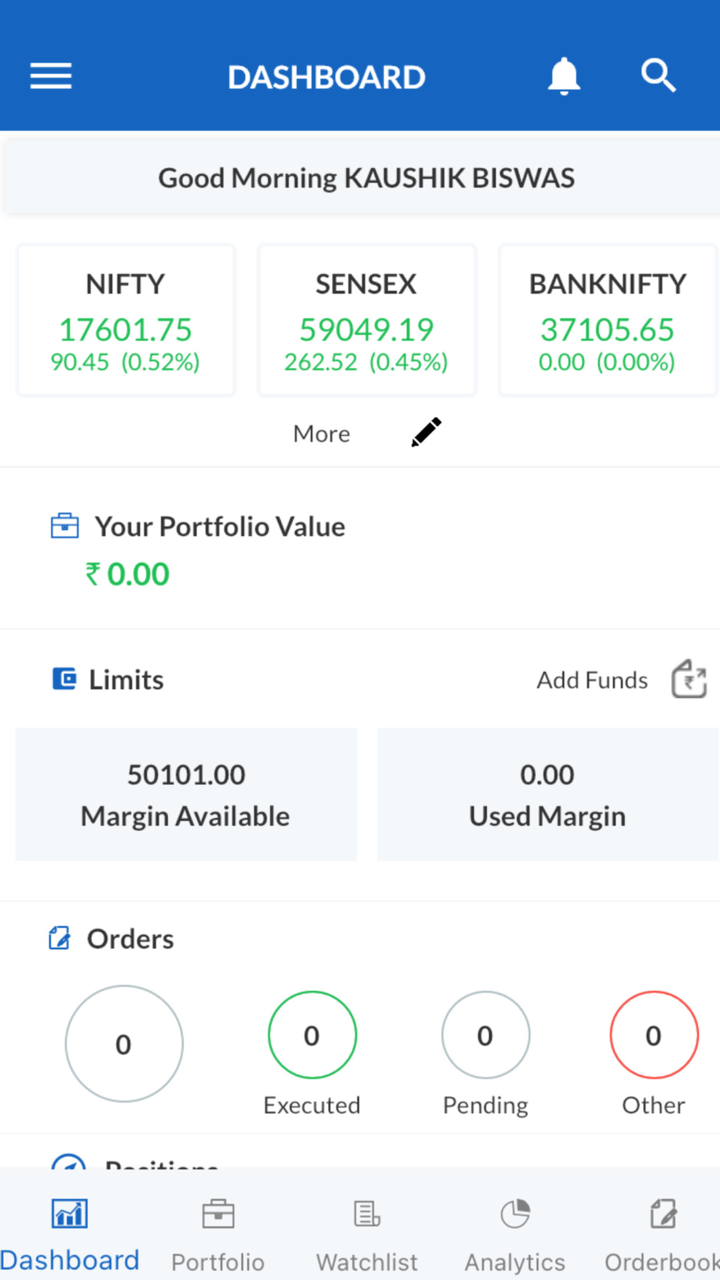

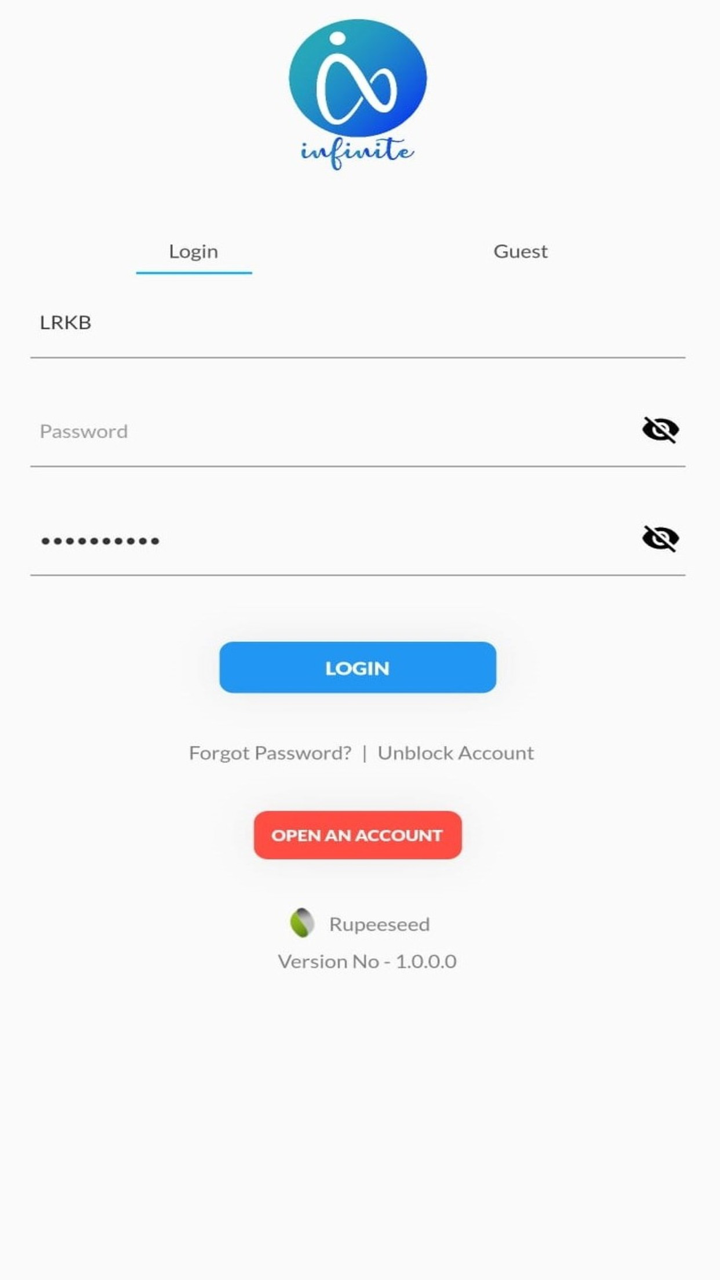

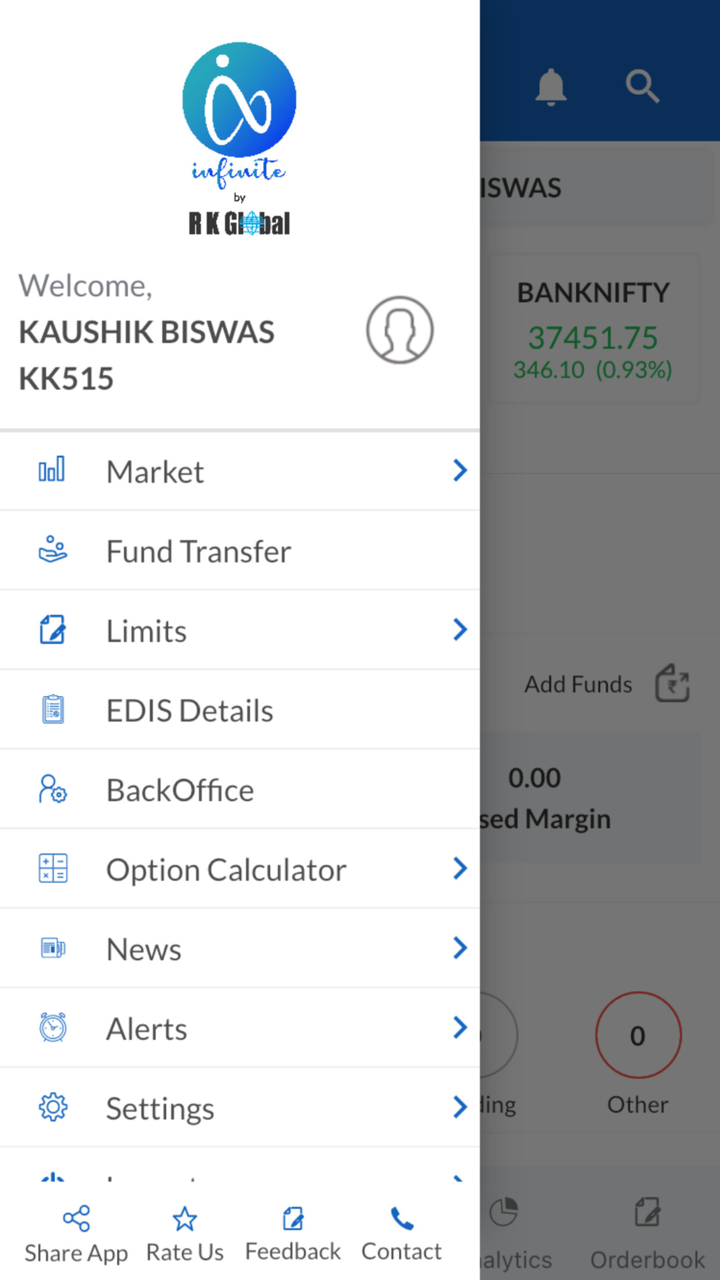

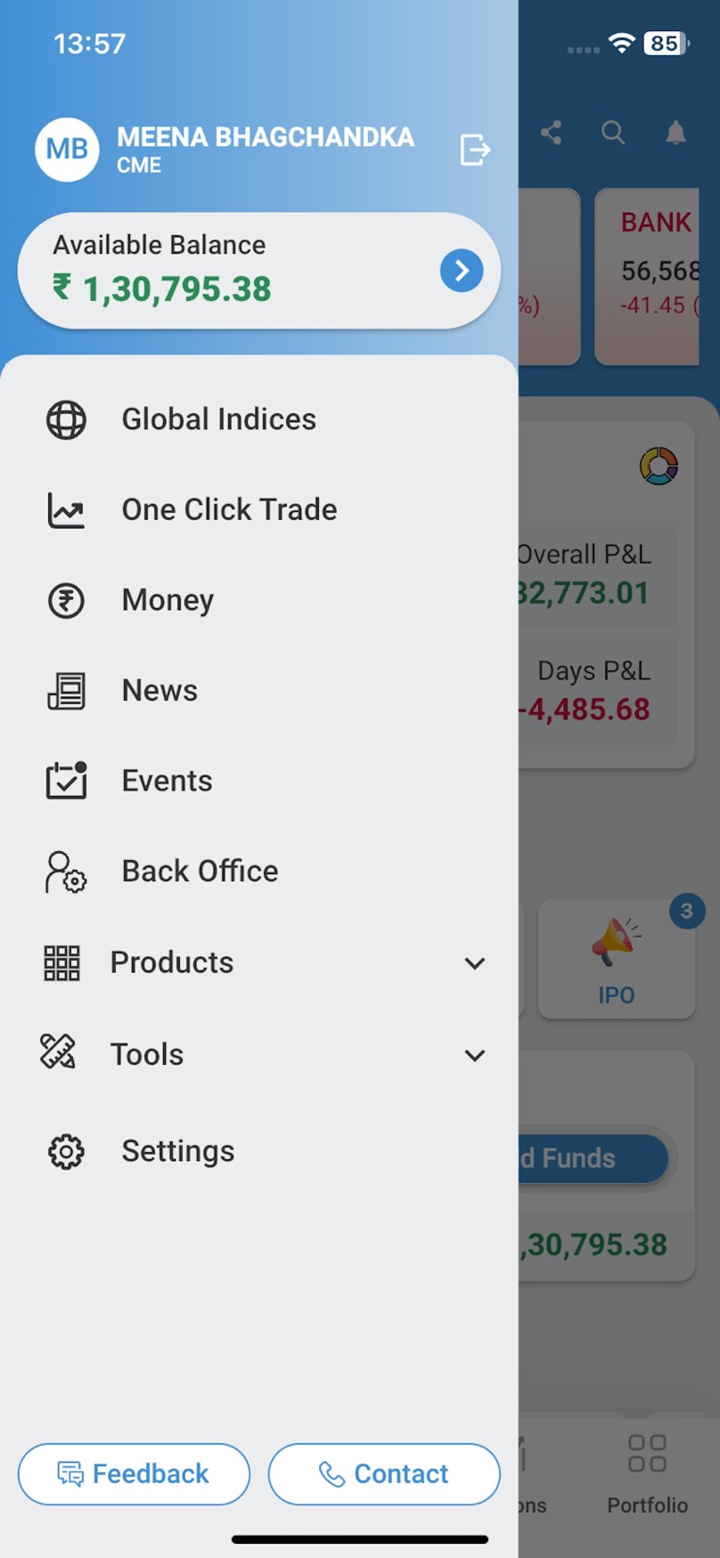

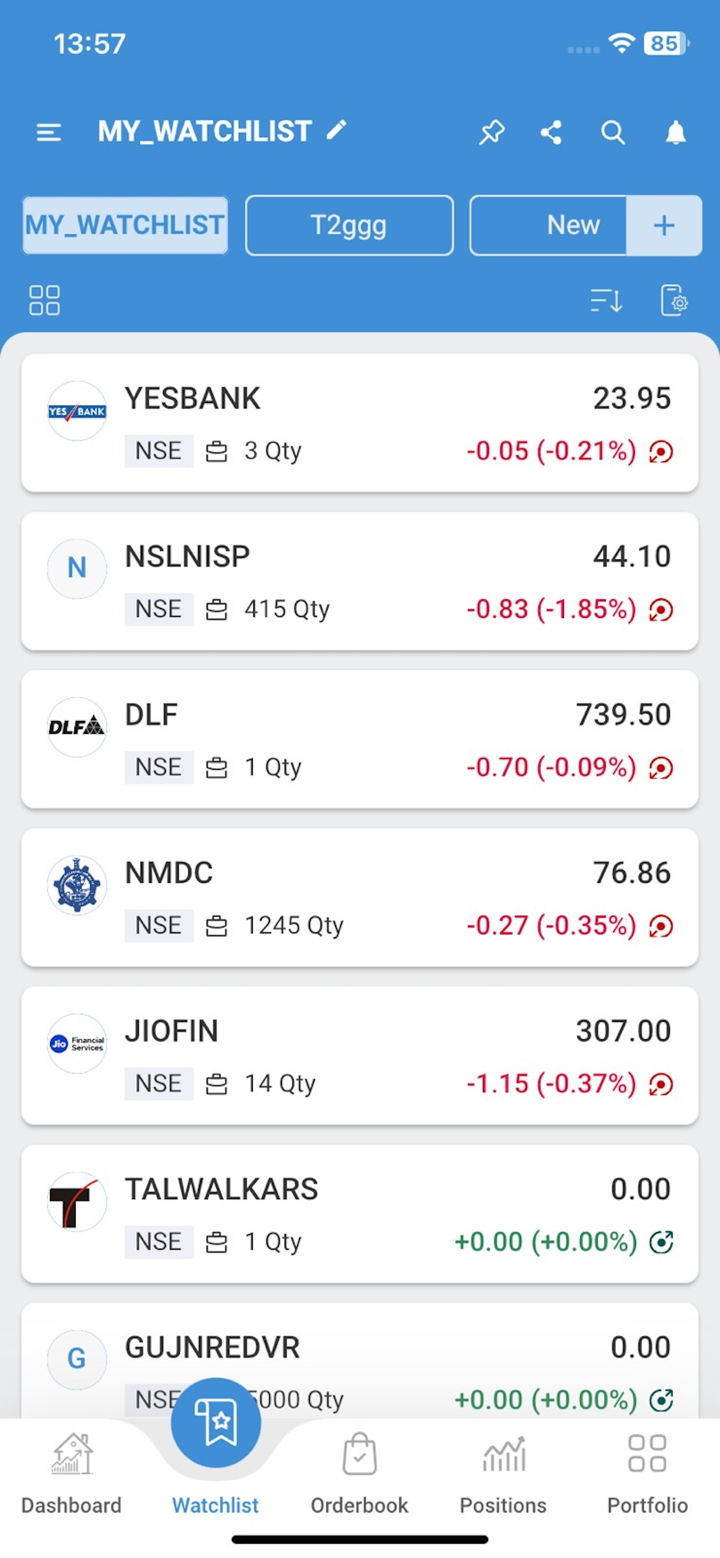

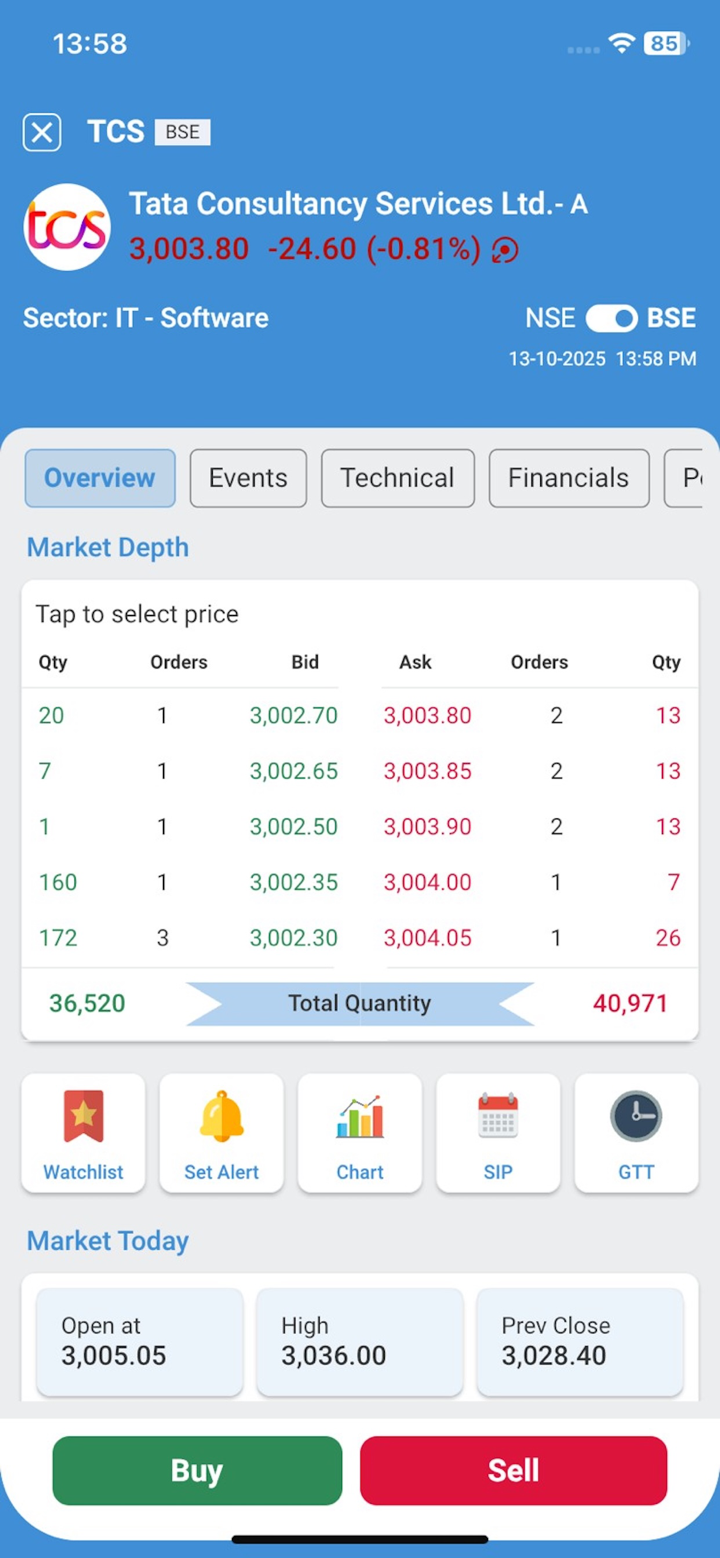

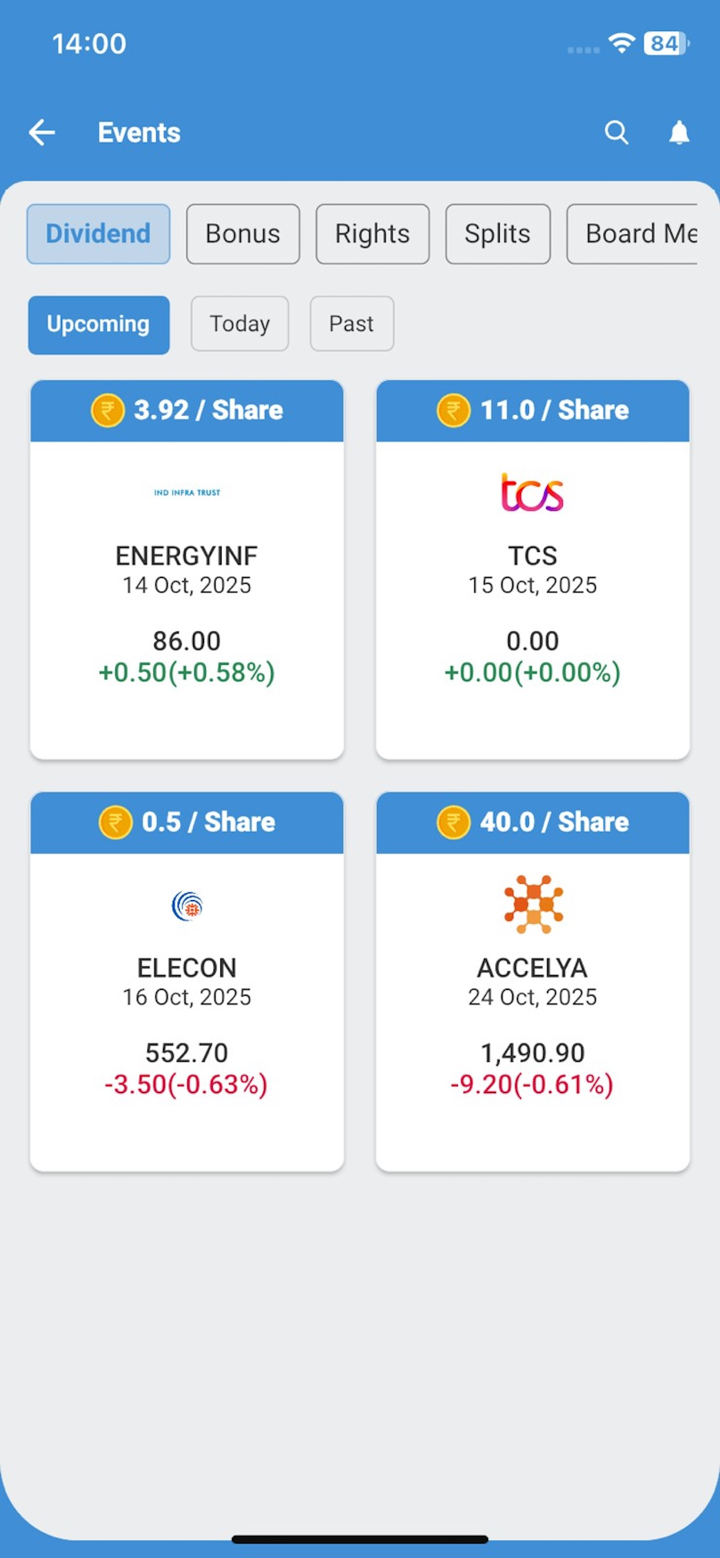

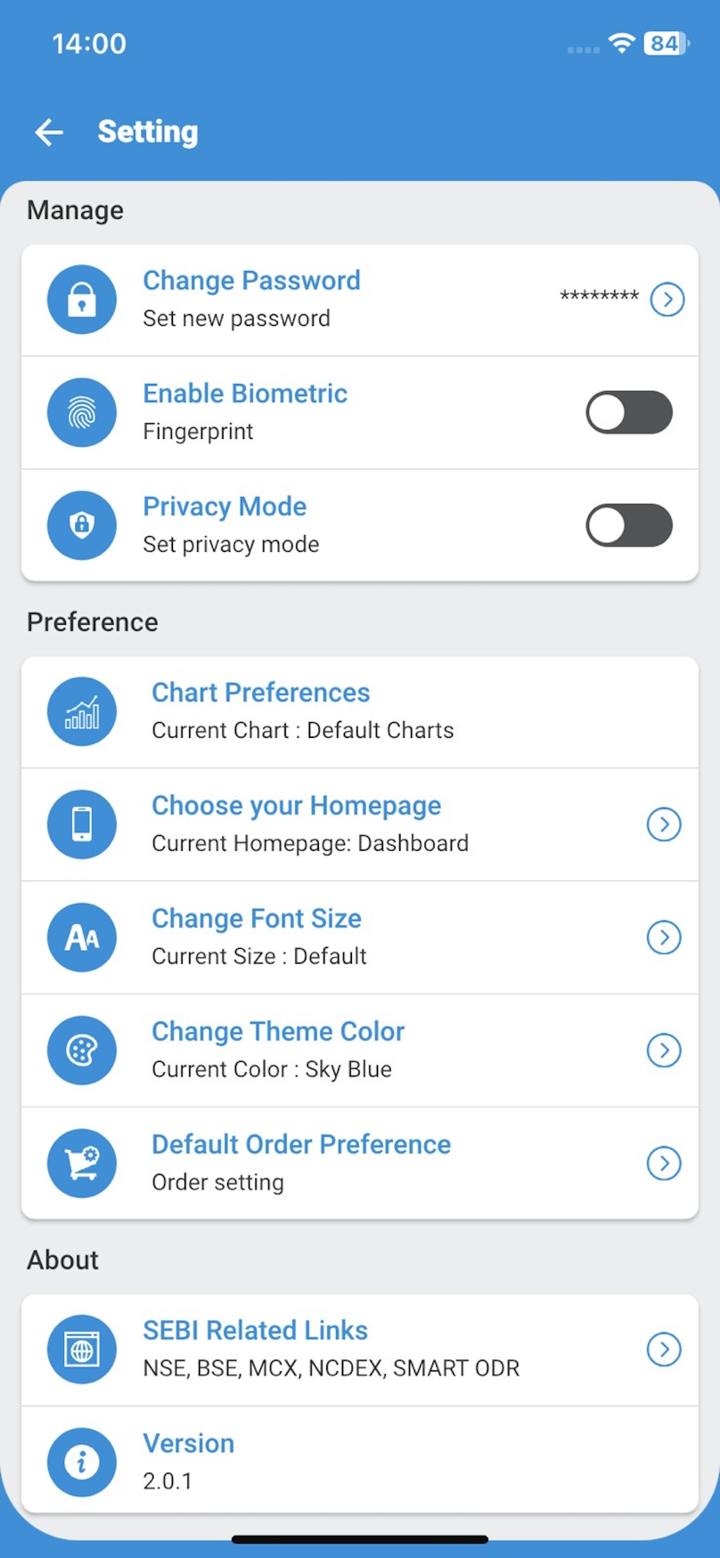

Trading Platforms Available of RK Global

RKG Diet ODIN-Diet ODIN 10x Setup is a high-speed trading terminal for desktops that supports multi-trade and multi-segment trading and provides customers with a fast way to access Ether quotes in real-time. It supports advanced order types such as bracket orders and cover orders.RKG Net. Net-RKG Net.Net is a trading website for fast, convenient, and accessible online trading with the same functionality as the trading terminal, providing quick and easy access to online trading tools without installation or download.

Pros & Cons of RK Global

The main advantages of RK Global are:

1. 24/7 customer service

2. Innovative trading platform

The main disadvantages of RK Global are:

1. Unclear regulatory information

2. Multiple fees

3. Account & deposits and withdrawal methods not provided