Company Summary

| Aspect | Information |

| Company Name | Lloyds Markets |

| Registered Country/Area | New Zealand |

| Founded Year | 2023 |

| Regulation | Not Regulated |

| Market Instruments | Stocks, ETFs, Options, Futures |

| Account Types | Basic, Standard, Silver, Gold, Platinum |

| Minimum Deposit | $250 |

| Maximum Leverage | N/A |

| Spreads | Start from 2.3 pips |

| Trading Platforms | N/A |

| Demo Account | None |

| Customer Support | Phone (+441515281485), Email (support@llds-group.com), Contact Form |

Lloyds Markets Information

Lloyds Markets is a broker registered in New Zealand from 2023. It offers stock, ETF, option, and futures trading with competitive fees and five account types. However, a red flag is their lack of regulatory information from well-known authorities like the FCA. This could put your investment at risk.

Pros and Cons

| Pros | Cons |

| Variety of tradable instruments | Lack of regulation |

| Five account types for users to choose from | No online chat or social media for customer support |

| 10 languages support |

Is Lloyds Markets Legit?

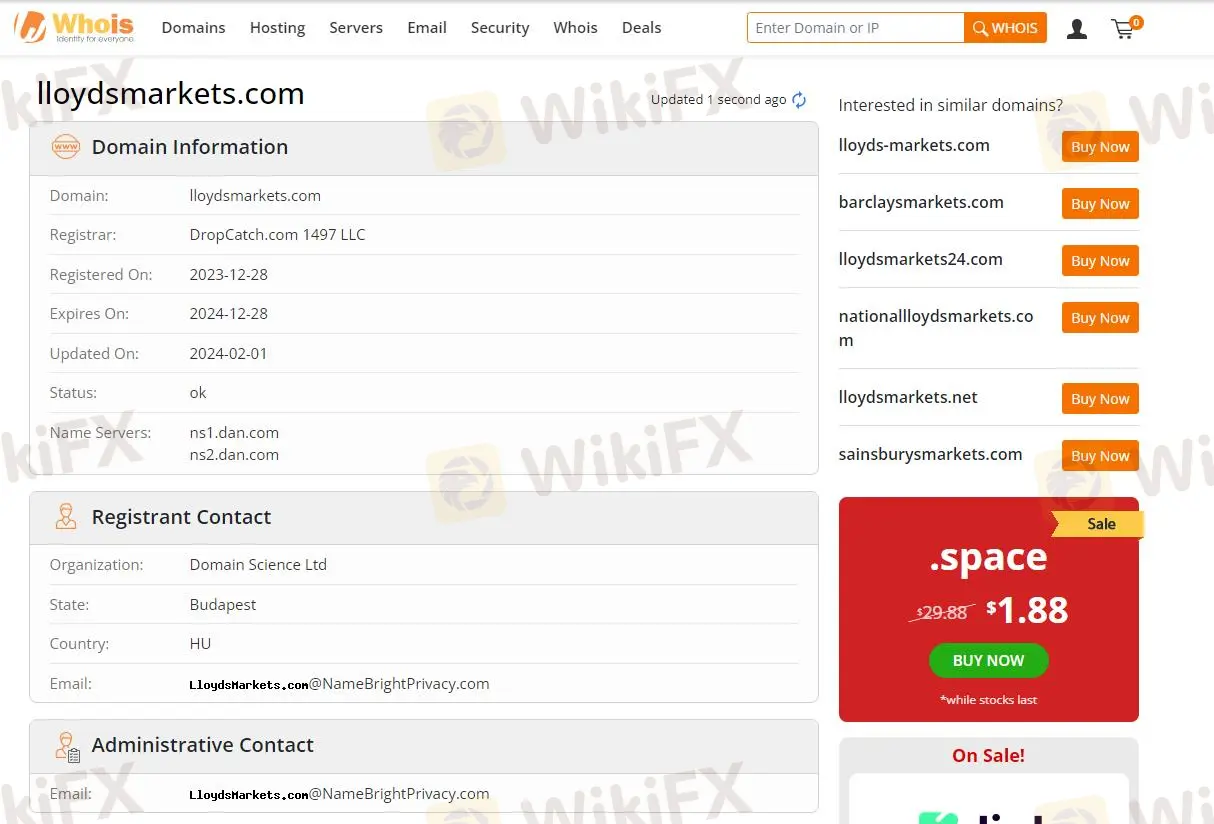

Lloyds Markets' regulatory information cannot be obtained on the internet, and it is not governed by other well-known regulatory authorities such as the Financial Conduct Authority (FCA) in the United Kingdom or the Australian Securities and Investments Commission (ASIC).

What Can I Trade on Lloyds Markets?

Lloyds Markets offers many different financial products, including stocks, ETFs, options and futures, to meet the needs and strategies of different traders.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ❌ |

| Shares | ✔ |

| Metals | ❌ |

| Commodities | ❌ |

| ETFs | ✔ |

| Crypto | ❌ |

| Options | ✔ |

Account Type

Lloyds Markets provides five account types for users to choose from.

The Basic account starts at $250 and offers a commission of $1 per deal, a spread from 2.3 pips, and cashback up to 20%. As you progress through the tiers to Standard, Silver, Gold, and Platinum, the commission drops to zero, the spread narrows, and the cashback increases.

Higher-tier accounts also offer extra features such as trading techniques, trade alerts, and comprehensive market analytics.

| Account Type | Minimum Deposit | Commission | Spread | Cashback | Negative Balance Protection | Education | Regular analytical publications | Personal manager | Trading strategies | Analytical consultations | Trading Signals | Full market analytics |

| Basic | $250 | $1 per deal | 2.3 pips | 20% | ✔ | ✔ | ✔ | ✔ | ✔ | ❌ | ❌ | ❌ |

| Standard | $1,000 | 0 | 2 pips | 30% | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ❌ | ❌ |

| Silver | $5,000 | 0 | 1.7 pips | 40% | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ❌ |

| Gold | $25,000 | 0 | 1.4 pips | 50% | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ❌ |

| Platinum | $50,000 | 0 | 1 pip | 60% | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

Lloyds Markets Fees

Lloyds Markets' fees are generally competitive with industry standards.

Trading Fees

The commission and spread structure varies across account types. The Basic account has a $1 commission per deal, and a spread start from 2.3 pips. The Standard, Silver, Gold, and Platinum accounts have no commissions, and the spread gradually decreases, starting from 2 pips, 1.7 pips, 1.4 pips and 1 pip.

Customer Service

| Contact Options | Details |

| Phone | +441515281485 |

| support@llds-group.com | |

| Support Ticket System | None |

| Online Chat | None |

| Social Media | None |

| Supported Language | Russian, English, Spanish, Italian, German, Polish, Norwegian, Finnish, French, Czech |

| Website Language | Russian, English, Spanish, Italian, German, Polish, Norwegian, Finnish, French, Czech |

| Physical Address | 12 Lakeview Terrace, Auckland 1024, New Zealand |

| Contact Form | Yes |

The Bottom Line

Lloyds Markets offers stocks, ETFs, options, and futures trading and five account types for users to choose from with low commissions and spreads. However, unregulated is a serious warn sign, and Lloyds Markets doesnt offer online chat or social media for quickly customer help.

Experienced traders looking for diversified account types with cheap fees will find Lloyds Markets interesting, but only after accepting regulatory problems.

FAQs

Is Lloyds Markets a safe trading platform?

No, Lloyds Markets is a very young broker (established in 2023) that is not regulated by any major financial agencies, so utilizing it bears some risk.

Does Lloyds Markets offer good customer support?

Their customer support options are traditional. They offer phone support and email, but lack features like live chat or social media support.

Is Lloyds Markets good for beginners?

Lloyds Markets for beginners is a higher risk. Due to the lack of regulation by well-known regulatory authorities, your investment may be at risk.