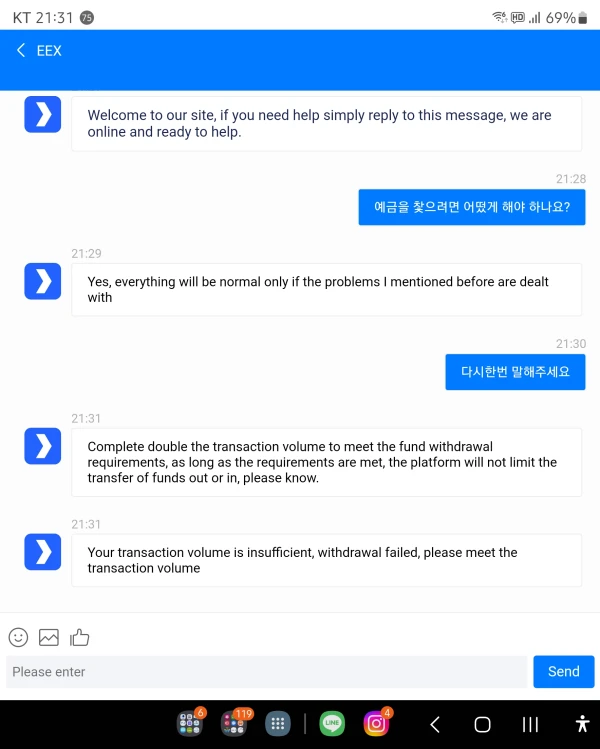

Company Summary

| eex Review Summary | |

| Founded | 1995 |

| Registered Country/Region | Germany |

| Regulation | Not Regulated |

| Market Instruments | Power, Natural Gas, Freight, and Agricultural Products |

| Customer Support | technology@eex.com |

| +49 341 2156-466 | |

eex Information

eex, the European Energy Exchange, is a global energy exchange that specializes in providing secure and sustainable commodity markets for financial investments. eex offers many products, including power, natural gas, freight, and agricultural products. However, this company is not regulated by any financial authorities.

Pros and Cons

| Pros | Cons |

|

|

|

|

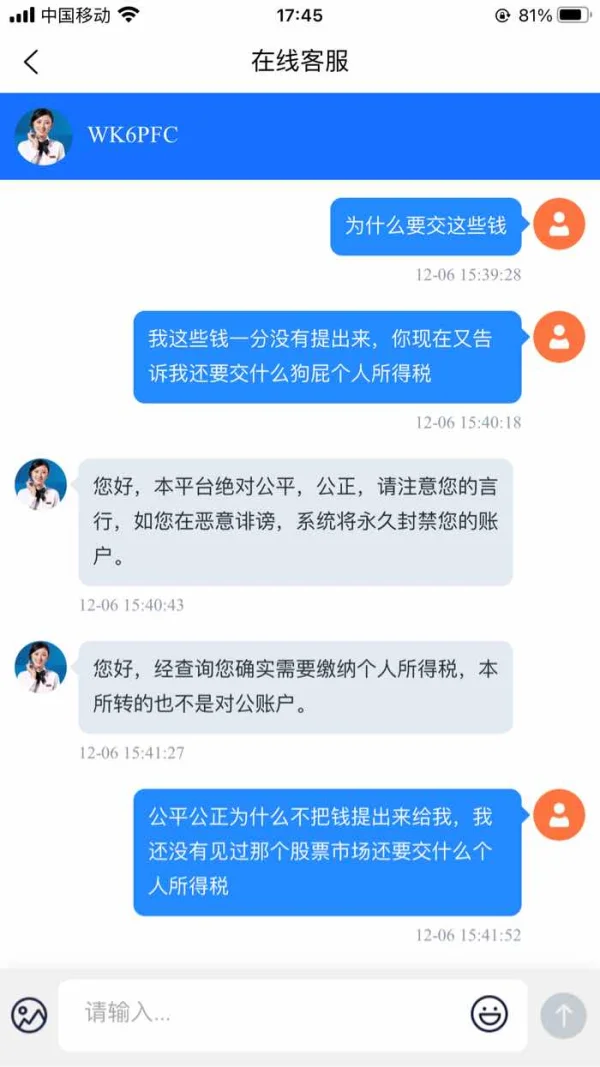

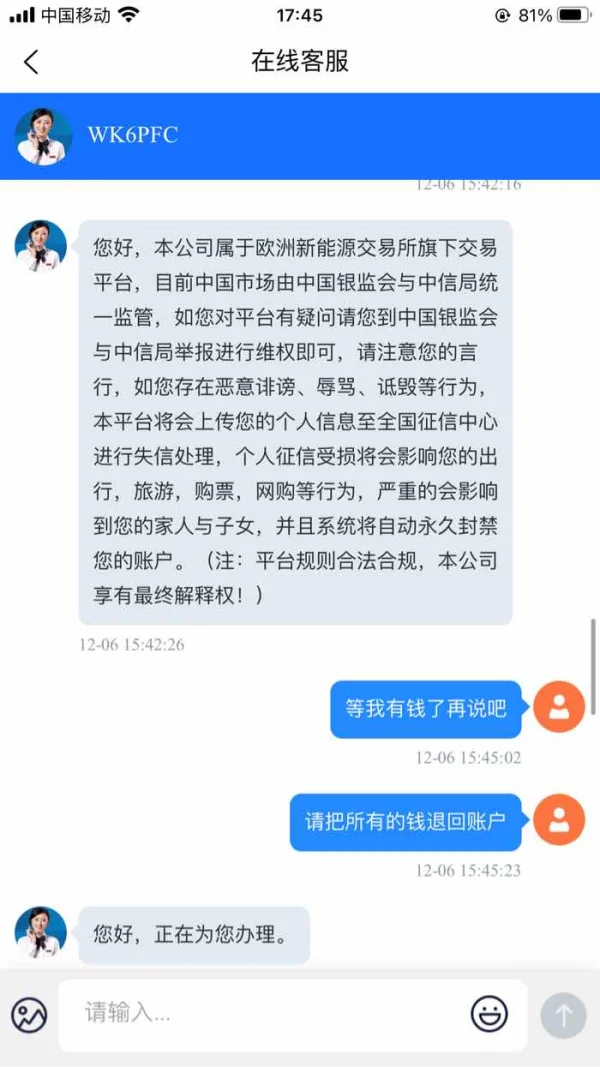

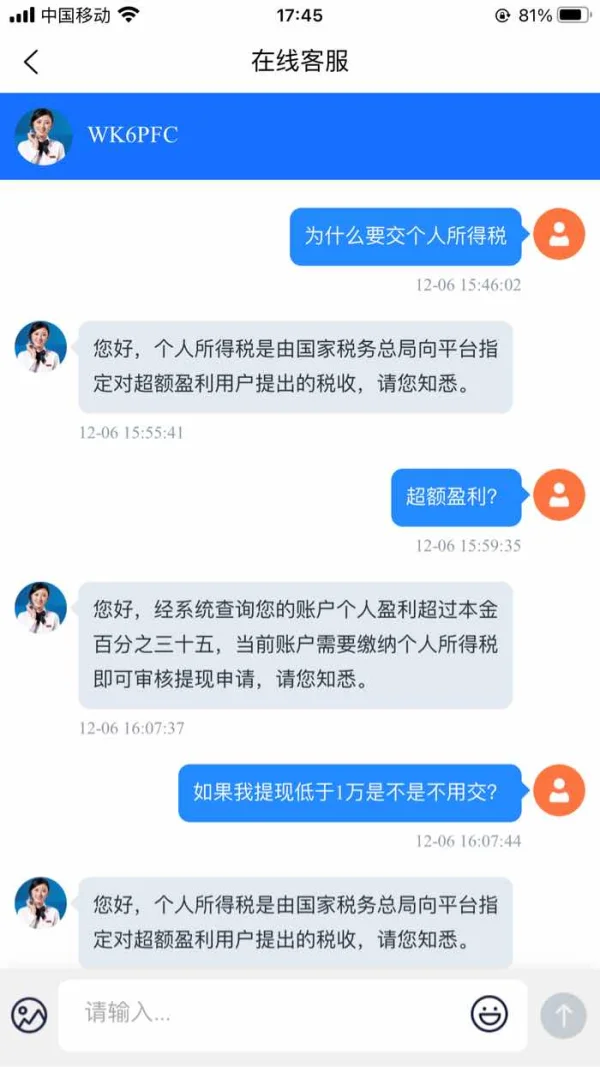

Is eex Legit?

eex is an unregulated broker. The WHOIS search shows that the domain eex.com was registered on December 15, 1995.

Market Instruments

EEX offers many trading instruments and various asset classes for financial investments. These include:

- Power: Trading electricity contracts (day-ahead, futures).

- Natural Gas: Trading natural gas contracts (spot, futures).

- Emission Allowances: Trading CO2 emission permits.

- Freight: Trading contracts for shipping rate hedging.

- Agricultural Products: Trading contracts for wheat, corn, rapeseed, and potatoes.

Fees

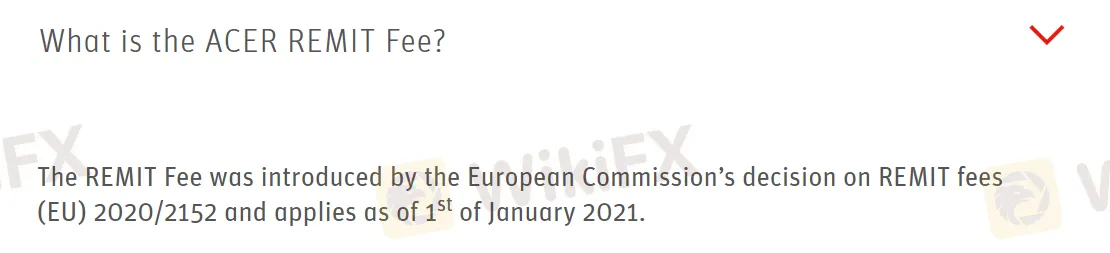

- ACER REMIT Fee: A pass-through fee, varying by reporting needs and market segment, to cover REMIT reporting costs as per ACER/EU Commission guidelines.

- Handling Fee for ACER Reporting: A fixed annual fee of 120 EUR per market segment (Gas, Power, EPEX) for EEX's REMIT reporting service.