Company Summary

| Johnan Shinkin Review Summary | |

| Company Name | The Johnan Shinkin Bank |

| Founded | 1945 |

| Registered Country/Region | Japan |

| Regulation | No Regulation |

| Services | Personal Internet Banking, Borrow, Deposit and Insurance |

| Fees | ATM Usage Fees, Transfer Fees, Foreign Remittance Related Fees, Collection Fees, Safe Deposit Box Fees, Cash Deposit/Withdrawal Fees, Exchange Fees, and their Fees |

| Customer Support | Tel: 0120-753-012/0120-921-311 |

| Company Address | 7-2-3 Nishigotanda, Shinagawa-ku, Tokyo |

What is Johnan Shinkin?

The Johnan Shinkin Bank, established in 1945, is regulated and based in Japan, and offers a comprehensive range of financial services to both individuals and enterprises. The bank caters to individual customers through services such as personal Internet banking, providing a convenient and accessible platform for online financial management.

In addition to internet banking, Johnan Shinkin offers deposit services, allowing customers to securely store their funds, along with borrowing facilities for those seeking financial assistance. The bank also extends its services to include insurance products, providing a holistic approach to financial well-being.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

|

|

Pros:

Experienced Company: Johnan Shinkin Bank boasts a long history since its establishment in 1945, indicating a wealth of experience and stability in the financial industry.

Comprehensive Financial Services: The bank provides a wide range of financial services, covering banking, deposit services for wealth accumulation, borrowing facilities, and insurance products. This comprehensive offering allows customers to address various financial needs within a single institution.

Large-scale Company: Being a large-scale financial institution, Johnan Shinkin Bank has more resources and infrastructure to cater to a diverse clientele and offer a robust set of services.

Cons:

No Regulation: A notable drawback is the lack of specific regulatory oversight. The absence of regulation raises concerns about adherence to industry standards and customer protection measures.

Multiple Fees Are Charged: The bank imposes various fees on its services, including ATM usage fees, transfer fees, foreign remittance-related fees, collection fees, safe deposit box fees, cash deposit/withdrawal fees, and exchange fees. The existence of multiple fees increases the overall cost for customers.

Engage in Social Contribution Activities: The bank actively participates in social contribution activities, such as supporting education for students and community-based contribution activities. This commitment to social responsibility can be seen as a positive aspect of the bank's fames and operations.

Is Johnan Shinkin Safe or Scam?

Regulatory Sight: Johnan Shinkin Bank operates without specific regulatory oversight, and as per the available information, it does not hold a regulatory license. The absence of regulatory recognition means that the bank is not subject to formal regulations and standards imposed by financial regulatory authorities.

User Feedback: Users should check the reviews and feedback from other clients to gain a more comprehensive sight of the broker, or look for reviews on reputable websites and forums.

Security Measures: So far we haven't found any information about the security measures for this broker.

Services

Johnan Shinkin Bank offers a range of financial services to both individuals and enterprises. For individual customers, the bank provides the following services:

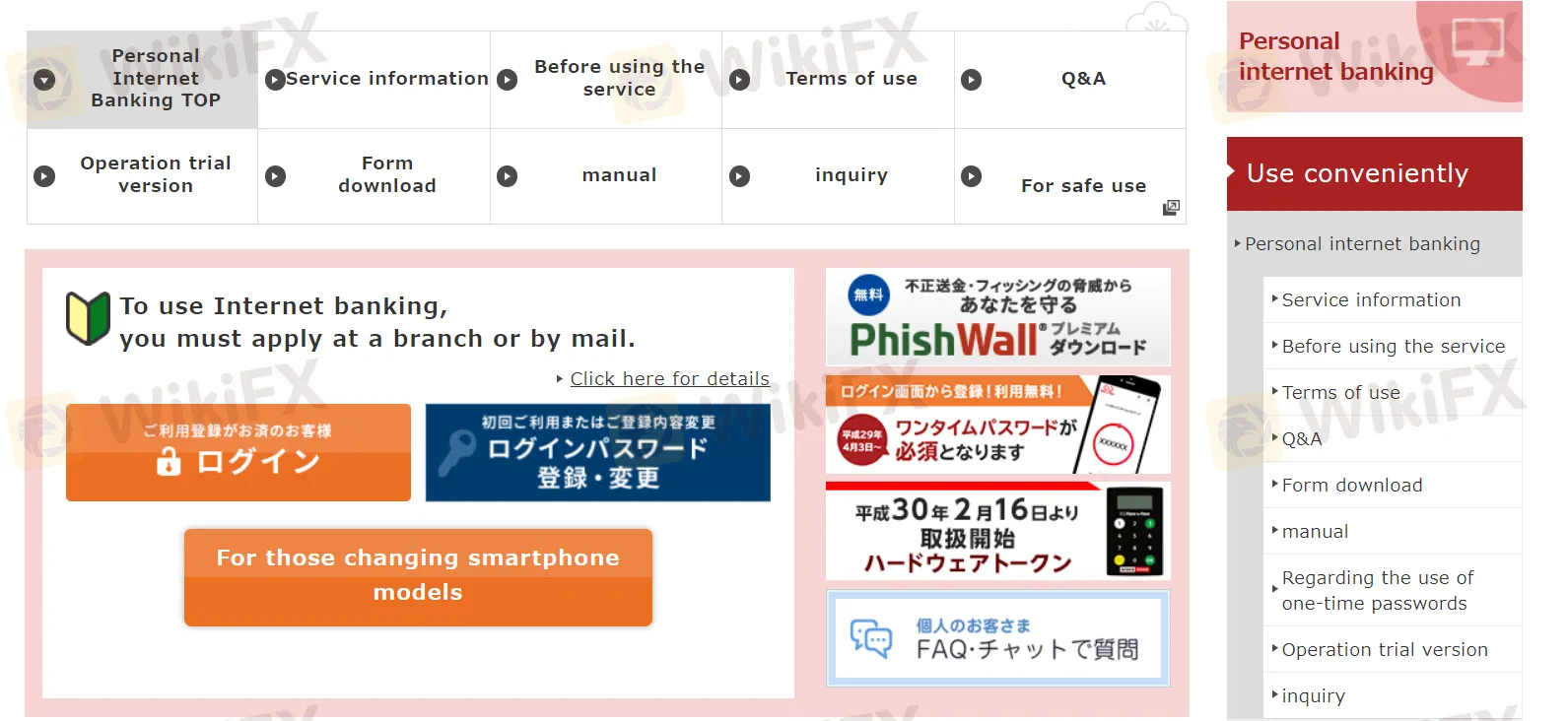

Personal Internet Banking: Johnan Shinkin Bank offers online banking services, allowing customers to manage their accounts, conduct transactions, and access various banking services through a secure online platform.

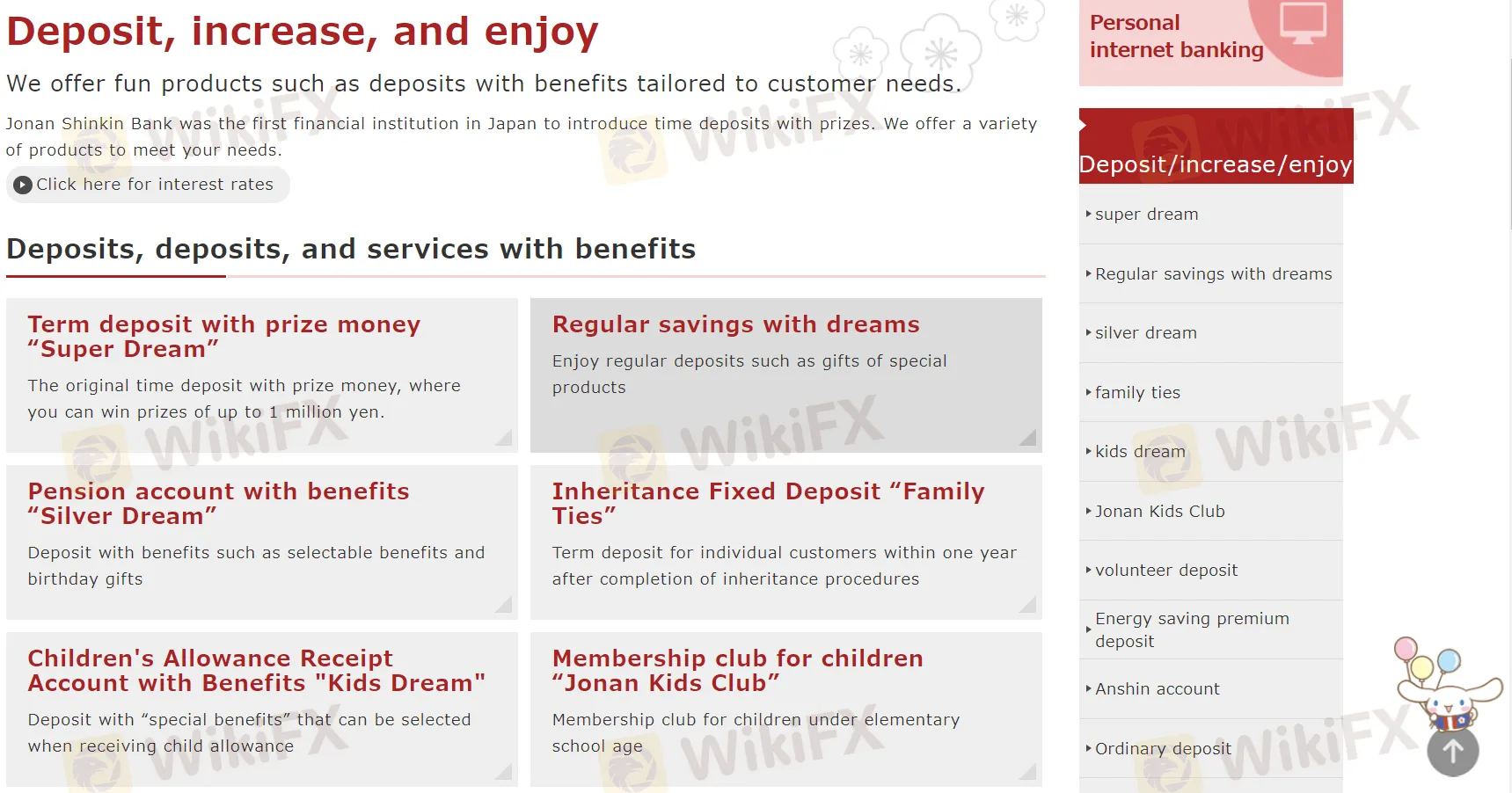

Deposit Services: The bank provides deposit services, offering customers the opportunity to save and increase their wealth through various deposit products. These include savings, pension accounts with benefits, term deposits, and so on.

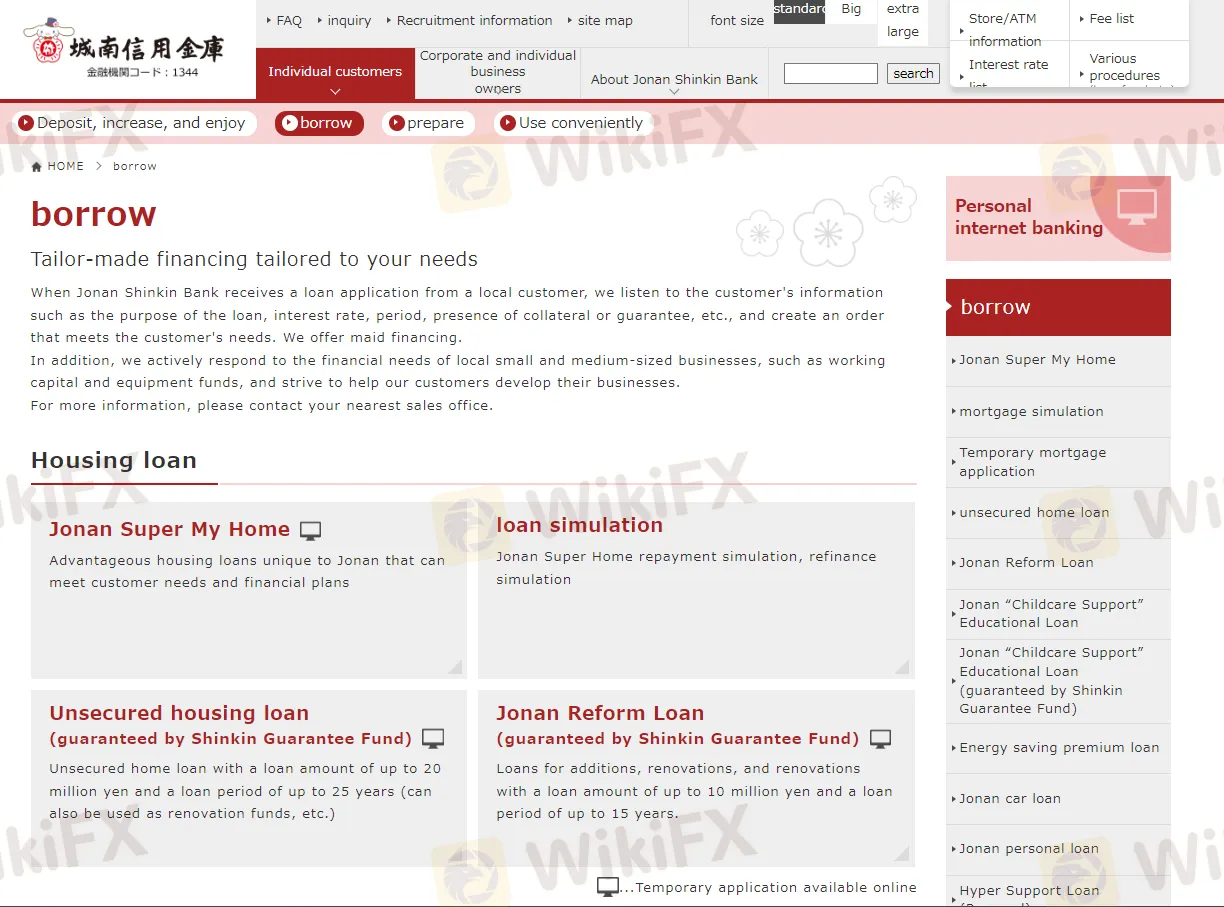

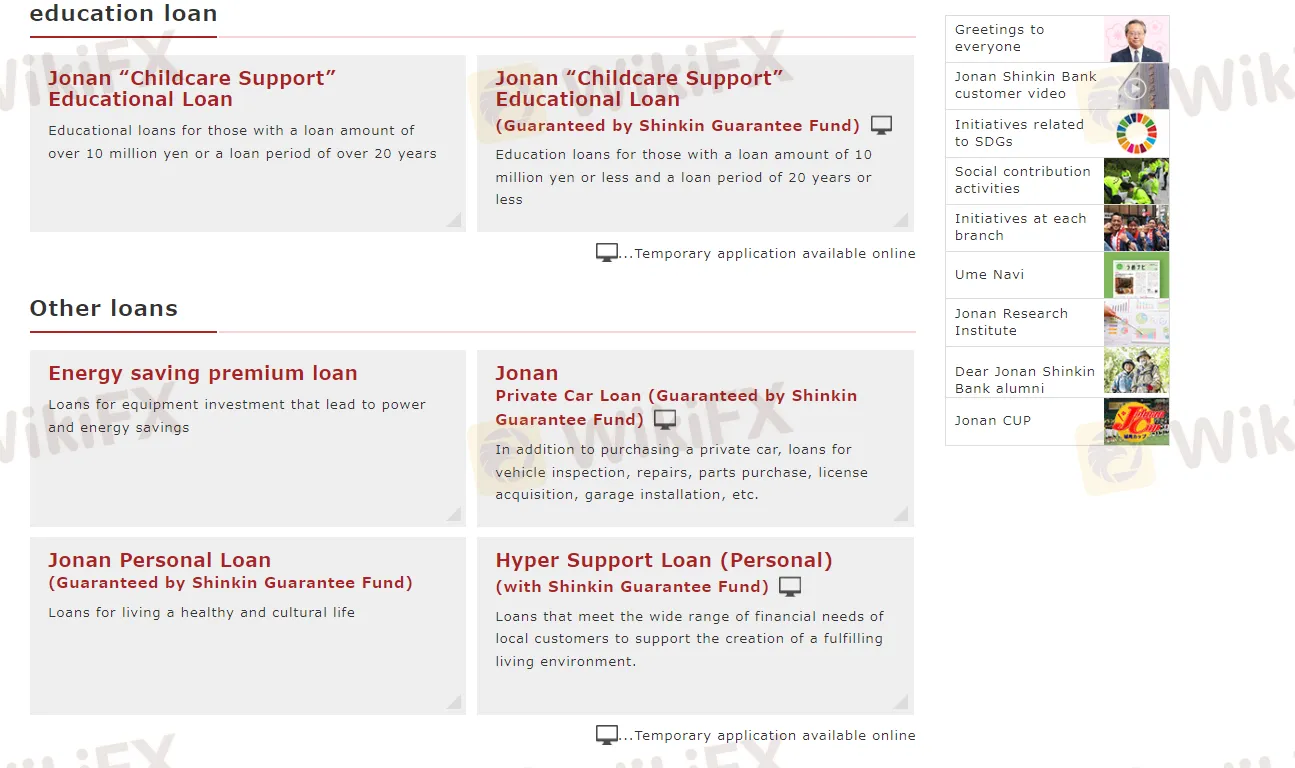

Borrowing Services: Johnan Shinkin Bank offers borrowing services, including housing loans, education loans, and other types of loans. Customers can access financial support for various purposes, such as home purchases, education expenses, and more.

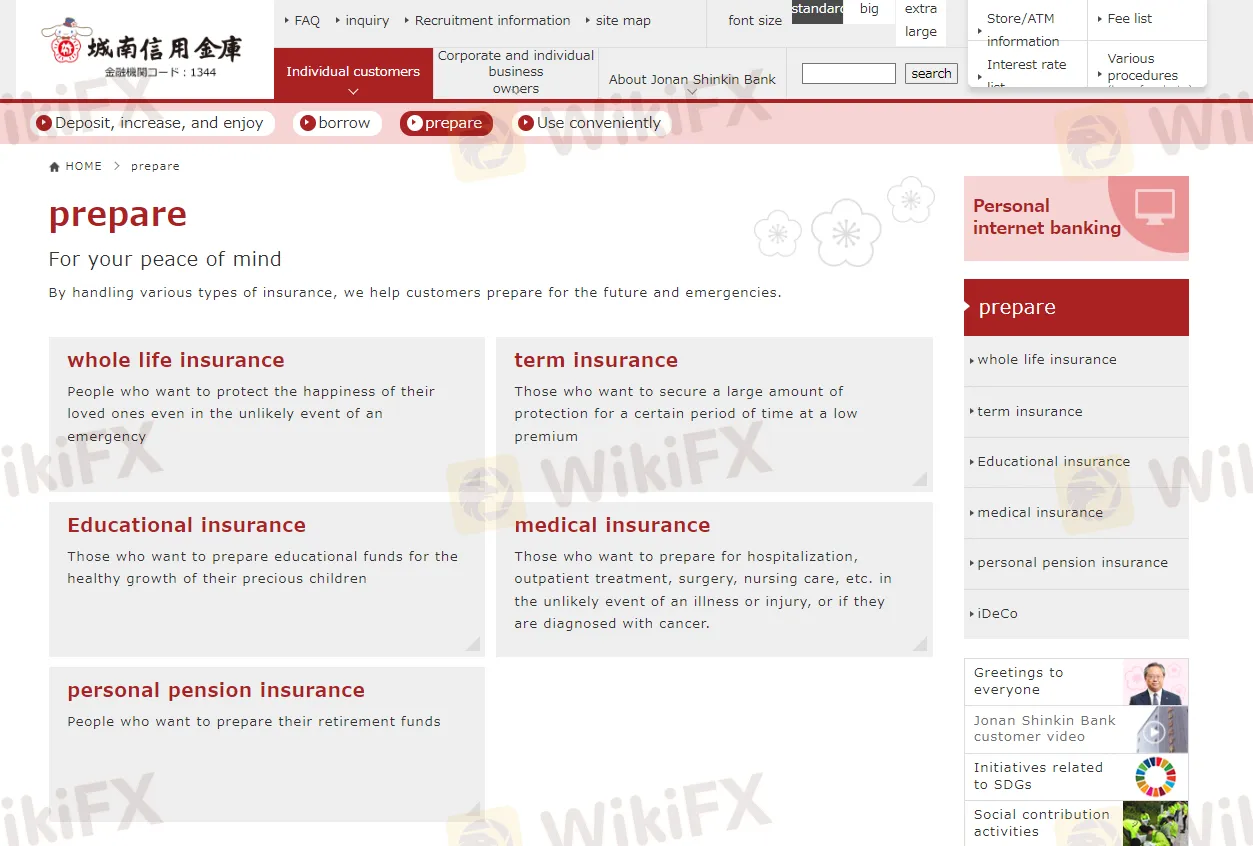

Insurance Services: The bank offers insurance products covering different aspects of individuals' lives. This includes whole life insurance, term insurance, educational insurance, medical insurance, and personal pension insurance. These insurance products provide financial protection and security against various risks.

Fees

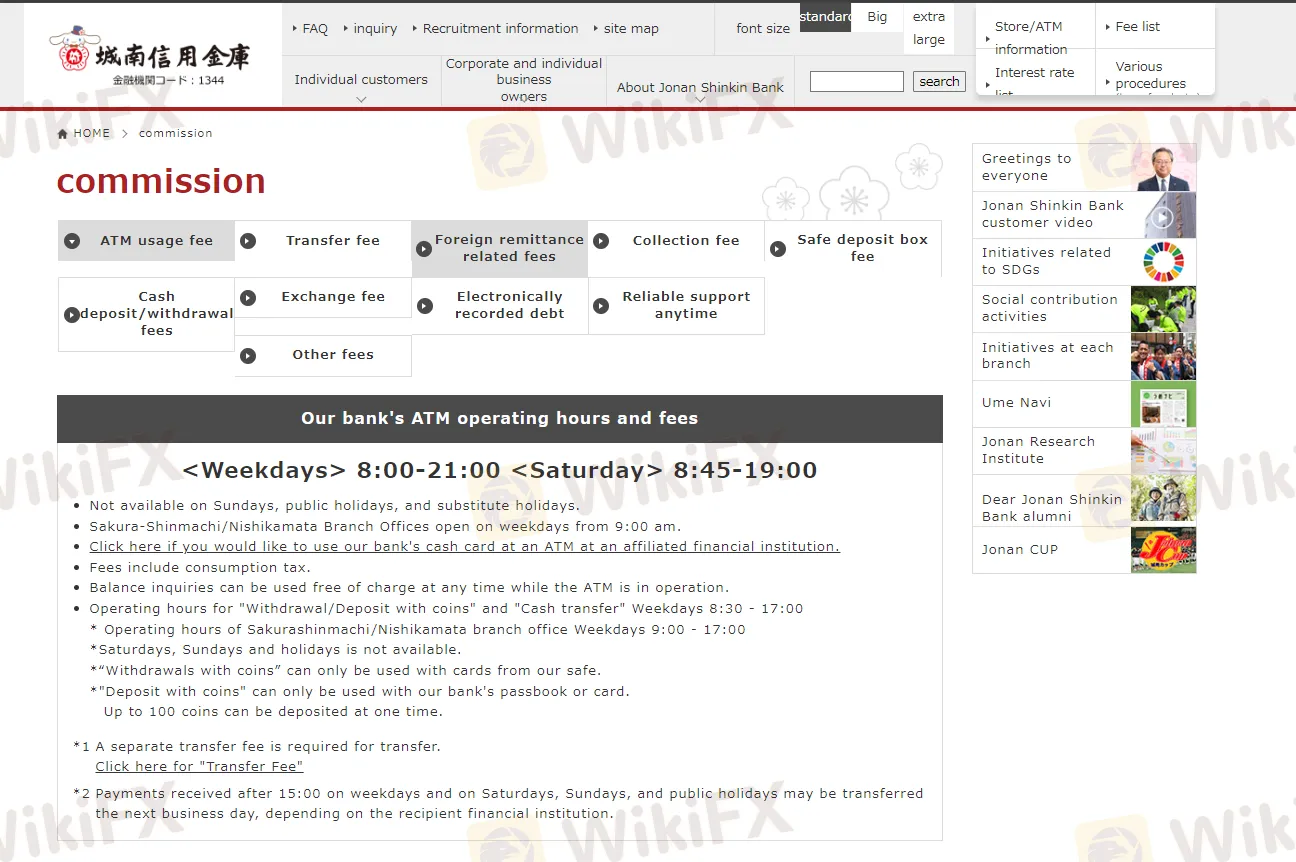

Multiple fees are charged by Johnan Shinkin. Generally, these include:

ATM Usage Fees: Customers may be charged fees for using ATMs, especially if they use ATMs outside the bank's network.

Transfer Fees: Fees are applicable when customers make fund transfers, either within the bank or to external accounts.

Foreign Remittance Related Fees: When customers engage in foreign remittances or international money transfers, the bank may charge fees associated with these transactions.

Collection Fees: Fees are levied for services related to the collection of checks, bills, or other financial instruments.

Safe Deposit Box Fees: If customers use safe deposit boxes provided by the bank for storing valuables, there could be associated rental fees.

Cash Deposit/Withdrawal Fees: Depending on the type and frequency of cash transactions, fees for depositing or withdrawing cash can incur.

Exchange Fees: Fees are applied when customers exchange currencies, especially if they are involved in foreign currency transactions.

Customer Support

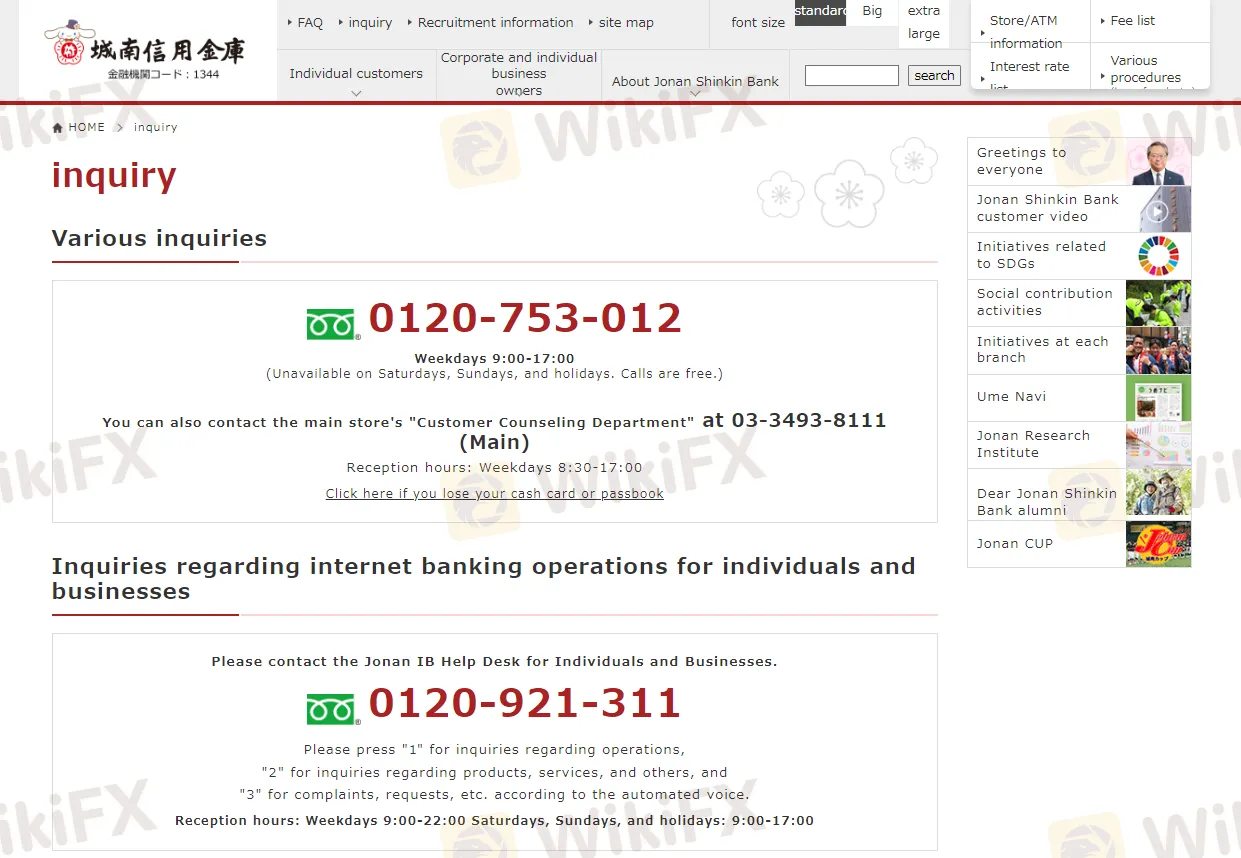

General Inquiries (Various):

Telephone: 0120-753-012

Reception Hours: Weekdays 9:00-17:00

Availability: Unavailable on Saturdays, Sundays, and holidays. Calls are free.

Customer Counseling Department (Main Store):

Telephone: 03-3493-8111 (Main)

Reception Hours: Weekdays 8:30-17:00

Internet Banking Operations for Individuals and Businesses:

Telephone: 0120-921-311

Reception Hours: Weekdays: 9:00-22:00; Saturdays, Sundays, and holidays: 9:00-17:00

Company Address:

Address: 7-2-3 Nishigotanda, Shinagawa-ku, Tokyo

Customers can contact Johnan Shinkin's customer support for a range of inquiries, including general questions, internet banking operations, and other banking-related matters. The availability of extended hours for Internet banking inquiries accommodates the diverse needs of customers. Additionally, the main store's Customer Counseling Department provides support during weekday business hours. The provision of free calls for general inquiries enhances accessibility for customers seeking assistance during regular business hours.

Conclusion

Johnan Shinkin Bank stands out as an experienced and large-scale financial institution offering a comprehensive suite of financial services to both individuals and enterprises. What's more, the bank actively engages in social contribution activities, reflecting a commitment to community well-being. However, customers should be mindful of the various fees charged by the bank and the non-regulated status of this company.

Frequently Asked Questions (FAQs)

Q: Is Johnan Shinkin regulated by any financial authority?

A: No, Johnan Shinkin operates without specific regulatory oversight.

Q: Can I visit Johnan Shinkin physically?

A: Yes, the headquarter of Johnan Shinkin is located at 7-2-3 Nishigotanda, Shinagawa-ku, Tokyo. You can visit the official website if you would like to check the branches and other departments of this company.

Q: Does Johnan Shinkin charge fees for foreign remittances?

A: Yes, foreign remittance-related fees apply when customers engage in international money transfers.

Q: Does Johnan Shinkin participate in social contribution activities?

A: Yes, it does play a role in several social contribution activities.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.