Company Summary

| CHINA REFORM SECURITIES FUTURES Review Summary | |

| Founded | 2022-08-23 |

| Registered Country/Region | China |

| Regulation | Regulated (CFFEX) |

| Market Instruments | Commodity Futures, Stock index futures, and options |

| Demo Account | ✅ |

| Customer Support | 0898-66763478 |

CHINA REFORM SECURITIES FUTURES Information

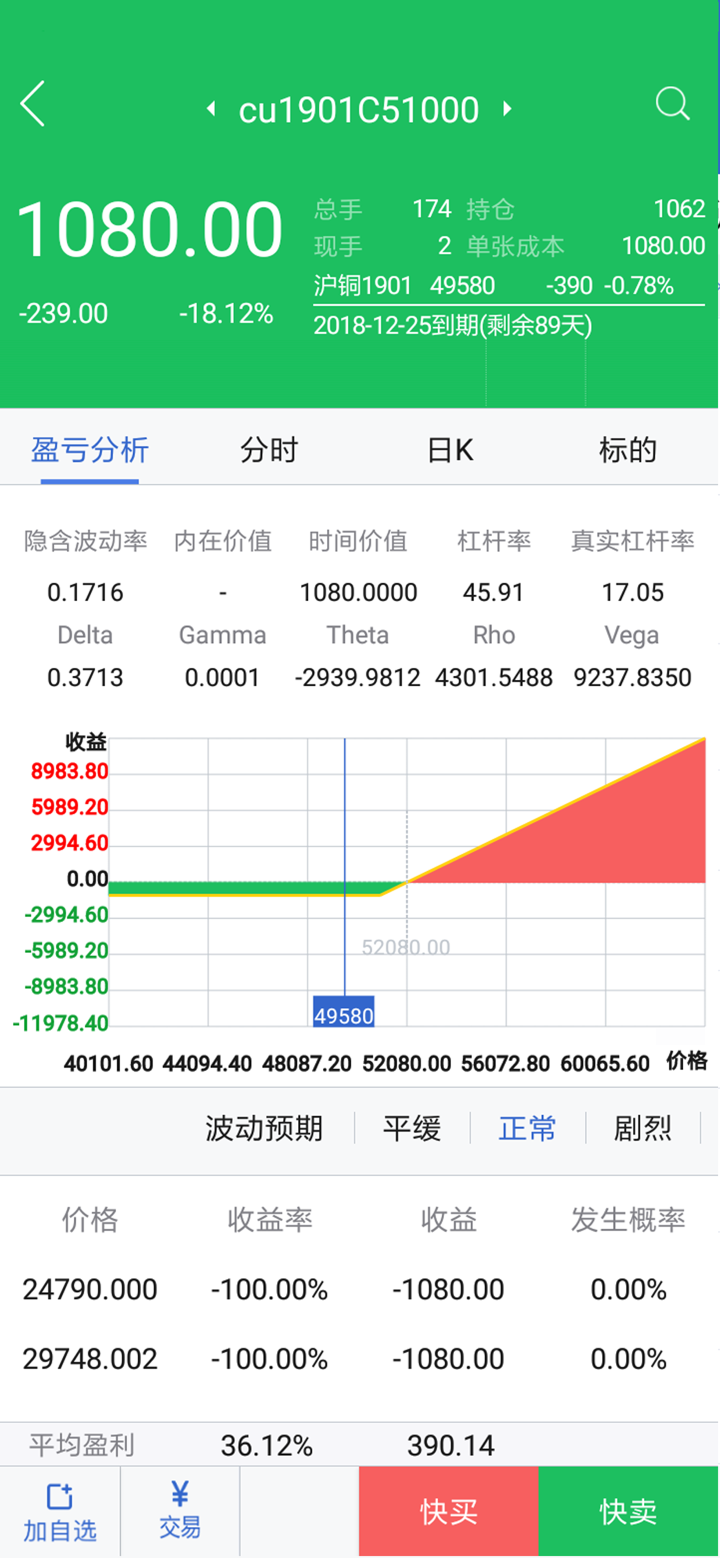

CHINA REFORM SECURITIES FUTURES, or 国新国证期货有限责任公司 in Chinese, is a futures company that offers a range of services to investors. It provides various trading platforms, including PC - based and mobile-based applications. These platforms support trading in different financial instruments such as commodity futures, stock index futures, and options.

Pros and Cons

| Pros | Cons |

| Regulated | Complex fee structure |

| Diverse Trading Platforms | Complex Account Opening Process |

Is CHINA REFORM SECURITIES FUTURES Legit?

Yes, CHINA REFORM SECURITIES FUTURES is regulated. It is supervised by the regulatory authority of the China Financial Futures Exchange (CFFEX), with the license number 0312, ensuring that its operations comply with industry standards.

What Can I Trade on CHINA REFORM SECURITIES FUTURES?

Investors can trade various financial instruments on CHINA REFORM SECURITIES FUTURES. This includes commodity futures, which cover a wide range of physical goods such as agricultural products, metals, and energy products. Stock index futures and options are also available.

Account Type

The company has a classification based on investor suitability. There are professional investors and ordinary investors. Professional investors are likely to have more experience and higher risk tolerance, while ordinary investors need to go through a risk-tolerance assessment during the account-opening process. Based on the assessment results, they are categorized into different risk-tolerance levels (C1-C5), with C1 having the lowest risk tolerance and C5 the highest.

CHINA REFORM SECURITIES FUTURES Fees

The fee structure on CHINA REFORM SECURITIES FUTURES is not fully disclosed on the website. It likely includes trading commissions, which are charged for each trade executed. There may also be fees related to account maintenance, data access, and certain value-added services. However, without clear details, it's challenging for investors to precisely estimate the costs associated with their trading activities.

Trading Platform

The company offers a diverse range of trading platforms. The PC-based platforms include the Boyi Master - Cloud Trading Platform, etc., which provide comprehensive market data and advanced analysis tools. The mobile-based platforms are very convenient to use. For example, the company's application and Wenhua Suishenxing are available.