Company Summary

| GVD Markets Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Cyprus |

| Regulation | CYSEC, FSC/FSA (Offshore) |

| Market Instruments | CFDs on forex, indices, metals, energies, stocks |

| Demo Account | ✅ |

| Leverage | / |

| Spread | / |

| Trading Platform | MT5 |

| Min Deposit | / |

| Customer Support | 9:00 to 18:00 Monday - Friday Cyprus local time (EEST or GMT+2 during the summer months and EET or GMT+2 during the winter months) |

| Contact form | |

| Email: gvdcncs@gvdmarkets.com | |

| Phone/Fax: +0035725250025 | |

| Address: 61, Griva Digeni A&V COURT office/Flat 401 Agios Nikolas, 3301, Limassol Cyprus | |

GVD Markets abides by the regulations set forth by CySEC, FSC and FSA. Traders can access a wide selection of financial products through MT5 trading platform. However, the trading conditions are not clarified openly on their website.

Pros and Cons

| Pros | Cons |

| Regulated by CYSEC | Limited information about trading conditions |

| Security measures provided | Deposit and withdrawals fees charged |

| Demo accounts available | No 24/7 support |

| MT5 available |

Is GVD Markets Legit?

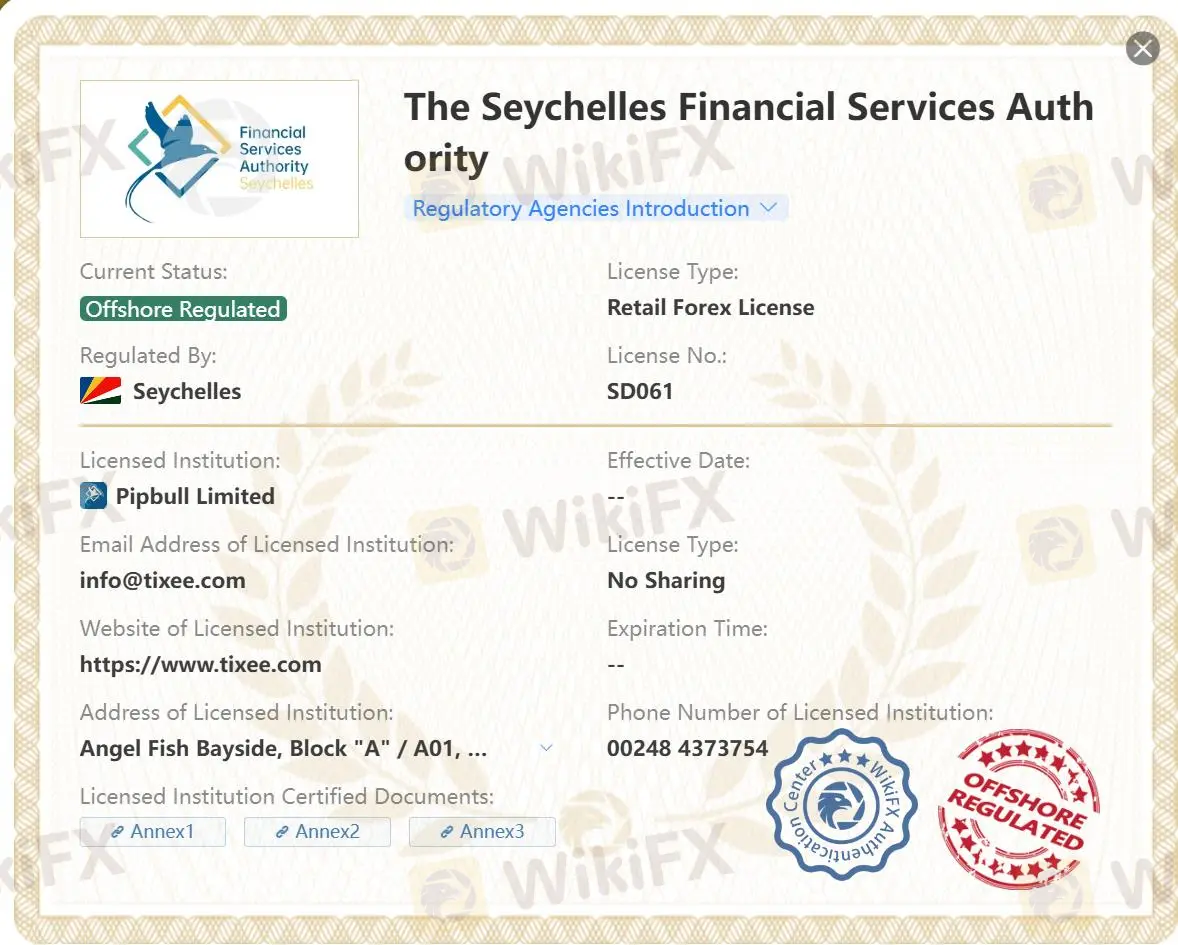

GVD Markets is regulated by three authorities: the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Commission in Mauritius (FSC), and the Seychelles Financial Services Authority (FSA).

The license type with CySEC is Straight Through Processing (STP), and the license number is 411/22. This means that GVD Markets operates as an intermediary between traders and liquidity providers without intervening in the trade execution process.

With the FSC in Mauritius and the FSA in Seychelles, GVD Markets holds Retail Forex Licenses. But both of them belong to offshore regulation.

Besides, it also offers many security measures including segregation of funds, Negative Balance Protection and investor compensation fund. The Investor Compensation Fund aims to protect covered clients by compensating them for claims against Fund members who fail to meet their obligations. Additionally, they provide Negative Balance Protection, the balance available in their trading accounts.

What Can I Trade on GVD Markets?

GVD Markets provides more than 100 financial derivatives, such as foreign exchange, indices, metals, energies (Brent crude oil and West Texas Intermediate crude oil) and stocks.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Indices | ✔ |

| Metals | ✔ |

| Energies | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

How to Open an Account on GVD Markets?

To open a live account, simply complete an online questionnaire and submit the necessary documents. Once your registration is reviewed and approved, you can fund your account and begin trading. You will need to provide clear color copies of the following documents:

- A copy of your passport or ID card that clearly displays your full name, date of birth, passport or ID number, and expiration date.

- A recent utility bill (dated within the last 3 months) that includes your full name and address.

Trading Platform

GVD Markets offers MT5 trading platform to trade on their products. With its advanced and user-friendly interface, the MT5 platform facilitates trading experiences, allowing clients to analyze markets, execute trades, and manage their portfolios with precision and ease.

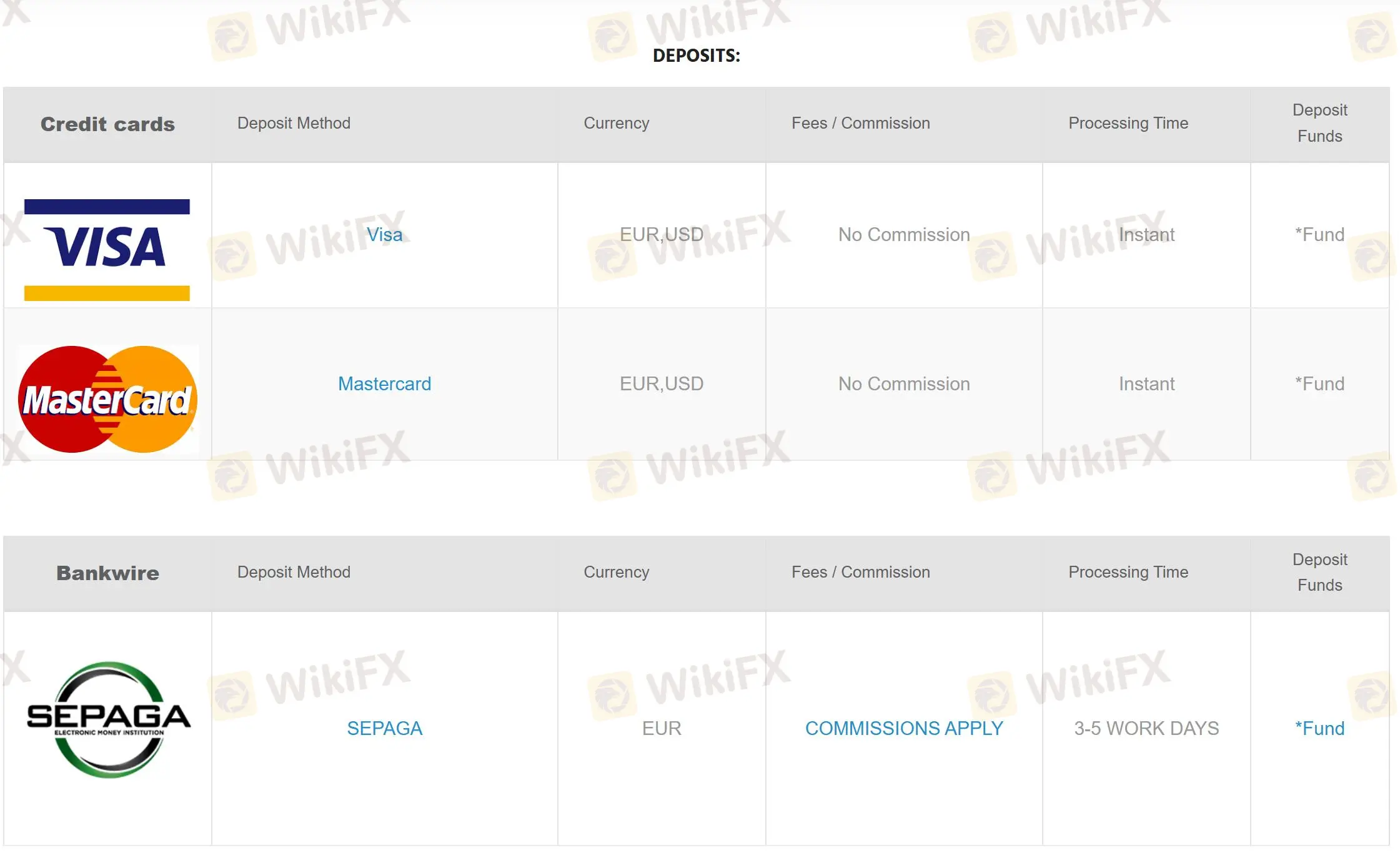

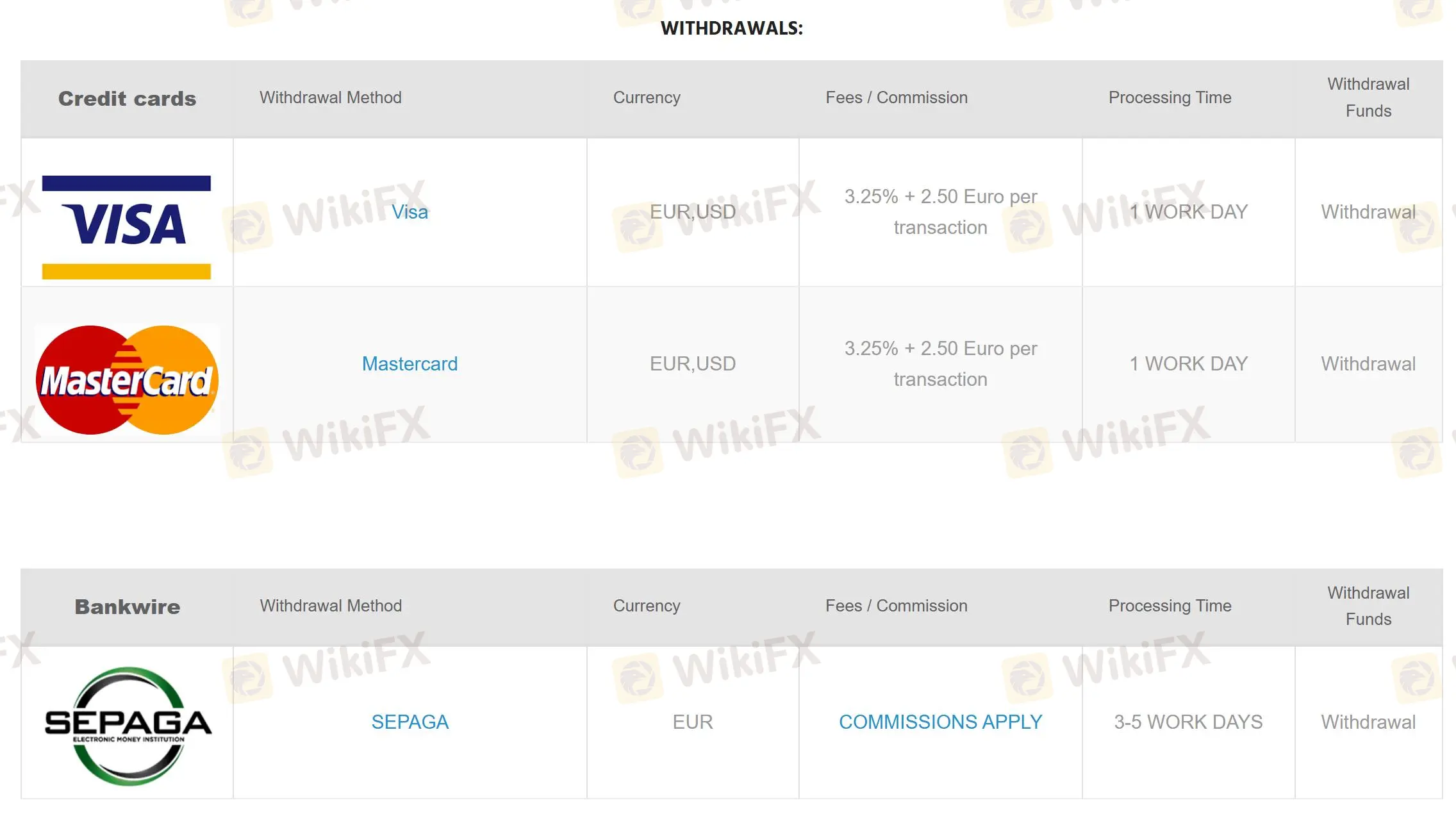

Deposit and Withdrawal

GVD Markets provides numerous money transfer options, including bank cards, bank wire transfers, and credit cards like VISA and Mastercard. They accept USD and EUR, with no fees for deposits. However, GVD Markets does not permit deposits made using a third party's credit card; the name on the account must match the name on the card. More details can be learn about through: https://www.gvdmarkets.eu/deposits-withdrawals/

| Payment Methods | Accepted Currencies | Deposit Fee | Withdrawal Fee | Deposit Time | Withdrawal Time |

| Visa | EUR, USD | ❌ | 3.25% + 2.50 Euro per transaction | Instant | 1 Work Day |

| Mastercard | EUR, USD | ❌ | |||

| Bankwire | EUR | Depends on different services, i.e. account opening fee: €150; Account Maintenance Fee: €20 and so on | Depends on different services, i.e. account opening fee: €500; Account Maintenance Fee: €20 and so on | 3-5 Work Days | |