Company Summary

Note: Goldexs official website: https://goldexapp.com/ is currently inaccessible normally.

| Goldex Review Summary | |

| Founded | 2017 |

| Registered Country/Region | United Kingdom |

| Regulation | Unregulated |

| Market Instruments | Physical Gold |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Trading Platform | Mobile App (24/7 access for gold trading) |

| Min Deposit | £20,000 |

| Customer Support | Email: support@goldexapp.com |

| Phone: +44 (0) 203 287 2878 | |

Goldex Information

Established in 2017, Goldex is a gold trading platform with UK headquarters. Operating in the physical gold trading market, it provides safe vault storage for deposits. The business offers a mobile app giving 24/7 access to the gold market. Goldex is unregulated and requires a high minimum deposit, which can restrict availability to some traders.

Pros and Cons

| Pros | Cons |

| 24/7 mobile app access for trading convenience | Unregulated |

| Secure storage options for physical gold | High minimum deposit of £20,000 |

| £5 withdrawal fee for each transaction | |

| No demo account available | |

| Limited information on trading conditions like spreads and leverage |

Is Goldex Legit?

Currently, Goldex does not hold any regulatory licenses in United Kingdom or any major jurisdictions like the FCA, ASIC, or other significant financial authorities.

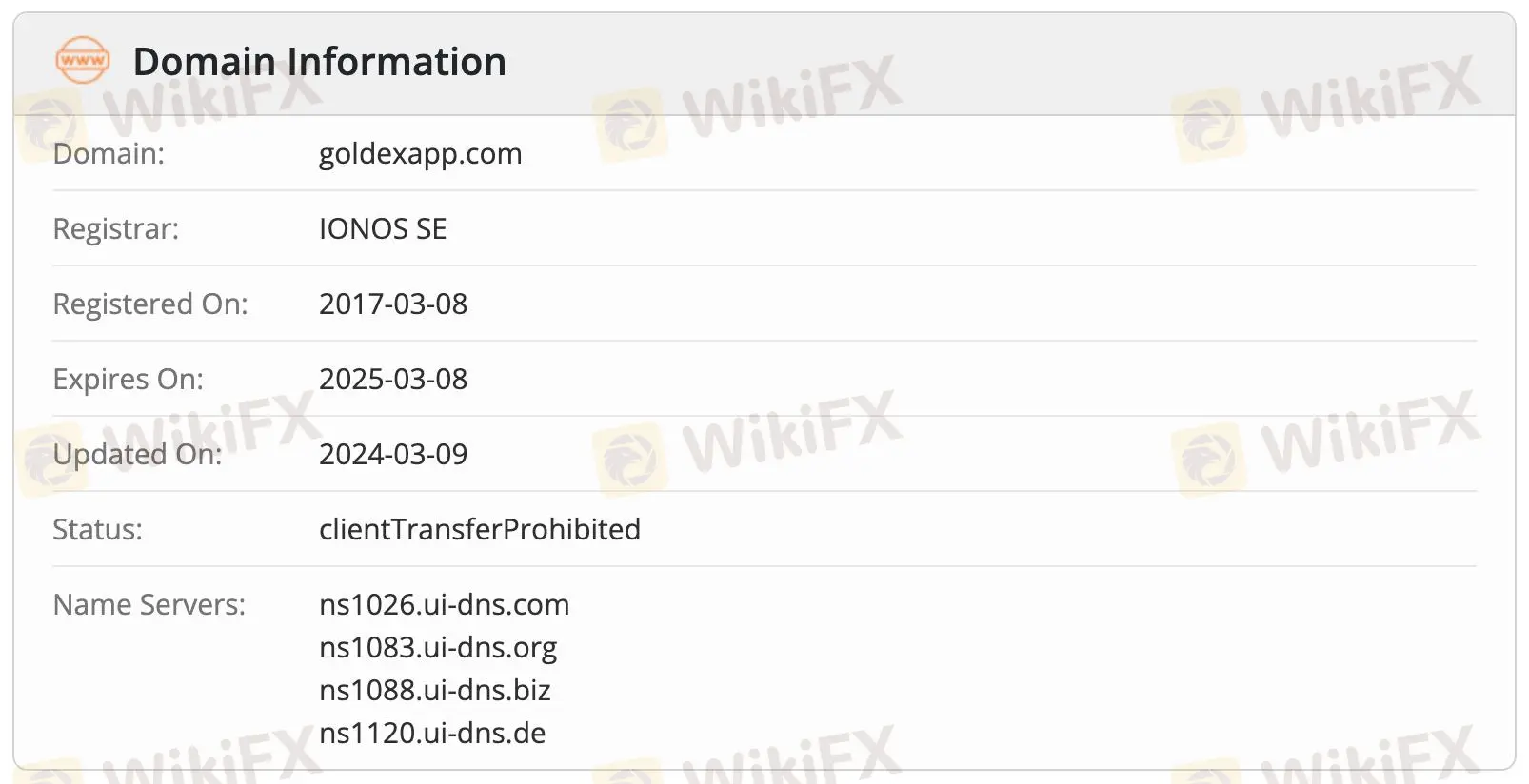

Goldexapp.com was registered on March 8, 2017, last updated on March 9, 2024, and expires on March 8, 2025, with a clientTransferProhibited status.

What Can I Trade on Goldex?

Goldex just provides trade in physical gold; storage alternatives for extra security come from high-security vaults. Without access to other asset kinds as FX, equities, or cryptocurrencies, the platform just addresses gold investment.

| Tradable Instruments | Supported |

| Physical Gold | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Crypto | ❌ |

| CFD | ❌ |

| Indexes | ❌ |

| Stock | ❌ |

Account Types

Goldex presents two account choices to customers:

Lite Registration gives access to explore the features of the app but does not permit gold purchases. Users may trade by upgrading to Full registration.

Full Registration calls for extra KYC checks for deposits exceeding £250 and extra verification. lets consumers buy and keep actual gold.

Goldex Fees

Goldex charges a commission of 0.75% per transaction (buy or sell), totaling 1.5% for a full transaction cycle.

| Fee Type | Charge |

| Trading Commission | 0.75% per transaction |

| Vaulting and Insurance | 0.02% per month (min £3.75) |

Non-Trading Fees

| Non-trading Fees | |

| Deposit Fee | None |

| Withdrawal Fee | £5 |

| Inactivity Fee | None |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| Goldex Mobile App | ✔ | Mobile | Gold investors seeking 24/7 access |

Deposit and Withdrawal

Goldex charges no fees for deposits; the minimum deposit is £20,000. Withdrawal pays a £5 fee. Deposits exceeding £250 require KYC verification; users can deposit using a debit card or bank transfer.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Bank Transfer | £250 | Free | Up to 2 working days |

| Debit Card | £250 | Free | Instant |

| Withdrawal Fee | N/A | £5 | Up to 3 working days |