Company Summary

| Lime Financial Review Summary | |

| Founded | 2000 |

| Registered Country/Region | United States |

| Regulation | No regulation |

| Market Instruments | Stocks, ETFs, Options |

| Demo Account | ❌ |

| Leverage | / |

| Spread | / |

| Min Investment | $1000 |

| Trading Platform | Lime Trader (Integrated API, Web and Mobile apps), TakeProfit, Sterling, CQG |

| Customer Support | Phone, email, contact form, LinkedIn, YouTube, fax |

Lime Financial Information

Lime Financial started its business since 2000 in the United States and offers financial services to clients in the United States as well as all over the globe. Its product offerings encompasses Stocks, ETFs and Options, with four platforms available for different client groups.

It mainly offers account types including individual account, joint account, custodial account, retirement account and business account. Each with different provisions and investment limits. Furthermore, the broker applies free-commission structure for trading and transparent fee structure on it services.

In addition, Lime Financial uses API technologies for faster and more secure trading environment.

However, one fact worth noting is that the broker currently operates without regulation from any authorities, degrading its credibility and reliability.

Pros and Cons

| Pros | Cons |

| Wide range of tradable products | Lack of regulation |

| Multiple trading platforms | Long list of non-service countries |

| Multiple account types | |

| Commission-free for trading | |

| Transparent fee structure | |

| Many years of industry experience |

Is Lime Financial Legit?

The broker operates without any valid supervision from any regulatory authorities. It raises a question about its legitimacy and credibility because regulated brokers usually adhere to strict industry standards to protect customer funds.

What Can I Trade on Lime Financial?

Lime Financial offers a range of investment products for traders to choose from, including:

- Stocks: Shares of publicly traded companies.

- ETFs: Exchange-traded funds that track market indexes or specific sectors.

- Options: Contracts that give the holder the right to buy or sell an underlying asset at a specified price.

While they do not currently offer foreign stocks or OTC securities, they provide access to a wide variety of domestic equities and derivatives.

| Tradable Instruments | Supported |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Shares | ✔ |

| ETFs | ✔ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

Lime Financial offers a variety of account types, each with its own minimum funding requirement.

- Individual Accounts: Minimum funding amount depends on trader country of citizenship/residence.

| Account Type | Account Category | Amount |

| US Accounts | Cash Account | $1,000 |

| Margin Account | $2,000 | |

| Foreign Accounts | Cash Account | $1,000 |

| Margin Account | $2,000 | |

| Enhanced Due Diligence Accounts | Cash Account | $5,000 |

| Margin Account | $5,000 |

- Joint Accounts: JTWROS and JTIC accounts have similar minimums to individual accounts.

- Custodial Accounts: Minimums depend on the state's laws and the type of custodial account (UGMA or UTMA).

- Retirement Accounts: Traditional and Roth IRAs have annual contribution limits for between $6500-7500 with different age ranges below or above 50. SEP IRAs have employer-specific contribution limits.

- Business Accounts: Corporate, LLC, partnership, and sole proprietorship accounts have higher minimums depending on the business structure and jurisdiction.

Lime Financial Fees

Lime Financial generally offers commission-free online trading for stocks, ETFs, and options. However, there will be additional fees for certain services, such as:

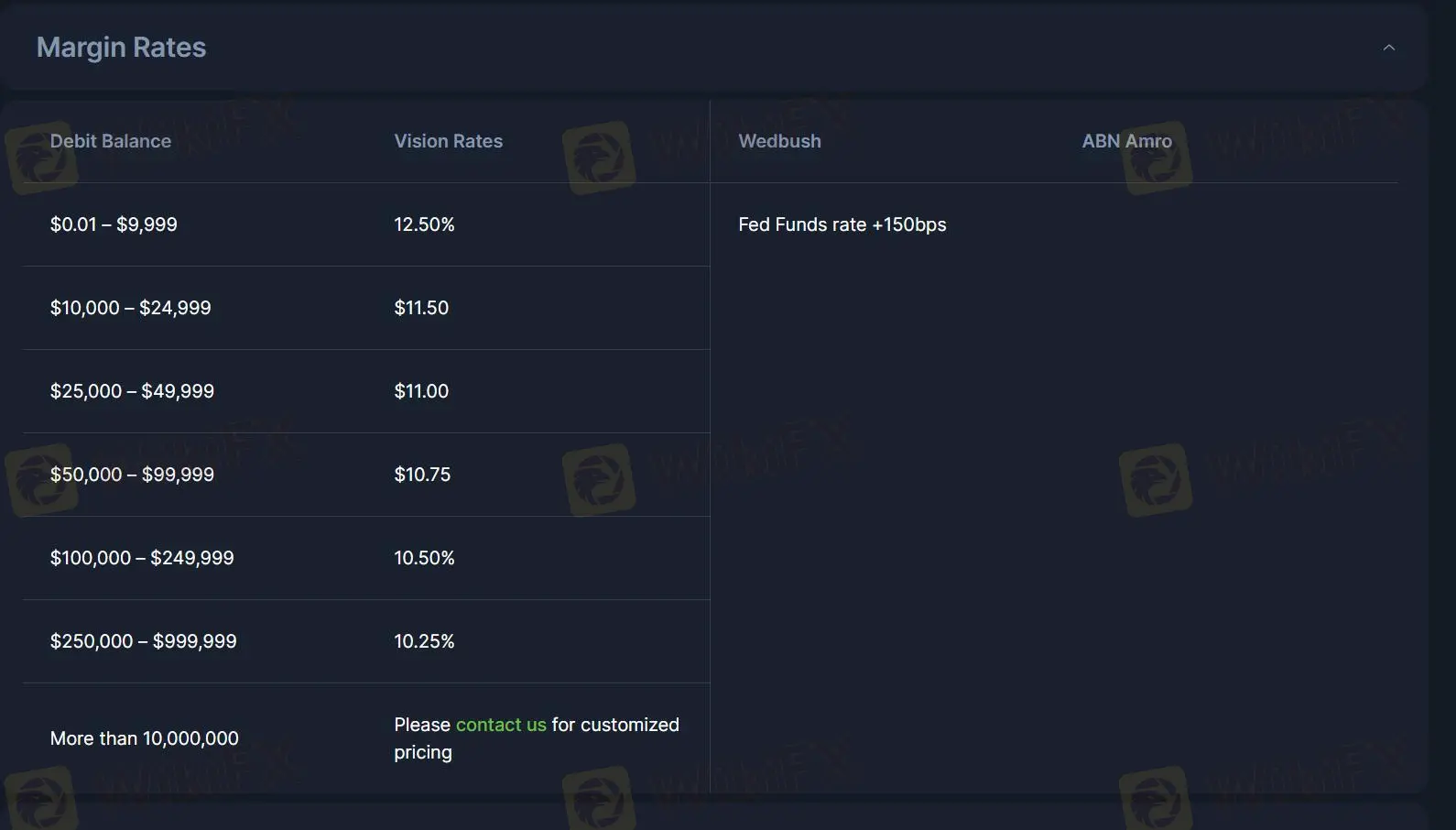

- Margin Interest: Charged monthly but calculated on a daily basis for a 360-day year; the daily cost is based on your debit at the end of each day.

| Debit Balance | Vision Rate |

| Up to $9,999 | 12.50% |

| $10,000 - $24,999 | 11.50% |

| $25,000 - $49,999 | 11.00% |

| $50,000 - $99,999 | 10.75% |

| $100,000 - $249,999 | 10.50% |

| $250,000 - $999,999 | 10.25% |

| Above $10000000 | Checck with the broker |

- Foreign Settlement Fee: Applied to securities that do not settle domestically (usually $75).

- Corporate Action Fee: Charged for corporate events like stock splits or mergers (mandatory fee of $30, voluntary fee of $50).

- Safekeeping Fee: For securities held in physical form rather than electronically (usually $75 per year).

- Option Trading Fees: Per-contract fees for buying or selling options (usually $0.50 per contract).

Trading Platform

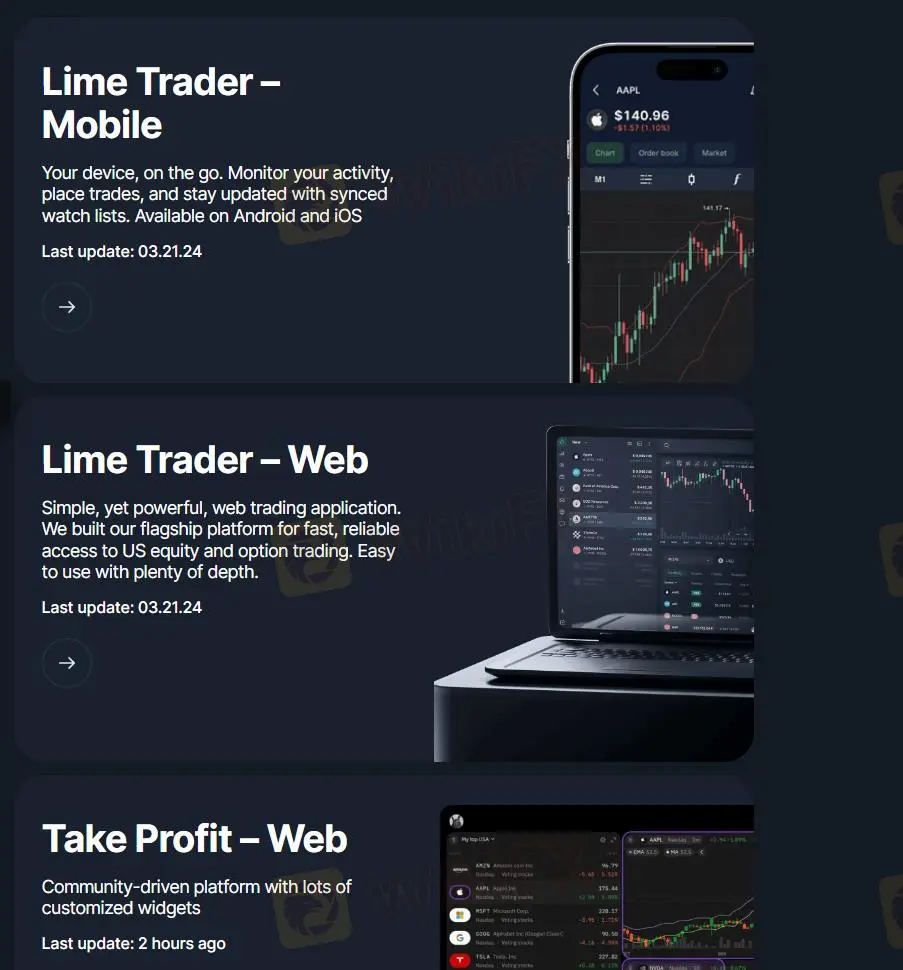

Lime Financial provides multiple trading platforms, each with its own features and benefits:

- Lime Trader: An integrated platform with web and mobile apps, offering charting, order types, market data, and real-time quotes.

- TakeProfit: A specialized platform for advanced traders, with advanced charting tools and customizable features.

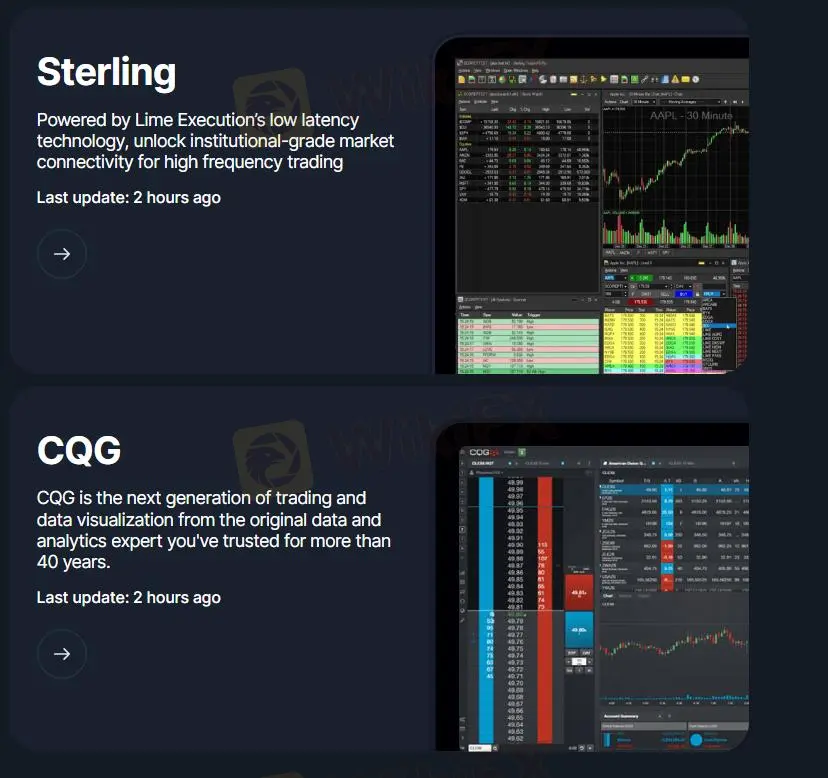

- Sterling: A platform for institutional investors, offering professional-grade tools and features.

- CQG: A platform for high-frequency trading, with low-latency connectivity and advanced algorithms.

Deposit & Withdrawal

Lime Financial offers various funding methods for domestic and foreign accounts.

Domestic accounts can fund via wire, ACH, or account transfer, while foreign accounts are limited to wire and account transfer,with no third-party transfers allowed.

ACH transfers typically take 1-3 business days, and theres a 5-day hold on trading with these funds.

Wires can take up to 24 hours for domestic transfers and 24-48 hours for foreign transfers, depending on accuracy.

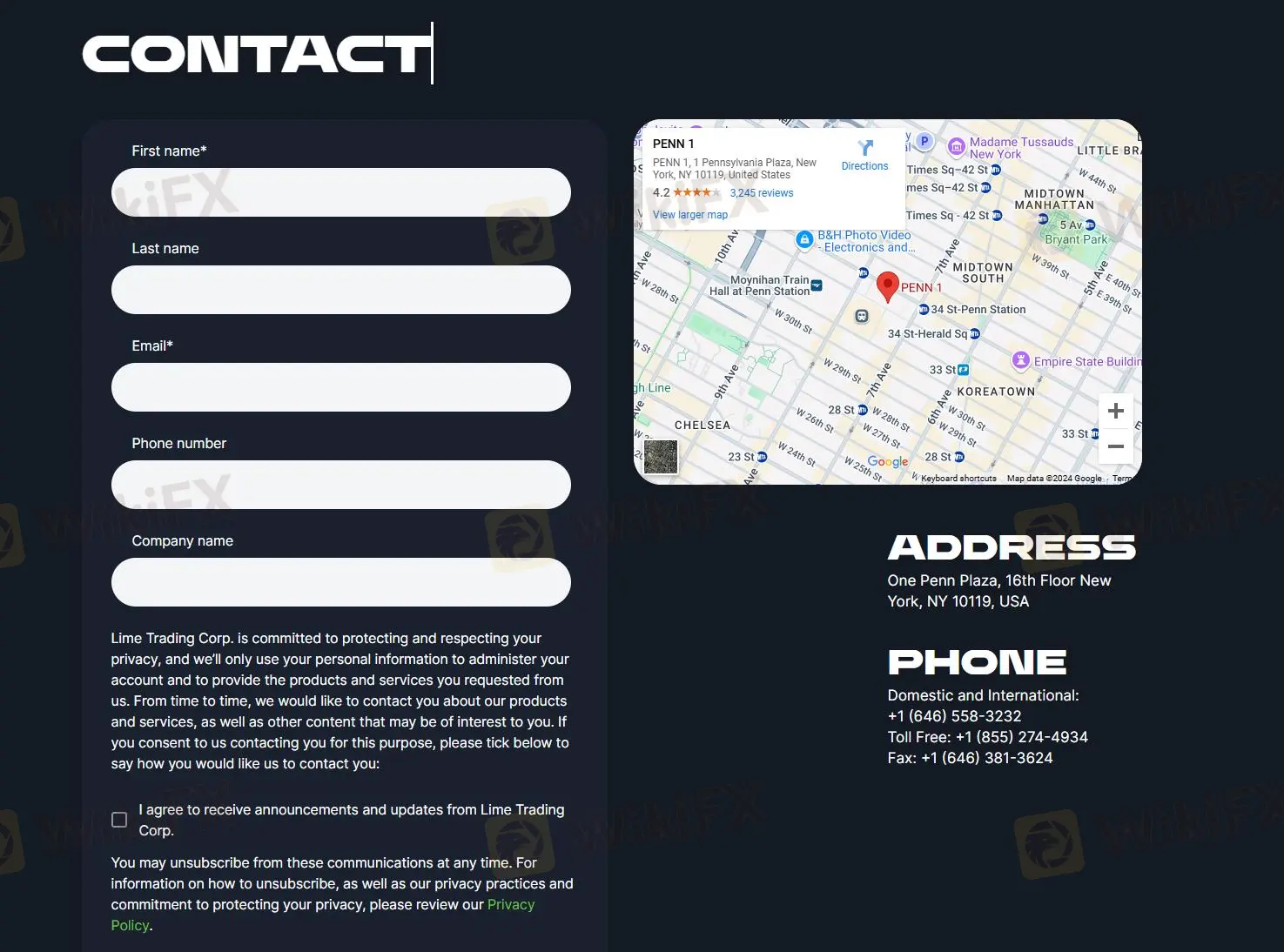

Customer Support Options

Lime Financial offers a comprehensive customer service channels for traders to seek support and help when encountering problems or want clarification.

Traders can contact Lime Financial by phone, email, fax and visit their office addresses during Monday – Friday, 9:00 a.m. – 5:00 p.m., excluding market holidays.

A support ticket form and social platforms are also available as supplementary interaction methods.

| Contact Options | Details |

| Phone | +1 (646) 558-3232 |

| Toll Free: +1 (855) 274-4934 | |

| Fax | +1 (646) 381-3624 |

| support@lime.co | |

| Support Ticket System | ✔ |

| Online Chat | ✔ |

| Social Media | LinkedIn, YouTube |

| Supported Language | English |

| Website Language | English |

| Physical Address | One Penn Plaza, 16th Floor New York, NY 10119, USA |

The Bottom Line

In summary, this broker mainly targets experienced individual traders and business traders and might not suitable for beginners. Multiple account types target different client groups with different demands and appels in investment. Several trading platforms also ensure dedicated services and using habits for each client base. Transparent fee structure makes you understand exactly your trading costs.

However, the absence of regulation is a taint that cannot be neglected, especially for those who are risk-sensitive. Take full investigations before determing to trade with the broker and ensure you can accept all the drawbacks.

FAQs

Is Lime Financial safe?

No, because the company is not regulated by any authorities so far.

Is Lime Financial good for beginners?

Not really, minimum investment in an individual account is $1000, which is quite a burden for beginners.

What trading platform does Lime Financial have?

Lime Financial offers several trading platforms including Lime Trader (Integrated API, Web and Mobile apps), TakeProfit, Sterling and CQG.

Are there any restricted areas of Lime Financial's services?

Yes, the broker does not provide services to clients in Afghanistan, Bosnia & Herzegovina, Belarus, Central African Republic, Cuba, Democratic Republic of the Congo, Guyana, Iran, Iraq, Laos, Libya, North Korea, Russia, Somalia, Syria, Uganda, Vanuatu, Venezuela and Yemen.

Risk Warning

Online trading involves considerable risk, so it may not be suitable for every client. Please make sure that you totally understand the risks involved and notice that the information above provided in this review may be subject to alteration owing to the constant updating of the company's services and policies.