Unternehmensprofil

| invertirOnline Überprüfungszusammenfassung | |

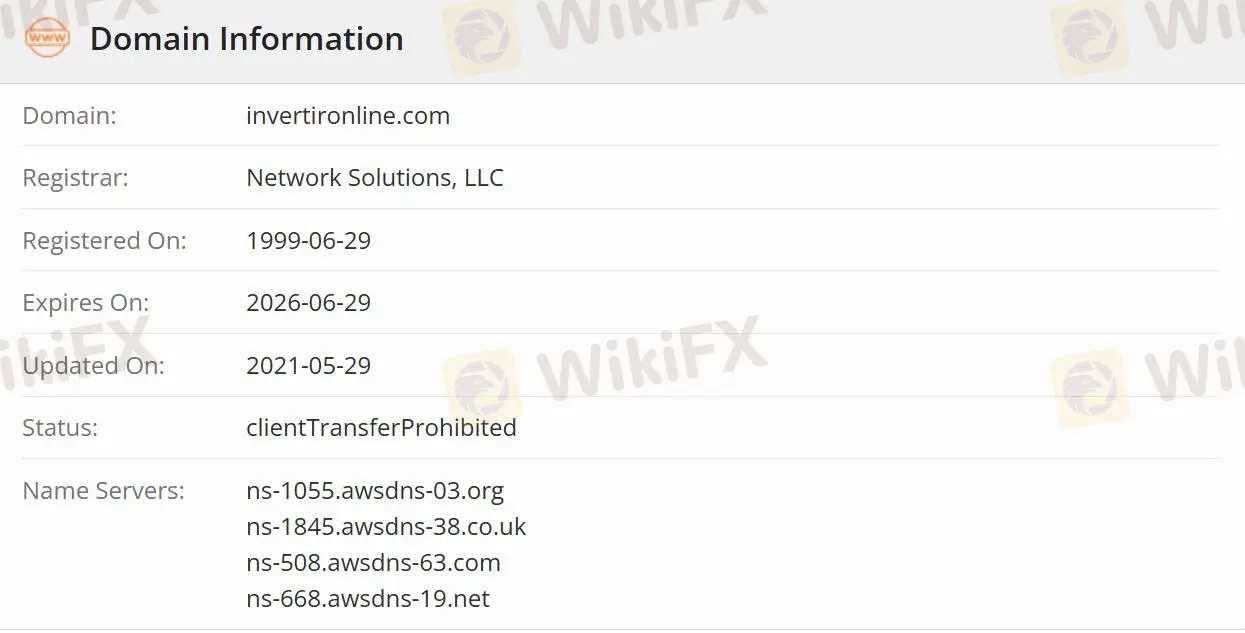

| Gegründet | 1999-06-29 |

| Registriertes Land/Region | Argentinien |

| Regulierung | Unreguliert |

| Produkte | Geldmanagement/Platzierungsgarantie/Vorsicht des Takers/Kauf und Verkauf von MEP-Dollars/Investmentfonds,/Aktienmarkt |

| Handelsplattform | IOL Investments App (Mobile) |

| Kundensupport | Soziale Medien: YouTube, Twitter, Telegram, Instagram, LinkedIn, Facebook |

invertirOnline Informationen

invertirOnline ist ein Finanztechnologieunternehmen, das sich auf den Online-Handel in Argentinien spezialisiert hat. Die in Argentinien und den USA gehandelten Produkte umfassen den Aktienmarkt, Aktien, ETFs und mehr. invertirOnline bietet auch proprietäre Handelstools - die IOL Investments App.

invertirOnline ist legitim?

invertirOnline ist nicht reguliert, was es weniger sicher macht als regulierte Broker.

Welche Produkte bietet invertirOnline an?

In Argentinien gehandelte Produkte haben Zugang zum Geldmanagement. Platzierungsgarantie, Vorsicht des Takers

Kauf und Verkauf von MEP-Dollars, Investmentfonds, Aktienmarkt, Anleihen, einfaches Portfolio, CEDEARS OF ETFS und mehr.

Die in den USA gehandelten Produkte umfassen den Aktienmarkt, Aktien, ETFs und ADRs. Kunden können über das Dollars-BlND-Girokonto und das Dollars-SPV-Girokonto einzahlen.

Handelsplattform

invertirOnline bietet die IOL Investments App zum Download an, indem Sie den Play Store oder den Apple Store besuchen.

| Handelsplattform | Unterstützt | Verfügbare Geräte |

| IOL Investments App | ✔ | Mobile |

santiago castro

Argentinien

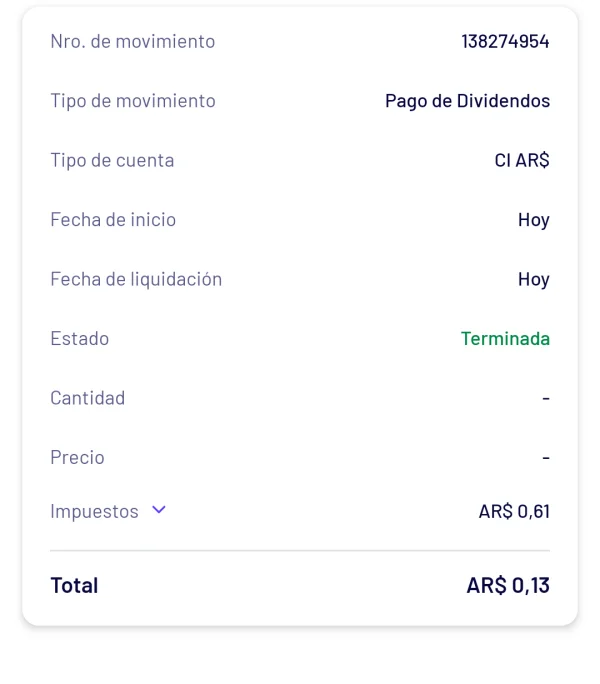

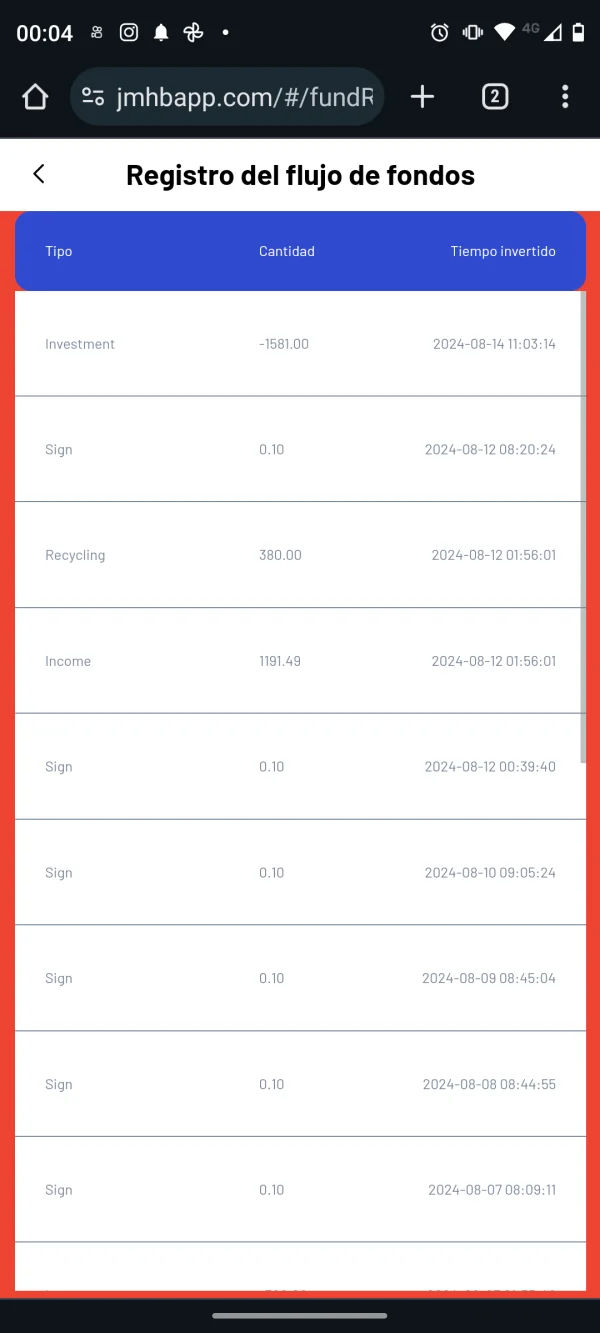

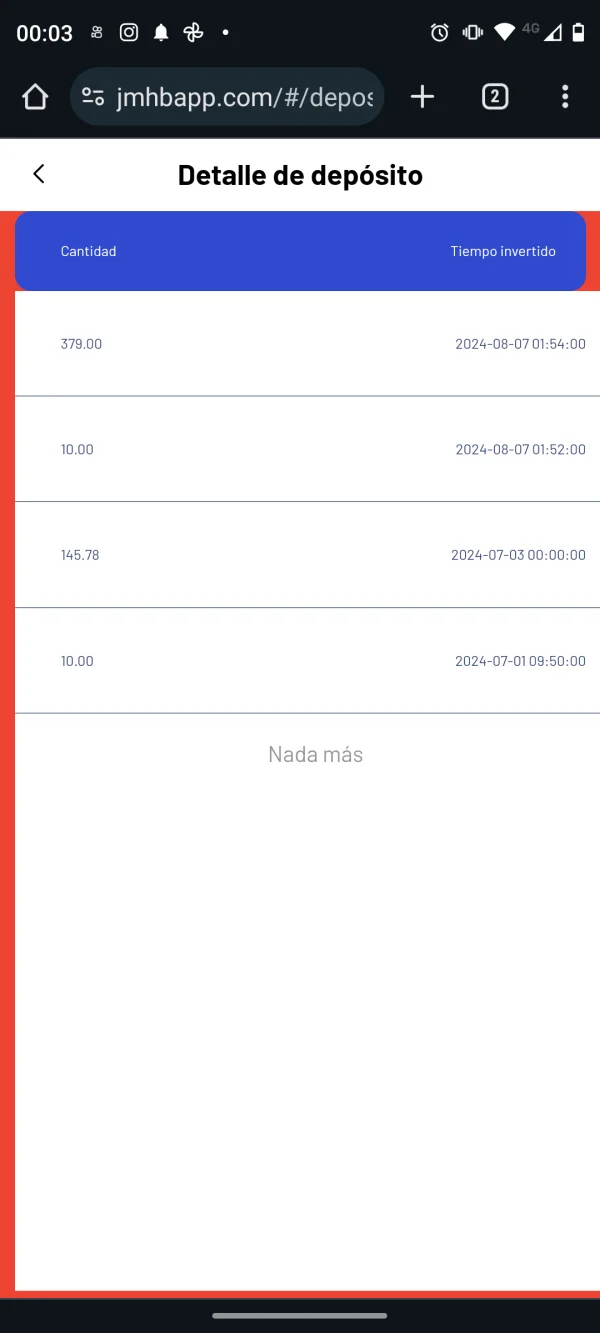

Ich habe in ein paar Aktien investiert, aber als es Zeit war, die Dividende einzusammeln, haben sie nicht nur fast alles genommen, sondern mir auch ein negatives Guthaben hinterlassen, um mich später zu berauben. Ja, diese 13 Cent, die auf dem Bild zu sehen sind, sind diejenigen, die als negativ auf meinem Konto erschienen sind – was für eine schamlose Bande.

Exposition

FX2025216881

Argentinien

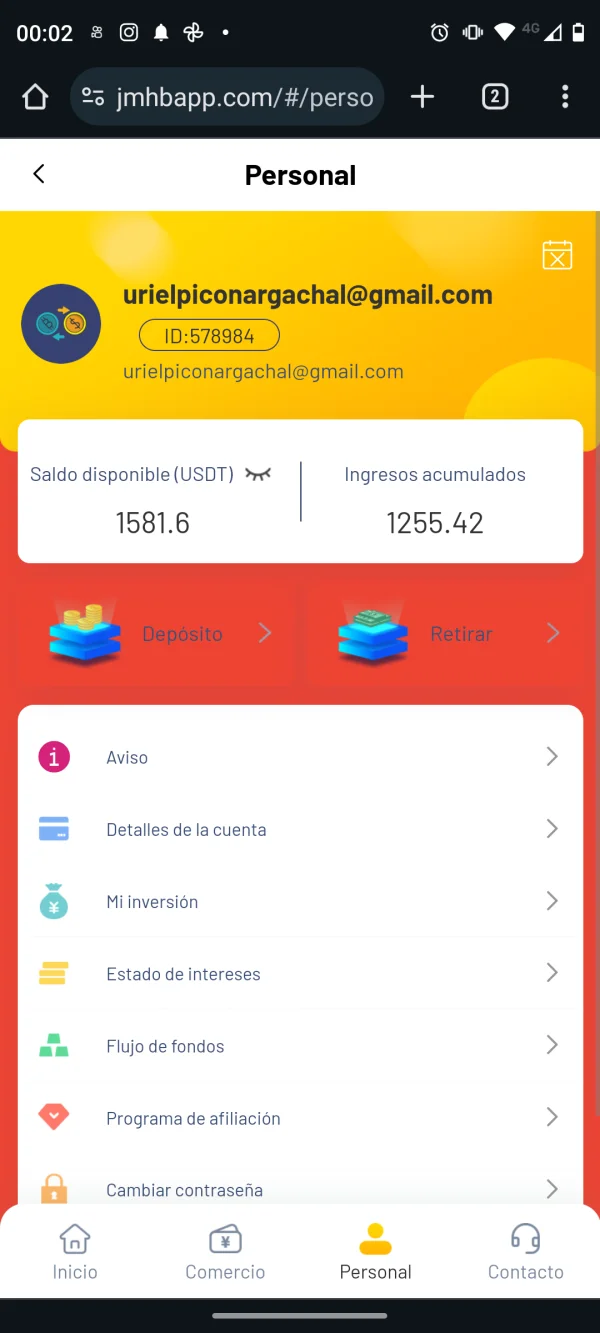

Diese Plattform betrügt seit einigen Monaten Menschen und hat heute auf die gleiche Weise mehr Menschen betrogen. Sie bringen Menschen dazu, zu investieren, zahlen ihnen, bis sie Vertrauen gewinnen und mehr Geld investieren, und dann verlangen sie mehr Geld, um es abheben zu können. Ich bin wütend, weil es niemanden gibt, der uns helfen kann. Wir versuchen, ein wenig mehr Geld zu verdienen, um zu überleben, und sie ruinieren uns auf diese Weise.

Exposition

FX1206187650

Argentinien

Wenn es von der CNV reguliert wird, gebe ich ihm eine 3, da ich es erst seit kurzer Zeit benutze.

Neutral

加菲丹丹

Neuseeland

Nur spanischer Service? Ich kann nur ein bisschen Spanisch lesen. Ich denke, die Dienstleistungen dieses Unternehmens sind speziell für spanische Muttersprachler konzipiert. Wenn Sie kein Spanisch verstehen, können Sie jetzt aufhören.

Neutral