Описание компании

| ALKHAIR CAPITAL Обзор | |

| Основана | 2009 |

| Страна/Регион регистрации | Королевство Саудовская Аравия |

| Регулирование | Отсутствует |

| Услуги | Инвестиционное банковское дело, кастодианство и брокерство, управление активами, торговое программное обеспечение, исследовательские услуги |

| Демо-счет | ❌ |

| Торговая платформа | Pro10Plus, DFNPro9 |

| Минимальный депозит | SR 10,000 |

| Поддержка клиентов | Форма обратной связи |

| Тел: +966 11 215 5607 | |

| Эл. почта: info@alkhaircapital.com.sa | |

| Факс: +966 11 219 1270 | |

| Адрес: P.O Box 69410, здание Quara holding, Королевство Саудовская Аравия, ул. Кинг Абдулазиз, район Аль-Визарат | |

| Социальные сети: X, LinkedIn | |

Информация о ALKHAIR CAPITAL

ALKHAIR CAPITAL - это нерегулируемый поставщик премиальных брокерских и финансовых услуг, основанный в КСА в 2009 году. Он предлагает продукты и услуги по инвестиционному банковскому делу, кастодианству и брокерству, управлению активами, торговому программному обеспечению и исследовательским услугам.

Плюсы и минусы

| Плюсы | Минусы |

| Длительное время работы | Отсутствие регулирования |

| Различные каналы связи | Отсутствие демо-счетов |

| Разнообразные финансовые услуги | Высокие требования к минимальному депозиту |

| Применяются торговые комиссии | |

| Взимаются абонентские платежи |

ALKHAIR CAPITAL Легально?

№ ALKHAIR CAPITAL в настоящее время не имеет действующих правил. Пожалуйста, будьте внимательны к риску!

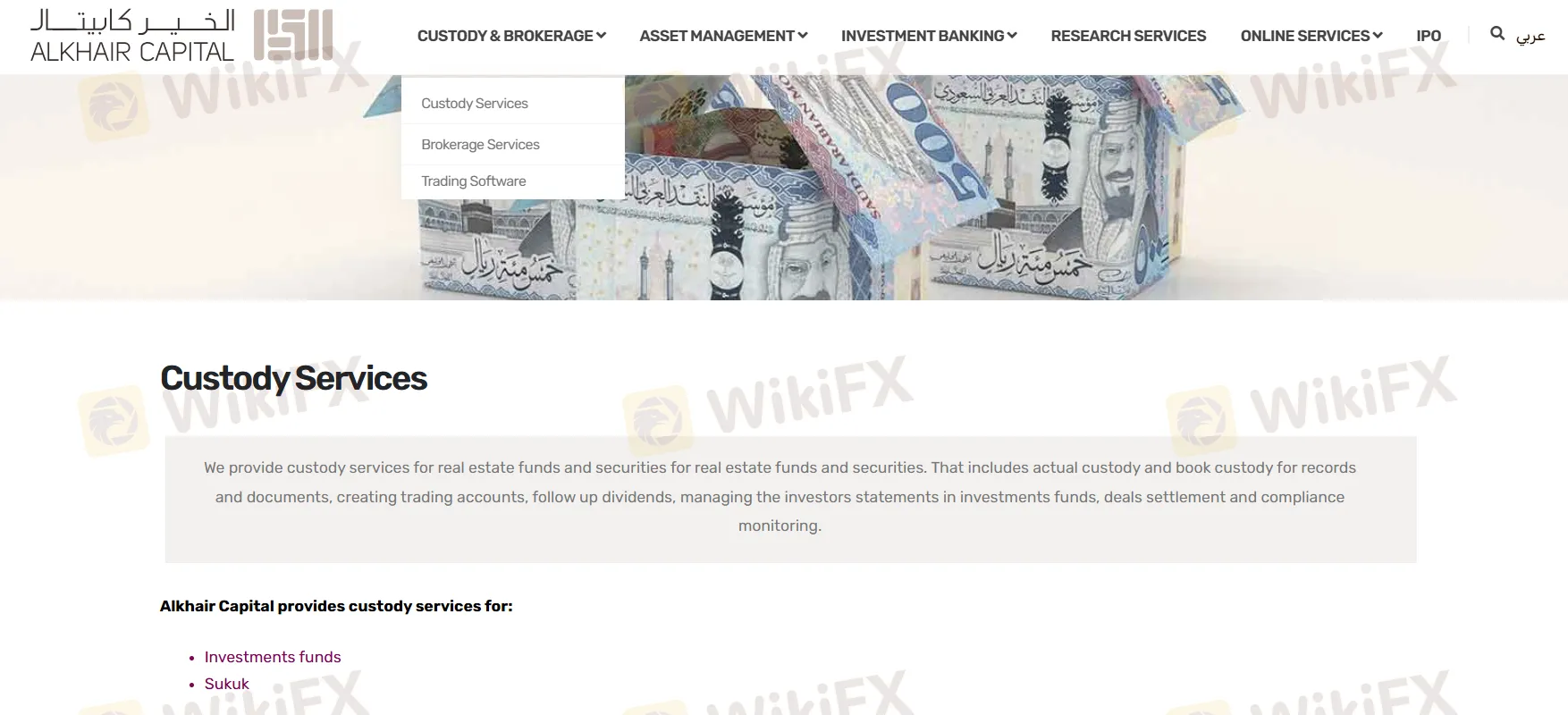

Услуги ALKHAIR CAPITAL

| Услуги | Поддерживается |

| Хранение и брокерство | ✔ |

| Инвестиционные фонды | ✔ |

| Сукук | ✔ |

| Брокерские услуги | ✔ |

| Управление активами | ✔ |

| Инвестиционное банковское дело | ✔ |

| Исследовательские услуги | ✔ |

| Торговое программное обеспечение | ✔ |

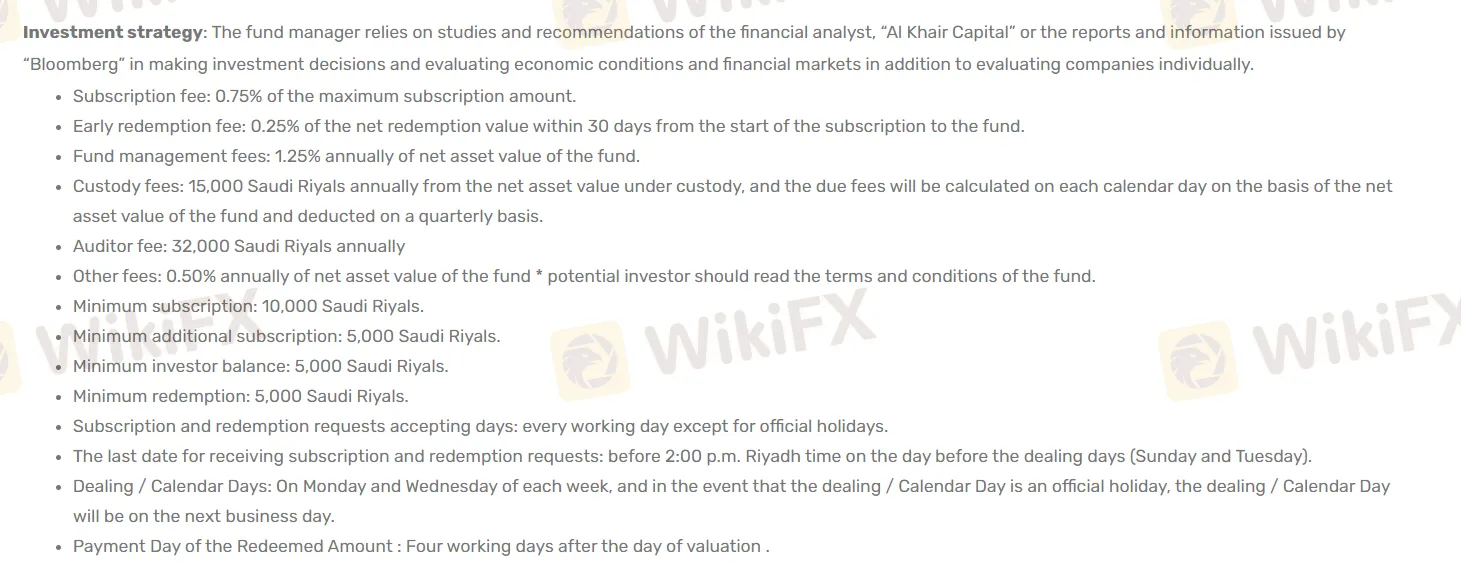

Сборы ALKHAIR CAPITAL

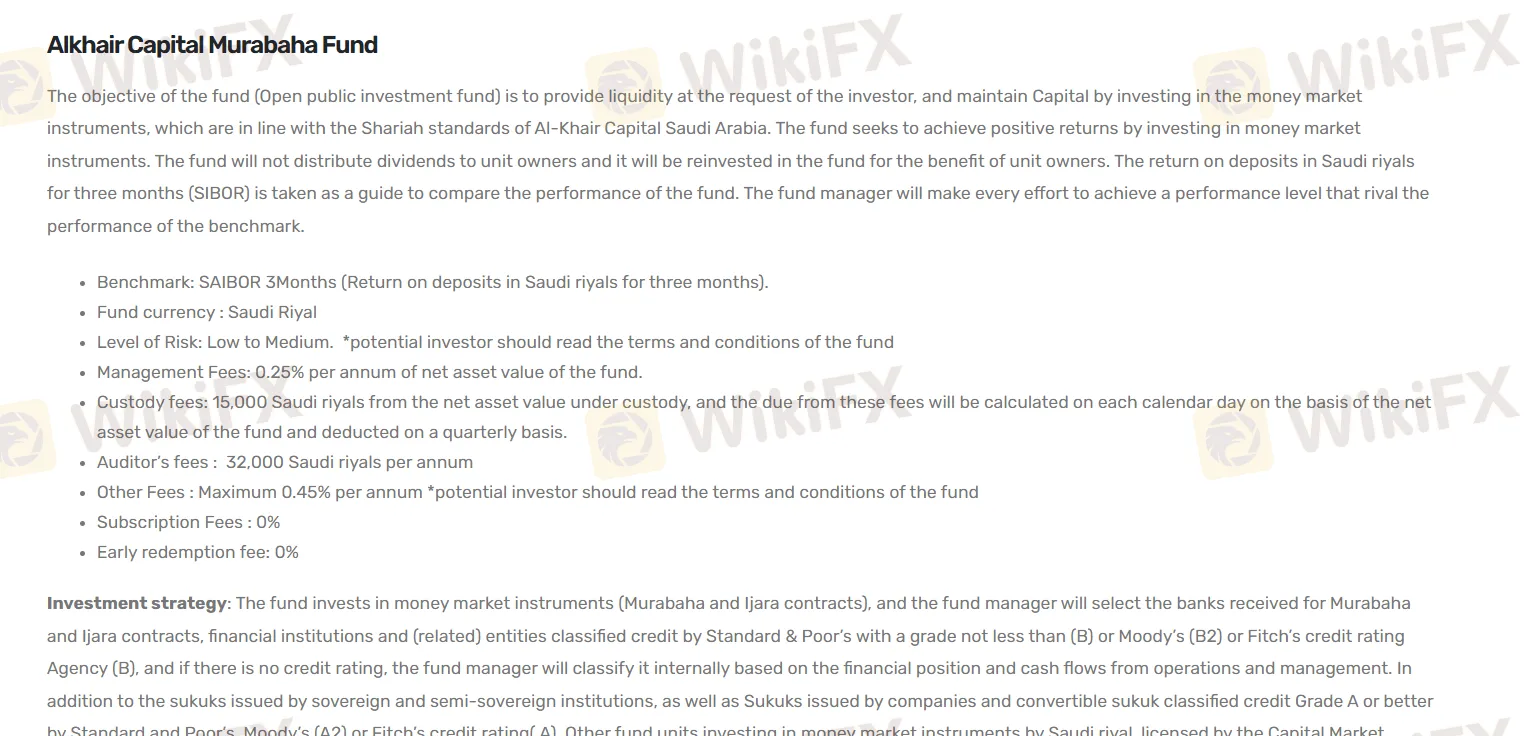

| Типы фондов | Сборы за управление | Сборы за хранение | Сборы аудиторов | Прочие сборы | Сборы за погашение |

| Фонд Alkhair Capital Murabaha | 0.25% в год | 15 000 саудовских риалов | 32 000 саудовских риалов в год | Максимум 0.45% в год | ❌ |

| Фонд Alkhair Capital Sukuk Plus | 0.75% в год | 15 000 SAR ежегодно | 8 533,33 $ в год | 0.5% в год | 1% первый год, 0.75% второй год, 0.5% третий год, и без сборов после третьего года |

| Фонд Alkhair Capital Saudi Equity | 1.25% в год | 15 000 саудовских риалов ежегодно | 32 000 саудовских риалов ежегодно | 0.75% в год | / |

| Фонд Alkhair Capital IPOs | 1.25% в год | 15 000 саудовских риалов ежегодно | 32 000 саудовских риалов ежегодно | 0.50% в год | / |

Торговая платформа

| Торговая платформа | Поддерживается | Доступные устройства |

| Pro10Plus | ✔ | Мобильный, настольный |

| DFNPro9 | ✔ | Мобильный, настольный |

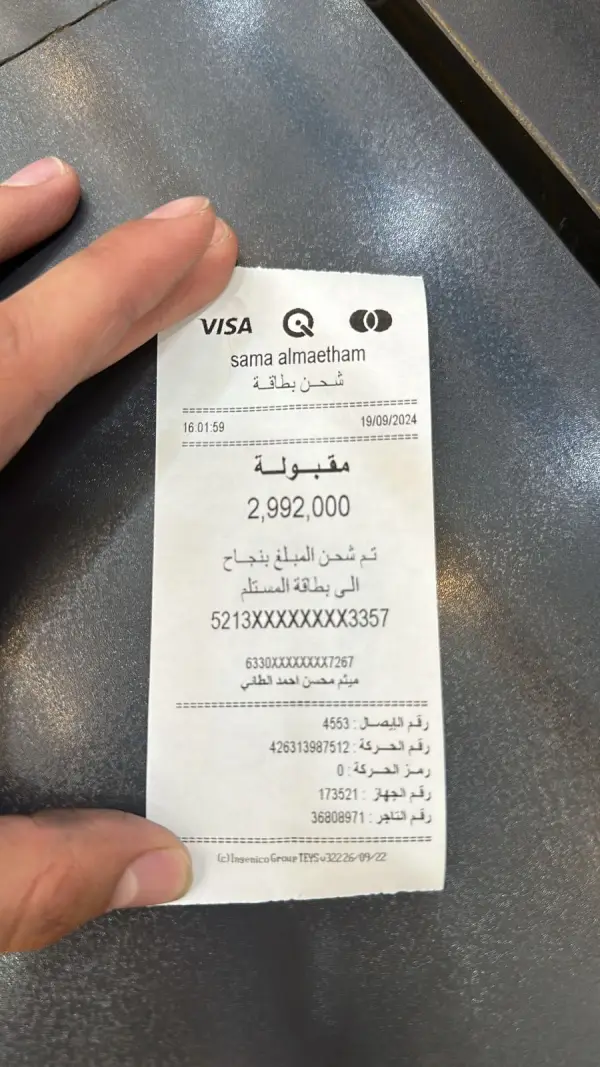

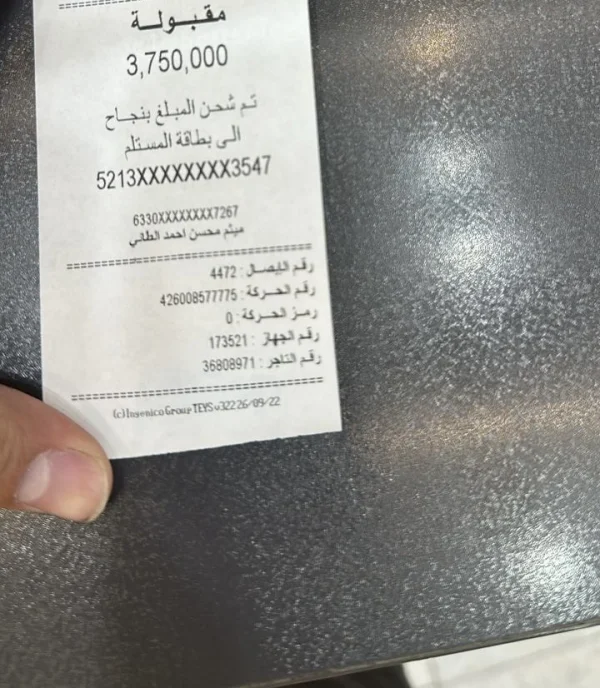

Депозит и вывод средств

| Типы фондов | Минимальная подписка |

| Фонд Alkhair Capital Murabaha | SR 10,000 |

| Фонд Alkhair Capital Sukuk Plus | USD 10,000 |

| Фонд Alkhair Capital Saudi Equity | SR 10,000 |

| Фонд Alkhair Capital IPOs | SR 10,000 |