简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold Reaches Short-Term Target — Correction Risks Loom

Sommario:The surge in risk assets is running hot, moving in tandem with golds bullish momentum as markets revel in the easing narrative and AI-driven optimism. Still, it is essential to step back and assess ma

The surge in risk assets is running hot, moving in tandem with golds bullish momentum as markets revel in the easing narrative and AI-driven optimism. Still, it is essential to step back and assess macroeconomic data to guide forward-looking investment decisions.

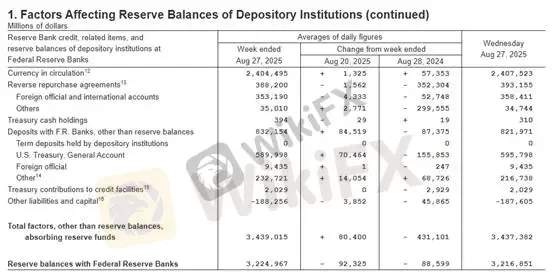

1. Liquidity Drain Persists

Weekly updates from the Federal Reserves balance sheet show bank reserves are still edging lower at a slow pace. However, the narrowing in the Overnight Reverse Repurchase (ONRRP) facility and the rising Treasury General Account (TGA) balance both signal that market liquidity is gradually tightening.

(Chart 1: Federal Reserve Balance Sheet; Source: FED)2. Weak U.S. Domestic Demand — Imports Turn Negative

Latest figures show that total U.S. goods trade (exports + imports) in 2024 grew by 4.38% year-over-year, with exports up 1.89% and imports up 6.02%. As of June 2025, export growth eased to 3.33%, while imports contracted by 1.39%.

Imports are a forward-looking reflection of domestic demand, cascading through raw material inflows, manufacturing, packaging, and finally consumer sales. This chain reaction highlights the so-called “butterfly effect.”

The tariff-driven surge in costs weighs heaviest on low-margin retailers, who face a double bind: passing on tariffs risks suppressing consumer demand, while absorbing higher costs erodes margins. Either way, it underscores fragility in todays risk-asset rally.

(Chart 2: U.S. Import and Export YoY Changes; Source: MacroMicro)3. Strong Q2 GDP Growth, Q3 Outlook Less Certain

Back in April, broad policy actions left risk assets deeply undervalued, with valuations even below long-term averages. Our objective macro view urged investors to embrace risk rather than shy away.

Todays rally, however, is largely a reflection of strong Q2 GDP. Yet robust growth inherently carries inflationary pressure. With consumer spending momentum likely to soften in Q3, inflation is also expected to moderate.

From the data side, the inventory-to-sales ratio in upstream industries remains elevated. Inventory build-ups from early procurement have not been meaningfully drawn down. Unless inventory-to-sales ratios normalize back toward 2022 levels (1.47) or pre-pandemic levels (1.44), the inventory cycle cannot be considered complete.

Note: Inventory-to-sales ratio = Inventory ÷ Sales. If inventory stays constant while sales increase, the ratio declines.

(Chart 3: Inventory-to-Sales Ratios Across Upstream, Midstream, Downstream; Source: MacroMicro)

When Will Stocks and Gold Correct?

The real correction will not require guesswork — as timing draws closer, market signals will be clear. Investors should prepare rather than fear.

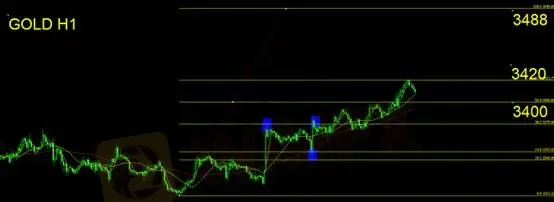

Gold Technical Analysis

Golds move toward 3420 was followed by a swift reversal, fulfilling our earlier-projected Fibonacci 1.618 extension target. Short-term bulls should consider partial profit-taking. Immediate focus is on support at 3400. Holding this level would imply potential continuation toward the next Fibonacci retracement target of 3488. A sustained break below 3400, however, could trap gold in a choppy consolidation phase over the next week.

As long as gold maintains its higher-highs and higher-lows pattern above 3400, the bullish case remains intact.

Stop Loss Suggestion: $15

Support: 3400

Resistance: 3420 / 3488

Risk Disclaimer: The views, analyses, research, prices, or other information above are provided as general market commentary and do not represent the stance of this platform. Readers assume full responsibility for their own trading risks. Please exercise caution.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

GTCFX

octa

InteractiveBrokers

FOREX.com

AVATRADE

STARTRADER

GTCFX

octa

InteractiveBrokers

FOREX.com

AVATRADE

STARTRADER

WikiFX Trader

GTCFX

octa

InteractiveBrokers

FOREX.com

AVATRADE

STARTRADER

GTCFX

octa

InteractiveBrokers

FOREX.com

AVATRADE

STARTRADER

Rate Calc