简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Fed Independence Under Scrutiny, Currency Fragility Concerns Fuel Gold Rally

Sommario:As central bank independence comes under political interference, investors lose faith in monetary credibility. Whether a central bank can remain independent directly determines if inflation can be eff

As central bank independence comes under political interference, investors lose faith in monetary credibility. Whether a central bank can remain independent directly determines if inflation can be effectively controlled. In an interview with Fox News, ECB President Christine Lagarde emphasized that the banks mandate to fight inflation and support the economy can only be achieved if independence is preserved.

Former President Trump has openly criticized the Federal Reserves current monetary stance and has intensified pressure on the central bank. On August 25, Trump announced the immediate dismissal of Fed Governor Cook—appointed by former President Biden—citing authority under the U.S. Constitution and the Federal Reserve Act.

According to Wall Street Journal reporter Nick Timiraos, Trump‘s move positions him to secure four seats at the Federal Reserve by March next year. With majority control, he could block regional Fed presidents from being reappointed, thereby reshaping the FOMC’s structure. The firing of Cook is a key step toward consolidating that power.

(Chart 1. Trump dismisses Fed Governor Cook. Source: Truth Social)

U.S. risk assets pulled back during todays Asian session on the news, while precious metals surged as concerns grew over potential currency fragility.

Our outlook remains unchanged from yesterday: the “summer fireworks” in risk assets are fading, primarily due to weakening end demand. Short-term headlines are merely catalysts accelerating the pullback. In capital markets, chasing fleeting news flows rarely leads to sustainable profits. Instead, understanding macroeconomic trends and consistently positioning with the right framework is the true “holy grail” for survival and returns.

Uncertainty in the event-driven landscape continues to drive volatility: Will inflation reaccelerate? How will retaliatory trade tariffs evolve? Could OPEC trigger a new oil price war?

At times, too many unanswered questions can overwhelm traders. Rather than being paralyzed by headlines, it is often wiser to focus on the clearer guidance that macroeconomic fundamentals provide.

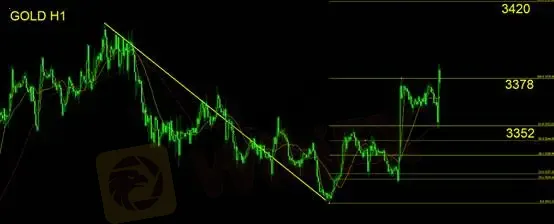

Gold Technical Analysis

Gold has broken out of its prior downtrend and entered a short-term upward phase. Based on Fibonacci extensions, the 1.618 projection points to a target zone near 3420.

From the daily chart, yesterday closed with a bearish engulfing candle, signaling potential downside. However, in todays Asian session, gold found support at 3352 and reversed higher, breaking above intraday resistance at 3378, shifting the short-term bias from “neutral-to-bearish” to “neutral-to-bullish.”

Our trading guidance remains as follows:

If the daily chart closes with a bullish engulfing candle, adding long exposure becomes safer.

If prices break below 3352 and close with a bearish reversal, traders should maintain flexibility to consider short positions.

Support: 3352

Resistance: 3378 / 3420

⚠️ Risk Disclaimer: The above views, analysis, research, prices, or other information are provided solely as general market commentary and do not represent the stance of this platform. All readers assume full responsibility for their trading decisions. Exercise caution.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

JustMarkets

AVATRADE

EC Markets

FXCM

Exness

ATFX

JustMarkets

AVATRADE

EC Markets

FXCM

Exness

ATFX

WikiFX Trader

JustMarkets

AVATRADE

EC Markets

FXCM

Exness

ATFX

JustMarkets

AVATRADE

EC Markets

FXCM

Exness

ATFX

Rate Calc