简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Loud Dovish Signals After CPI Data — Bulls Keep Dancing on Wall Street

Sommario:Following the July U.S. CPI release, all four major U.S. stock indexes surged as markets priced in stronger rate cut expectations. However, the Treasury market lagged — the 10-year yield still rose 1.

Following the July U.S. CPI release, all four major U.S. stock indexes surged as markets priced in stronger rate cut expectations. However, the Treasury market lagged — the 10-year yield still rose 1.80 bps despite the dovish data.

As we noted yesterday — “Trim longs at highs, trim shorts at lows” — investors should remain cautious about chasing equity gains. In this highly dovish sentiment, our stance is to preserve profits and await a more rational market.

(Figure 1. Global Market Overview; Source: MacroMicro)

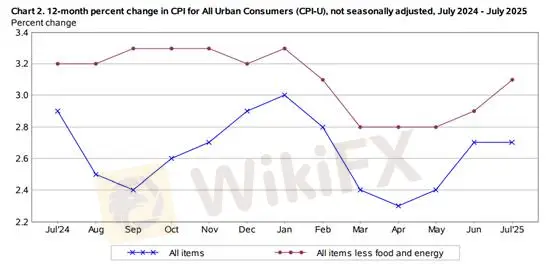

Headline CPI stayed at 2.70%, below the 2.80% forecast, while Core CPI rose for the third straight month to 3.10%, matching expectations.

CPI Structure — Cost-Push vs Demand-Pull

(Figure 2. CPI and Core CPI; Source: BLS)

Month-over-month (MoM) data reveals price drivers:

Cost-Push Inflation — from higher input costs (oil, agriculture, transport, wages).

Demand-Pull Inflation — from stronger consumer demand (economic recovery, higher confidence, service expansion).

Energy: -1.07% MoM — easing cost pressure, dragging CPI lower.

Housing, transportation services, recreation: MoM gains show demand resilience.

Food: +0.22% — mix of cost and demand influences.

Vehicles: Prices rose (new +0.48%, used +0.22%), but volumes lagged — a cost-push signal from supply chain pressures.

Food & Beverages: +0.22% prices; grocery (+0.87%) and restaurant (+0.57%) sales growth mainly price-driven.

Recreational Services: +0.42% prices; demand concentrated in select entertainment goods.

Healthcare Services: +0.79% — supported by inelastic demand.

Transportation Services: +0.78% — boosted by travel and tourism recovery.

Market Implications

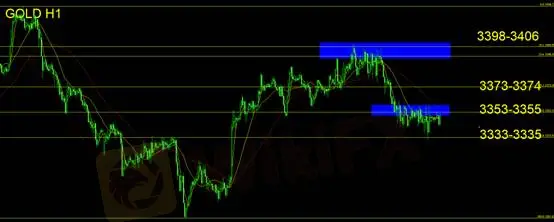

Gold Technical Analysis

July 2025 highlights:

Overall, July inflation shows cost-side cooling with stable demand. Future CPI trends will hinge more on service-sector demand than energy costs.

Comparing Inflation With Retail Sales

June retail sales show mixed patterns:

Resilient sectors:

This structure shows price gains concentrated in essential services and cost-restricted durable goods, with “high prices, low volumes” signaling weaker willingness to pay.

Weak demand often calls for rate cuts; cost-push pressures may require demand management via rate hikes. Despite steady headline CPI and rising core inflation, markets remain optimistic on cuts. A weaker USD has also lifted precious metals and non-USD currencies.

Gold found support at $3,333–$3,335 and rebounded in Asia to test $3,353–$3,355. The daily bullish “mother-and-child” candlestick suggests upside potential. Sustaining above $3,350 could target $3,373–$3,374. Short-term outlook: likely sideways over the next three sessions; watch weekly close for next weeks trend. Stop-loss: $10.

Support: 3,333–3,335

Resistance: 3,353–3,355 / 3,373–3,374 / 3,398–3,406

Risk Disclaimer: The views, analyses, research, prices, and other information herein are for general market commentary only and do not represent this platforms position. All readers assume full responsibility for their own trading decisions.

Disclaimer:

Le opinioni di questo articolo rappresentano solo le opinioni personali dell’autore e non costituiscono consulenza in materia di investimenti per questa piattaforma. La piattaforma non garantisce l’accuratezza, la completezza e la tempestività delle informazioni relative all’articolo, né è responsabile delle perdite causate dall’uso o dall’affidamento delle informazioni relative all’articolo.

WikiFX Trader

InteractiveBrokers

Plus500

GTCFX

FXCM

EC Markets

ATFX

InteractiveBrokers

Plus500

GTCFX

FXCM

EC Markets

ATFX

WikiFX Trader

InteractiveBrokers

Plus500

GTCFX

FXCM

EC Markets

ATFX

InteractiveBrokers

Plus500

GTCFX

FXCM

EC Markets

ATFX

Rate Calc