Riepilogo dell'azienda

Informazioni generali e regolamento

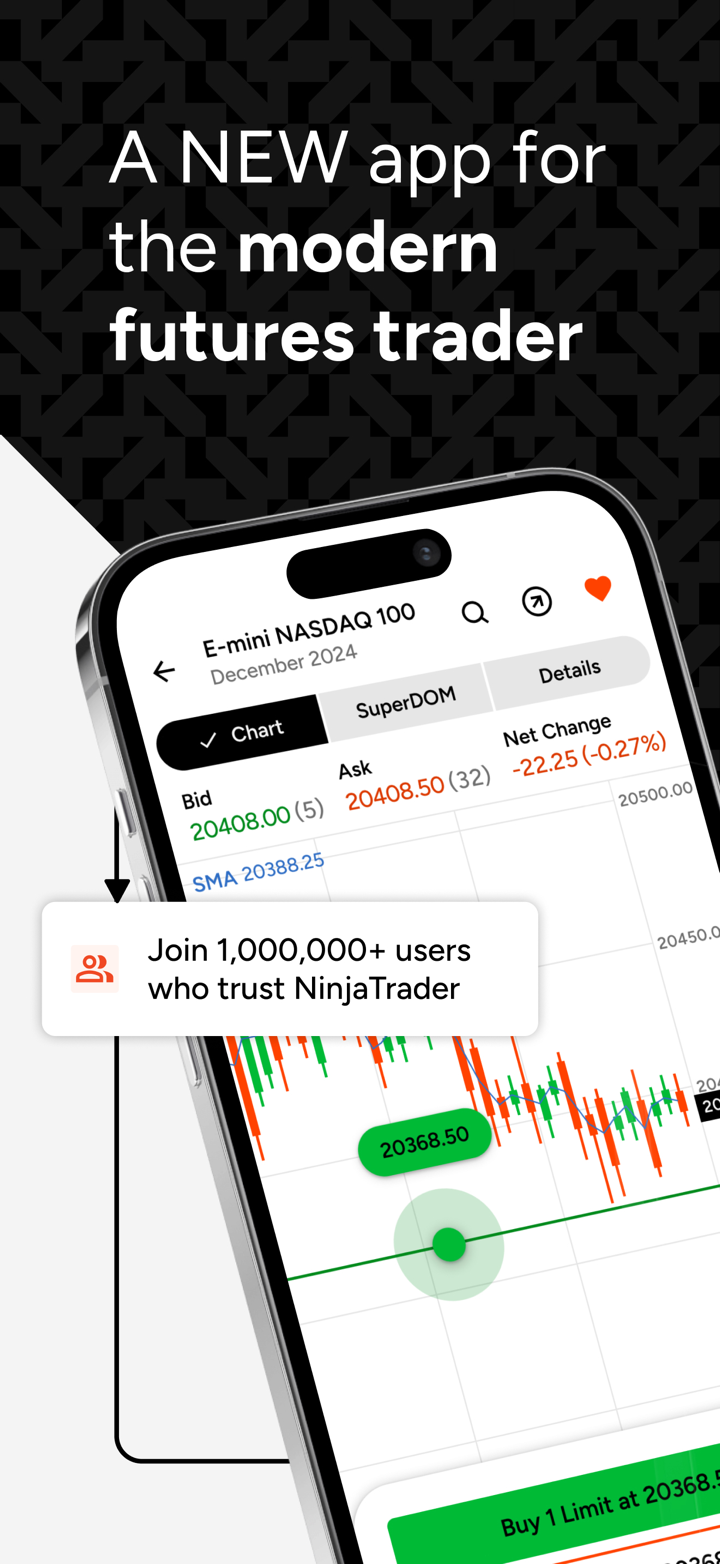

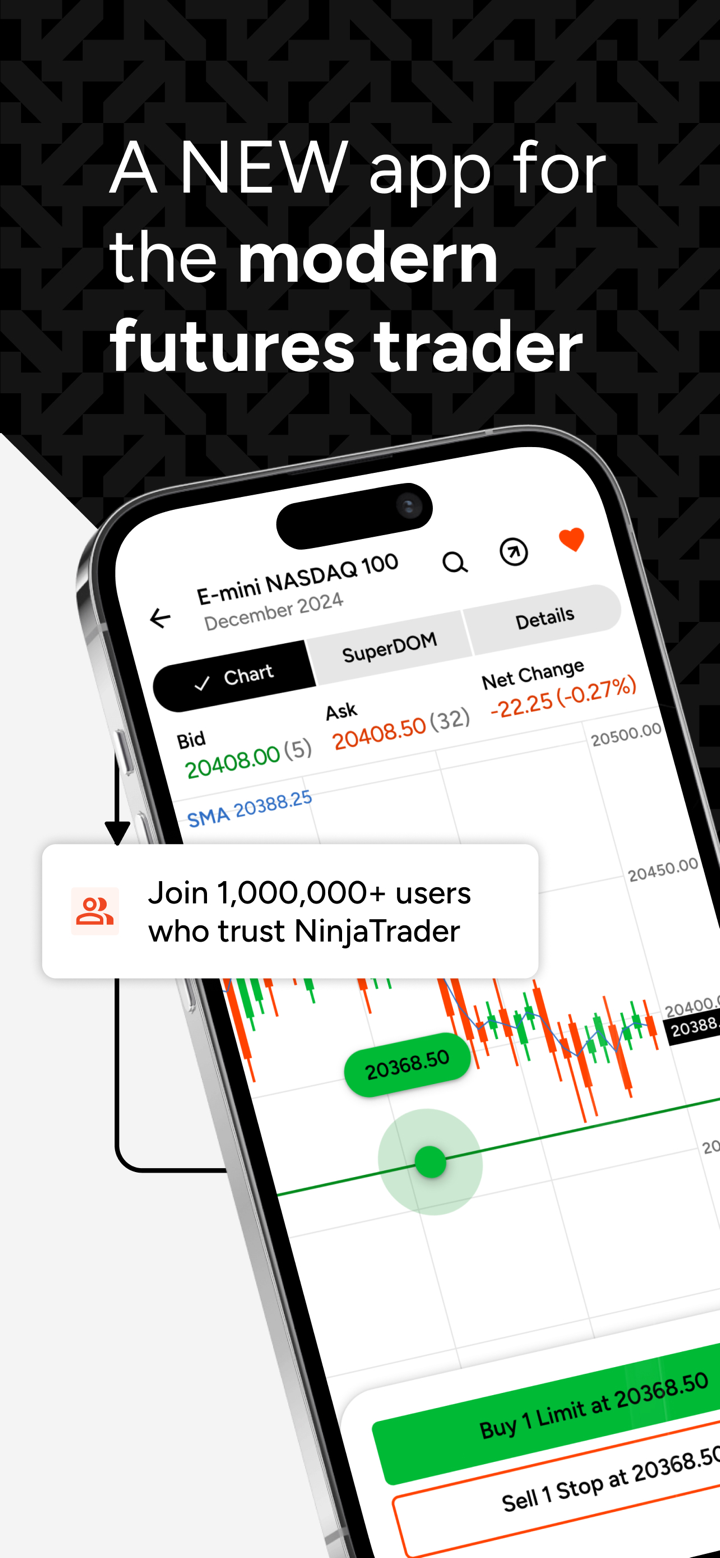

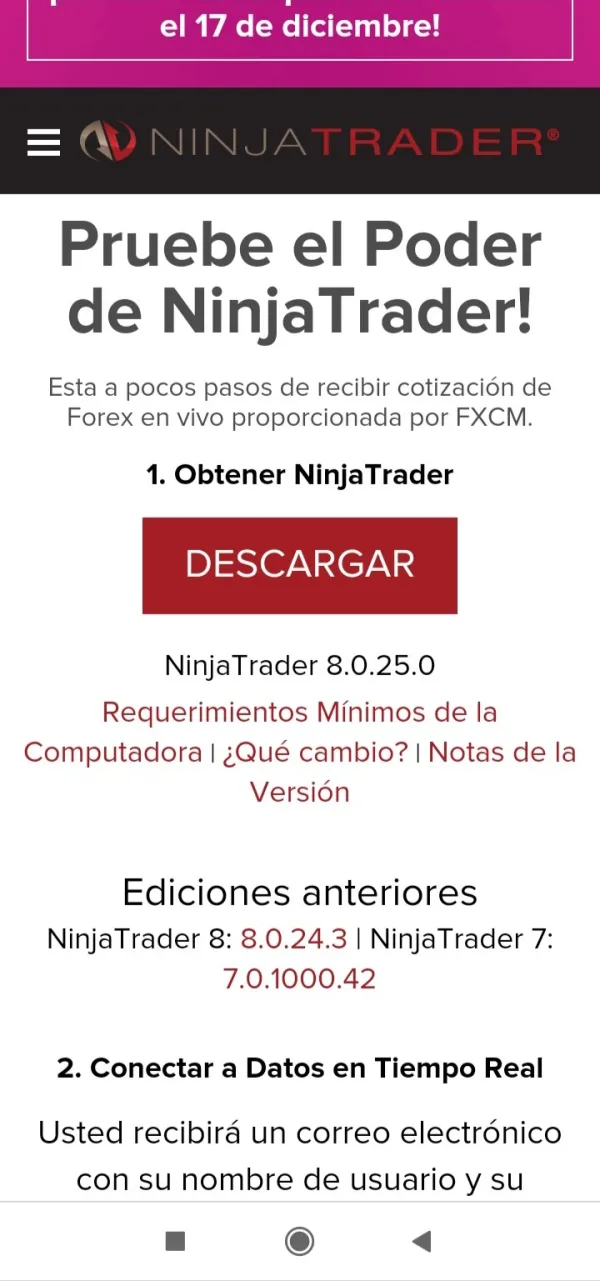

istituito nel 2004, NINJA TRADER aveva sede a denver, colorado e chicago, illinois. ninja trade offre una sofisticata piattaforma di trading con più grafici e una gamma di funzionalità oltre a servizi di dati di mercato. inoltre, ninjatrader fornisce servizi di intermediazione per supportare i trader forex e futures con prezzi scontati. NINJA TRADER non è soggetto ad alcuna regolamentazione.

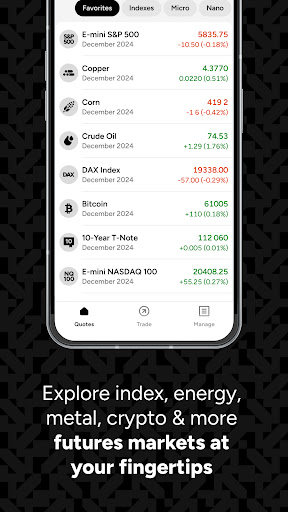

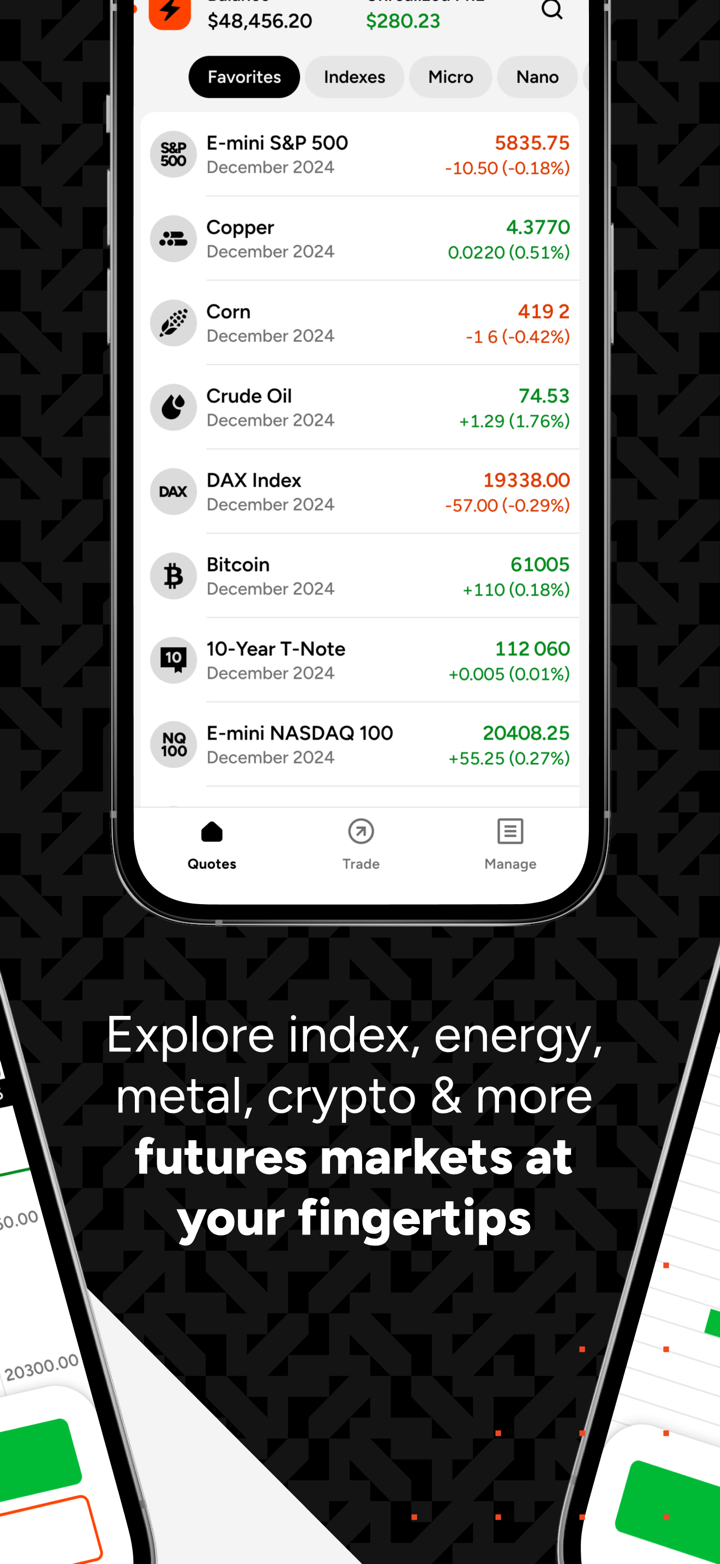

Strumenti di mercato

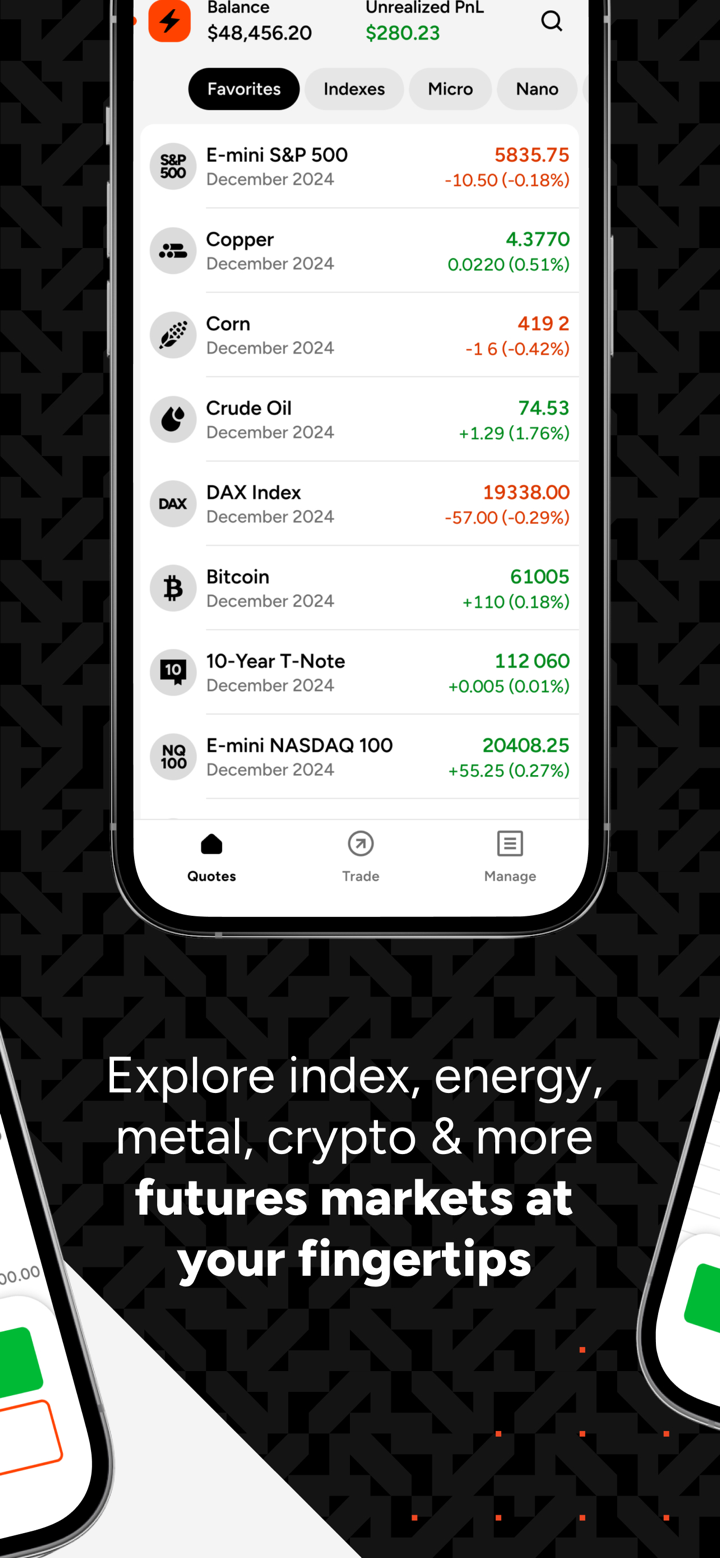

gli investitori possono scambiare forex, CFD, futures, opzioni, azioni sul NINJA TRADER piattaforma.

Deposito minimo

è associato il requisito di deposito minimo NINJA TRADER servizi di broker, ad esempio, il deposito minimo per un conto di trading forex è di soli $ 50, mentre questo requisito per un conto di trading di futures è di $ 1.000.

NINJA TRADERleva

Non sono state annunciate informazioni specifiche relative alla leva di trading. I margini di day trading per futures popolari come l'S&P 500 emini sono di $500. Entrambi i futures Mini Dax e FTSE 100 hanno margini di $ 1000.

Spread e commissioni

La parte su spread e commissioni non è completamente divulgata.

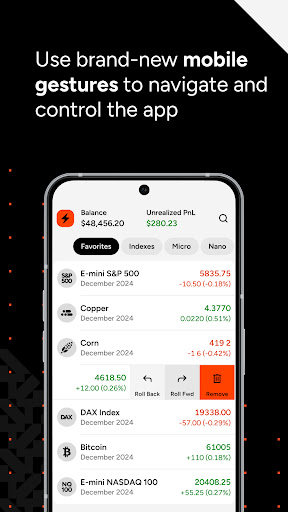

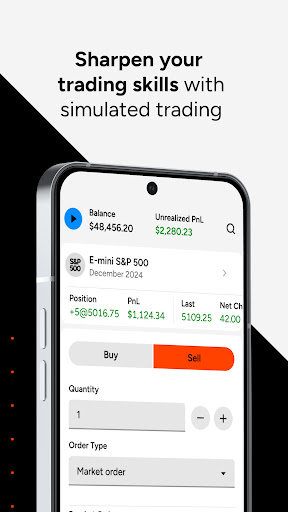

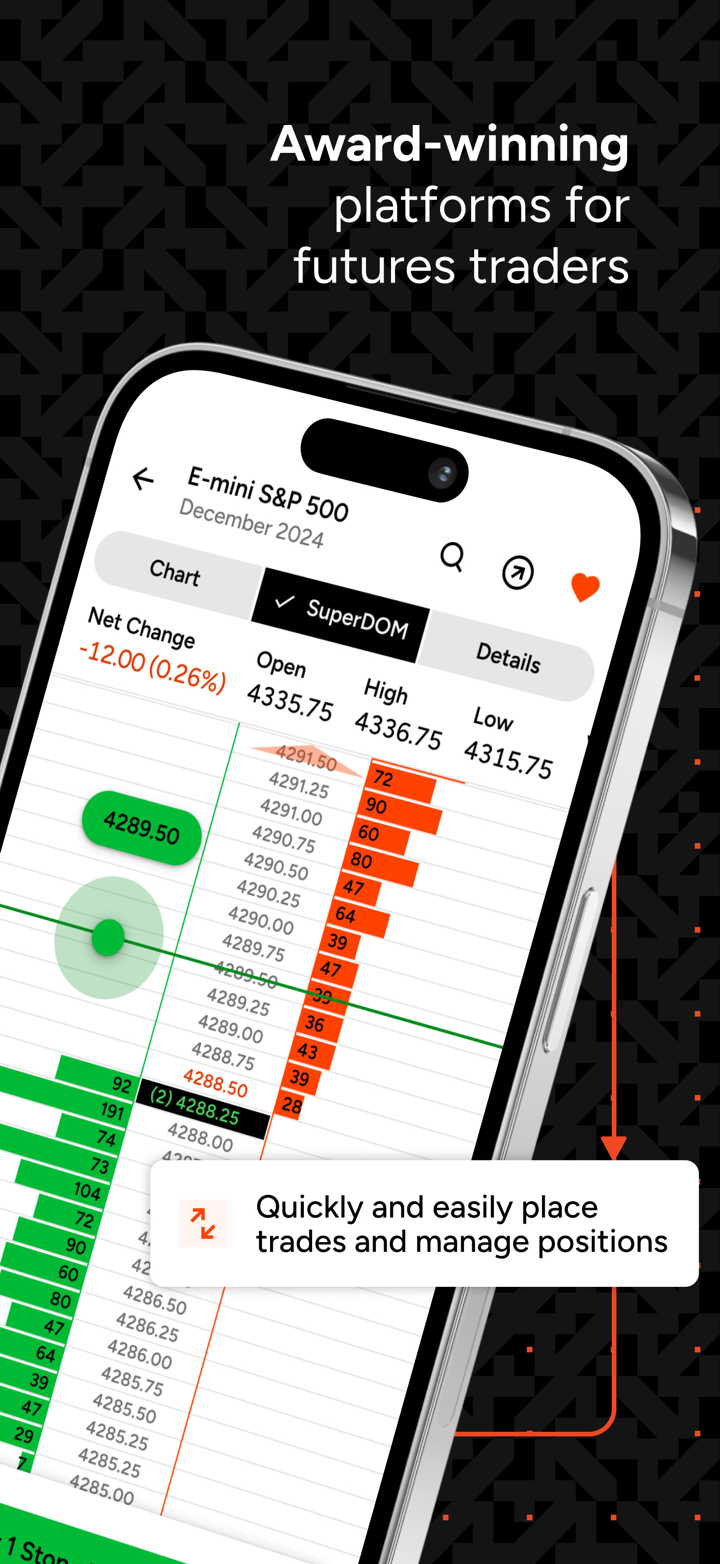

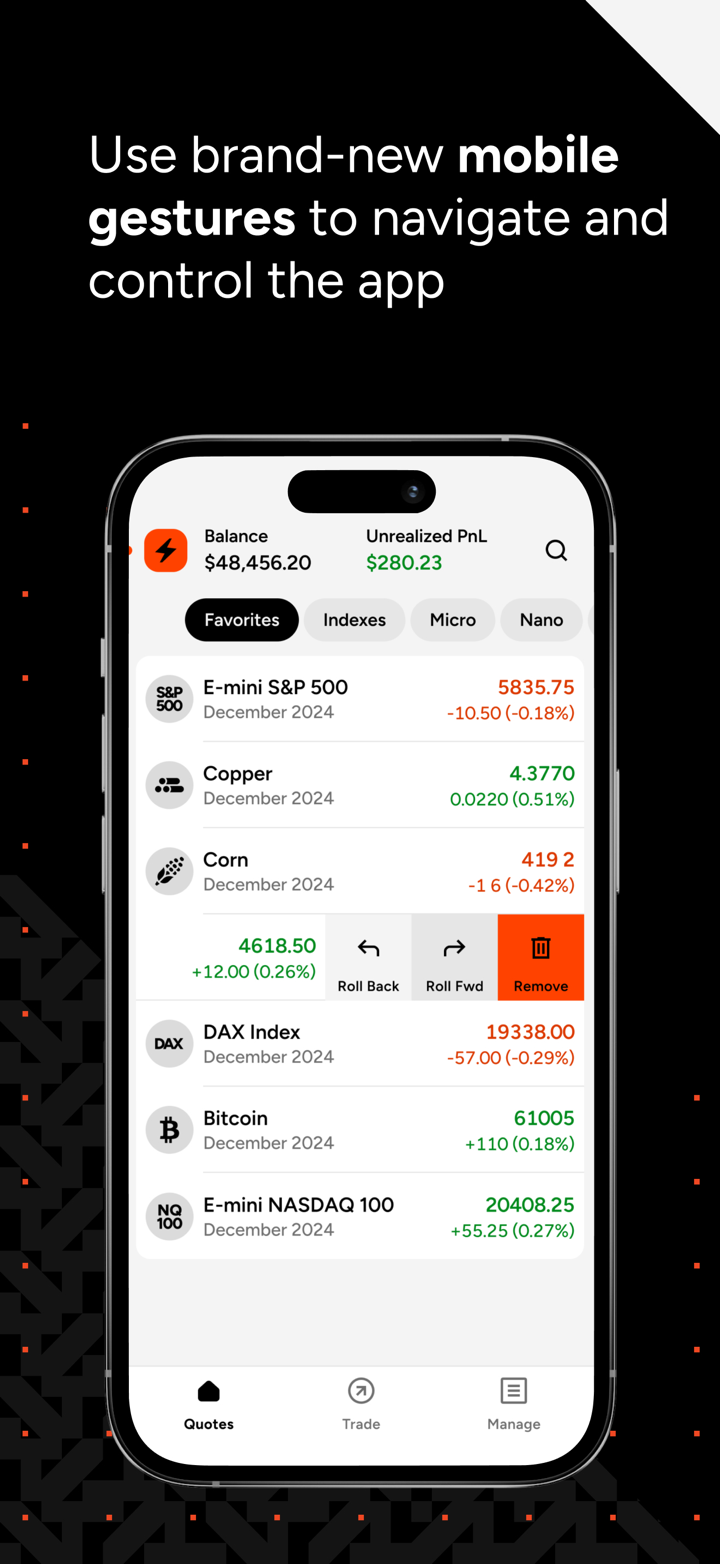

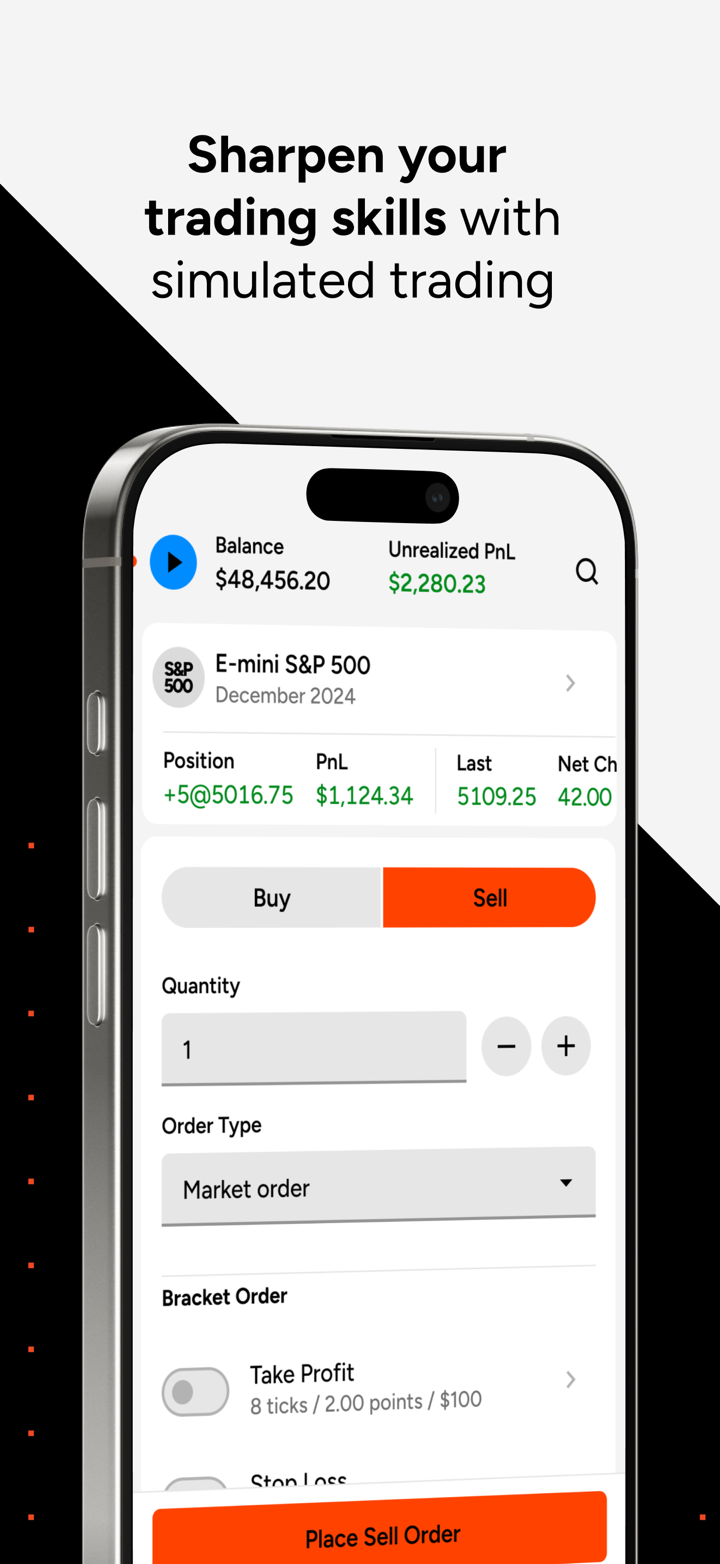

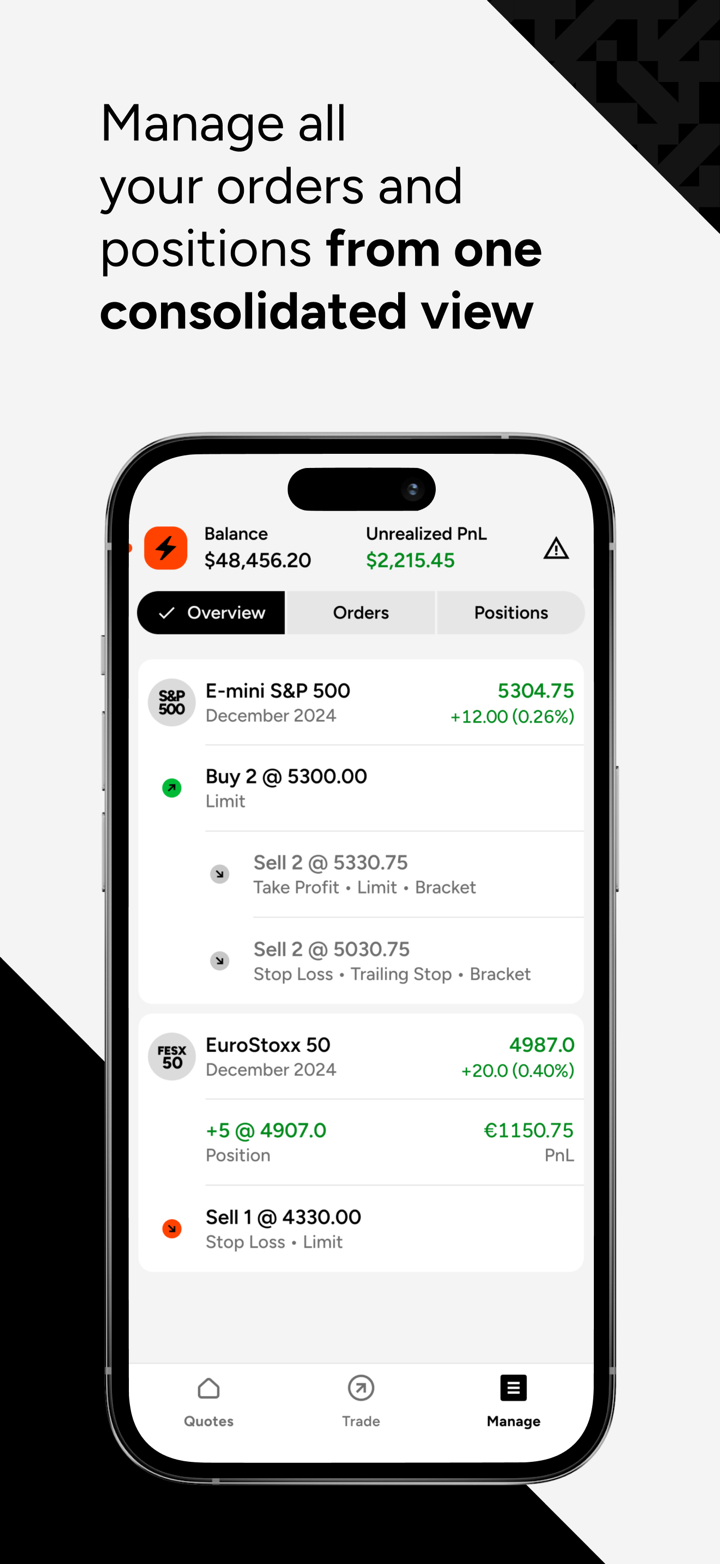

Piattaforme di trading

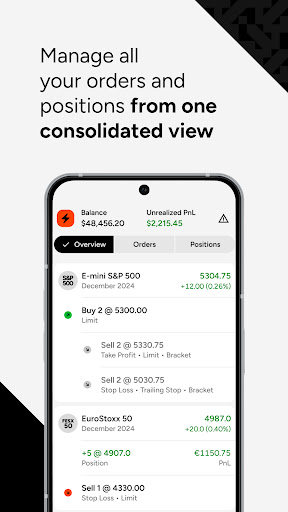

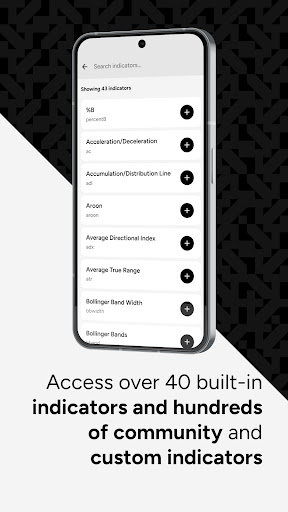

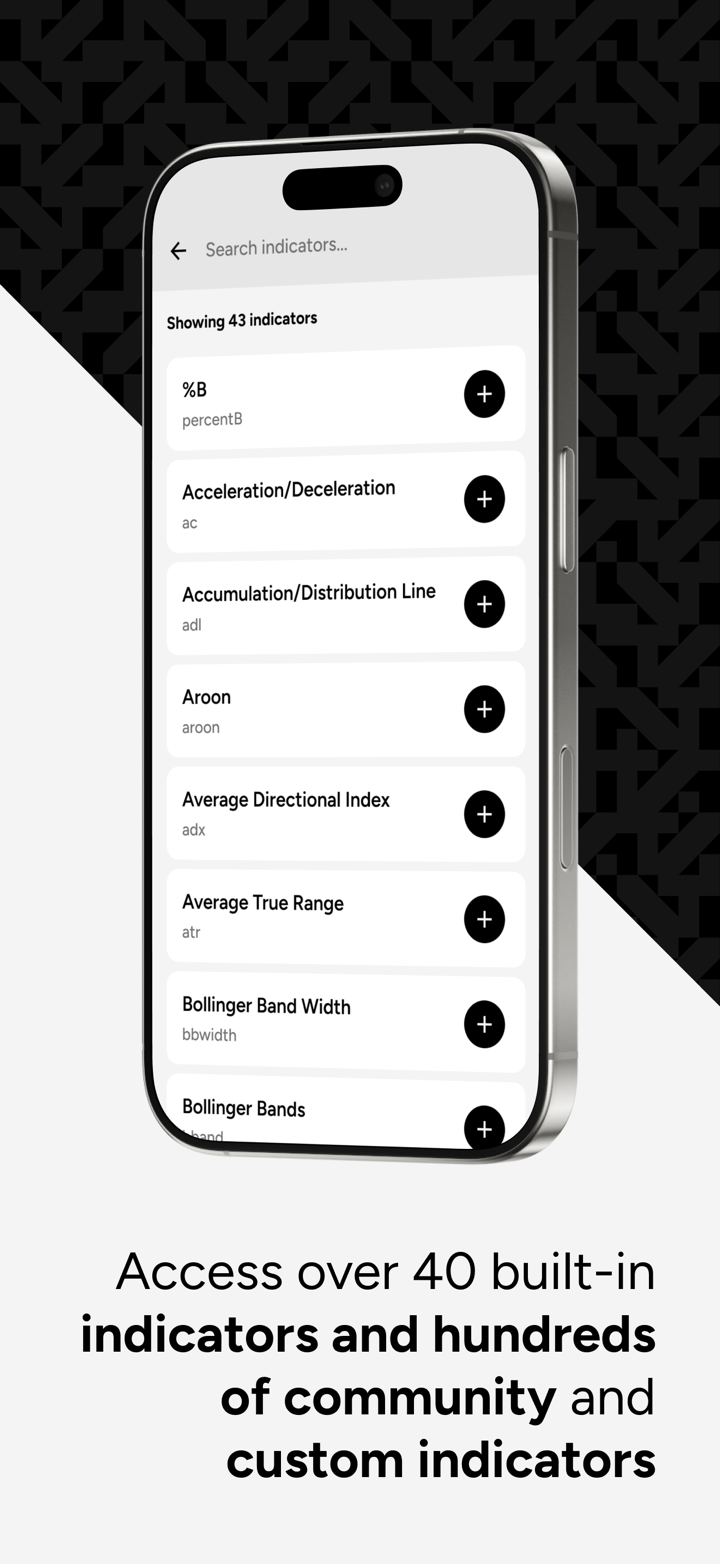

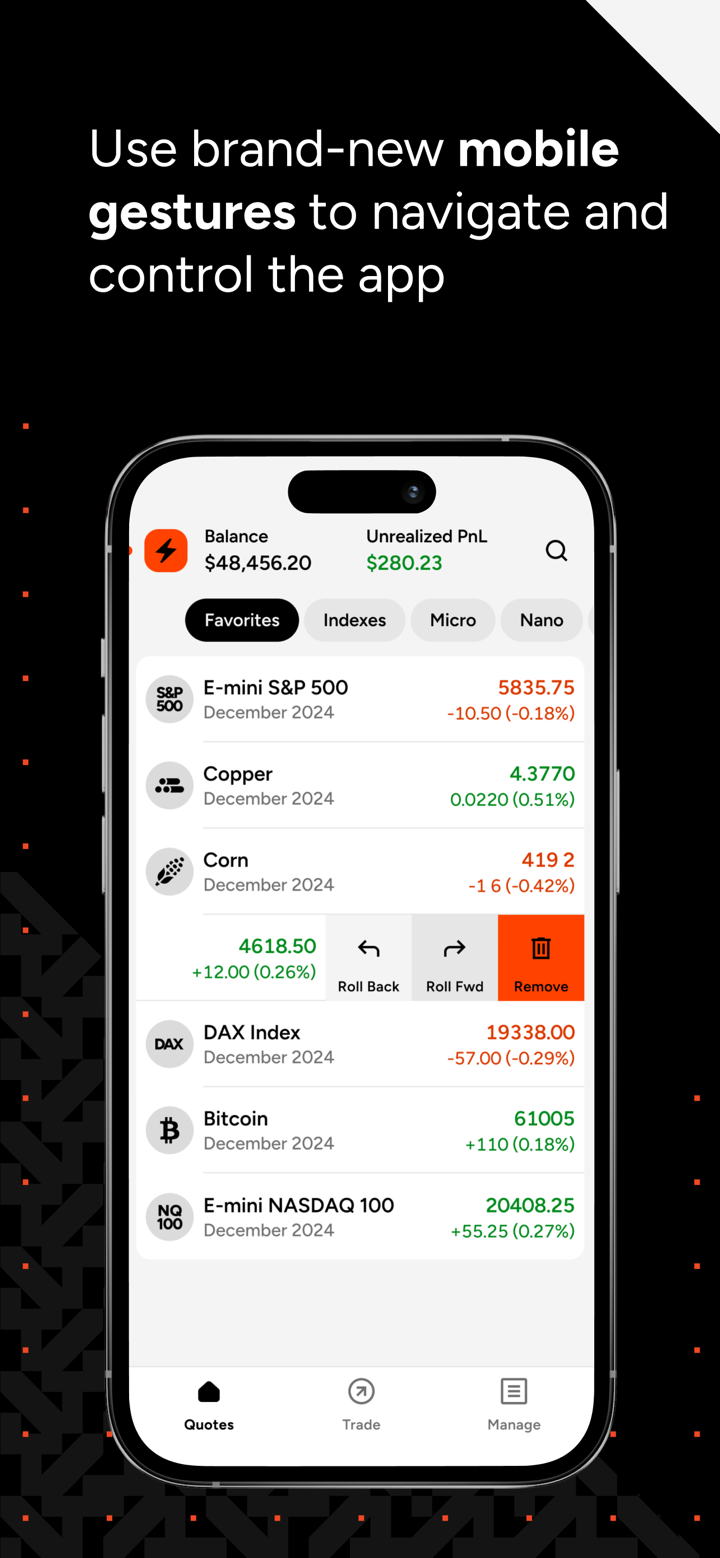

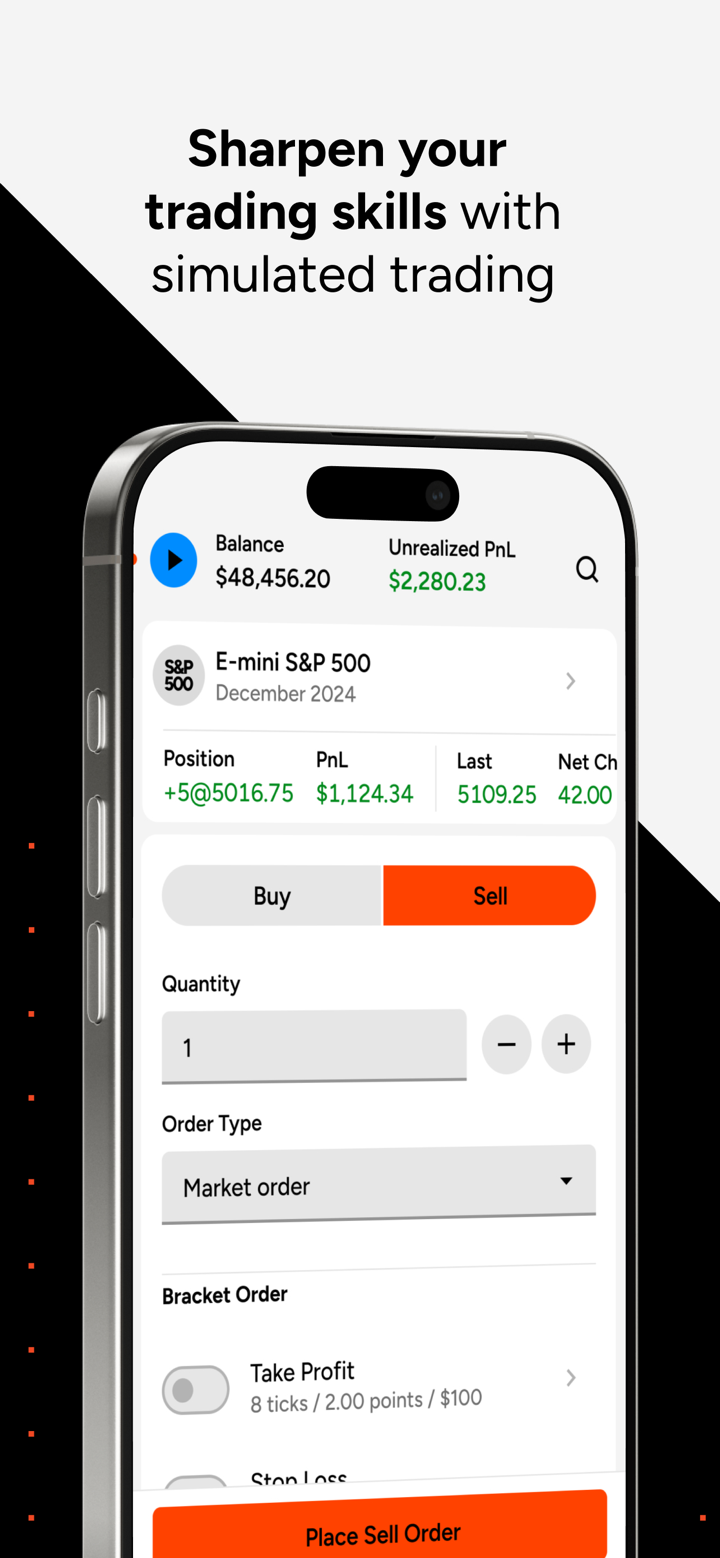

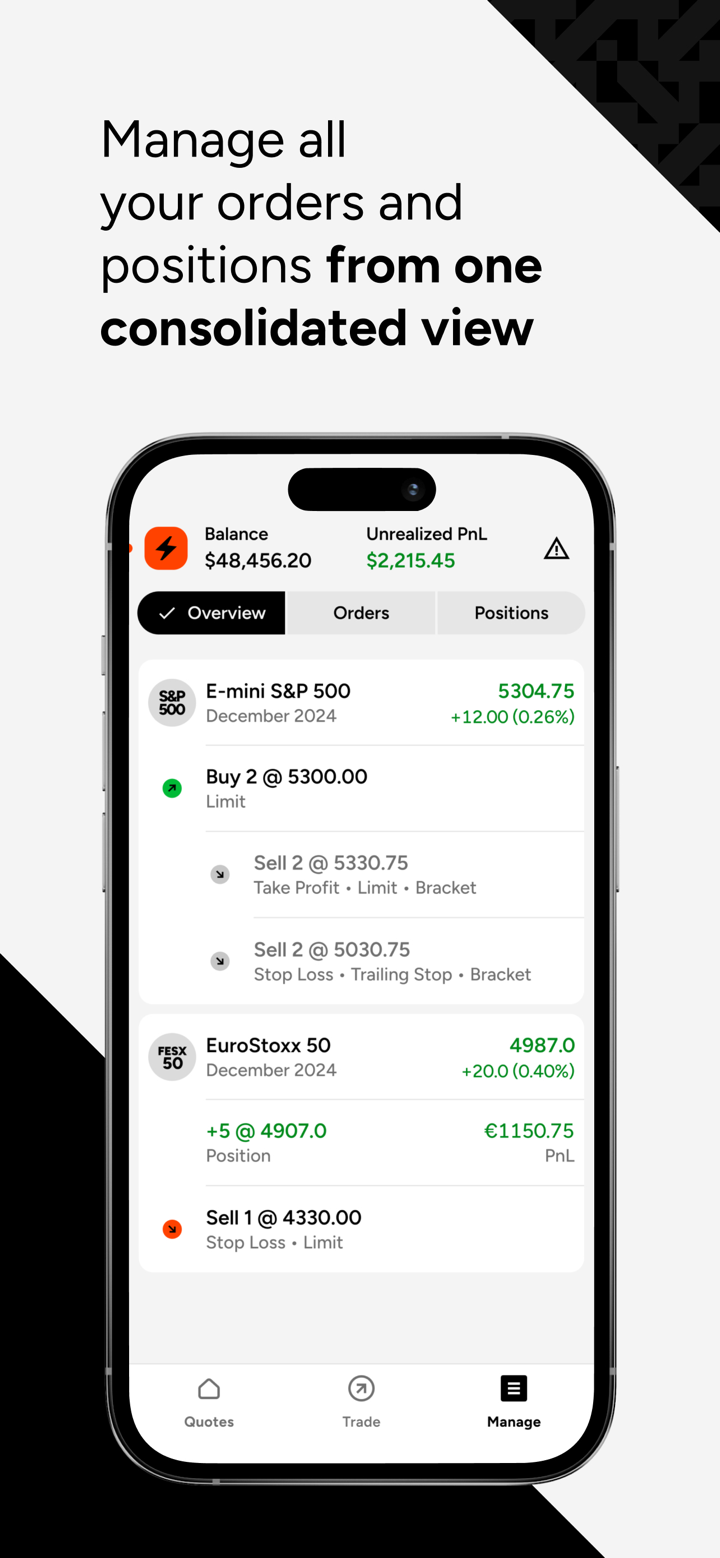

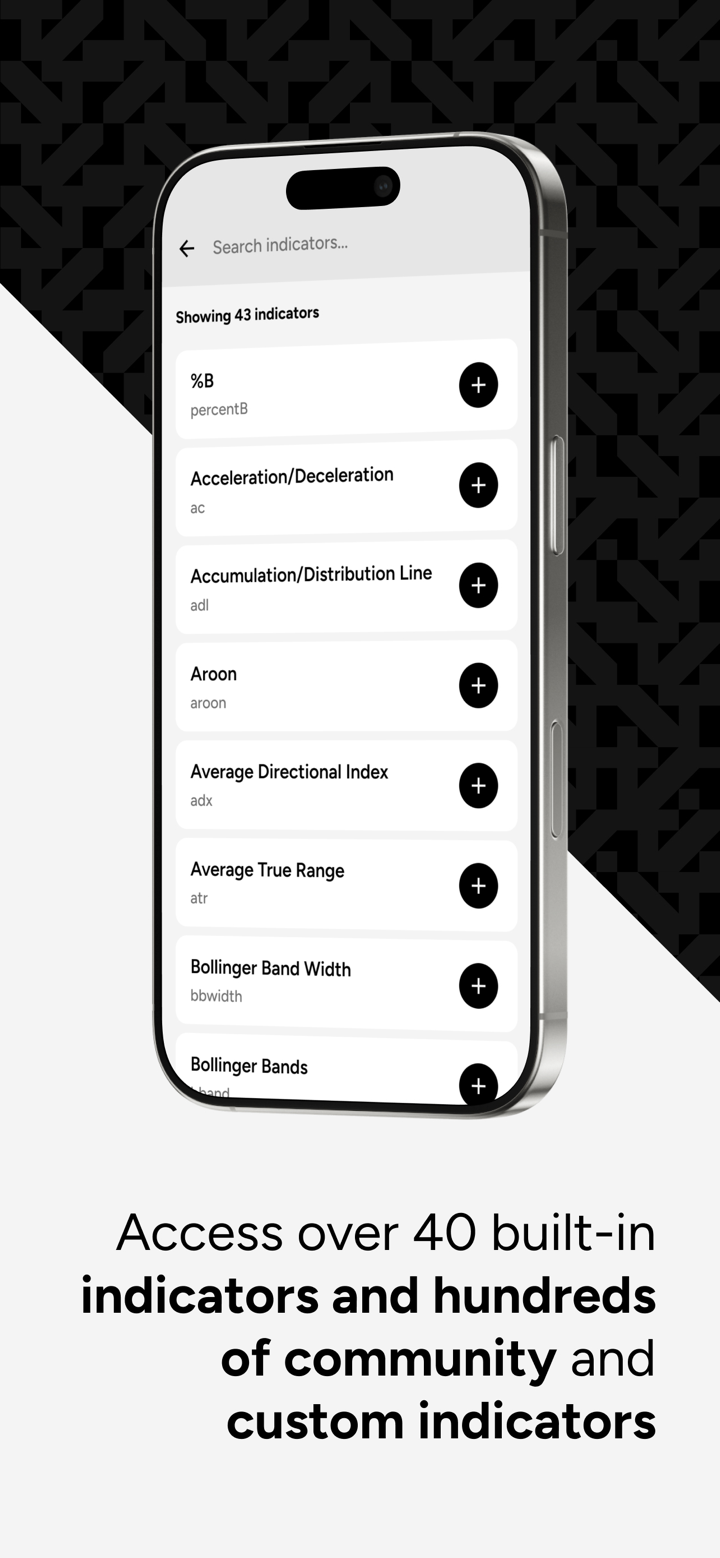

NINJA TRADERoffre ai suoi trader non il più popolare software di trading mt4/mt5 ma il suo NINJA TRADER software di trading invece, le cui funzionalità standard includono grafici avanzati, simulazioni di trading, backtesting della strategia, scansione in tempo reale e riproduzione del mercato. inoltre, esiste una serie di altre funzionalità come dati storici eod gratuiti per azioni, futures, forex, centinaia di applicazioni e strumenti gratuiti creati dalla comunità di utenti, oltre 100 video educativi e guide di aiuto alle risorse multimediali.

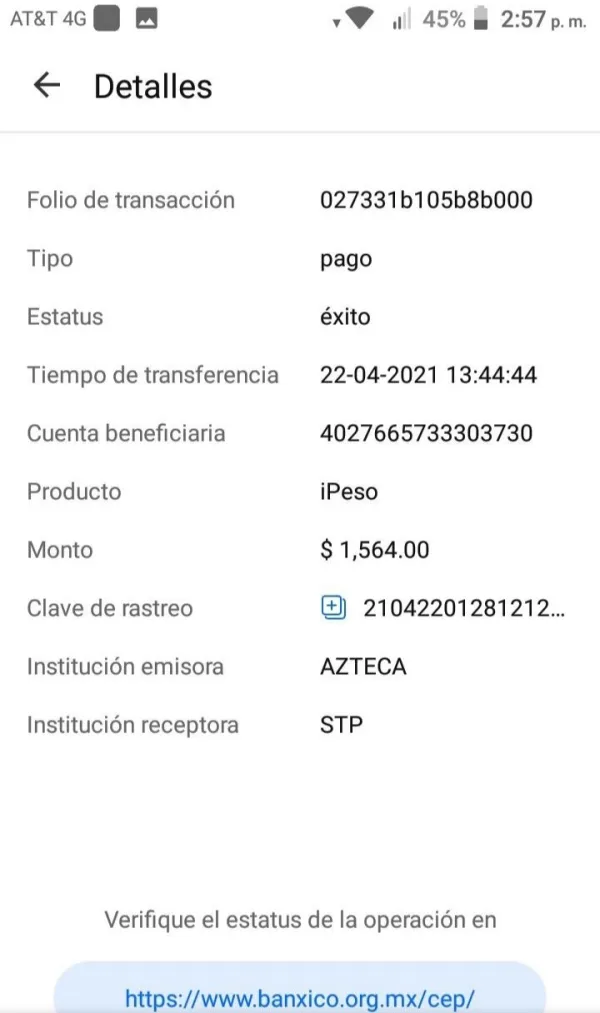

Deposito e prelievo

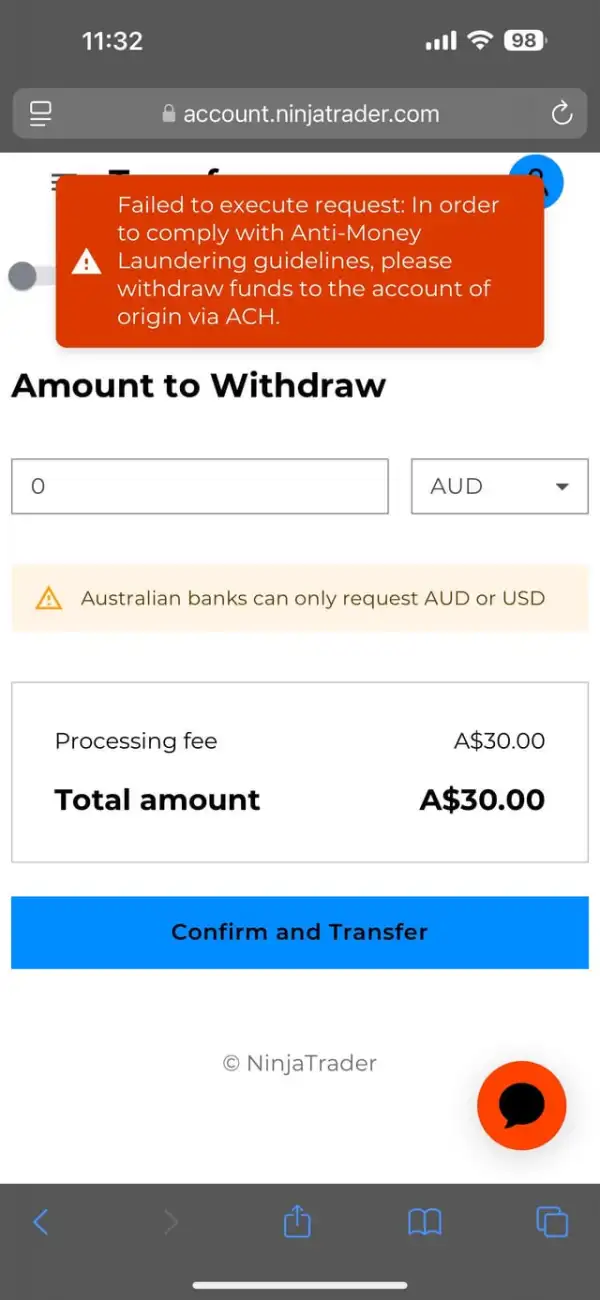

NINJA TRADERsupporta gli utenti a prelevare e depositare fondi sui propri conti di investimento tramite assegno, bonifico bancario.

Servizio Clienti

NINJA TRADERoffrire supporto tecnico 24 ore su 24, 5 giorni su 5, oltre a supporto commerciale di emergenza 24 ore su 24, 7 giorni su 7 in diverse lingue, quindi indipendentemente dal fuso orario dei trader, qualcuno sarà nei paraggi.