Riepilogo dell'azienda

Informazioni generali e regolamento

titoli taishin, un nome commerciale di Taishin Securities Co., Ltd. , opera come commerciante di titoli a Taiwan dal 2018. si occupa di intermediazione, negoziazione per conto proprio, servizi di sottoscrizione e fornitura di piattaforme di negoziazione elettronica. ecco la home page del sito ufficiale di questo broker:

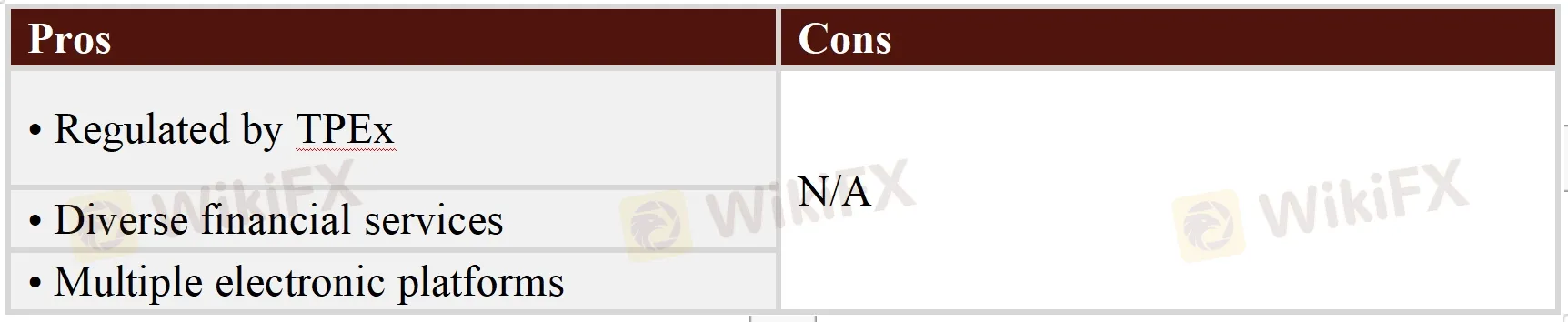

per quanto riguarda il regolamento, è stato verificato che Taishin Securities ha una licenza regolamentata di Taipei Exchange (tpex). ecco perché il suo stato normativo su wikifx è elencato come "regolamentato" e riceve un punteggio relativamente alto di 7.18/10.

Prodotti

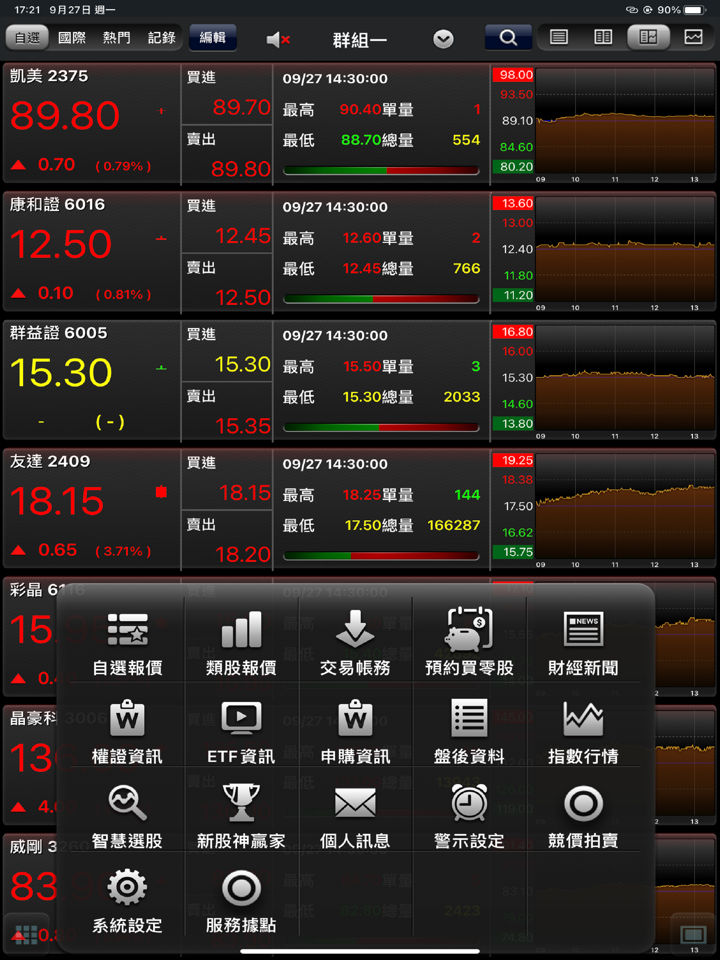

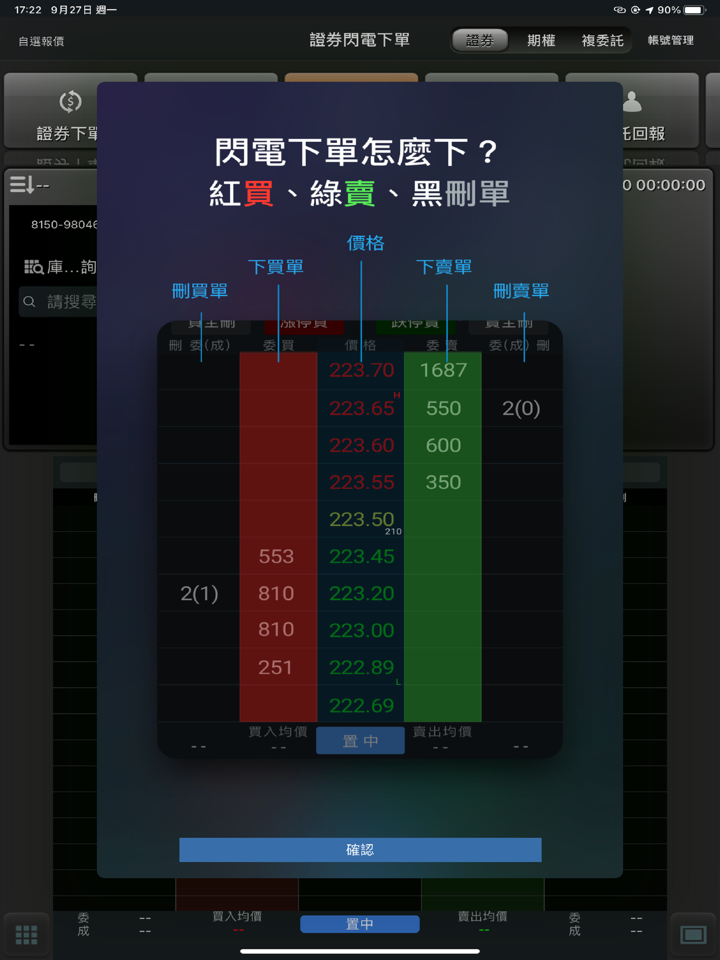

secondo le informazioni su Taishin Securities sito ufficiale, abbiamo scoperto che il broker è un commerciante di titoli specializzato in warrant, derivati e trading di futures.

Piattaforma di trading disponibile

Il sito Web di Taishin Securities afferma che la società offre una piattaforma di trading chiamata PhoneEZ, disponibile per dispositivi Apple iOS, Android e Windows, nonché altre piattaforme di trading elettronico basate sul web.

Servizio Clienti

L'assistenza clienti di Taishin Securities può essere raggiunta telefonicamente: +886 4050-9799 o inviare messaggi online per mettersi in contatto. Sede: (104) 2° piano, n. 44, sezione 2, Zhongshan North Road, città di Taipei.

Pro e contro

Avviso di rischio

Il trading online comporta un rischio significativo e potresti perdere tutto il capitale investito. Non è adatto a tutti i trader o investitori. Assicurati di aver compreso i rischi coinvolti e tieni presente che le informazioni contenute in questo articolo sono solo a scopo informativo generale.