Punteggio

Straits Financial

Hong Kong | 5-10 anni |

Hong Kong | 5-10 anni |http://www.straitsfinancial.com/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

C

Indice di influenza NO.1

Stati Uniti 3.41

Stati Uniti 3.41 Contatto

Licenza Forex 1

Licenza Forex 1

Single core

1G

40G

1M*ADSL

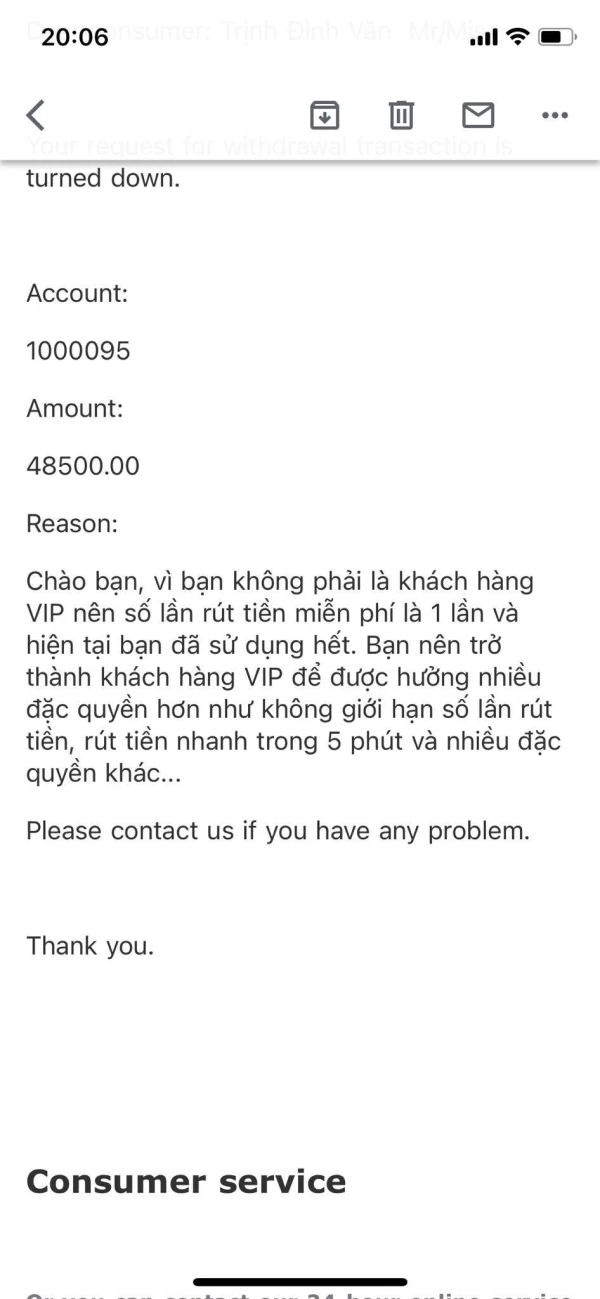

- Hong Kong SFC (numero di licenza: BHT974) Lo stato normativo è anormale, lo stato annucianto dal supervisore è Revocato, si prega di essere consapevoli del rischio!

Informazioni di base

Hong Kong

Hong Kong Gli utenti che hanno visualizzato Straits Financial hanno visualizzato anche..

FXCM

HANTEC MARKETS

GTCFX

Vantage

Sito web

straitsfinancial.com

192.124.249.61Posizione del serverStati Uniti

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio--Nome del sito--Azienda--

Relazioni Genealogia

Società collegate

Domande e risposte Wiki

What are the fees at Straits Financial?

Straits Financial offers a relatively competitive fee structure with spreads starting as low as 0 pips. This is a significant advantage for active traders who rely on tight spreads to maximize their profitability. For those engaged in short-term trading or scalping, such tight spreads can make a noticeable difference in overall costs. However, it is important to note that Straits Financial may charge additional fees, such as overnight swap fees for positions held beyond the trading day. These swap fees can vary depending on the type of asset being traded and the direction of the position. While Straits Financial doesn’t charge commissions on most accounts, traders should also be mindful of other potential costs, such as inactivity fees, which can be charged if an account remains inactive for an extended period. These hidden fees could add up for traders who do not engage in regular trading, so it’s crucial to thoroughly review the fee structure before signing up. Additionally, traders should consider potential withdrawal fees or charges associated with certain payment methods, which may be applicable depending on the selected funding option.

What is the spread at Straits Financial?

The spread at Straits Financial starts as low as 0 pips, which is highly advantageous for traders who are focused on minimizing trading costs. Tight spreads can be particularly beneficial for active traders, scalpers, or those using high-frequency trading strategies, as even small differences in spreads can add up over time. While Straits Financial’s spreads are competitive, it’s important to remember that spreads can widen during periods of high market volatility or low liquidity. Traders should be prepared for this and consider it when executing trades during news events or other volatile market conditions. The broker’s transparency in offering low spreads is certainly a positive feature, but traders should always be aware of how market conditions could impact the spreads and overall costs. For long-term traders, spreads may not be as important, but for short-term traders, low spreads can have a significant impact on their overall profitability.

What are the pros of Straits Financial?

Straits Financial offers several key advantages that make it an appealing option for traders. One of the most attractive features is its low spreads, starting from 0 pips. This is particularly advantageous for traders who engage in high-frequency trading or those who operate with tight margins. The broker also provides access to a wide range of commodities, including agricultural products, soft commodities, and metals, which is beneficial for traders who want to diversify their portfolios and explore opportunities in different asset classes. Furthermore, Straits Financial supports a range of account types, from individual accounts for retail traders to specialized accounts for commercial hedgers, institutions, and family offices. This flexibility ensures that Straits Financial can cater to a diverse clientele, whether you’re a novice trader or a large institution. The availability of demo accounts also allows beginners to test the platform without risking real money, making it easier for them to learn and gain confidence before transitioning to live trading. Lastly, Straits Financial provides access to multiple advanced trading platforms, including Straits Direct and CQG Desktop, offering traders a variety of tools to suit their trading strategies. Overall, Straits Financial combines competitive trading conditions with a wide range of services, making it a solid choice for both retail and institutional traders.

Which payment methods does Straits Financial support?

Straits Financial supports various payment methods for deposits and withdrawals, including traditional bank transfers, payments through other licensed brokers, and cash deposits through the CME. While these methods provide flexibility, traders may find the options somewhat limited compared to brokers that support credit cards or popular e-wallets like PayPal or Skrill. If flexibility in payment options is important to you, it might be worth reaching out to Straits Financial to verify whether any new payment methods have been added or if they plan to expand their payment options in the future.

Recensioni utenti3

Cosa vuoi valutare

inserisci...

Commento 3

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora