Punteggio

BYDS

Cina | 5-10 anni |

Cina | 5-10 anni |https://www.boyidashi.com/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

C

Indice di influenza NO.1

Cina 4.62

Cina 4.62 Contatto

Licenza Forex

Licenza Forex

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

Cina

Cina Gli utenti che hanno visualizzato BYDS hanno visualizzato anche..

Exness

Vantage

PU Prime

XM

Sito web

boyidashi.com

129.226.161.157Posizione del serverHong Kong

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio2011-07-15Nome del sitoWHOIS.GODADDY.COMAziendaGODADDY.COM, LLC

Domande e risposte Wiki

What is the highest leverage BYDS provides for major forex pairs, and how does this leverage differ for other asset types?

Based on my assessment and careful review of the available details, I found that BYDS appears to focus primarily on futures rather than forex pairs. The WikiFX report did not disclose any explicit information about leverage ratios for major forex pairs or for other asset types. This, in itself, is a significant point of caution for me as a trader. In my experience, legitimate brokers are transparent about such key trading conditions, since leverage has a major impact on both potential returns and risks. The absence of clear information about maximum leverage for forex or other assets means I cannot accurately gauge the risk profile involved in trading with this broker. Moreover, my due diligence revealed that BYDS is unregulated and has received several serious customer complaints, including restricted withdrawals and a lack of accountability—another reason why I am especially careful here. For me, dealing with a broker that does not openly state its leverage policies, especially when combined with a lack of regulation, is a substantial concern. Without full disclosure on leverage—whether for forex, commodities, or other products—I would personally avoid committing funds. It is crucial for traders to have clarity on such terms before making any trading decisions, especially in markets as volatile as forex and futures.

What’s the smallest amount I’m allowed to withdraw from my BYDS account in a single transaction?

Speaking from my experience as a trader, I have learned that clear, transparent withdrawal policies are absolutely essential for building trust with any broker. With BYDS, I would exercise an abundance of caution. Based on all the information I could find—especially recent user reports—there is no verifiable or official disclosure regarding the minimum withdrawal amount allowed per transaction. In my professional judgement, this lack of clarity is a considerable red flag. What’s more troubling for me is the number of reports from users who allege severe withdrawal difficulties, including situations where substantial sums have been locked or access to accounts was simply denied after funds were deposited. Such consistent patterns are, in my view, indicative of very high risk and a fundamentally untrustworthy environment for handling funds, regardless of the specific withdrawal limits. In essence, unless a broker clearly publishes its withdrawal terms—and demonstrates, through regulation and user track record, that those terms are fairly honored—I cannot recommend proceeding with any deposits at all. For BYDS, I personally would not fund the account until I had written, direct clarification from a responsible company official, and evidence of withdrawals actually being processed. Being conservative with brokers of this profile is the only prudent approach.

Which types of trading instruments can you access on BYDS, such as forex, stocks, indices, cryptocurrencies, or commodities?

Drawing strictly from my experience reviewing BYDS and focusing intently on its offering, I noticed that the platform is positioned mainly around futures trading. In my research and use of BYDS, I found no direct evidence of access to traditional spot forex, stocks, indices, or cryptocurrencies. The core services advertised by BYDS are centered on opening and managing futures trading accounts, and engaging in analysis and market updates focused on futures instruments. The platform provides tools tailored to futures markets and seems to connect users to major futures exchanges, with particular emphasis on commodities and financial instruments typically available in the futures sector. I could not verify any official support for cash equities, CFD indices, or crypto assets through BYDS. Their educational resources, trading software, and community all revolve around futures markets. For me, as someone who prioritizes safety and clarity in trading environments, it is crucial to point out that the range of trading instruments here is quite focused. If your primary interest is in forex pairs, stocks, or digital assets, my experience suggests that BYDS does not currently offer these products. I also remain highly cautious due to BYDS’s unregulated status and the significant user complaints, especially involving withdrawal issues, as these factors could influence the reliability of any purported instruments on offer. For anyone considering BYDS, I advise confirming the specific futures products yourself before engaging.

Could you break down the total trading costs involved for indices such as the US100 when trading on BYDS?

As an experienced trader who evaluates brokers carefully, I must say that determining the total trading costs for indices like the US100 on BYDS is quite challenging due to a lack of transparent, independently verified fee disclosures. In my review of BYDS, I found that the platform’s official materials focus on its range of services—like futures account opening and market analysis—rather than providing clear, detailed information on spreads, commissions, or overnight fees for index contracts. What concerns me most is that BYDS is not licensed or regulated by any recognized financial authority. From my perspective, this absence of oversight means there is no external guarantee that fee structures, pricing models, or trading execution for products like the US100 are held to fair or industry-standard benchmarks. Even with demo accounts and educational resources, the core data about real-money trading costs remains elusive, and several user reports highlight issues with transparency and withdrawal restrictions, which further erodes trust. Without published specifications, a trader considering BYDS has no objective way to calculate the true cost per contract for the US100 or other indices—including potential hidden fees or slippage. Personally, this level of uncertainty is an unacceptable risk. For me, consistency, transparency, and regulatory assurance are non-negotiable when assessing the total trading costs for any asset class, and these are aspects that BYDS fundamentally lacks.

Recensioni utenti4

Cosa vuoi valutare

inserisci...

Commento 4

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora

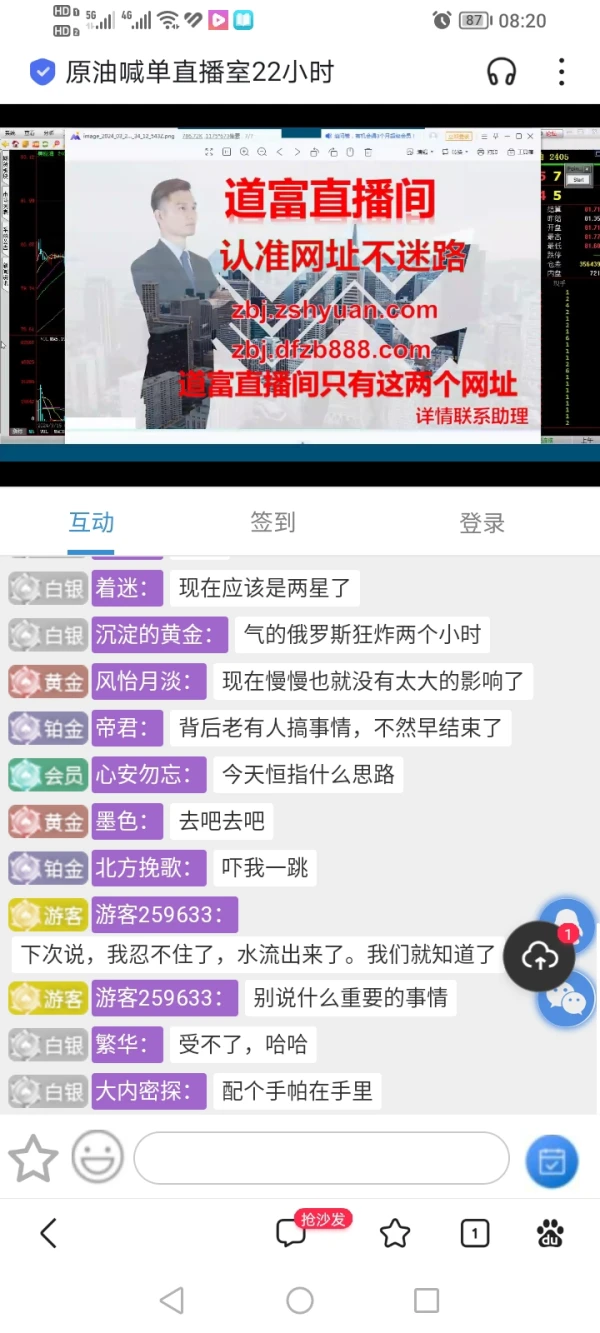

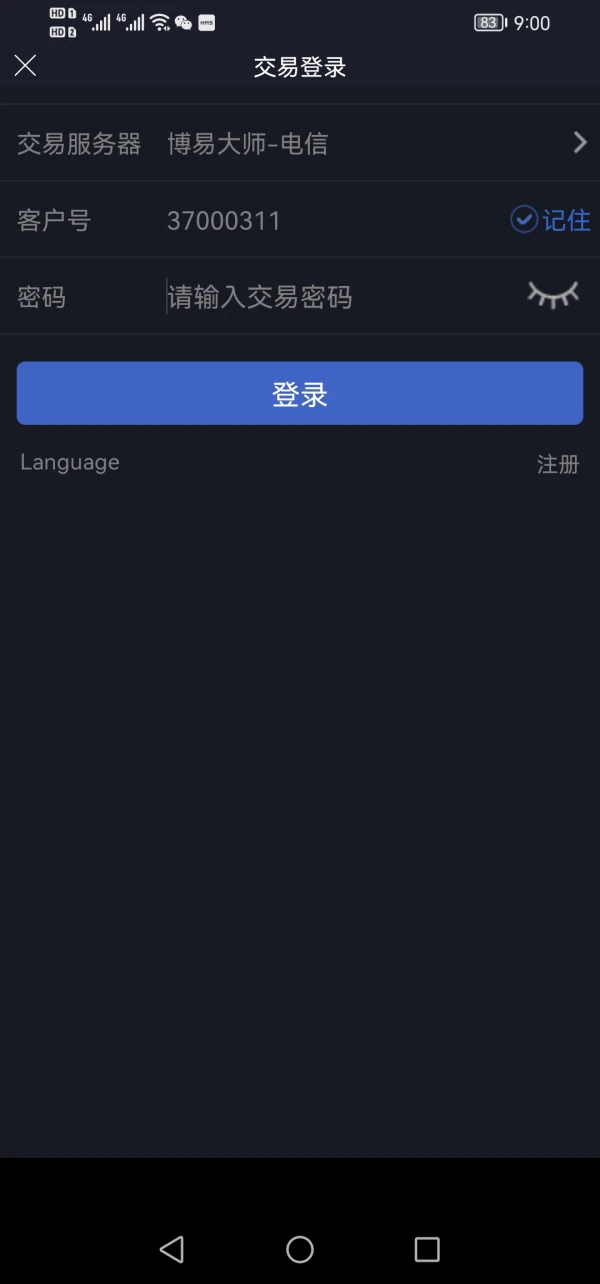

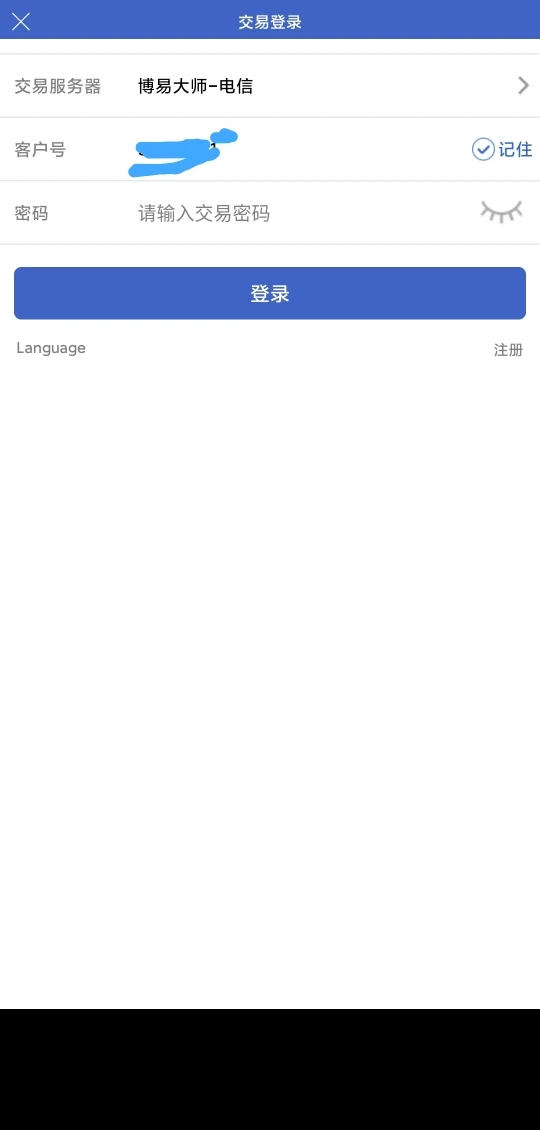

上善若水9346

Hong Kong

Tutto è falso, il nome del trader è falso, il nome della sala di trasmissione in diretta cambia continuamente, anche il nome del personale del servizio clienti cambia continuamente, il software di trading utilizzato è Boyi Master, il numero di conto è 37000311.

Esposizione

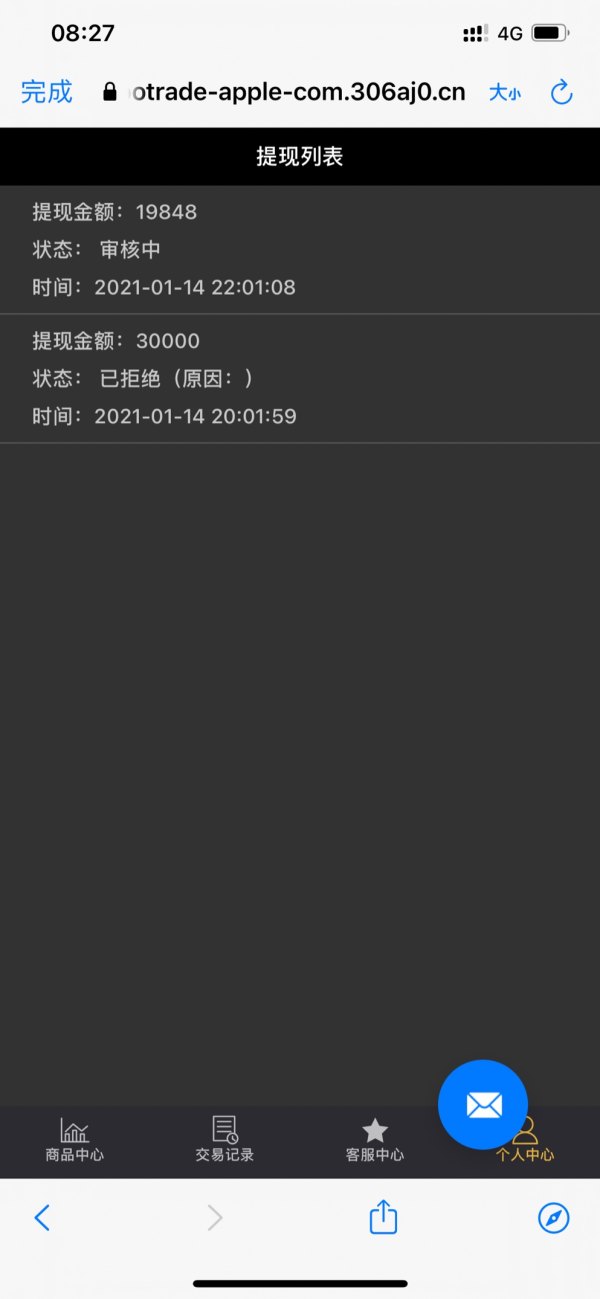

Destiny14234

Hong Kong

evadere per vari motivi. Sul conto sono presenti cinquantamila dollari USA e non è possibile prelevarli. Si prega di aiutare a mediare

Esposizione

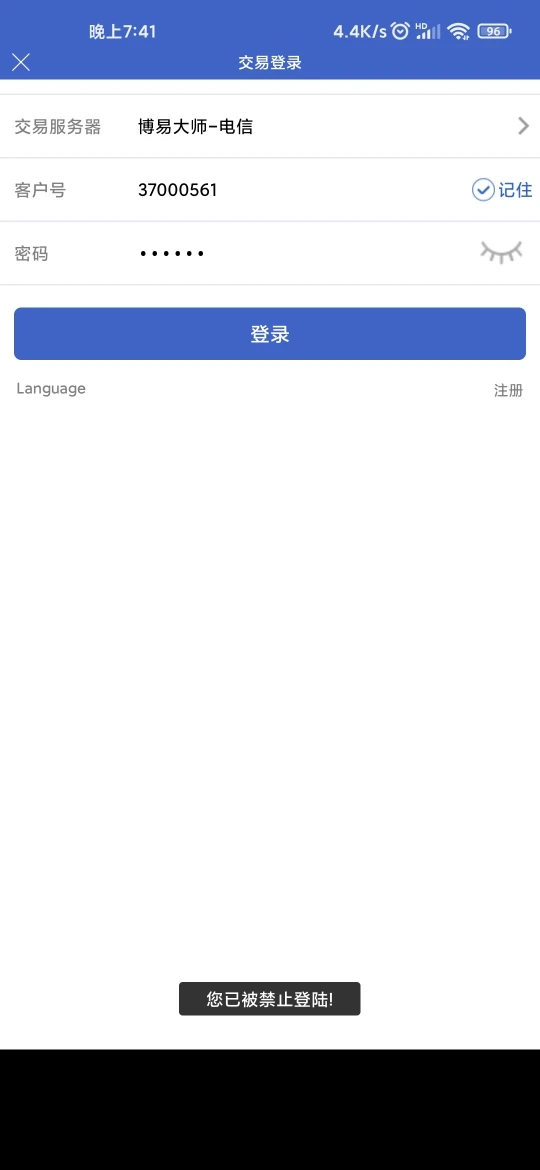

Destiny14234

Hong Kong

Un servizio clienti mi ha aggiunto e ha affermato di essere della Excalibur Company e mi ha indotto a scaricare ilBYDS software commerciale. Dopo il deposito, si sono rifiutati di ritirarsi per vari motivi. Ora, hanno semplicemente detto che l'accesso all'account è limitato. Il mio account ha 5,6 w di dollari USA, che equivale a Quasi 400.000 non possono essere prelevati

Esposizione

FX1058151091

Hong Kong

Un amico che ho aggiunto molti anni fa è diventato un dipendente di una società di tecnologia dei dati, guadagnando 3-8 volte il tuo principale. È così attraente. Poiché i miei affari non andavano bene, voglio guadagnare di più. E ho collaborato con lui, quindi mi sono fidato di lui. Ho depositato 10.000. I primi due ordini sono stati utili, ma ho perso la terza volta per un mio errore. Voglio recuperare la mia perdita, quindi ho depositato 30.000. Poi ho commesso di nuovo un errore. Pensavo di aver perso a causa dei miei errori, quindi ho continuato a depositare 30.000. Ma in realtà è una trappola. A quel tempo, hanno detto che avevo sprecato i loro dati e fatto perdere la loro azienda, dovevo ricaricare 100.000 per avere un operatore che mi aiutasse a operare. Poi ho capito di essere stato imbrogliato e ho provato a prelevare fondi ma il servizio clienti ha detto che dovevo soddisfare il fatturato. Ora ho terminato il giro d'affari ma la mia domanda non è stata approvata. Ho chiamato il telefono indicato sulla loro licenza commerciale ma ho ricevuto la risposta che la loro licenza era stata peculata. E hanno chiamato la polizia. Il denaro investito è stato preso in prestito per la carta di credito e per i miei amici. Non so cosa fare, quindi li ho esposti qui e spero di recuperare i miei soldi. Dovrebbe servire per ricordare di non commettere lo stesso errore.

Esposizione