Punteggio

IFX

Regno Unito | 5-10 anni |

Regno Unito | 5-10 anni |https://www.ifxpayments.com/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

C

Indice di influenza NO.1

Stati Uniti 2.73

Stati Uniti 2.73 Contatto

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

Regno Unito

Regno Unito Gli utenti che hanno visualizzato IFX hanno visualizzato anche..

EC markets

GTCFX

TMGM

HANTEC MARKETS

Fonte di ricerca

linguaggio

Analisi di mercato

Consegna del materiale

Sito web

ifxpayments.com

35.189.84.33Posizione del serverRegno Unito

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio--Nome del sito--Azienda--

Relazioni Genealogia

Società collegate

CAMILLA JANE RICHARDSON

Regno Unito

Direttore

Data iniziale

Stato

Impiegato

IFX (UK) LTD(United Kingdom)

WILLIAM JOSEPH ALLISON MARWICK

Regno Unito

Direttore

Data iniziale

Stato

Impiegato

IFX (UK) LTD(United Kingdom)

NICHOLAS ANTHONY WILLIAMS

Regno Unito

Direttore

Data iniziale

Stato

Impiegato

IFX (UK) LTD(United Kingdom)

Domande e risposte Wiki

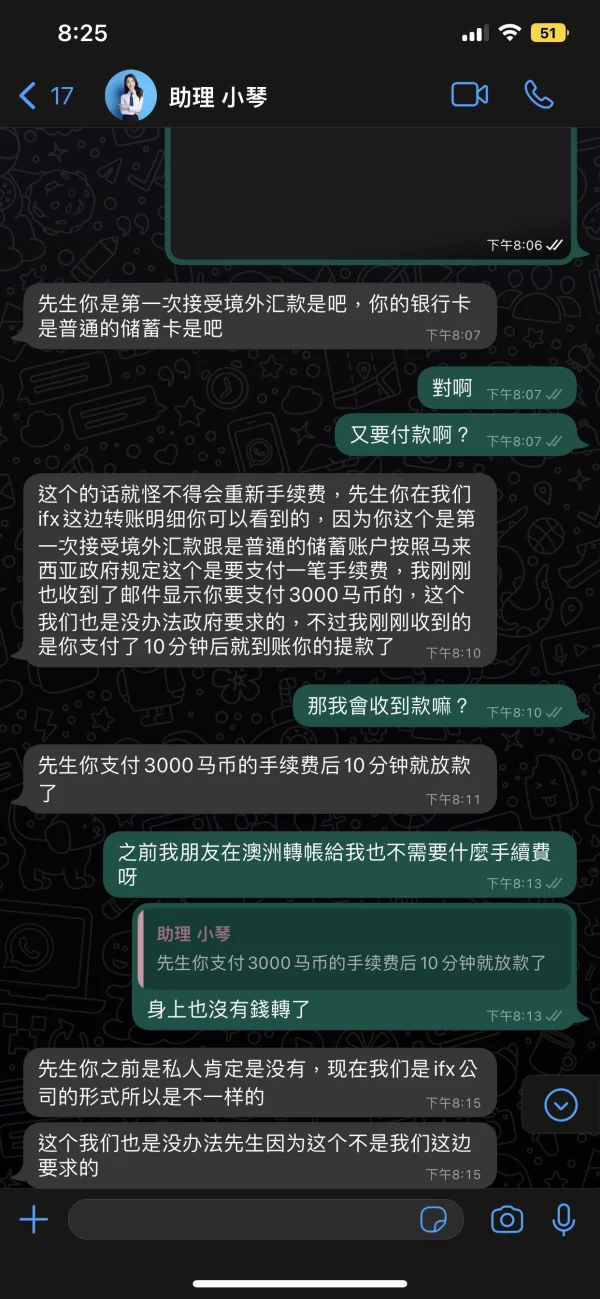

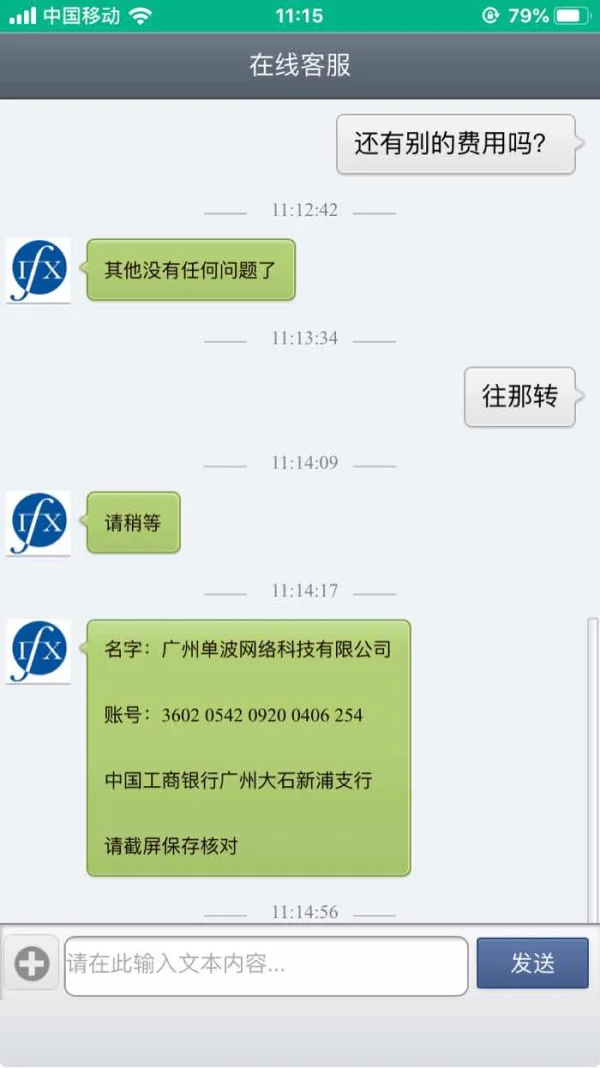

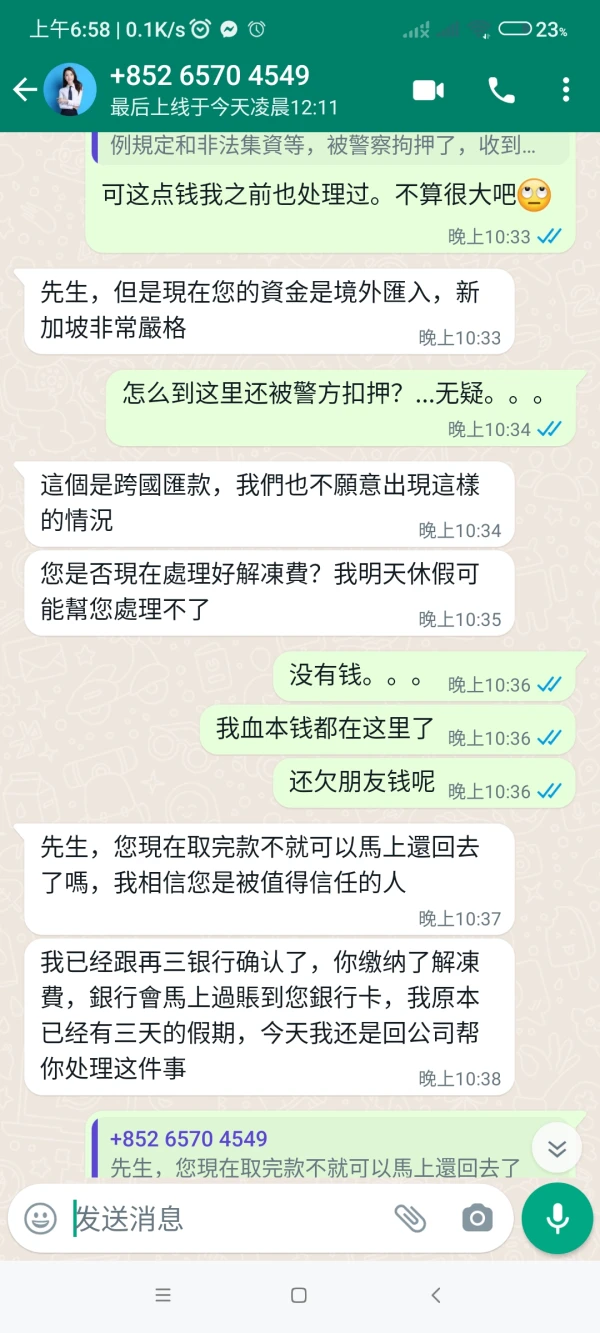

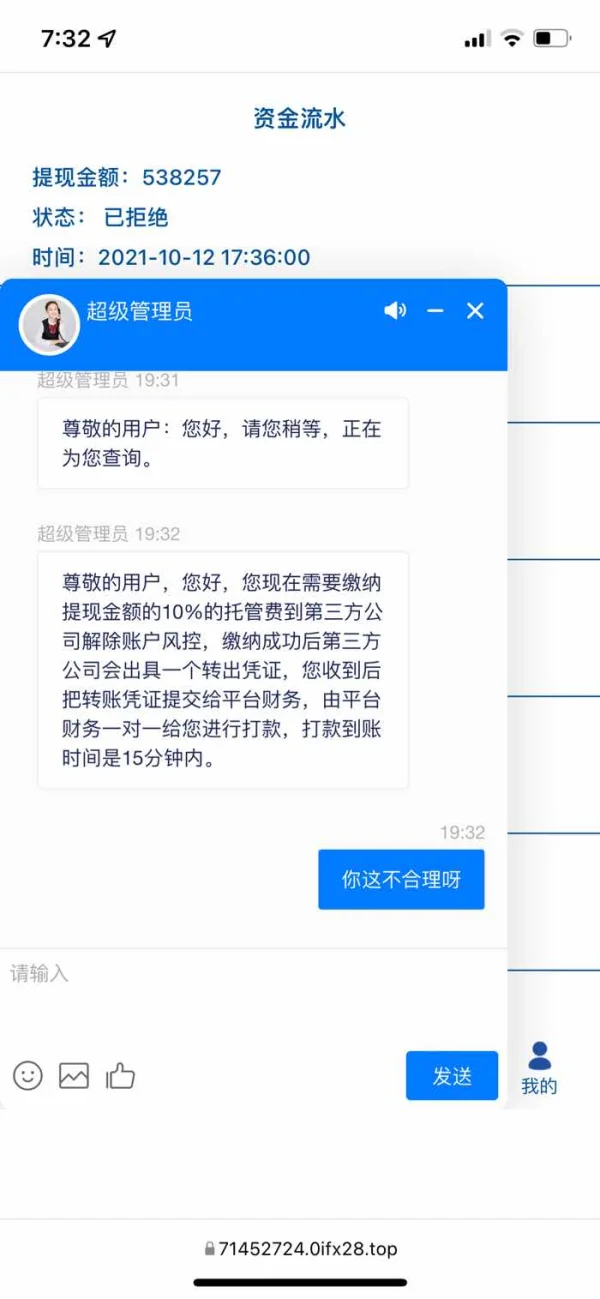

Does IFX charge any undisclosed fees when you make deposits or withdrawals?

As an independent forex trader who values transparency and regulatory safeguarding, I approach brokers like IFX with a great deal of caution, particularly regarding their fee structure around deposits and withdrawals. Based on both my due diligence and the community reports, there are several red flags here. IFX's regulatory licenses are noted as "exceeded" in both the UK and UAE, meaning their authority to offer certain services may no longer be current or valid. This undermines their accountability, which is critical when it comes to handling client funds and fees. What truly concerns me are the recurring reports from users who experienced demands for various unexpected fees—commission, margin, processing, and even unfreezing fees—especially tied to the withdrawal process. Several clients described being unable to access their funds unless they paid such fees, which were not clearly disclosed upfront. From my experience, legitimate brokers always maintain a transparent fee schedule and never require arbitrary payments to unblock accounts or process withdrawals. These warning signs, combined with the lack of clear and verifiable regulatory standing, make me wary of trusting IFX with my deposits or expecting smooth withdrawals. Personally, I would avoid any platform where there is a history of clients being surprised by undisclosed or excessive charges simply to access their own money. I believe it's far safer to work with brokers who are fully transparent, well-regulated, and free from such troubling client reports.

Does IFX offer a swap-free (Islamic) account option for traders?

Based on my research and evaluation of IFX, I could not find any clear, official indication that IFX offers a swap-free or Islamic account option specifically tailored for traders who follow Sharia law. In my experience, brokers who provide this feature typically make it transparent in their account offerings, given its significance to many traders worldwide. IFX appears to focus primarily on payment solutions and general foreign exchange services, and while they do provide demo accounts and other customer support features, there is no explicit mention of swap-free trading conditions. For me as a trader, the lack of detailed information around account types and the absence of any direct reference to Islamic account options raise red flags about suitability for those requiring such accounts. Furthermore, with IFX’s regulatory licenses noted as “exceeded,” and the broker’s exposure to user complaints—especially regarding withdrawal issues and extra fees—I am particularly cautious. Reliability and clear, accessible information are paramount for my trading decisions, especially when specific account features are essential due to religious or ethical considerations. Therefore, unless IFX provides direct confirmation or updates its disclosures to include swap-free accounts, I would not assume that this option is available. For traders with these specific needs, I recommend seeking out brokers that clearly advertise and support Islamic account offerings and maintain transparent, current regulatory status.

In what ways does IFX's regulatory standing help safeguard my funds?

As someone who has seen both strong and weak regulatory oversight in this industry, I place immense value on the security that a broker’s regulatory standing should provide. With IFX, however, my experience compels me to tread very cautiously. On paper, IFX lists itself as having held licenses under the UK’s FCA and Dubai’s DFSA, two authorities known for upholding stringent compliance standards that, in ideal circumstances, mean robust client fund segregation, stringent capital adequacy, and transparency requirements. This kind of regulation is generally designed to reduce the risk of misappropriation or loss of client money, which is something I always look for when vetting a broker. However, for IFX, there are critical caveats that cannot be ignored. WikiFX indicates that both the FCA and DFSA licenses for IFX are now “exceeded” or no longer active, and this profoundly weakens those expected safeguards. In practice, this means that IFX no longer operates under the direct oversight or consumer protections those regulators offer. For me, the shift from a previously regulated status to an “exceeded” or expired one raises potential red flags: recourse options become limited, and the broker is not bound to follow ongoing auditing, capital, or client fund protection protocols. While there are a handful of positive user remarks about IFX’s payment solutions, I also note a worrying pattern of withdrawal issues and fee complaints, which further amplifies my concern. Without up-to-date active regulation, I cannot trust that my funds would be insulated from operational risk or possible malfeasance. In summary, while regulatory standing can dramatically enhance fund security with a broker, for IFX, the lapse of those crucial licenses undermines that assurance for me. I would personally avoid depositing substantial funds here under these conditions.

Are there any payment methods with IFX that allow for instant withdrawals?

In my experience as a trader, a broker’s withdrawal process is an essential factor in evaluating their trustworthiness and usability. Regarding IFX, I would approach claims of instant withdrawals with considerable caution. Although IFX positions itself as a provider of payment solutions and foreign exchange services, my research shows that its regulatory licenses with both the FCA and DFSA have been exceeded, and there are multiple user reports raising red flags specifically about withdrawal issues. Several users have shared that they could not access their funds and were subjected to repeated requests for additional fees under different pretexts. For me, these patterns create significant concern, especially since transparent, seamless withdrawals are non-negotiable in this industry. I have not found credible evidence of a reliable, instant withdrawal mechanism with IFX. In fact, the exposed risk of denied withdrawal requests and the firm’s regulatory overrun status suggest that even standard withdrawals may be problematic. Before funding any account or expecting quick access to your capital, I would urge anyone to proceed with extreme caution and prioritize their financial safety. In this environment, I cannot recommend relying on any promises of instant withdrawals from IFX.

Recensioni utenti11

Cosa vuoi valutare

inserisci...

Commento 11

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora

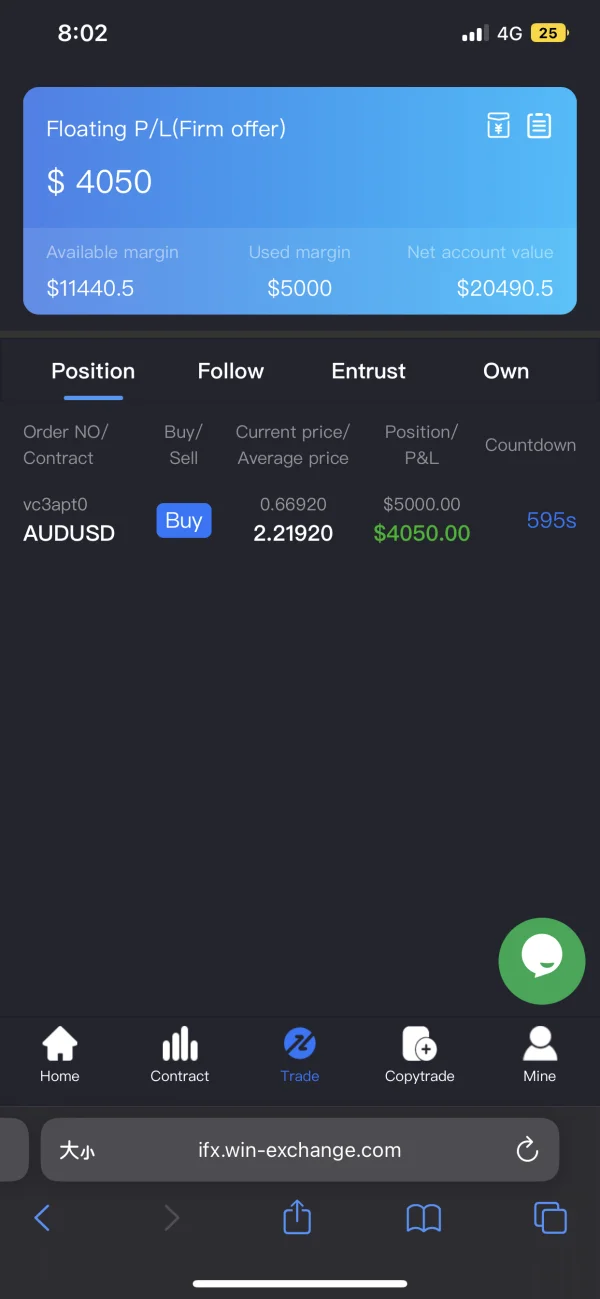

E1211

Malaysia

La commissione di gestione è davvero 3000 RM e verrò citato in giudizio se non lo pago? Questo sito web è vero?

Esposizione

Red Star

Hong Kong

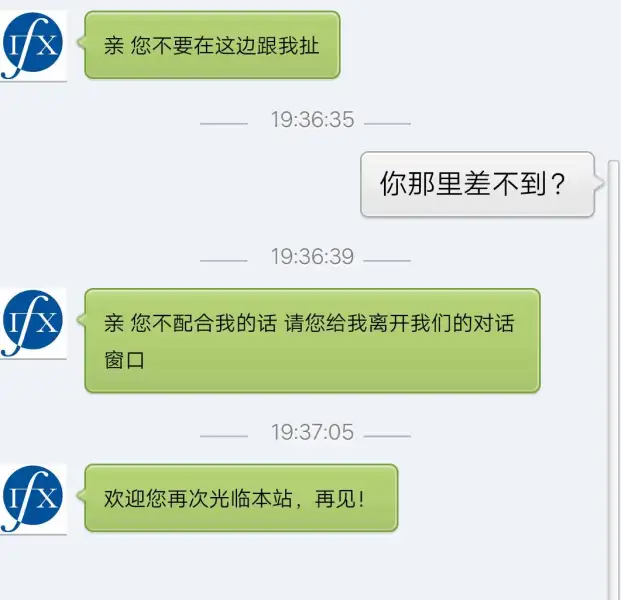

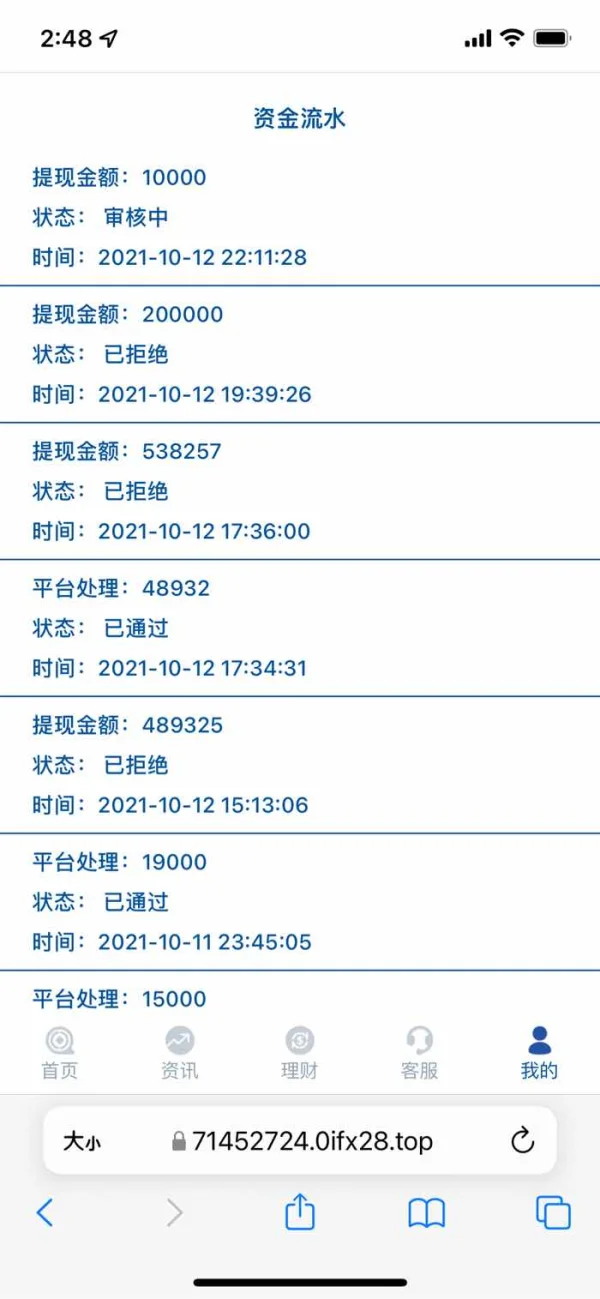

假平台,出不了金,报警后平台把我的用户名也删了,提醒广大群众千万不要上当。

Esposizione

五四六一九一六六八

Hong Kong

,这个平台不给出金,把客户账号锁定了,找各种原因不给出金,说身份信息卡号不对。

Esposizione

FX1287225689

Marocco

Onestamente, IFX è una buona piattaforma per i servizi di trasferimento dei pagamenti. Ho utilizzato i suoi servizi diverse volte e riconosco il suo ottimo servizio.

Positivo

A瞬间

Regno Unito

Ho un'ottima esperienza di trading con IFX. Grazie mille per l'assistenza clienti che è bravissima ad aiutarmi quando ho domande e problemi. Saluto i tuoi ragazzi!

Positivo

lee9022

Singapore

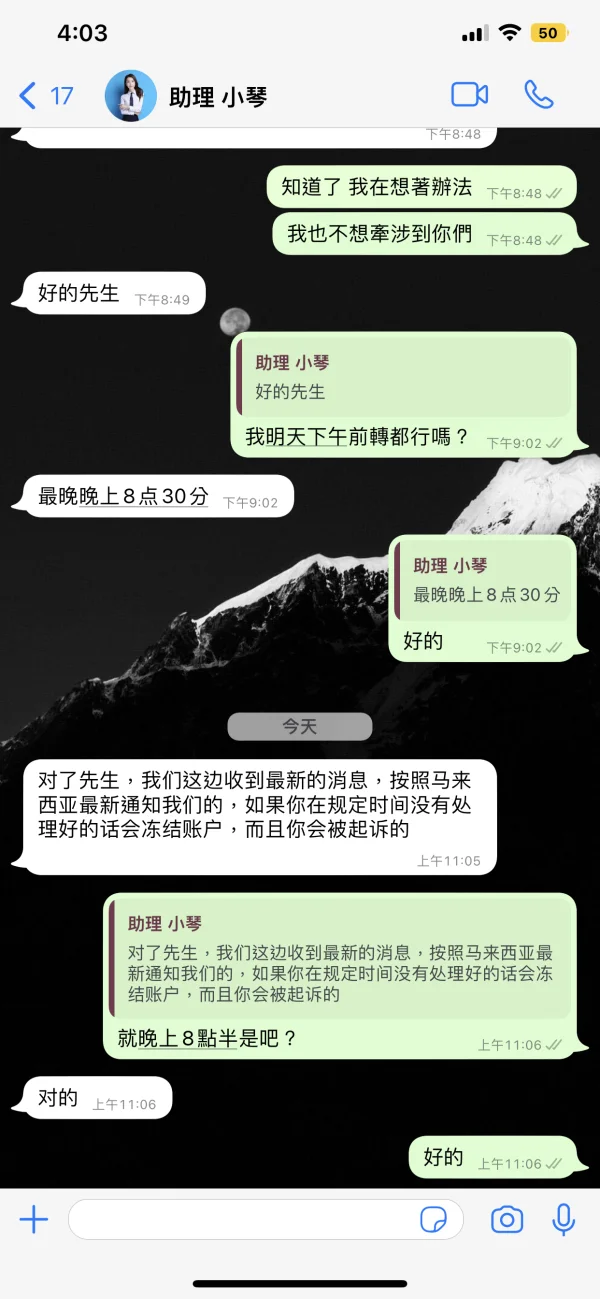

Frode, il capo vuole che tu paghi la commissione, la tassa di elaborazione, il margine, l'imposta sul reddito e la tassa di sblocco. Ci sono commissioni infinite

Esposizione

生死劫

Hong Kong

Sì, ho avuto un'esperienza piacevole con i pagamenti IFX. Sunny è stata molto disponibile e ha fatto del suo meglio per trovarmi il miglior tasso di cambio. Ottimo servizio e grazie.

Positivo

༺蜜糖༻

Hong Kong

Impossibile ritirare. Mi ha detto di depositare per molte ragioni. Era una truffa?

Esposizione

FX4234736427

Hong Kong

诈骗你入金各种理由以及借口让你交保证金风险金,其次说是系统维护修补漏洞,最后无法联系逃跑

Esposizione

随风29414

Hong Kong

无法出金,还要继续充值解冻,直接就是骗子。

Esposizione

Red Star

Hong Kong

IFX markets Inc 是黑平台,提现时说我初始信息有误,需交百分之二十的保证金,交了后说还要再交各种理由的费用,无法出金,纯黑诈骗平台。望监管部门能够重视,能够挽回老百姓损失的血汗钱。

Esposizione