Buod ng kumpanya

| ADMIS Pangkalahatang Pagsusuri | |

| Itinatag | 2010 |

| Rehistradong Bansa/Rehiyon | Hong Kong |

| Regulasyon | SFC |

| Mga Instrumento sa Merkado | Futures sa mga butil, metal, softs, at forex |

| Demo Account | / |

| Leverage | / |

| Plataforma ng Pagkalakalan | CQG, TT |

| Min Deposit | / |

| Suporta sa Customer | Tel: +65-6632-3000 |

| Email: sales@admis.com.sg | |

| Address: 230 Victoria Street Bugis Junction Towers #11-06 Singapore 188024 | |

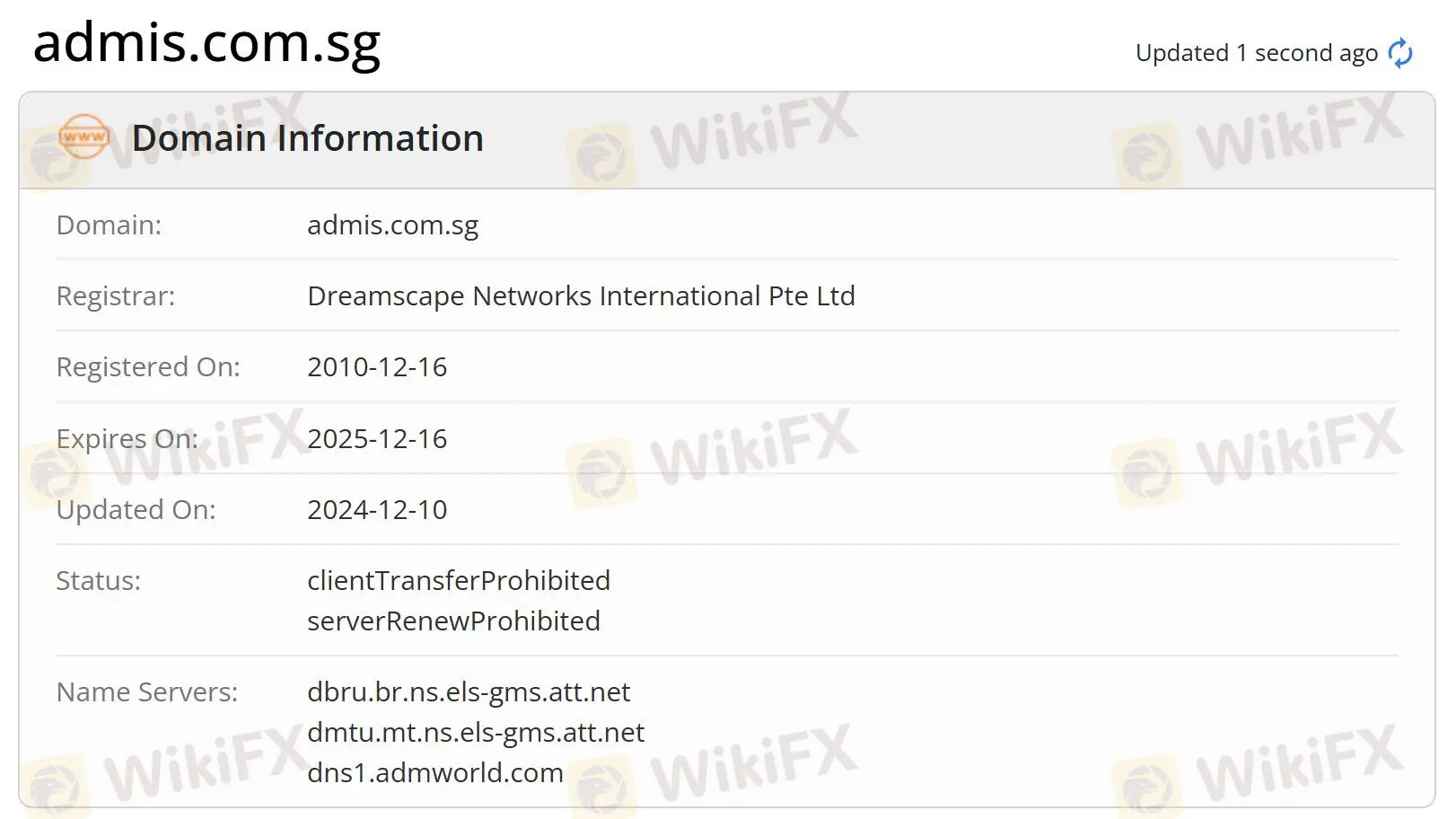

Ang ADMIS ay nirehistro noong 2010 sa Hong Kong, na isang broker na espesyalista sa futures trading. Ginagamit nito ang CQG at TT bilang mga plataporma ng pagkalakalan, at ito ay regulado ng SFC. Gayunpaman, hindi ito naglalantad ng maraming impormasyon tungkol sa mga detalye ng account at pagkalakalan.

Mga Kalamangan at Disadvantage

| Mga Kalamangan | Mga Disadvantage |

| Mahabang oras ng operasyon | Walang pisikal na opisina |

| Di-malinaw na istraktura ng bayarin | |

| Walang MT4 o MT5 | |

| Hindi kilalang mga pagpipilian sa pagbabayad |

Tunay ba ang ADMIS?

Oo, ang ADMIS ay regulado ng Securities and Futures Commission ng Hong Kong (SFC).

| Rehistradong Bansa | Regulator | Kasalukuyang Katayuan | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| Securities and Futures Commission ng Hong Kong (SFC) | Regulado | ADMIS Hong Kong Limited | Pagsasangkot sa mga kontrata ng futures | ACP509 |

Pagsusuri ng Field ng WikiFX

Ang koponan ng pagsusuri ng WikiFX ay bumisita sa rehistradong address ng ADMIS sa Hong Kong, ngunit hindi namin natagpuan ang pisikal na opisina nito.

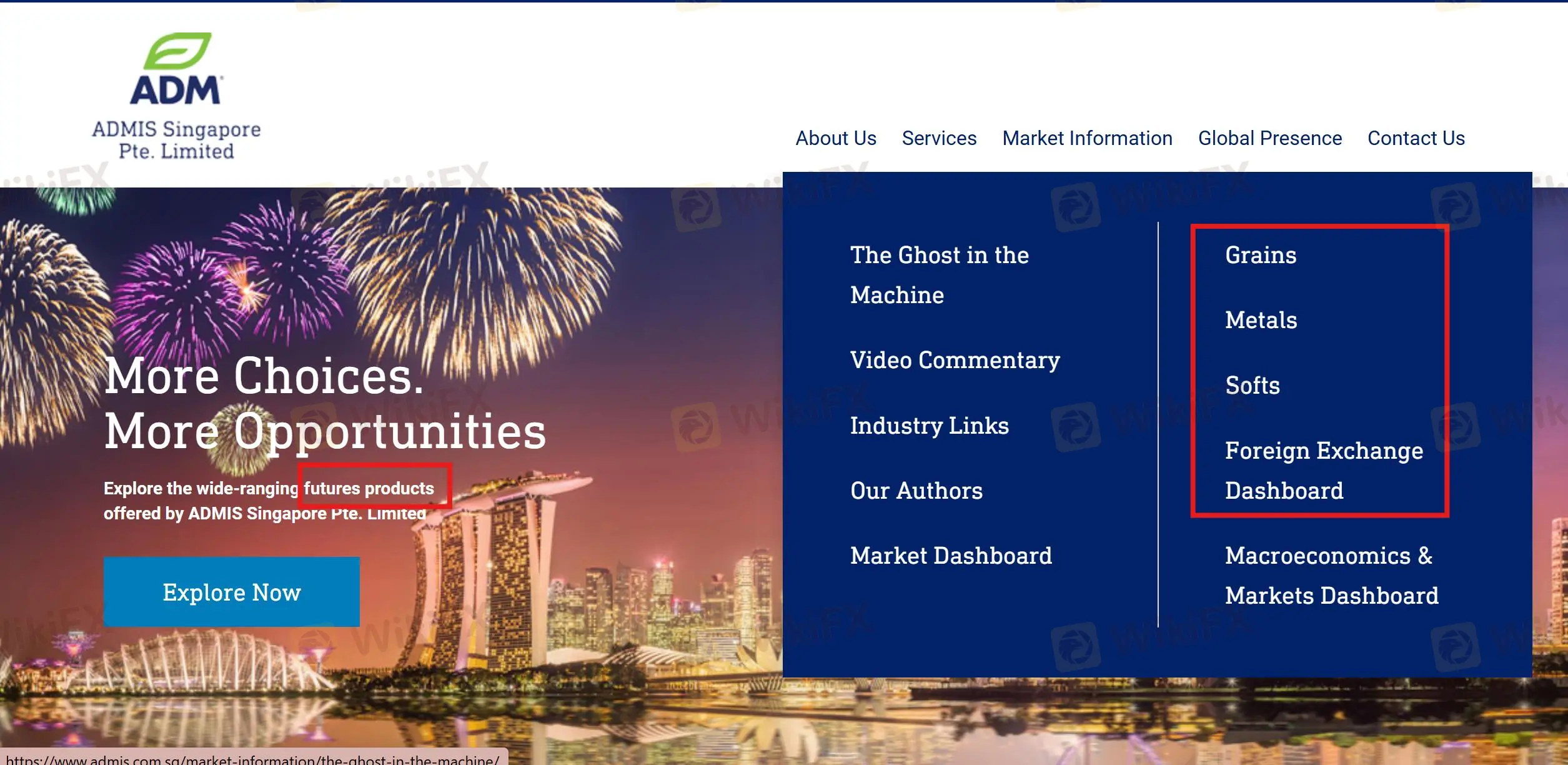

Ano ang Maaari Kong Ikalakal sa ADMIS?

ADMIS nagbibigay ng malawak na hanay ng mga produkto ng futures. Bukod dito, nag-aalok ito ng impormasyon sa merkado na may kaugnayan sa mga butil, metal, softs, at forex.

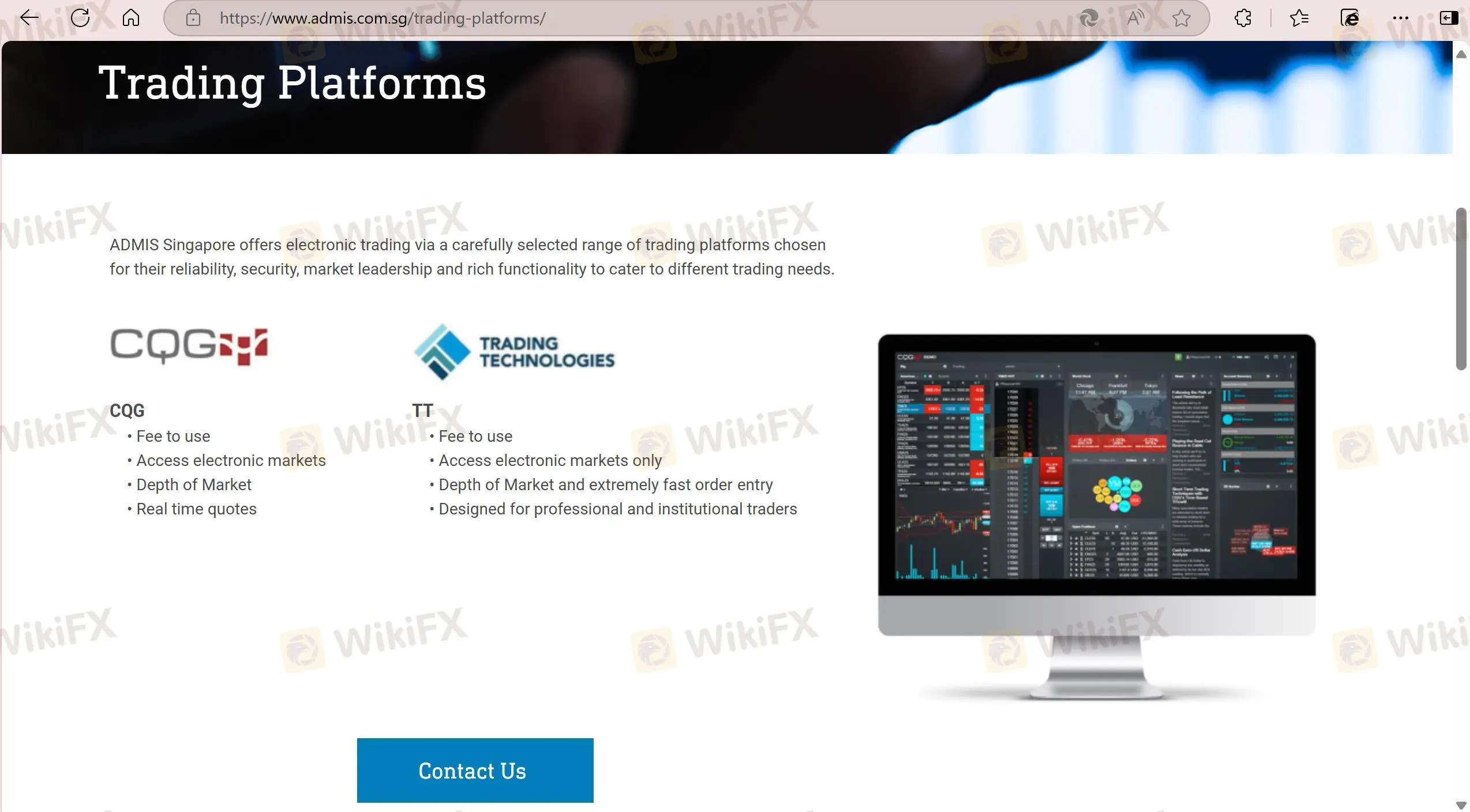

Plataporma ng Pagkalakalan

ADMIS gumagamit ng CQG at Trading Technologies (TT) bilang mga plataporma ng pagkalakalan nito, at hindi nito sinusuportahan ang MT4 o MT5.

| Plataporma ng Pagkalakalan | Supported | Available Devices | Suitable for |

| CQG | ✔ | PC, web | / |

| Trading Technologies | ✔ | PC, web | / |

| MT4 | ❌ | / | Mga Beginners |

| MT5 | ❌ | / | Mga Kadalubhasaan na mga mangangalakal |

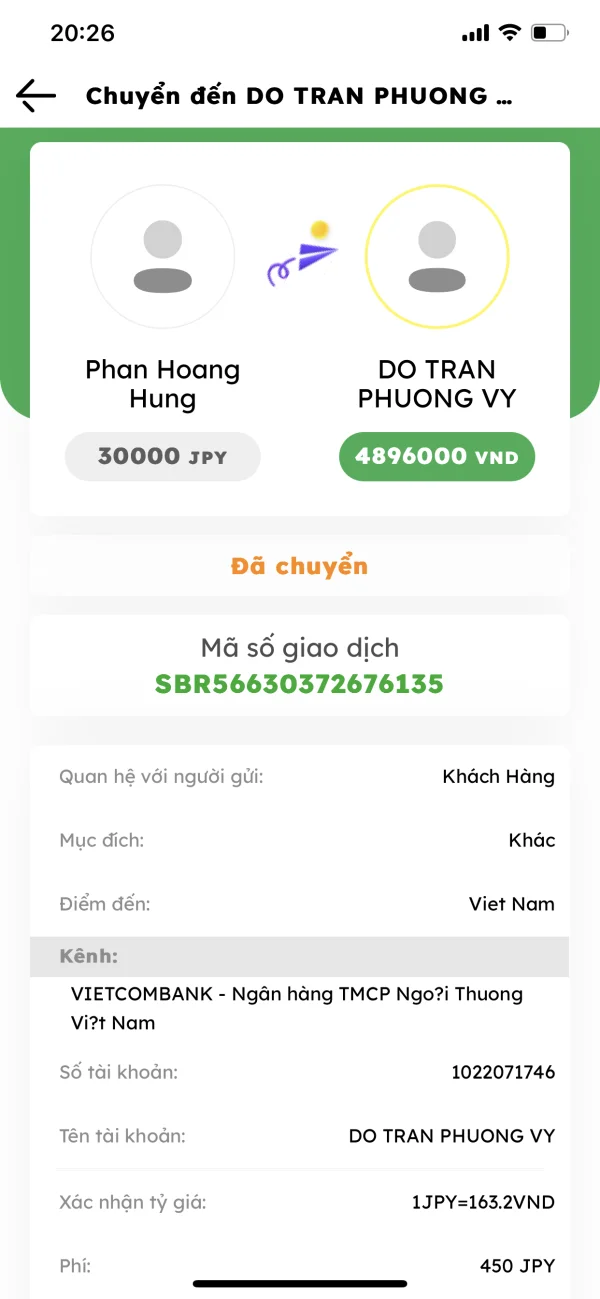

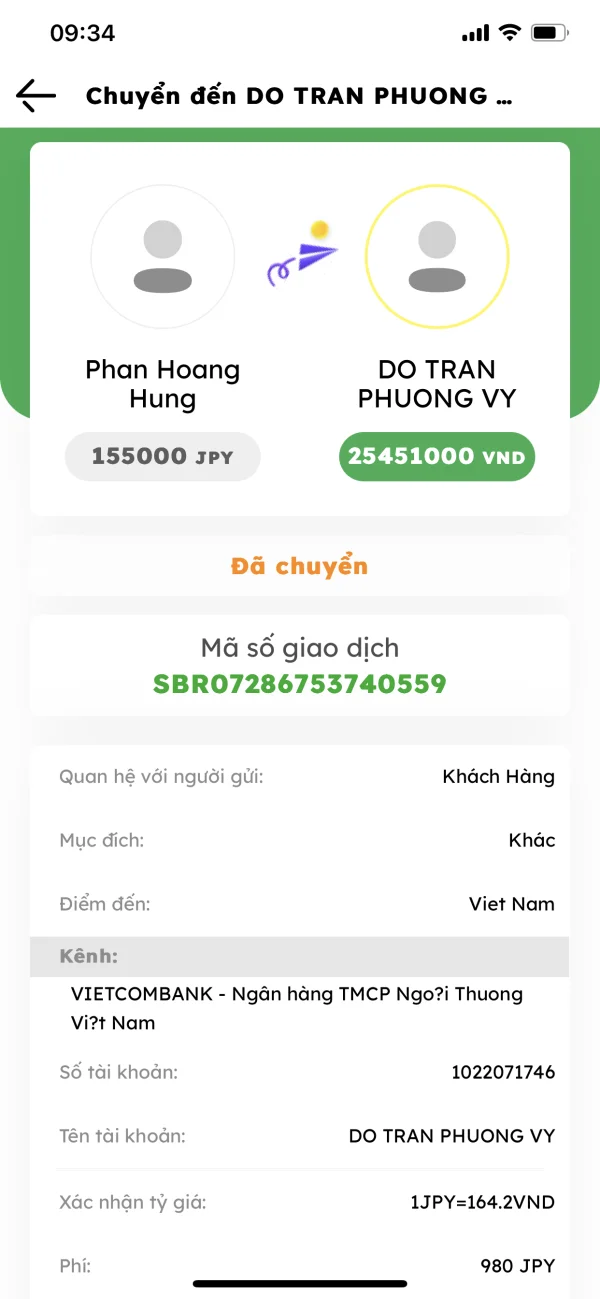

hung816

Japan

Minamahal kong customer, kailangan kong tumugon sa pag-usad ng order ng negosyo ng Vietnam Debt Trading Company Limited - Ministry of Finance na ginagarantiyahan ng Gobyerno ng Vietnam. Ang iyong treasury business order ay may hindi pangkaraniwang katayuan dahil sa money transfer (napakalaki ng halaga, pinaghihinalaang money laundering) Vietnam Debt Trading Company Limited - Ministri ng Pananalapi na ginagarantiyahan ng Gobyerno ng Vietnam ay upang matiyak ang kaligtasan ng mga pondo para sa negosyo at ang sanhi ng nakatagong panganib. Sa kasalukuyan, ang order ng negosyo na ito ay na-freeze. Upang ang pera ng iyong negosyo ay mabisa at ligtas na mailipat sa iyong bank account. Vietnam Debt Trading Company Limited - Hinihiling sa iyo ng Ministri ng Pananalapi na ginagarantiyahan ng Pamahalaan ng Vietnam. Numero ng tala: 20230825.6192061 G. PHAN HOANG HUNG 1: Numero ng telepono: 08075008346 2: Gmail address: hungphan3051999@gmail.com 3: NumeroHalaga ng withdrawal: 205.643$ = 4.935.432.000 VND 4: Pangalan ng bangko: Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) 5: Bank account number: 050111039736 6: Pangalan ng may-ari ng account: TRAN THI KIM NGOC Na-seal na ang halagang 205.643$ = 4.935.432.000 VND. Kailangan mong bayaran ang currency exchange fee, pagkatapos ang Vietnam Debt Trading Company Limited - Ministry of Finance na ginagarantiyahan ng Gobyerno ng Vietnam ay gagawa ng withdrawal order para sa iyo - Ang currency exchange fee ay inilapat sa 2%. Conversion 205.643$ = 4.935.432.000 VND x 0.02 = 98.708.640 VND Ipaliwanag na pagkatapos makumpleto ang pagbabayad, ang halaga ay awtomatikong mako-convert sa business order money transfer at ililipat sa State Bank of Vietnam. - Kahilingan mula 08/25/2023 hanggang 09/05/2023 dapat mong bayaran ang halagang 98.708.640 VND Pagkatapos mong bayaran ang buong halaga 98.708.640 VND, Vietnam Debt Trading Company Limited - Ire-refund ng Ministry of Finance na ginagarantiyahan ng Gobyerno ng Vietnam ang halagang 98.708.640 VND pagkatapos ng 30 araw mula sa petsa na binayaran mo ang buong halaga ng 98.708.640 VND. Kung hindi mo babayaran ang buong halaga ng 98.708.640 VND pagkatapos ng Setyembre 5, 2023, ipapadala ang file sa Department of Planning and Finance - Ministry of Public Security para sa pagproseso at pag-aayos. salamat po

Paglalahad

FX1519754694

Hong Kong

Napatunayang top-notch ang customer service sa ADMIS. Nagkaroon ito ng pakiramdam ng responsibilidad na hindi mo mahahanap kahit saan. Mabilis ang mga tugon at sapat ang mga ibinigay na solusyon. Parang may mapagkakatiwalaang kaalyado sa aking paglalakbay sa pangangalakal. Ang nagpahanga din sa akin ay ang bilis ng proseso ng kanilang pag-withdraw. Ang pagtanggap ng mga pondo mula sa ADMIS ay parang pagkuha ng express delivery, mabilis at walang anumang hindi kinakailangang pagkaantala.

Positibo

FX7287257892

United Kingdom

napakagaling, nanalo ako ng 100,000$, nakatulong ang exchange para makapag-withdraw at deposit nang maayos. salamat!

Positibo

FX1993775032

Vietnam

Ang aking personal na pakiramdam ay ang serbisyo sa customer ay masigasig, 24/7 na suporta. Mabilis na naproseso ang proseso ng deposito at withdrawal. Ang palitan ay gumagana nang maayos, walang mga error kapag nangangalakal.

Positibo

时尚阳光

Ecuador

Sa personal, sa tingin ko ang ADMISI na ito ay hindi masama, ngunit nakakita ako ng masamang impormasyon sa website ng wikifx at medyo natakot ako. Ipinapakita ng field research na ito na wala itong opisina sa UK. Ibig sabihin ba nito ay isa itong scammer? Dapat ko bang itigil ang pagkalugi sa tamang oras?

Positibo

FX1023300450

United Kingdom

Ang suporta sa customer ng broker na ito ay hindi gaanong propesyonal, at hindi sila sumusuporta sa online chat. Naalala ko na nagpadala ako ng tanong sa kanila, at walang sumagot sa akin, na medyo kakaiba. Nakakita ako ng ilang problema: kakulangan ng mga detalye ng bayad, walang malinaw na impormasyon tungkol sa minimum na deposito… Sino ang makakapagsabi sa akin kung paano gumagana ang platform na ito?

Katamtamang mga komento