简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

90% of Traders Fail After Entry: Master the Art of the Exit to Outlast the Rest.

Abstract:New traders treat the Stop-Loss (SL) like an enemy. They think it guarantees a loss. In reality, it’s the only thing guaranteeing you live to trade another day. If you are trading without a plan for where to exit—both in profit and in loss—you aren't trading. You are gambling.

I have watched more traders wash out of this industry in their first year than I can count. Their charts looked distinct, their strategies were different, but their fatal mistake was always the same.

They didn't know when to get out.

New traders treat the Stop-Loss (SL) like an enemy. They think it guarantees a loss. In reality, its the only thing guaranteeing you live to trade another day. If you are trading without a plan for where to exit—both in profit and in loss—you aren't trading. You are gambling.

Here is the brutal truth about how to set your “life lines” scientifically, moving away from guessing and toward protecting your capital.

Why do 90% of traders fail this test?

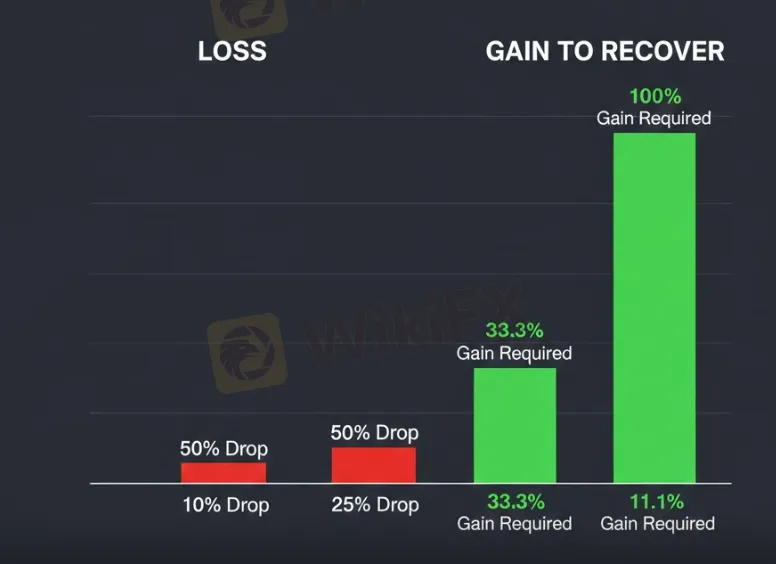

It usually starts with ego. You look at the EUR/USD chart, seeing a perfect setup. You enter a buy order. The market dips 10 pips against you. You think, “It'll come back.” It drops 30 pips. You think, “It has to turn around soon.”

By 50 pips down, you are paralyzed. You eventually close the trade when the pain is too great, often right at the bottom before the reversal happens.

Setting a scientific Stop-Loss removes emotion from the equation. It defines your risk before you enter the trade. If you determine you are wrong about the market direction, the SL gets you out automatically. It is a business expense, not a personal failure.

Where exactly should you place your exit?

Stop placing your SL at random numbers like “20 pips” or “50 pips.” The market does not care about your arbitrary numbers. It cares about structure.

1. The Market Structure Approach

This is the bread and butter of price action.

- For Buys: Place your SL just below the most recent “Swing Low” (the lowest point of the previous dip). If price breaks that low, the uptrend is likely broken, and your reason for being in the trade is invalid. (In high-volatility currency environments (such as NGN or ZAR), spreads can widen significantly during late-night sessions. Consequently, your stop loss needs to account for more 'breathing room' compared to major pairs like EUR/USD.)

- For Sells: Place it just above the most recent “Swing High.”

2. The ATR Method (Volatility)

Currency pairs breathe. GBP/JPY moves differently than AUD/USD. Using the Average True Range (ATR) indicator helps you set stops based on the pair's current volatility.

- Check the daily ATR. If a pair moves 80 pips a day on average, setting a 10-pip stop loss is suicide. You will get stopped out by normal market noise before the move even happens. Give the trade room to breathe.

- It is recommended to set your Stop Loss at $1.5 \times ATR$ or $2 \times ATR$.

What about taking profit?

This is where greed kills you. You see green on the screen, your heart races, and you close the trade for a quick $20 win. Then you watch the chart fly another 100 pips in your direction.

Scientifically, you need a positive Risk-to-Reward Ratio.

If your Stop-Loss is risking 50 pips, your Take-Profit (TP) should aim for at least 100 pips (a 1:2 ratio). If the distance to the next resistance level doesn't allow for a 1:2 ratio, do not take the trade. The math simple doesn't work in your favor long-term.

The “Invisible” Risk: Your Broker

You can have the perfect technical setup, the perfect swing low identified, and the perfect risk ratio. But there is one external factor that ruins everything: The Broker.

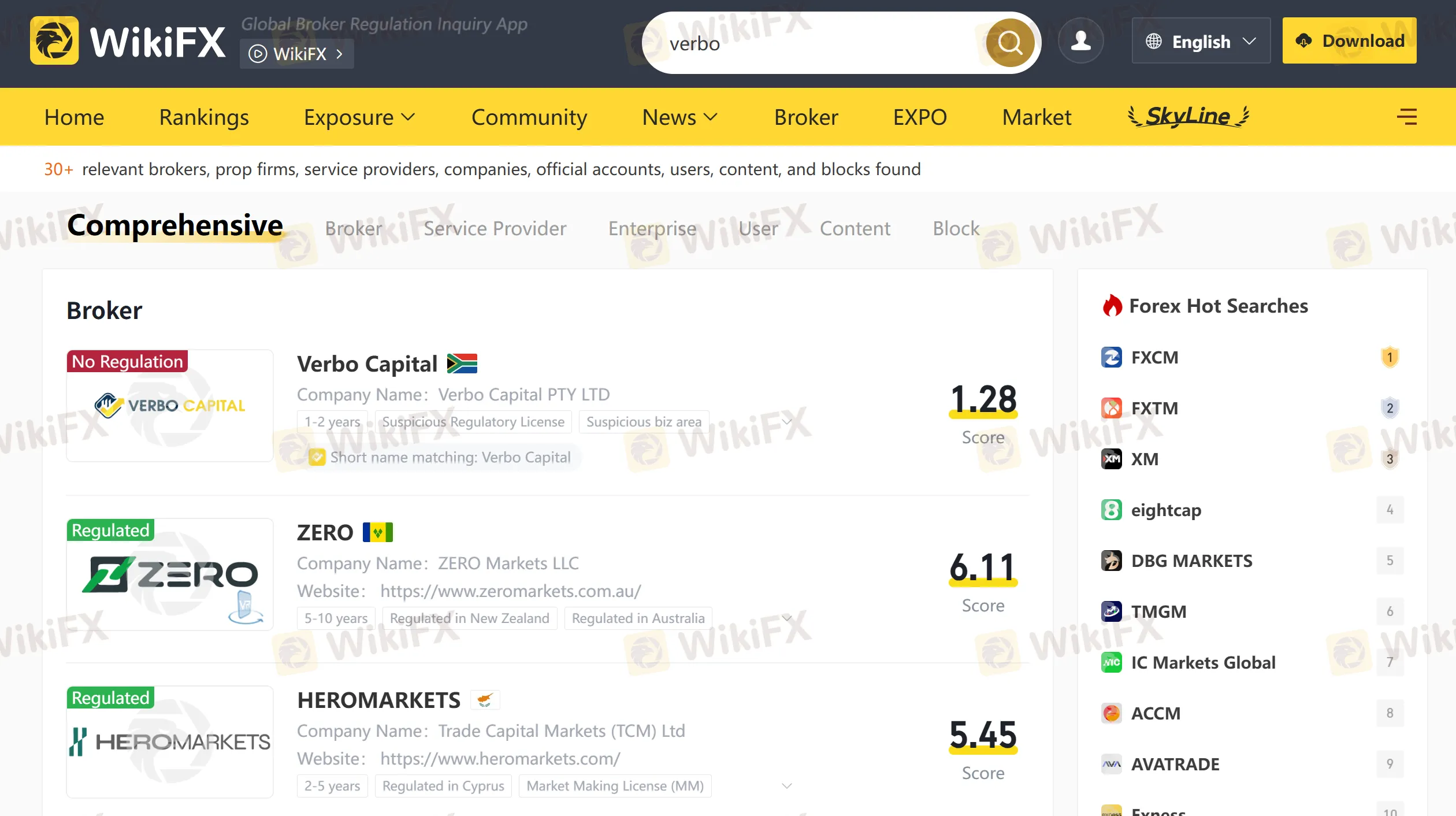

I have seen brokers artificially widen spreads during news events or periods of low liquidity to trigger client stop losses. This is often called “stop hunting.” If your broker is unregulated or operates in the shadows, your SL is not a safety net; it's a target.

Before you trust a platform with your hard-earned deposit, you need to verify they play fair. Are they regulated? Do they have a history of slippage complaints? I always tell my students to run a check on WikiFX before opening an account. It aggregates regulatory data and user complaints to show you if a broker is legitimate or just waiting to eat your margin.

If the broker has a low score on WikiFX, move on. There are plenty of honest providers out there. Don't let a bad broker ruin a good strategy.

The Action Plan

Next time you open your trading app:

- Identify the Entry.

- Find the Invalid Point: Where does the chart prove you wrong? That is your Stop-Loss.

- Measure the Distance: Calculate the pips between Entry and SL.

- Set the Target: Look for the next Support/Resistance zone. Is it at least 2x the distance of your risk?

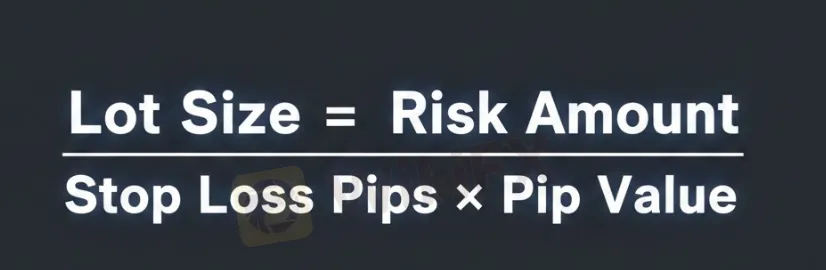

- Calculate Lot Size: Adjust your lot size so that if the SL hits, you lose only 1% or 2% of your account.

Example: If your account balance is $10,000 and your risk is set at 1% ($100), with a distance of 50 pips from your entry to your stop loss (SL):Formula:

In this scenario, you should execute a trade of 0.2 lots.

Trade what you see, not what you feel. The market is relentless, but with a scientific exit plan, you can survive the choppy waters.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Forex trading involves significant risk and is not suitable for all investors. You should consider whether you understand how leveraged products work and whether you can afford to take the high risk of losing your money.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Currency Calculator