简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Jetafx Review 2026: A Trader's Warning on Regulation and High-Risk Signals

Abstract:This Jetafx Review gives a complete analysis for traders thinking about this broker in 2025. Our goal is to look past the marketing claims and give you a fact-based review of how safe and legitimate it is. This investigation uses reliable data from independent tracking platforms like WikiFX, which are important tools for any trader's research process. The main finding of our review is immediate and serious: Jetafx operates with a "Suspicious Regulatory License" and is marked as a high-risk company with an extremely low trust score. The information we present here is not just an opinion but an analysis of real facts, designed to help you understand the major risks involved. Our main goal is to give you the information you need to protect your money from potentially dangerous trading environments.

This Jetafx Review gives a complete analysis for traders thinking about this broker in 2025. Our goal is to look past the marketing claims and give you a fact-based review of how safe and legitimate it is. This investigation uses reliable data from independent tracking platforms like WikiFX, which are important tools for any trader's research process. The main finding of our review is immediate and serious: Jetafx operates with a “Suspicious Regulatory License” and is marked as a high-risk company with an extremely low trust score. The information we present here is not just an opinion but an analysis of real facts, designed to help you understand the major risks involved. Our main goal is to give you the information you need to protect your money from potentially dangerous trading environments.

Jetafx Pros and Cons

When looking at a broker, it's easy to be attracted by appealing features. However, these features must be compared against the basic aspects of safety and regulation. A side-by-side comparison of Jetafx's offerings shows a clear contrast between its advertised benefits and the serious underlying risks.

| Appealing Features (The “Pros”) | Critical Red Flags (The “Cons”) |

| MT5 Trading Platform Supported | No Verifiable, Active Regulation |

| Four Different Account Types | “Exceeded” FCA License (Non-functional) |

| High Maximum Leverage (up to 1:2000) | Registered in a High-Risk Offshore Zone (Saint Lucia) |

| No Minimum Deposit on Some Accounts | Warning: “High Potential Risk” & Low Trust Score on WikiFX |

| Wide Range of Trading Instruments | Numerous Allegations of Withdrawal Issues & Scams |

While the list of “Pros” might seem attractive, especially to new or traders with limited funds, they become almost meaningless without the basic protection of strong, active regulation. Features like high leverage and a wide range of instruments are standard in the industry, but they become dangerous when offered by a broker that lacks credible oversight. The absence of a legitimate regulatory framework means there is no authority to hold the broker accountable, no client fund protection plan, and no formal dispute resolution process. Therefore, the “Cons” do not simply balance the “Pros”; they completely undermine them.

Before considering any broker, especially one with red flags like Jetafx, it is important to check Jetafx Review on a trusted platform like WikiFX.

Understanding Jetafx's Red Flags

Understanding a broker's regulatory status is the single most important step in protecting your investment. The terminology can be confusing, but the consequences are serious. Here, we break down exactly what Jetafx's regulatory red flags mean for you and your money.

The Misleading FCA License

Jetafx's information mentions a license from the Financial Conduct Authority (FCA) in the United Kingdom. However, the status of this license is “Exceeded.” This is a critical distinction that can be dangerously misleading. An “Exceeded” status does not mean Jetafx is regulated by the FCA. It means that a license, which in this case is tied to a separate company named “DLS MARKETS (AUST) PTY LTD,” is no longer valid or authorized to provide regulated services.

This is a historical record, not a current stamp of approval. It provides zero protection for current Jetafx clients. Trading with a broker under the false assumption of FCA oversight is one of the biggest risks a trader can take. The FCA is a top-tier regulator with strict rules on client fund separation, negative balance protection, and compensation plans. Jetafx clients are not entitled to any of these protections, as the broker does not hold an active, valid license from the FCA or any comparable regulatory body.

Dangers of Offshore Registration

Jetafx is registered in Saint Lucia, a popular offshore location for forex brokers. While not illegal, registration in such a location is a major red flag. Offshore financial centers typically have very relaxed regulatory requirements, minimal oversight, and weak enforcement.

For a trader, this means:

• No Fund Security: Regulators like the FCA or ASIC (Australia) require that brokers keep client funds separate from company funds. This prevents the broker from using your money for its operational expenses and protects it in case of bankruptcy. Offshore brokers often have no such legal requirement.

• No Legal Options: If you have a dispute with a broker regulated in the UK or Australia, you can appeal to a financial ombudsman service. If your broker is in Saint Lucia, resolving disputes like withdrawal problems becomes incredibly difficult, if not impossible.

• High Risk of Disappearance: Unregulated or poorly regulated offshore brokers can, and often do, disappear with client funds without any legal consequence. Their corporate structure is intentionally unclear, making it difficult to track down the owners or hold anyone accountable.

The WikiFX Verdict

Independent verification platforms exist to provide clarity in a complex market. The Jetafx Review on WikiFX a global broker inquiry app, is clear. The platform assigns Jetafx a score of just 1.89 out of 10, a score that means extreme risk.https://www.wikifx.com/en/dealer/2259845172.html

The platform explicitly issues the following warnings based on its data:

• “No Regulation”

• “Suspicious Regulatory License”

• “High potential risk”

Most importantly, WikiFX provides direct and clear advice to traders: “Warning: Low score, please stay away!” Such a low score and direct warning from a reputable third-party verification service should be considered a clear signal of danger. It reflects a comprehensive analysis of the broker's regulatory status, business practices, and user feedback, concluding that the risk to traders' capital is unacceptably high.

Jetafx Trading Conditions Analyzed

Beyond the critical issue of regulation, a detailed look at Jetafx's trading conditions reveals a model that, while appearing attractive on the surface, contains features that increase risk for traders. We will analyze these offerings, consistently framing them within the context of the broker's high-risk, unregulated profile.

Accounts and High Leverage

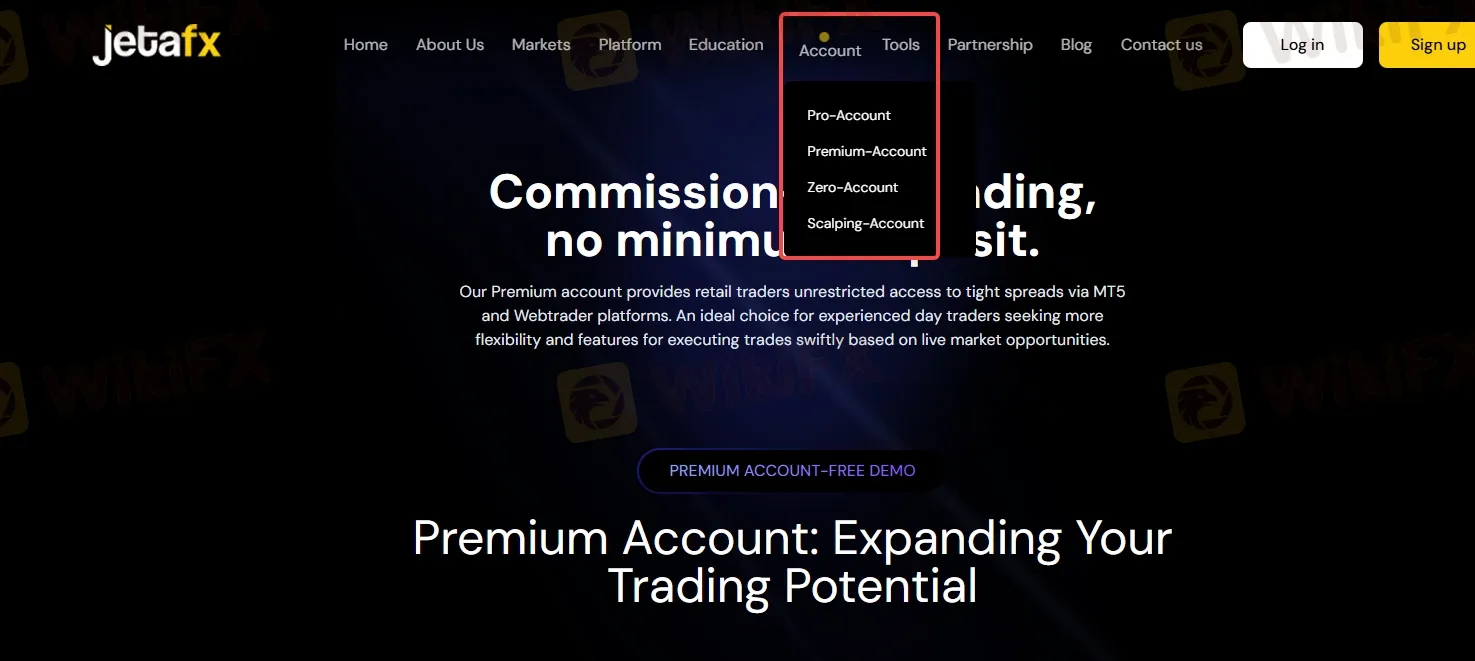

Jetafx offers four main account types, seemingly catering to a wide range of traders. The details are as follows:

• Pro Account: Advertised spreads from 0.5 pips, $100 minimum deposit.

• Premium Account: Advertised spreads from 1.2 pips, $0 minimum deposit.

• Zero Account: Advertised spreads from 0 pips, $0 minimum deposit.

• Scalp Account: Advertised spreads from 0.1 pips, $0 minimum deposit.

The most alarming feature across these accounts is the maximum leverage offered: up to 1:2000.

*Trader's Advisory: Extremely high leverage like 1:2000, when offered by an unregulated broker, is a major red flag. Top-tier regulators limit leverage (e.g., 1:30 for major forex pairs in the UK and EU) specifically to protect retail traders from catastrophic losses. Unregulated brokers use extreme leverage as a marketing tool to attract unsuspecting traders, dramatically increasing the risk of losing your entire capital instantly on a single small market movement.*

Platforms and Instruments

Jetafx provides access to the industry-standard MetaTrader 5 (MT5) platform, for which it holds a “Full License.” It also offers a proprietary mobile app. The broker lists a wide range of tradable instruments, including Forex, CFDs, Stocks, ETFs, Bonds, Commodities, and Futures.

It is important to understand that an MT5 “Full License” is a software license purchased from MetaQuotes Software Corp. It is not a financial regulation. It simply means the broker has paid for the right to use the full version of the platform. This license does not guarantee the broker's own business practices are safe, ethical, or solvent. An untrustworthy company can still operate on a legitimate platform.

*Trader's Advisory: A wide array of instruments and a familiar platform are irrelevant if the broker holding your funds is not trustworthy. The primary concern is not what you can trade, but whether you can ever withdraw your profits or even your initial deposit. The safety of your capital should always be the first priority.*

Deposits and Withdrawal Issues

Jetafx Review reveals that Jetafx lists several common payment methods for deposits and withdrawals, including VISA, MasterCard, bank transfers, and cryptocurrencies like Bitcoin and Tether. However, the availability of deposit methods does not guarantee the availability of withdrawals.

This is where user experience and formal complaints become critically important. Our review of data from WikiFX's exposure reports reveals a disturbing and consistent pattern. While a few unverified positive reviews mention fast withdrawals, formal complaints and news reports claim that Jetafx may block withdrawals, often citing arbitrary or unfair rules. One such report highlights “Allegations of Fund Scams and Withdrawal Blocks Using Unfair VPS Trading Rule.”

This is a classic tactic used by untrustworthy brokers. They may process small, early withdrawals to build trust, only to block larger withdrawal requests later, citing vague terms and conditions or accusing the user of prohibited trading strategies. The conflicting reports on withdrawals—a few positive versus serious formal allegations—are a significant warning sign.

*These conflicting reports on withdrawals highlight the importance of thorough research. You can investigate user complaints and exposure reports for Jetafx and any other broker on WikiFX to see if a pattern of issues exists.*

Final Verdict for Traders

After a thorough Jetafx Review and Jetafx's regulatory status, business practices, trading conditions, our conclusion is clear and decisive. The evidence points overwhelmingly to an environment of extreme risk for any trader who deposits funds with this broker.

Our Recommendation: Avoid Jetafx

We cannot recommend Jetafx to any trader, regardless of their experience level or risk appetite. The decision is based on several critical failures in the core pillars of trust and safety that should define any legitimate brokerage.

The primary reasons for this clear warning are:

• Lack of any valid, active regulation. The “Exceeded” FCA license is misleading and offers no client protection.

• Registration in a high-risk offshore location. Saint Lucia provides minimal oversight and leaves traders with no practical legal options.

• A low trust score and direct warnings from verification services. A score of 1.89/10 and a “Stay Away” notice from WikiFX are clear indicators of danger.

• Serious claims from users regarding withdrawal blocks and fund security. Reports of blocked withdrawals citing unfair rules are a hallmark of untrustworthy brokers.

Your Safest Next Step

The most important lesson from this Jetafx review is the absolute necessity of independent verification. The forex market is filled with companies that make attractive promises, but only a few operate with the integrity and regulatory oversight required to keep your money safe. Your most powerful tool as a trader is not a trading strategy, but thorough research.

Do not take any broker at their word. Before you deposit a single dollar, protect yourself by performing a thorough check on WikiFX. A simple search can reveal critical information about a broker's regulation, history, and user experiences, helping you avoid high-risk entities like Jetafx.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

Currency Calculator