简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

A Market Gripped by Heightened Volatility

Abstract:Cryptocurrencies once again became the epicenter of losses yesterday, reflecting a broadly fragile risk sentiment across global capital markets. Precious metals, including gold and silver, saw renewed

Cryptocurrencies once again became the epicenter of losses yesterday, reflecting a broadly fragile risk sentiment across global capital markets. Precious metals, including gold and silver, saw renewed sell-offs that caught market attention, while equities were dragged lower in tandem. At present, financial markets are clearly entering a deleveraging phase, during which investors are actively reducing exposure and compressing risk to more manageable levels.

During yesterdays live session, we highlighted that the economic cycle is currently approaching the late expansion phase. Historically, capital markets at this stage are characterized by sharp rallies followed by equally abrupt corrections. As volatility intensifies, such price swings should be viewed as an inherent feature of the economic cycle rather than an anomaly. Over the past year, gold and silver have surged by more than 90% and 290%, respectively. The current pullback is therefore largely a function of the prior outsized gains. When upside momentum is driven primarily by sentiment, a rapid and disorderly correction becomes an anticipated outcome rather than a surprise.

Investor sentiment this week has shifted decisively from greed to fear. Consistent with our long-held framework, we believe that when the Fear & Greed Index falls below the 40 threshold, investors should begin monitoring opportunities associated with medium-term equity pullbacks.

S&P 500 declined from its recent high of 6,978.60 to 6,798.40 (−2.58%)

NASDAQ Composite retreated from 23,461.82 to 22,540.59 (−3.93%)

Dow Jones Industrial Average eased from 49,590.20 to 48,908.72 (−1.37%)

While index-level drawdowns remain contained within 5%, well below the technical correction threshold of −10%, volatility among select mega-cap technology stocks, notably Nvidia and Alphabet, has increased meaningfully in recent sessions.

(Figure 1: Fear & Greed Index | Source: CNN)

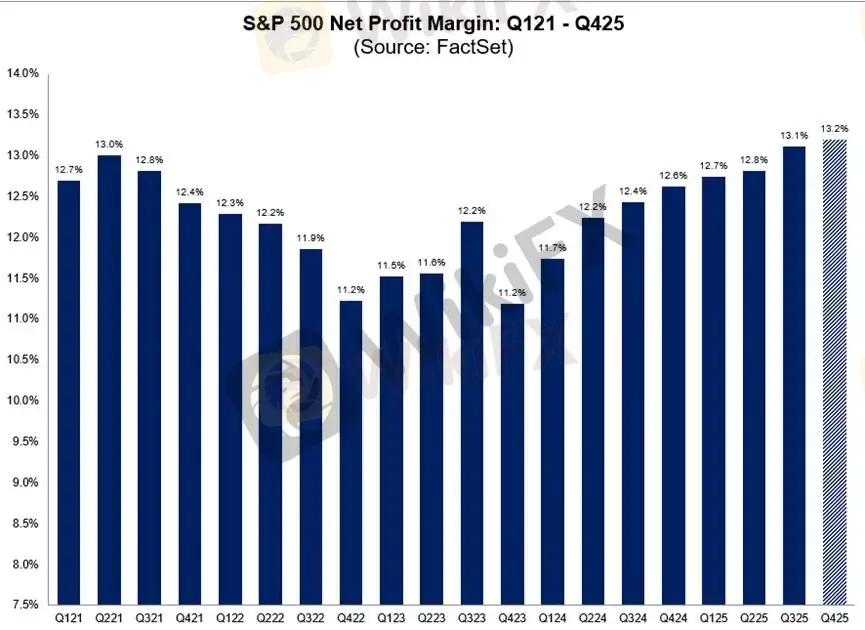

According to the latest Q4 2025 earnings analysis released by John Butters, Senior Analyst at FactSet, the S&P 500 currently exhibits a dual dynamic of strong earnings resilience alongside elevated valuation levels.

2026 Outlook

Analysts remain constructive on profit margin expectations across all quarters of 2026, with full-year net margins projected to range between 13.2% and 14.2%.

(Figure 2: Estimated Q4 Net Profit Margin at 13.2%, Maintaining Double-Digit Growth | Source: FactSet.com)

The core bullish thesis for equities rests on the principle that high growth justifies high price-to-earnings multiples. As long as growth momentum remains intact, attempting to call a structural trend reversal based solely on valuation metrics represents a flawed analytical approach. While elevated U.S. equity valuations are widely acknowledged, investors often underestimate the degree to which sustained high growth can support higher multiples. As the economic cycle advances deeper into its expansion phase, relying on valuation as a prerequisite for market participation may significantly limit investment opportunities going forward.

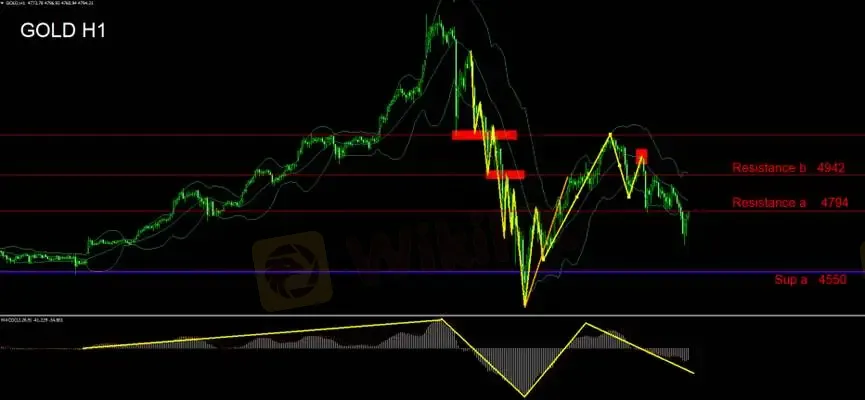

Gold Technical Analysis

Building on yesterdays technical focus, we continue to assess gold through the lens of Bollinger Bands. The current downward expansion of the bands confirms a bearish configuration, suggesting that recent price action represents a continuation of the broader downtrend following a failed rebound.

The decline has exhibited a consistent structure: rebounds have repeatedly stalled near the midline of the Bollinger Bands, followed by renewed downside pressure. Lower highs and progressively lower lows remain intact, with attention now shifting to the prior support zone near 4550.

Momentum indicators further reinforce this view. As outlined previously, the MACD histogram continues to expand into negative territory, lending support to short-side positioning.

During todays Asian session, prices briefly touched 4663 before rebounding. Investors should closely monitor resistance at the Bollinger midline. A decisive break above this level would warrant a neutral, wait-and-see stance.

Given current conditions, the market environment is more suitable for intraday trading, and we recommend avoiding overnight positions.

Support Levels

Support A: 4550

Resistance Levels

Resistance A: 4794

Resistance B: 4942

Risk Disclosure:

The views, analyses, research, prices, and other information provided above are intended solely for general market commentary and do not represent the official position of this platform. All readers assume full responsibility for their own investment decisions and associated risks. Please exercise caution when trading.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CAD Outlook: Historic Drop in Student Enrollment Signals Demographic Drag

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

South African Rand (ZAR) on Alert: DA Leadership Uncertainty Rattles Markets

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

Currency Calculator