简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Is STMARKET Legit? A 2026 Deep Dive into Red Flags and Risks

Abstract:This review goes beyond the fancy marketing materials to give you a clear answer to the question Is STMARKET Legit?. Right from the start, you should know that independent reviewers have given STMARKET a very low score of 3.65 out of 10. They also issued official warnings telling traders to stay away. This review will carefully examine the broker's legal status, its confusing company structure, conflicting account information, and what users are saying. Our goal is to give you the real facts you need to make a safe choice about your money.

Many traders ask themselves an important question before investing their money: “Is STMARKET legit or Scam?” At first glance, this broker looks professional. It has a full MT5 license and claims to have been operating for 5-10 years. However, when we dig deeper and look at the facts, we find many serious warning signs that should make you very careful.

This review goes beyond the fancy marketing materials to give you a clear answer to the question Is STMARKET Legit?. Right from the start, you should know that independent reviewers have given STMARKET a very low score of 3.65 out of 10. They also issued official warnings telling traders to stay away. This review will carefully examine the broker's legal status, its confusing company structure, conflicting account information, and what users are saying. Our goal is to give you the real facts you need to make a safe choice about your money.

The Verdict at a Glance

For traders who want a quick answer of Is STMARKET Legit, the evidence strongly suggests that STMARKET is a high-risk broker. The combination of weak regulation, misleading company information, and official danger warnings shows this is not a trustworthy financial partner. Here are the most important findings.

| Metric | Finding | Implication |

| Overall Score | 3.65 / 10 | Extremely low; indicates major deficiencies and risk. |

| Risk Warning | “High potential risk,” “Danger,” “Please stay away” | Official warnings from evaluators against using the broker. |

| Primary Regulator | SERC (Cambodia) | Not a top-tier regulatory body, offering limited protection. |

| Physical Office | UK registration but “No Physical Presence Found” | A major red flag suggesting a lack of transparency. |

These key points alone should make you very worried. When a company is registered in the UK but has no actual office there, this is a classic trick used by companies that are not what they claim to be. This sign is sufficient to answer your question Is STMARKET Legit.

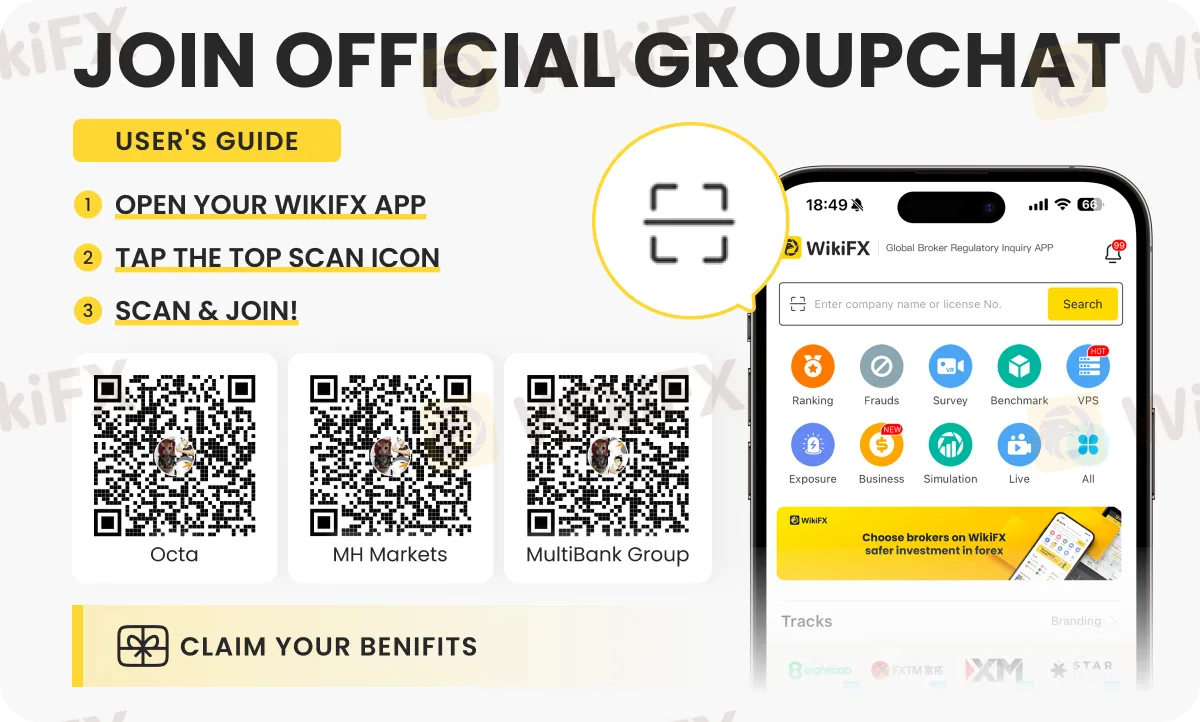

Before considering any broker, especially one with concerning numbers like these, you should do your own research. We strongly recommend using a comprehensive tool like WikiFX to get an up-to-date, detailed report on any broker's status. This simple step can be the difference between a secure investment and losing your money.

Understanding the Regulation

A broker's regulatory status is the foundation of whether it can be trusted. It determines what rules they must follow and what protections you have as a trader. While to check Is STMARKET Legit or not . We need to visit its website.

Official Regulatory Status

According to official records, STMARKET COMPANY LIMITED holds a trading license from the Securities and Exchange Regulator of Cambodia (SERC). The license number is 00049975. Having a license is better than having no license at all. However, this is where understanding the global financial system becomes important.

The Regulator Difference

Not all financial regulators are the same. They vary greatly in how strict they are, how well they enforce rules, and what safety nets they provide for investors. A license from a top-level jurisdiction is a sign of high compliance and financial stability.

Top-tier regulators, such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), typically require the following protections:

• Strict Financial Requirements: Brokers must keep significant money in reserve, ensuring they can meet their obligations to clients even during market problems.

• Segregated Client Funds: Client deposits must be held in bank accounts separate from the company's operating funds. This protects your money if the broker goes out of business.

• Investor Compensation Schemes: These schemes act as a safety net, providing some compensation to traders if their broker fails and cannot return their funds.

• Rigorous Auditing and Enforcement: Regulators in these areas conduct frequent audits and have the power to impose heavy fines or cancel licenses for rule violations.

The SERC in Cambodia does not have the same long-standing reputation or strict enforcement history as these top-level regulators. While STMARKET's license provides basic legitimacy within Cambodia, it offers much less protection to international traders compared to what you would receive from a broker regulated in the UK, Australia, or the EU.

Understanding a broker's regulatory situation can be complex. To easily check the validity and level of any broker's license, we recommend using a dedicated verification platform like WikiFX, which simplifies this important research.

A Tale of Two Countries

One of the most alarming warning signs about STMARKET and Is STMARKET Legit is the disconnect between where it is registered and where it actually operates. This geographical trick is a common tactic used by high-risk brokers to create a false sense of security.

The On-Paper UK Presence

Records show that a company named ST MARKET UK LTD is registered in the United Kingdom under registration number 12576898. For many potential clients, a UK registration immediately creates confidence, as the UK is globally recognized for its strong financial industry and tough regulatory oversight. This is exactly the impression such a registration is designed to create.

However, a registration is not the same as a regulated, operational presence. The critical finding from independent field surveys is clear and repeated:

> Important Warning: Multiple verification attempts have confirmed that STMARKET has no physical, operational office at its registered UK address.

This means that while a company exists on paper in the UK, there is no staff, no trading floor, and no administrative center there. The UK entity appears to be a shell company.

A Classic Red Flag

This mismatch is a textbook “bait-and-switch” strategy. Brokers use a UK registration to appear trustworthy and legitimate, using the UK's strong financial reputation to attract clients. In reality, their entire operation—including client support, fund processing, and regulatory oversight—is based elsewhere. In STMARKET's case, the actual headquarters and operational hub are located at AMASS Tower in Phnom Penh, Cambodia.

The impact of this is serious and directly affects your safety as a trader. Should you encounter any problems, such as withdrawal issues or trade disputes, you have virtually no help through UK authorities or legal channels. Your legal agreement is not with a UK-based entity but with STMARKET COMPANY LIMITED in Cambodia. Any dispute would fall under Cambodian law, which offers far less consumer protection and a less predictable legal framework for international clients. This deliberate confusion about their operational base is a serious warning sign about the broker's transparency and to the question Is STMARKET Legit or not ?

A Look Inside STMARKET

An analysis of a broker's services—its account types, fees, and trading platforms—can reveal further inconsistencies that either build trust or destroy it. In the case of STMARKET, a closer look at their offerings uncovers more signs of unprofessionalism.

Accounts and Deposits

STMARKET offers three primary account types, designed for different levels of traders. The details are presented below.

| Account Type |

| Standard |

| Premium |

| Pro |

While the ECN account offers competitive raw spreads, a glaring inconsistency appears regarding the minimum deposit. The account comparison table on their site lists the minimum deposit for a Standard account. However, in another section about funding, the broker clearly states that the first deposit amount .

This kind of conflicting information is more than a simple mistake; it is a sign of carelessness and a lack of professionalism. For a potential client, it creates confusion and uncertainty about the basic terms of engagement. It raises the question: if a broker cannot maintain consistency on a basic detail like its minimum deposit, can it be trusted with complex financial transactions and the security of your funds?

Platform and Instruments

STMARKET provides its clients with the MetaTrader 5 (MT5) platform, which is available for PC, web, and mobile devices. MT5 is a globally recognized, powerful, and legitimate trading platform known for its advanced charting tools, technical indicators, and support for automated trading (Expert Advisors).

However, it is a critical mistake to think that a good platform means a good broker. High-risk and scam operations frequently use popular, ready-made platforms like MT5 to attract unsuspecting traders . They try to paint positive image of broker and dodge the question Is STMARKET Legit or scam to avoid .

The software's legitimacy gives credibility to the broker using it. The real test is not the platform they offer, but the integrity of the company behind it. The broker offers a standard range of tradable instruments, including Forex (over 55 pairs), Energies (Crude Oil, Natural Gas), Indices, Metals (Gold, Silver), and major Cryptocurrencies (Bitcoin, Ethereum).

Real User Experiences

User reviews can provide a glimpse into a broker's operational reality, though a small sample size must be viewed with caution. The available feedback for STMARKET is limited and mixed.

One positive review highlights a “seamless crypto trading” experience and easy withdrawals, praising the simplicity of the web terminal over the full MetaTrader suite. While positive, this is a single data point focused on a specific function and does not address the larger concerns about regulation and corporate transparency.

A second, neutral review points to a potential problem with the platform's data feed. The user noted that the percentage changes in share values did not seem to be a “true reflection” of market movements. This is a potentially serious concern, as accurate pricing and data are fundamental to fair trading. Any discrepancy, whether intentional or due to technical incompetence, can negatively impact a trader's profitability and trust in the platform. Together, these reviews are insufficient to form a solid conclusion, but the neutral feedback does reinforce the possibility of operational inconsistencies.

Final Assessment

After a thorough review of the available evidence, we can now provide a final verdict on Is STMARKET Legit trading partner or Scam company to Avoid.

Summarizing Red Flags

It is our clear assessment that STMARKET exhibits too many significant red flags to be considered a safe or legitimate choice for traders. The risks associated with this broker are substantial and should not be ignored. The conclusion is based on the accumulation of multiple, serious issues that, when viewed together, paint a picture of a high-risk operation.

The key issues are summarized below:

• An extremely low trust score of 3.65/10 from independent evaluators.

• Regulation is based solely in a non-tier-1 jurisdiction (Cambodia), offering minimal protection for international clients.

• A misleading UK company registration is used without any verifiable physical presence, a classic deception tactic.

• The broker is subject to official “Danger” and “Stay Away” warnings.

• There is conflicting and unprofessional information on their website regarding fundamental details like the minimum deposit.

Your Safest Path Forward

Based on this analysis, we strongly advise against depositing any funds with STMARKET. The potential for financial loss, withdrawal complications, and lack of regulatory help is unacceptably high.

This investigation serves as an important reminder of a universal principle in online trading: doing your homework is not optional; it is essential. The tactics and red flags identified in this STMARKET review are unfortunately common in the less regulated corners of the forex industry.

Your financial safety is most important. To protect yourself, make it a non-negotiable habit to thoroughly check every broker before opening an account. Use a trusted, independent verification platform like WikiFX to check regulatory licenses, read unfiltered user reviews, and check it is regulated or not . You can check just in one click https://www.wikifx.com/en/dealer/7121233630.html Is STMARKET Legit or not . It is the single most important step you can take to trade safely and avoid becoming a victim of high-risk operations.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator