Abstract:Unicorn Prime Liquidity (UniPrime) exposed: user reports a blocked account and unresponsive support. Protect your funds and file a complaint.

Introduction: Why This Warning Matters

The online trading industry has attracted millions of investors worldwide, offering opportunities for profit and financial growth. Unfortunately, this rapid expansion has also created fertile ground for fraudulent brokers who exploit unsuspecting traders. One such broker is UniPrime, also known as Unicorn Prime Liquidity or UNFXB.

Reports from traders reveal alarming practices, including blocked accounts, denied withdrawals, and unresponsive customer support. This article exposes UniPrimes operations, explains the risks, and provides clear steps to protect yourself. To illustrate the seriousness of such scams, we will reference a real case involving UNFXB/UniPrime, which demonstrates how these schemes operate and the devastating impact they have on traders.

Broker Overview: UniPrime / Unicorn Prime Liquidity / UNFXB

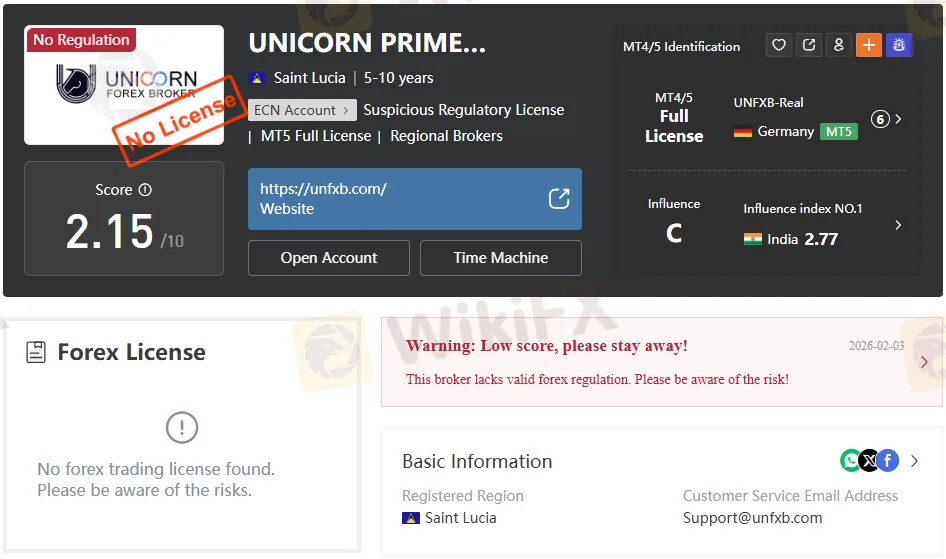

According to its profile on Wikifx, UniPrime presents itself as a liquidity provider and trading broker. However, the details raise serious concerns:

- Regulation Status: UniPrime does not provide evidence of credible regulation.

- Transparency Issues: The broker's ownership and location details are vague.

- User Complaints: Traders consistently report blocked accounts and vanished deposits.

- Risk Level: High, due to a lack of investor protection and accountability.

Without proper regulation, UniPrime operates outside the boundaries of financial oversight, leaving traders vulnerable to fraud.

Case Study: Blocked Account Incident

A recent case highlights UniPrimes fraudulent behaviour. A trader deposited funds and engaged in minimal trading activity. Despite no violations, UniPrime blocked the account entirely. The trader was unable to withdraw either the initial deposit or profits. Support channels went silent, effectively cutting off communication.

This is not a trading loss—it is deliberate theft. By blocking accounts and denying withdrawals, UniPrime prevents traders from reclaiming their funds. Such practices are consistent with scam brokers that lure investors in, only to trap their funds.

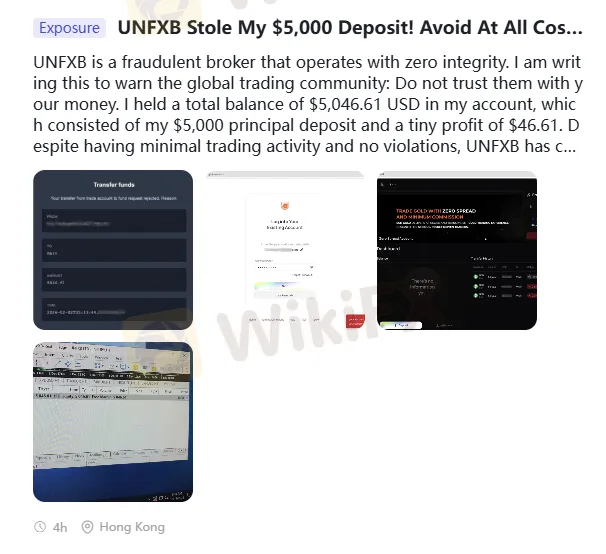

Real Victim Testimony: UNFXB / UniPrime in Hong Kong

To understand the gravity of these scams, consider the case of UNFXB, which is also known as Unicorn Prime Liquidity or UniPrime. One trader shared their experience from Hong Kong:

“UNFXB is a fraudulent broker that operates with zero integrity. I held a total balance of $5,046.61 USD in my account, consisting of my $5,000 principal deposit and a small profit of $46.61. Despite having minimal trading activity and no violations, UNFXB completely blocked my access and stole my entire capital. This is not a trading loss—this is blatant theft. They refused to process my withdrawal and vanished with my hard‑earned money. The bottom line: UNFXB is a classic scam broker. They will take your deposit, but you will never see it again.”

This case mirrors the complaints against UniPrime. Both names—UniPrime, Unicorn Prime Liquidity, and UNFXB—refer to the same fraudulent entity. The tactics are identical: lure traders with promises of liquidity and profit, then block accounts and deny withdrawals once funds are deposited. The similarity underscores the need for vigilance.

Red Flags That Cannot Be Ignored

1. Lack of Regulation

Legitimate brokers are licensed by recognized authorities. UniPrime fails to provide verifiable licensing, which is a major red flag.

2. Blocked Withdrawals

Multiple reports confirm that UniPrime denies withdrawal requests. This is a direct violation of trading ethics and investor trust.

3. Poor Transparency

The broker's website and profile lack clear information about ownership, compliance, or financial safeguards. This opacity is typical of fraudulent platforms.

4. Negative User Reviews

Traders consistently report blocked accounts, vanished deposits, and unresponsive support. These complaints align with the behaviour of scam brokers like UNFXB.

Impact on Traders

The consequences of UniPrimes actions are severe:

- Loss of Capital: Deposits and profits are stolen.

- Emotional Stress: Victims face frustration, anxiety, and financial insecurity.

- Erosion of Trust: Confidence in online trading is damaged.

- Community Harm: Fraudulent brokers undermine the credibility of legitimate platforms.

UniPrimes practices harm not only to individuals but also to the broader trading ecosystem.

Comparison with Legitimate Brokers

To understand UniPrimes risks, compare it with regulated brokers:

This comparison underscores why UniPrime should be avoided.

Common User Questions Answered

Is UniPrime Regulated?

No. UniPrime (UNFXB/Unicorn Prime Liquidity) lacks verifiable regulation, making it unsafe for traders.

Can I Withdraw Funds from UniPrime?

Reports show withdrawals are routinely blocked. Victims lose access to deposits and profits.

What Should I Do If Scammed?

Document all interactions, file complaints with regulators, and warn others by sharing your experience.

Action Steps for Victims

If you have been affected by UniPrime:

- Gather Evidence: Save emails, screenshots, and transaction records.

- File a Complaint: Report to financial regulators and consumer protection agencies.

- Warn Others: Share your experience on forums and social media.

- Seek Legal Advice: Consult professionals for recovery options.

- Avoid Further Deposits: Do not send additional funds to UniPrime.

Conclusion: Protect Your Capital

UniPrime (Unicorn Prime Liquidity / UNFXB) has been exposed as a fraudulent broker that blocks accounts and denies withdrawals. With no regulation, poor transparency, and multiple user complaints, it poses a serious risk to traders. The Hong Kong case involving UNFXB demonstrates how this broker operates under different names while using the same fraudulent tactics.

Protect your funds—do not deposit with UniPrime.

If you or someone you know has been scammed by UniPrime, report the fraud immediately and share this article to raise awareness. Together, we can protect the trading community from predatory brokers.