简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MultiBank Group Review: A Deep Dive into Safety and Regulation

Abstract:MultiBank Group holds multiple Tier-1 licenses from regulators like ASIC and MAS, yet it carries a low WikiFX score of 2.54 due to a massive volume of recent complaints. Market data indicates severe risks regarding withdrawal refusals and profit deductions, particularly for clients onboarded under its offshore entities.

Quick Summary

MultiBank Group presents a confusing picture for investors. On the surface, it appears to be a global giant, established in 2012 with licenses from top-tier regulators like the Australian Securities & Investment Commission (ASIC) and the Monetary Authority of Singapore (MAS).

However, the safety data tells a different story. MultiBank Group currently holds a WikiFX Score of 2.54, which is considered High Risk. A score this low, despite having valid licenses, usually indicates severe operational issues. The primary reason for this low rating is an overwhelming number of negative reports: WikiFX has received over 615 complaints in just the last three months.

Key Takeaways

- Regulatory Gap: While top-tier licenses exist, many international clients are registered under offshore regulations (Vanuatu/BVI), which offer less protection.

- Withdrawal Crisis: The most common user report involves the inability to withdraw funds, with delays lasting months or even years.

- Profit Cancellations: Traders report that profits are frequently removed under the accusation of “bonus abuse” or “invalid trading methods.”

- Regulatory Warnings: European regulators like CNMV (Spain) and AMF (France) have issued warnings regarding unauthorized services associated with this group.

Is the License Real?

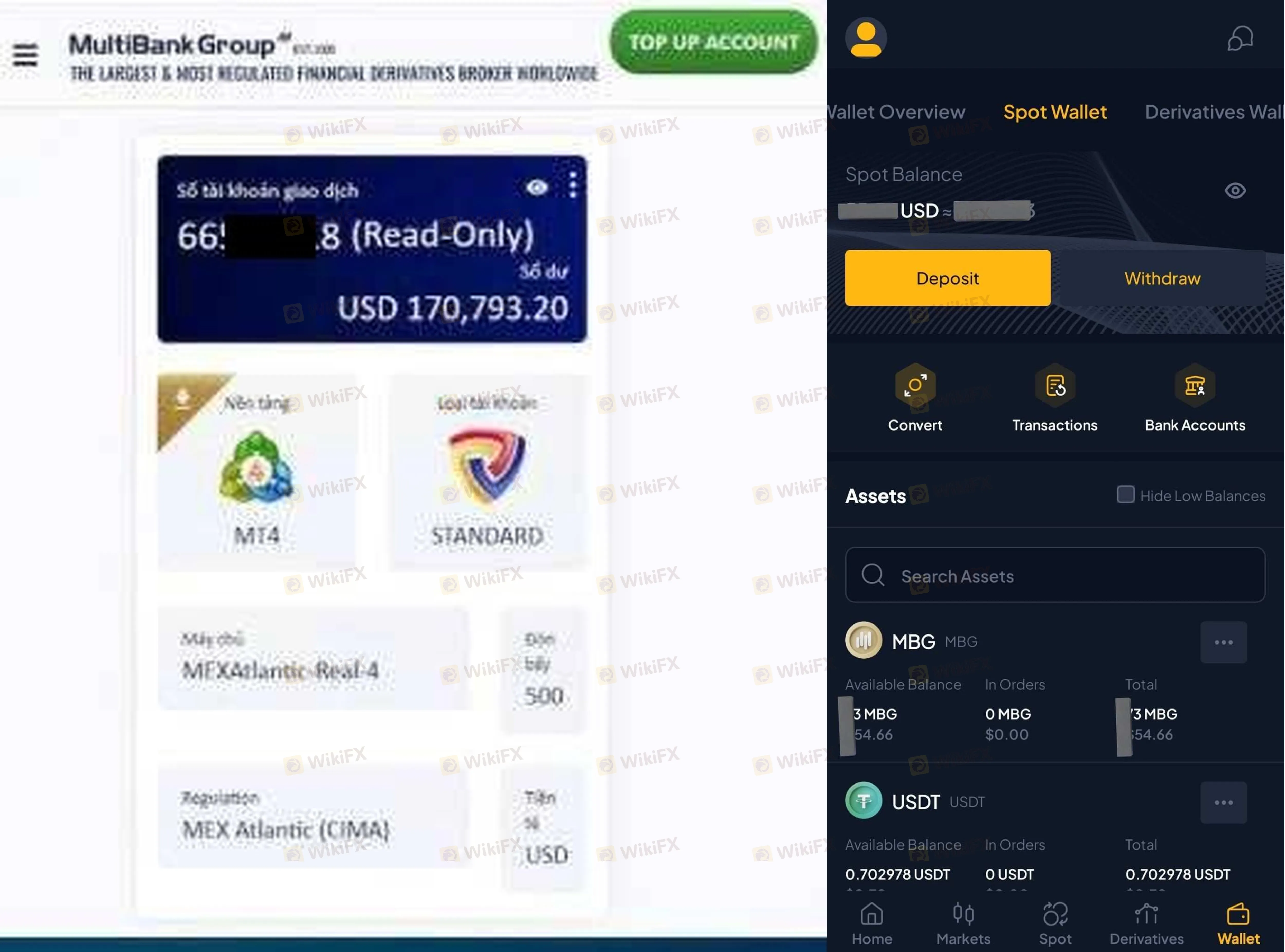

One of the most critical steps in verifying a broker is checking their regulatory status. MultiBank Group holds a mix of strong Tier-1 licenses and looser offshore licenses.

Regulatory Table

| Regulator | Country | License Type | Status |

|---|---|---|---|

| ASIC | Australia | MM (Market Maker) | Regulated |

| MAS | Singapore | Retail Forex | Regulated |

| CYSEC | Cyprus | MM (Market Maker) | Regulated |

| SCA / CMA | UAE | Retail Forex | Regulated |

| CIMA | Cayman Islands | STP | Offshore Regulated |

| FSC | British Virgin Islands | Retail Forex | Offshore Regulated |

| VFSC | Vanuatu | Retail Forex | Unverified / Offshore |

Why This Matters for You

If you are a resident of Australia or Singapore, you will likely fall under the protection of ASIC or MAS. These are strict regulators that ensure brokers segregate client funds.

However, most global investors (especially from Africa, Asia, and Latin America) are often onboarded through the Vanuatu (VFSC) or BVI (FSC) entities.

- The Risk: Offshore regulators generally have lower capital requirements and fewer rules about client compensation.

- The Warning: According to `wikifx_broker_content`, the broker has “Unverified” status on some offshore licenses. Furthermore, the CNMV in Spain and AMF in France have placed MultiBank domains on warning lists for providing investment services without proper local authorization.

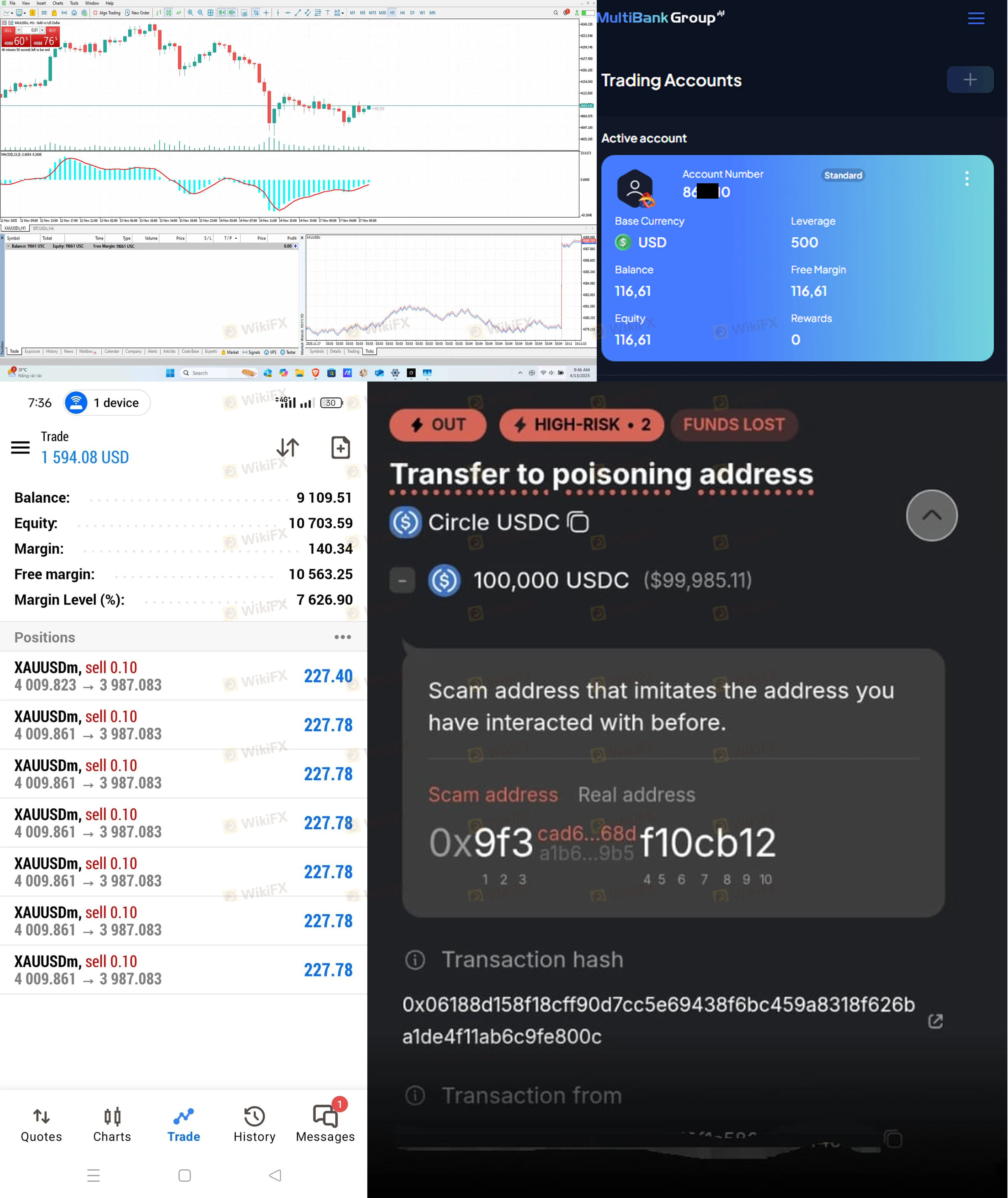

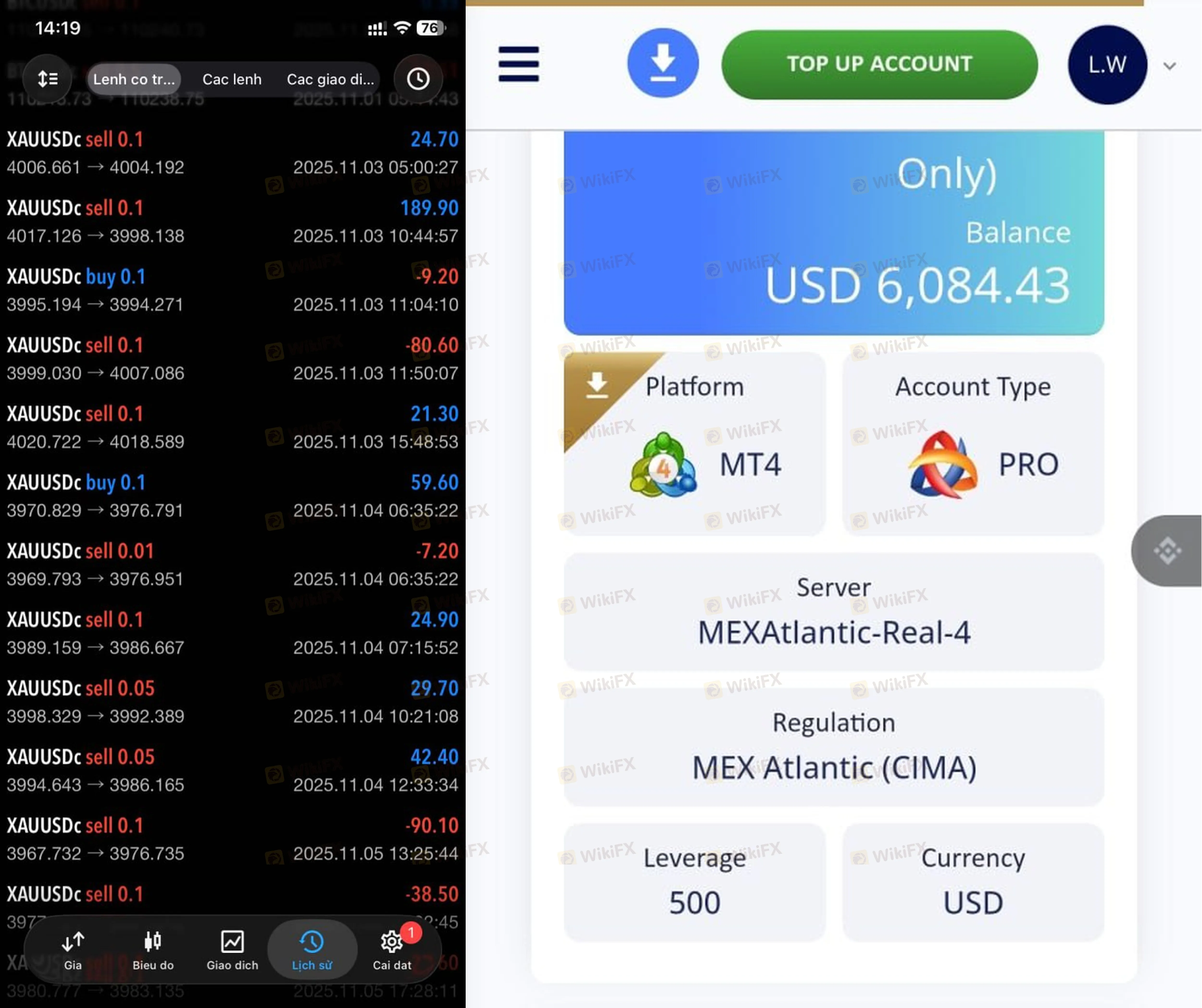

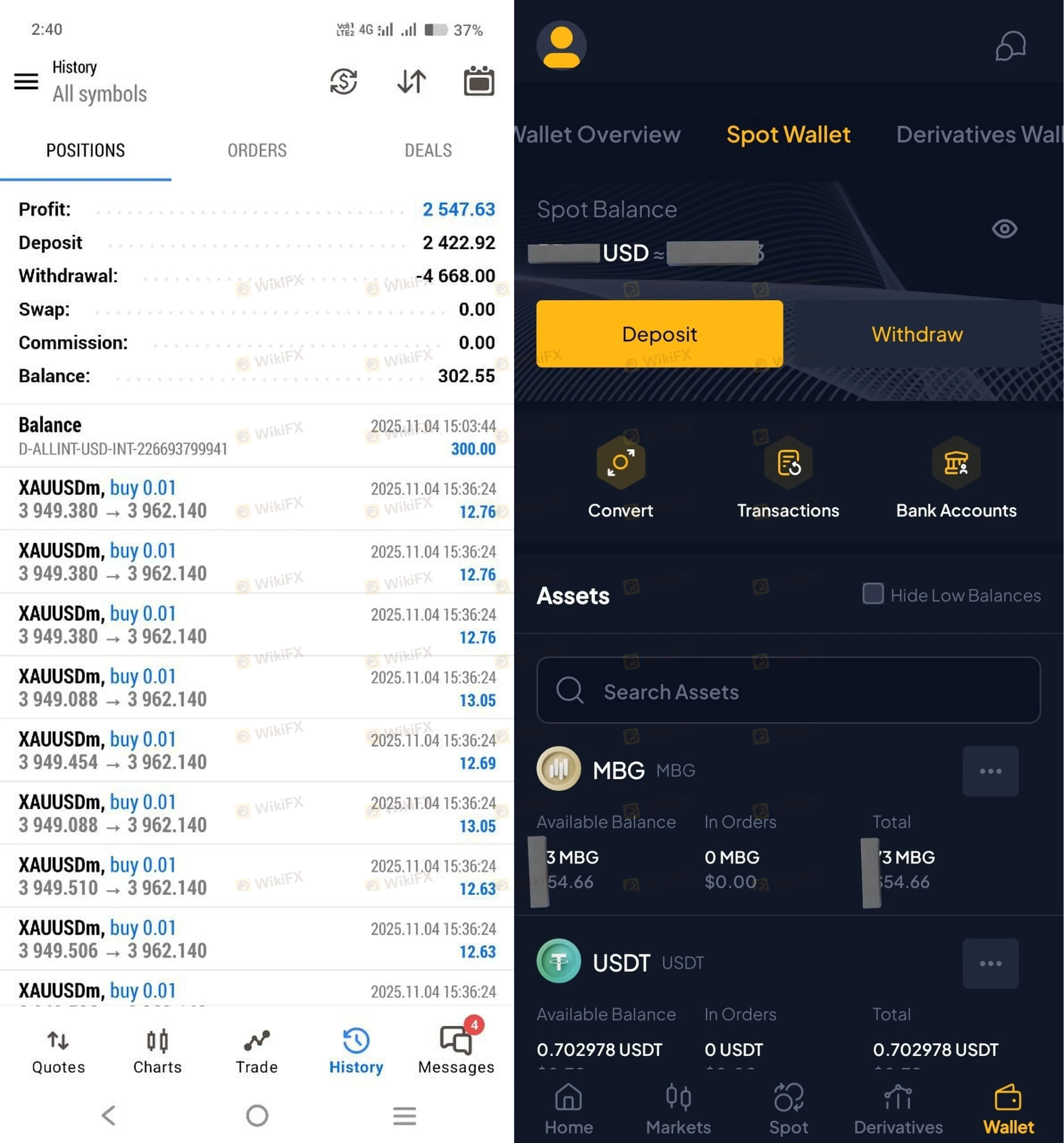

What Traders Say

We analyzed the review database (`casesText`) to understand the real-world experience of traders. The data reveals alarming patterns of operational failure.

1. The Withdrawal Blockade

The most persistent issue is the refusal to process withdrawals. This is not just a delay; many users report a complete freeze of their funds.

- Funds Locked Without Trading: In Case 4 and Case 5, users from Vietnam reported that they deposited funds but decided not to trade. When they attempted to withdraw their principal capital (e.g., $750), the requests were denied, and account managers ceased communication.

- Long-Term Delays:Case 22 from Hong Kong reports a user waiting two years for a withdrawal that has never arrived. Similarly, Case 26 describes a user facing a two-year delay with no resolution.

- Systemic Excuses: Users in Case 9 report that while depositing is instant, the withdrawal function is frequently disabled or rejected without valid reasons.

2. Profit Erasure and “Bonus Abuse”

Traders who manage to make a profit often face administrative barriers.

- Retroactive cancellation:Case 3 involves a client who traded with MultiBank for 6 years. After making a profit, the broker refused to pay, accusing the client of “gambling” and abusing a 20% bonus. The client argued that their trading style had not changed in 6 years.

- History Deletion:Case 7 alleges that the broker not only confiscates profits but also deletes the account's trading history to remove evidence of the winning trades.

3. Severe Execution Issues (Slippage)

Reliable execution is vital for safety, but reports suggest instability.

- 20-Second Latency: In Case 1, a trader reported a massive 20-second delay in closing a position, leading to severe losses. The broker's dealing desk allegedly called this “normal,” contradicting their claims of millisecond execution speeds.

- Forced Liquidation:Case 27 details an incident where the broker abruptly exited the Malaysia market, giving clients less than 14 days to close long-term positions, resulting in forced losses for investors holding maintaining positions.

Conclusion

MultiBank Group is a paradox. It holds some of the world's most prestigious licenses (ASIC, MAS), yet its operational behavior towards international clients mirrors that of an unregulated entity.

The evidence from WikiFX records is clear:

1. High Withdrawal Risk: There is a significant probability of facing delays or rejections when trying to access your funds.

2. Profit Risk: Profitable traders face scrutiny and potential profit invalidation based on vague “bonus abuse” clauses.

3. Customer Service Failure: Dozens of reports cite account managers who stop replying once a withdrawal is requested.

Final Verdict:

Despite its size and license portfolio, MultiBank Group currently poses a high risk to retail investors. The low score of 2.54 reflects serious unresolved disputes. We strongly advise using extreme caution. If you have funds in this broker, we recommend testing a withdrawal immediately to verify access to your capital.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Currency Calculator