简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

DBG Markets | Understanding Non-Farm Payrolls (NFP): Why It Matters and How to Trade It

Abstract:Understanding Non-Farm Payrolls (NFP): Why It Matters and How to Trade ItThe U.S. Non-Farm Payrolls (NFP) report is one of the most closely watched economic indicators in global financial markets. For

Understanding Non-Farm Payrolls (NFP): Why It Matters and How to Trade It

The U.S. Non-Farm Payrolls (NFP) report is one of the most closely watched economic indicators in global financial markets. For FX, gold, equity index, and bond traders, the NFP is often a key volatility catalyst that can redefine short-term momentum and, at times, broader market trends.

While many market participants are drawn to the trading opportunities created by NFP volatility, trading the report without understanding its macroeconomic role and policy implications can significantly increase risk. The NFP is not just a data release—it is a critical signal within the Federal Reserves policy framework.

This article explains what the NFP report is, why it matters to financial markets, and how traders can approach NFP trading with a more informed, structured, and professional mindset.

What Is the Non-Farm Payroll (NFP) Report?

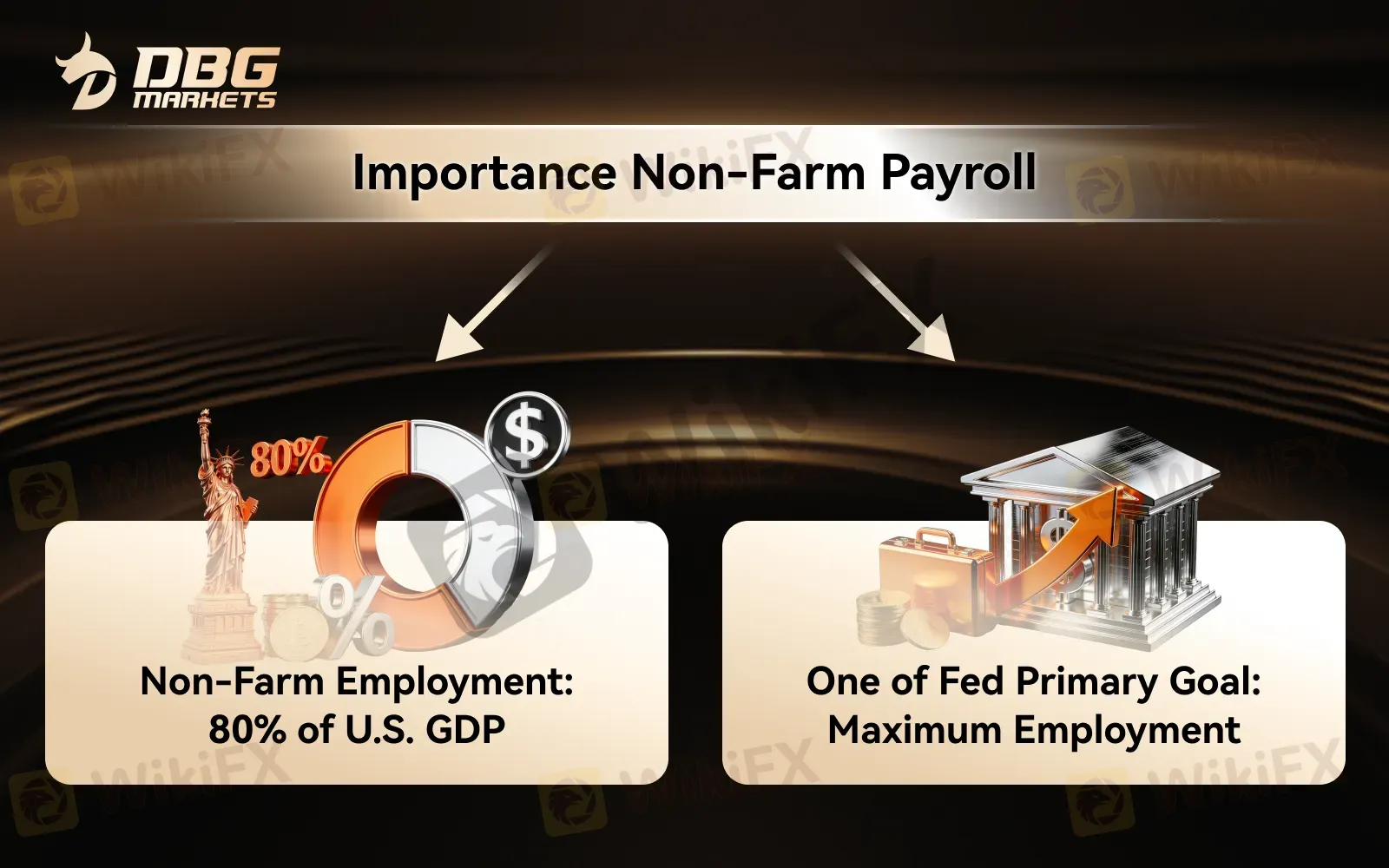

The Non-Farm Payrolls report, released monthly (typically on the first Friday of each month) by the U.S. Bureau of Labor Statistics (BLS), measures the net change in employment across approximately 80% of the U.S. workforce.

It excludes:

· Farm workers

· Private household employees

· Non-profit organization employees

Because of its broad coverage, the NFP is widely regarded as the most comprehensive snapshot of U.S. labor market conditions.

From a policy perspective, the NFP functions as a core reference point for the Federal Reserve, directly influencing expectations around interest rates. Since interest rate expectations are a primary driver of the U.S. Dollar (USD), the NFP often acts as a transmission mechanism between economic data and asset price movements.

Why the NFP Matters to Financial Markets

The importance of the NFP extends beyond the headline employment number. Its market impact is driven by two fundamental pillars: economic growth dynamics and monetary policy expectations.

1. Employment Drives Economic Growth

Employment growth underpins consumer spending, which accounts for roughly two-thirds of U.S. GDP. A strong labor market typically signals:

•Stable household income

•Resilient consumption

•Reduced near-term recession risk

Conversely, weakening job creation can act as an early warning indicator of slowing economic momentum—often before declines appear in corporate earnings or GDP data.

For analysts, investors, and traders, the NFP therefore serves as a forward-looking gauge of U.S. economic performance, not merely a backward-looking statistic.

2. Federal Reserves Policy Decisions

The NFPs second—and often more powerful—impact channel is through Federal Reserve monetary policy expectations.

The Fed operates under a dual mandate: Price stability and Maximum employment.

As such, labor market data—particularly the NFP—plays a central role in shaping policy decisions.

•Stronger-than-expected NFP data may signal economic resilience, reducing the urgency for rate cuts and supporting the U.S. dollar.

•Weaker-than-expected NFP results, especially when accompanied by rising unemployment or negative revisions, can reinforce expectations of policy easing—typically weighing on the USD while supporting assets such as gold and equities.

In this sense, the NFP often acts as a policy confirmation tool, validating or challenging existing market narratives.

How to Trade the NFP: A Strategic Approach

Despite its reputation as a high-impact trading event, successful NFP trading is not about reacting to a single number. A structured approach is essential.

1. Understand the Full NFP Report

The headline job changes figure captures attention, but it rarely tells the full story. Professional traders assess the entire employment report, including:

· Unemployment Rate A weaker job gain may be offset by a declining unemployment rate, altering the policy interpretation.

· Average Hourly Earnings This is a key proxy for wage inflation. Strong wage growth can keep inflation pressures elevated, potentially limiting the Feds ability to ease policy—even if job growth slows.

· Labor Force Participation Rate Changes here reveal whether employment strength is driven by genuine job creation or shifts in workforce participation.

Ignoring these components can lead to misreading the true policy signal embedded in the data.

2. Market Expectation, Not Just the Data

Markets trade on expectations and positioning, not data in isolation.

· A weaker-than-expected NFP does not automatically weaken the USD if markets were already positioned for a sharper slowdown.

· Similarly, a strong NFP may generate only a muted reaction if investors believe the Feds policy stance is already set.

Understanding consensus forecasts, positioning, and sentiment is critical to interpreting post-NFP price action.

3. Fed Expectations Define the Impact

The same NFP result can produce vastly different market reactions depending on where the Fed stands in the policy cycle.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator