Abstract:FXRoad Review 2026: Seychelles-registered broker offers CFDs on forex, stocks, crypto, commodities. Leverage up to 1:1200, spreads from 1.2 pips, TradingView platform. Min deposit 250 EUR unregulated.

FXRoad operates as a Seychelles-registered broker targeting traders with CFDs across forex, stocks, cryptocurrencies, and commodities. Questions persist about its safety given its offshore status and light regulatory touch. Traders weigh high leverage against reported hurdles like withdrawals.

FXRoad Company Background

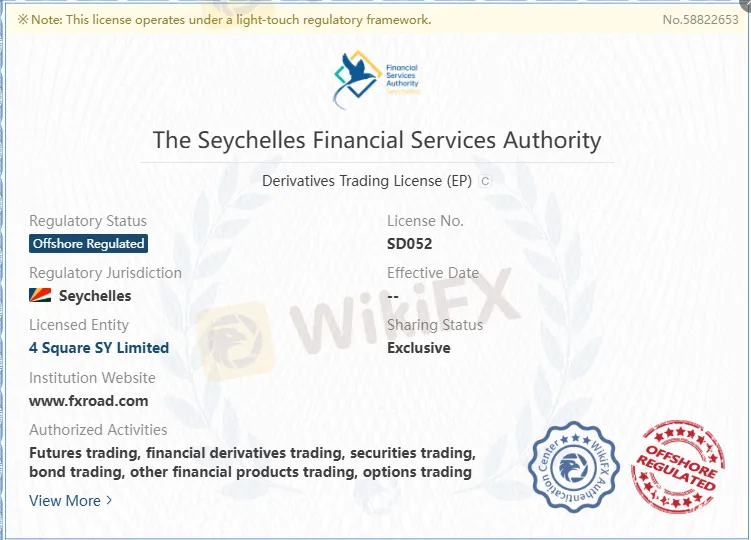

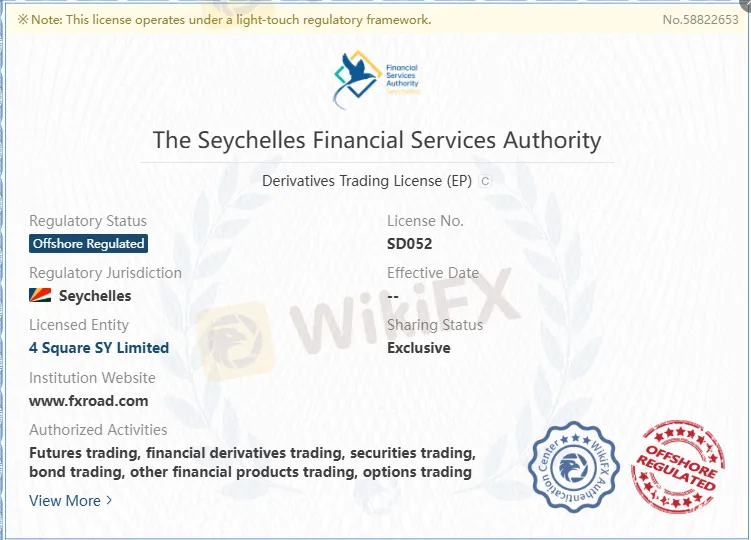

FXRoad emerged around 2023 as a trading firm based in Seychelles. The licensed entity, 4 Square SY Limited, holds Derivatives Trading License EP (No. SD052) from the Financial Services Authority (FSA). Registered at CT House, Office 9A, Providence, Mahe, its website, fxroad.com runs on server 172.67.69.100 with no ICP registration noted.

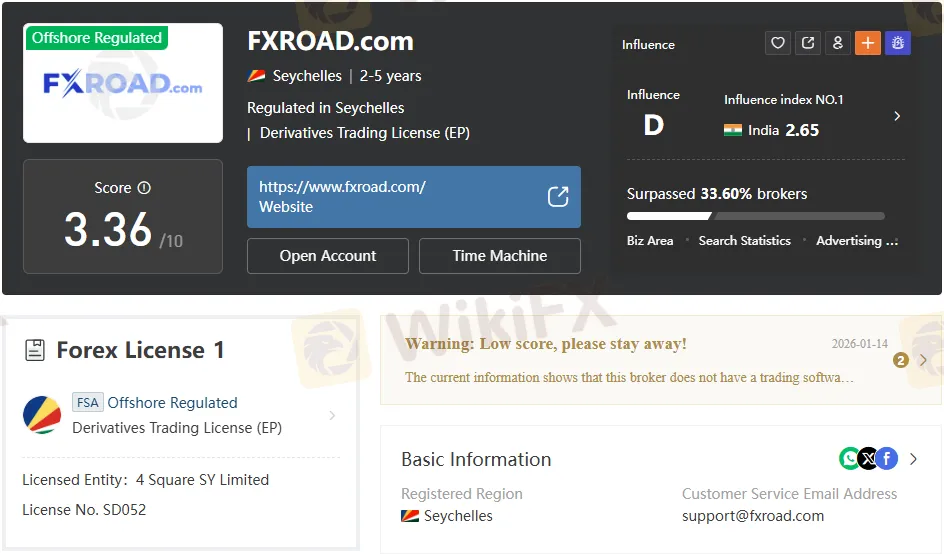

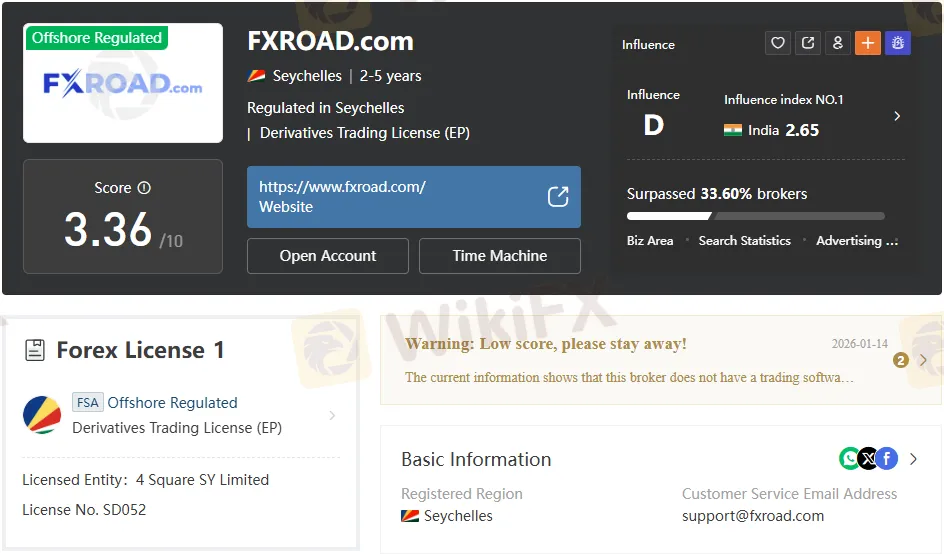

Domain details remain sparse, with traffic skewed toward the United States among top visitors. WikiFX assigns a score of 3.36 out of 10, flagging low influence and risks. No physical office verification appears, underscoring offshore opacity.

Comparisons to peers like FBS or Exness highlight FXRoads newer footprint—2-5 years old—versus established players with multi-jurisdiction licenses.

Regulatory Status Deep Dive

Seychelles FSA oversees FXRoad under a “light-touch” framework for derivatives, including forex, securities, bonds, options, and futures. This offshore regulation permits high leverage but lacks stringent client protections found in Tier-1 bodies like FCA or ASIC.

The license authorizes CFD trading yet draws warnings: WikiFX urges caution due to the score and absence of top platforms like MT4/MT5. No major enforcement actions surface, but the setup prioritizes broker flexibility over trader safeguards.

Versus regulated alternatives, FXRoad skips segregation mandates or compensation schemes, heightening fund risk.

Trading Instruments Offered

FXRoad provides CFDs on over 350 assets. Major currency pairs like EUR/USD anchor forex offerings, alongside shares from Netflix, Amazon, Tesla. Cryptocurrencies feature Bitcoin CFDs; commodities cover oil, gold.

Stocks span global top firms; extras include ETFs, bonds, indices per license scope. Demo accounts start with 100,000 virtual funds for testing.

Breadth rivals brokers like XM, but execution depends on variable spreads without fixed options noted.

Account Types Breakdown

Four accounts cater to varied traders: Silver, Gold, Platinum, Islamic. All share 1:1200 leverage, zero deposit commissions, no trading fees.

Silver suits beginners at 2.4-2.6 pips minimum spread. Gold targets intermediates from 1.8-2.0 pips. Platinum delivers for pros from 1.2-1.4 pips. Islamic avoids swaps, mirroring others in features.

Minimum deposit hits 250 EUR across types, higher than peers like IC Markets $200. Currencies limited to EUR/USD.

Trading Platforms Examined

Platforms include WebTrader, TradingView, FXRoad apps for iOS/Android. No MT4 or MT5 support limits expert advisors and automation.[1]

WebTrader enables browser-based access sans downloads, ideal for quick sessions. TradingView supplies advanced charts, indicators for analysis across assets. Mobile apps push notifications, full control on-the-go.

Beginners favor web options; pros miss MT5 depth compared to Pepperstone.

Fees and Spreads Analyzed

Variable spreads start at 1.2 pips (Platinum), no commissions. Leverage caps at 1:1200 boosts position sizes but amplify losses.

Deposits via Visa, MasterCard, Maestro, Apple Pay, Google Pay incur no broker fees—user covers provider costs. Minimum withdrawal 50 EUR, potential third-party charges apply.

Overnight swaps undisclosed; inactivity fees absent in docs. Tighter than average offshore but trails ECN brokers like FP Markets.

Deposits and Withdrawals Process

Fund accounts in EUR/USD matching base currency. Minimum 250 EUR via cards or e-wallets; contact support for changes.

Withdrawals minimum 50 EUR; process unspecified but user bears bank fees. Policy notes possible withdrawal charges per company rules.

One reviewer reported struggles withdrawing over 19,000 after profits/losses, calling it unpayable. No verified timelines; delays echo offshore norms.

Customer Support Evaluation

Support runs 05:00-18:00 GMT weekdays, 07:00-16:00 GMT weekends via live chat, form, email (support@fxroad.com). Phones: Brazil +55 61947565589, India +91 1171279109.

Social channels: Facebook, Instagram, Twitter, LinkedIn. Response quality unrated; regional lines aid non-English speakers.

Lags behind 24/7 global teams at AvaTrade, but weekend extension helps.

Restricted Regions Listed

Bans target USA, Canada, EU, Iran, Iraq, Syria, North Korea, Sudan. Focuses emerging markets like India, Brazil via localized support.

Compliance sidesteps strict zones, common for high-leverage offshore firms.

Pros and Cons Balanced

Pros:

- High 1:1200 leverage expands opportunities.

- Over 350 CFDs span forex, stocks, crypto, commodities.

- Tight spreads from 1.2 pips, no commissions.

- TradingView integration for charting.

- Demo with 100k virtual funds.

- Mobile apps for iOS/Android.

Cons:

- Offshore FSA license offers light oversight.

- No MT4/MT5 hampers advanced tools.

- 250 EUR min deposit exceeds many rivals.

- Withdrawal complaints surface, fees possible.

- Restricted in major markets like US/EU.

- Low WikiFX score signals caution.

User Experiences Spotlighted

Sparse reviews: One Indian Gold account holder exposed 19k withdrawal block post-profits/losses, advising avoidance. Positive note absent; exposure case from 2025.

WikiFX logs two reviews, mixed with warnings on software, oversight. Patterns mirror unregulated peers—profit ease, payout resistance.

FXRoad vs Competitors

FXRoad stacks against offshore like FBS (FSC Mauritius, 1:3000 leverage, $5 min dep) but trails in regulation strength. Exness (FCA-regulated) mandates lower leverage, adds protection.

Spread-wise, Platinum edges FBS raw accounts; platforms lag MT5 ubiquity.

Safety Concerns Investigated

High leverage pairs with unregulated status—FSAs EP license covers basics sans fund guarantees. Withdrawal exposure raises red flags; no scam convictions but low scores advise wariness.

Domain lacks age transparency; server US-hosted despite Seychelles base. Traders risk non-segregation, disputes in lax jurisdiction.

Mitigants: Demo access, multi-platforms; still, pros bypass for ASIC/FCA firms.

Bottom Line

FXRoad suits risk-tolerant traders chasing 1:1200 leverage and diverse CFDs from 1.2 pips, but offshore regulation and withdrawal reports undermine safety. Beginners avoid; experienced traders weigh against regulated peers.

Value hinges on tight spreads, TradingView—no match for MT5 or protections elsewhere. Proceed post-demo, small stakes only.