Abstract:For traders asking the important question, "Is FXPN safe and worth trying?", our research gives a clear and warning answer. After looking closely at its legal status, how it operates, and what users say, FXPN shows a high-risk situation that needs extreme care. We have gathered a quick summary to give you an immediate answer before you read the detailed results. The proof shows major warning signs that potential investors cannot ignore.

FXPN: A Quick Decision

For traders asking the important question, “Is FXPN safe and worth trying?”, our research gives a clear and warning answer. After looking closely at its legal status, how it operates, and what users say, FXPN shows a high-risk situation that needs extreme care. We have gathered a quick summary to give you an immediate answer before you read the detailed results. The proof shows major warning signs that potential investors cannot ignore.

Rules and Safety Problems

A broker's legal standing is the foundation of trader security. While FXPN, working under the name Leverate Capital Markets Limited Liability Company, has a Forex Trading License (No. 193295922) from the National Bank of the Republic of Belarus (NBRB), this single credential is heavily overshadowed by a series of alarming warning signs that question the broker's overall trustworthiness and safety.

The most serious issue is the broker's legal history in a top-level area. Our findings confirm that FXPN's Cyprus Market Making (MM) License has been taken away. A CySEC license is a gold standard in the retail trading industry, giving traders with significant protections, including investor compensation funds and strict operational oversight. A removal is not a minor problem; it means a serious failure to follow legal standards, often related to client fund handling, operational transparency, or business conduct. For a trader, this past failure removes a critical layer of trust and protection, suggesting the broker was unable or unwilling to operate under one of the world's more strict financial authorities.

This legal concern is made worse by physical verification failures. Field survey teams conducted on-site visits to addresses connected with FXPN and discovered a disturbing pattern:

· No Office Found in Belarus: Investigators visiting the registered address (223050 Minsk region, Kolodischi, Minskaya st. 69a-2, Office 34) found no physical presence for FXPN.

· No Office Found in Russia: Similar investigations into addresses linked to the broker in Russia also concluded with a “No Office Found” report.

· No Office Found in Cyprus: Despite its past connection to a CySEC license, field surveys in Cyprus also failed to locate a functioning office for FXPN.

The absence of a verifiable physical office in its country of registration, let alone in other claimed operational hubs, is a classic warning sign of a potentially untrustworthy operation. Legitimate financial service providers maintain real offices for administration, support, and compliance. The inability to verify FXPN's physical existence raises critical questions about its accountability and legitimacy.

Further analysis reveals additional warnings, including a “Suspicious Scope of Business” tag, which suggests the broker may be conducting activities beyond the permissions of its Belarusian license. Moreover, FXPN is connected with other low-scoring entities such as Leverate and Levelmax, pointing to a network of high-risk operations.

These differences between stated regulation and verifiable presence are why thorough checks are essential. Before considering any broker, we strongly advise cross-referencing their claims on an independent verification platform like WikiFX to see the full investigative report.

FXPN Pros and Cons

To provide a balanced perspective, we must weigh the broker's advertised features against the verified risks we have identified. While FXPN presents a standard set of offerings on paper, these potential benefits are severely undermined by critical operational and legal failings. This structured comparison makes the trade-off clear: the cons are not minor inconveniences but significant threats to trader safety.

Trading Conditions and Fees

Looking closely into the specific trading environment at FXPN reveals a mix of standard features, inconsistencies, and conditions that may not be competitive. It is crucial to evaluate these details not in isolation, but through the lens of the broker's high-risk profile.

Account Levels

FXPN offers a tiered account structure, supposedly to cater to different levels of traders. However, the entry barrier is notably high, and the information presented contains differences.

A significant warning sign is the conflicting data regarding the minimum deposit for the entry-level Silver account.

Spreads, Commissions, and Leverage

The cost of trading is a primary concern for any trader. FXPN's fee structure is not particularly competitive and suffers from a lack of clarity. The minimum spread for the basic Silver account is stated as 1 pip, which is within the industry average of around 1.0-1.5 pips. At the same time, the standard account offers a higher spread of 1.5 pips.

The commission structure is also unclear. The broker states “No commission” for CFD on foreign currency but applies a commission for stock CFDs (e.g., 0.5% for the Silver account). The lack of a comprehensive, transparent fee schedule for all instruments makes it difficult for traders to accurately calculate their potential trading costs.

The broker offers a leverage of up to 1:500.

Trading Platforms

FXPN provides access to two trading platforms:

· MetaTrader 4 (MT4): The industry-standard platform, known for its robust charting tools, support for expert advisors (EAs), and widespread popularity. It is available across desktop, web, iOS, and Android.

· SIRIX Web Trader: A web-based platform also available on iOS and Android.

The inclusion of MT4 is positive, as it provides a familiar and reliable trading interface. However, a notable omission is the MetaTrader 5 (MT5) platform. MT5 offers more advanced features, additional timeframes, and a wider range of order types, and its absence is a clear drawback for traders seeking the latest technology.

While these trading conditions might seem standard on the surface, they must be viewed in the context of the broker's overall risk profile. A trader can find similar or better conditions at brokers with verifiable safety records. Always check a broker's full profile and user reviews on a trusted platform, such as WikiFX, before depositing funds.

The Trader's Voice

Beyond legal data and advertised features, the collective experience of actual users provides valuable insight into a broker's real-world performance. We have combined reviews from the past few years to identify recurring themes in traders' interactions with FXPN. This social proof paints a compelling picture of the challenges users face.

Withdrawal and Support Failures

A primary concern for any trader is the ability to access their funds and receive timely support. Multiple reviews highlight significant problems in these areas. User “CC87,” in a review from mid-2024, described their experience as anything but smooth, citing “constant issues with withdrawals and unresponsive customer support.” This sentiment was echoed by user “善哉6447” in early 2023, who noted that “withdrawals take a long time.” These comments point to fundamental operational failures that directly impact a trader's capital and peace of mind. Delays in processing withdrawals and a lack of support are major warning signs that often come before more serious financial issues.

High Entry Barrier

A consistent complaint, particularly from those who considered the broker a few years ago, is the high barrier to entry. Multiple users from 2022, including “。94447,” “FX1038965397,” and “随心波,” all singled out the “$500” minimum deposit as “too high” and “unfriendly” for new traders. One user stated, “I can never relax about my money around them,” capturing the anxiety that a high initial investment with a questionable broker can cause. This feedback validates the data difference surrounding the minimum deposit and shows that, for many, FXPN is simply not an accessible or welcoming platform for those starting out.

Mixed Views on Trading

To maintain an objective view, it is important to acknowledge all feedback. A couple of users from 2022 had a more positive take on specific aspects. User “A九月九” found the transaction costs on their Silver account to be “reasonable,” and “Claire18709” called FXPN a “competent broker” despite its flaws, such as the lack of MT5 and low leverage. However, these isolated positive comments on trading costs are heavily outweighed by the more serious and more recent complaints regarding fund safety, withdrawals, and customer support—the core elements of a trustworthy brokerage relationship.

Conclusion: A Final Decision

After a thorough investigation into its legal status, operational integrity and user feedback, our conclusion on FXPN is clear and definite. This is a high-risk broker that traders should approach with extreme caution, if at all.

The critical findings—a snatched CySEC license from a top-tier regulator, a consistent failure to verify a physical office in three different countries, and a pattern of user complaints centered on withdrawal difficulties—are not minor issues. They are fundamental indicators of a potentially unsafe trading environment.

While FXPN offers the familiar MT4 platform and a standard range of tradable assets, these features are readily available at countless other brokers that do not carry the same heavy burden of warning signs. The benefits are entirely overshadowed by the significant and verifiable risks to your capital. The conflicting information on core conditions, such as minimum deposits and leverage, further erodes any confidence in the broker's transparency and professionalism.

In the online trading space, a broker's trustworthiness is most important. The evidence surrounding FXPN points to a high-risk environment where trader safety may be compromised. Before committing funds to *any* broker, we urge you to conduct your own independent investigation. Utilize comprehensive verification tools, such as WikiFX, to check its live legal status, read unfiltered user reviews, and view the results of on-site investigations. Your capital's safety should always be your number one priority.

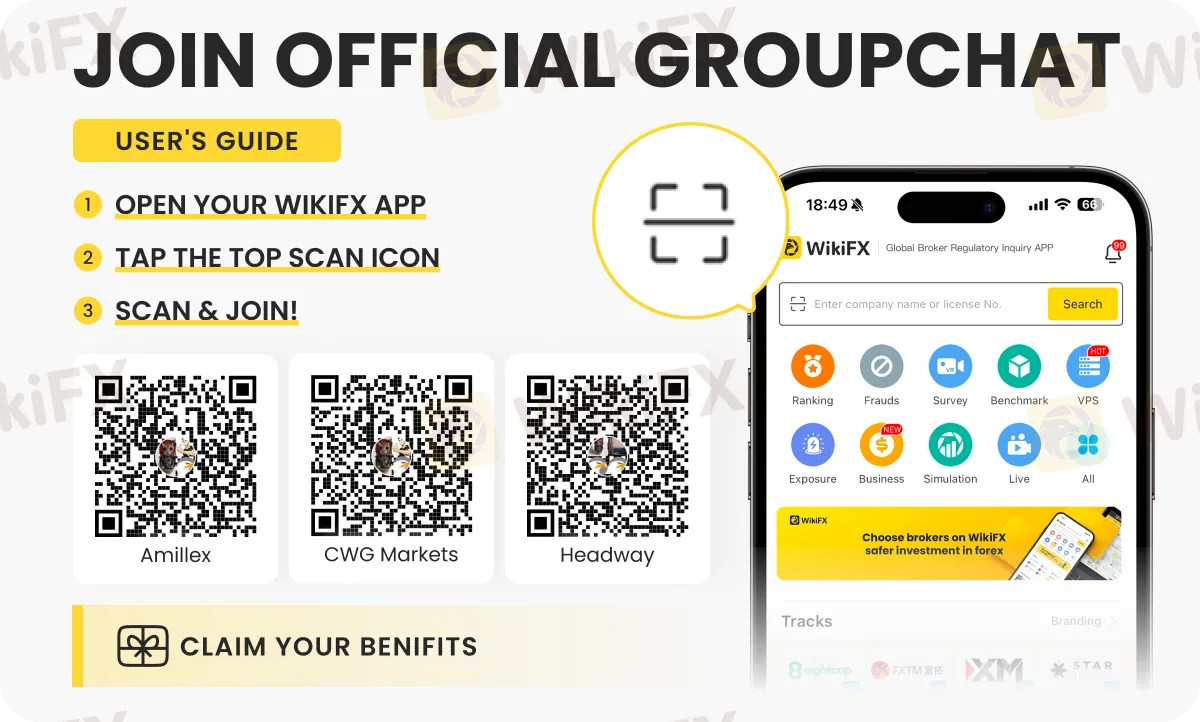

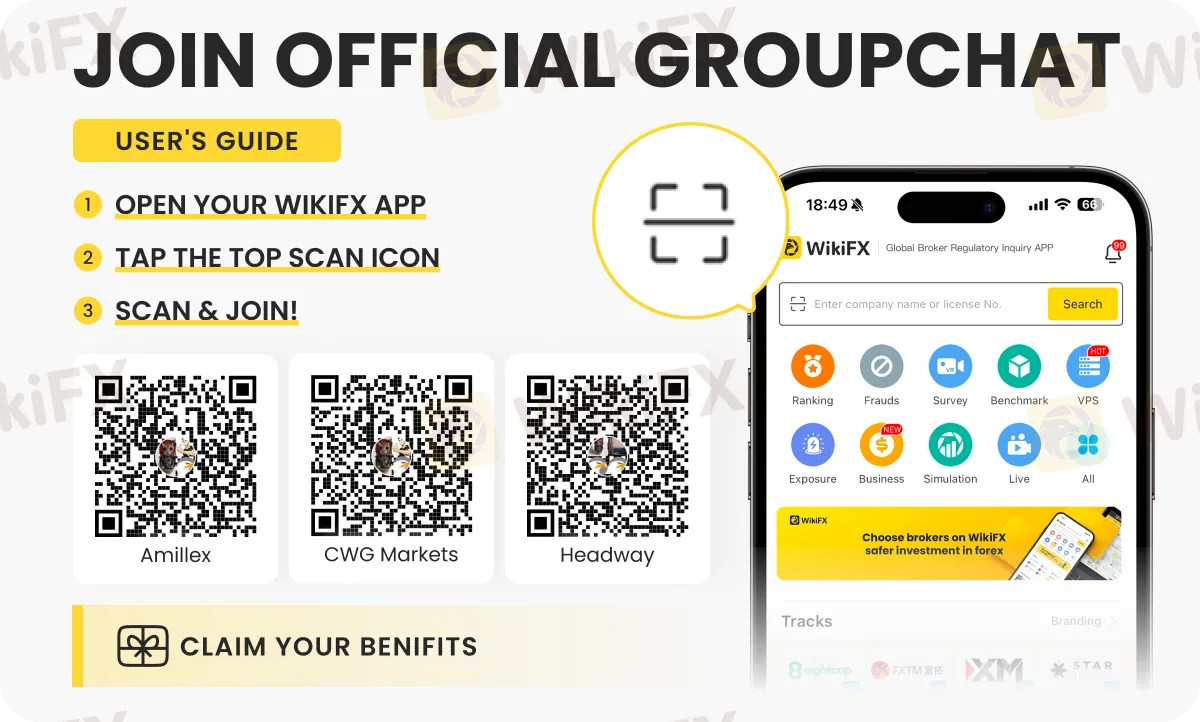

Want regular forex updates? Follow us on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - where experts share everything that helps shape your forex journey.