Abstract:When choosing a broker, traders usually focus on trading costs, software, and borrowing power. While these matter, they come second. The most important thing is whether the broker is properly regulated. This decides if your money is safe and if you can get help when problems happen. For IMPERIAL, whether it follows regulations is the first and most important thing you should know. This affects everything else the broker offers.

IMPERIAL offers trading features that look good on the surface, but it has a serious problem that cannot be ignored. Knowing this from the start is extremely important for keeping your capital safe.

Major Warning Sign: No Regulation

When choosing a broker, traders usually focus on trading costs, software, and borrowing power. While these matter, they come second. The most important thing is whether the broker is properly regulated. This decides if your money is safe and if you can get help when problems happen. For IMPERIAL, whether it follows regulations is the first and most important thing you should know. This affects everything else the broker offers.

IMPERIAL offers trading features that look good on the surface, but it has a serious problem that cannot be ignored. Knowing this from the start is extremely important for keeping your capital safe.

What You Must Know Right Away:

· Broker Name: IMPERIAL (run by Imperial Solutions Ltd)

· Where It's Registered: Saint Lucia

· Regulation Status: Not regulated

· Main Risk: You could lose all your capital with no way to get it back.

Good Points and Bad Points: A Careful Look

To understand what a trader might be considering, it is important to compare IMPERIAL's advertised features with its real risks. This quick comparison shows the big difference between what looks good and what is actually dangerous. The “Bad Points” list isn't just problems; these are serious warnings that should matter much more than any good features.

Breaking Down The Warning Signs

The red flags around IMPERIAL aren't small issues; they are major problems that directly affect your capitals safety. Making a smart decision thus requires understanding not just what these red flags are, but what they mean to you as a trader. This section explains the serious problems when trading with an offshore, unregulated company.

What “Not Regulated” Really Means

Regulation isn't just paperwork; it's a complete safety system for investors. When you choose an unregulated broker like IMPERIAL, registered in an offshore place like Saint Lucia, you are choosing to give up this protection. Here is exactly what you lose:

· No Separate Funds: Regulated brokers must keep client capital separate from their own business funds. Without this, IMPERIAL can mix your capital with theirs. If the company goes bankrupt, your fund is treated as company property and can be used to pay their debts. You become just another creditor with little chance of getting your funds back.

· No Fund Protection Program: Top countries have protection funds (like the FSCS in the UK or CySEC's ICF in Cyprus) that protect traders up to a certain amount if their broker fails. With an unregulated offshore broker, your capital is gone if it disappears. There is no safety net.

· No Official Problem Resolution: If you have trouble with withdrawing capital, trade problems or suspect price manipulation, you have no independent organization to help you. Your only option is the broker's own customer service, which has no reason to rule against itself.

· No Negative Balance Protection: Many regulated brokers must offer negative balance protection, making sure you cannot lose more than what you put in your account. Unregulated brokers often don't offer this, meaning a bad market move with high borrowing could leave you owing money to the broker.

The MT5 License Trick

A common confusion for new traders is the “MT5 Full License” label. IMPERIAL advertises this, and traders may wrongly think it means the company is legitimate or regulated. This is a dangerous mistake.

An MT5 license is a software license, bought from the software company, MetaQuotes. It is not a financial services license given by a government regulator. Any company, no matter how trustworthy or legal, can buy a license to use the MetaTrader platform. It is just a technology tool. Having this license is not a sign of a broker's financial stability, good practices, or regulatory compliance. Using this as a sign of safety is a serious mistake.

The First Step to Safety

Before you even look at the account types or trading costs of a broker like IMPERIAL, your first step should always be to check its regulatory claims. Not being regulated is a clear warning. We strongly suggest using a third-party checking tool like WikiFX to verify the detailed regulatory profile and any public warnings against a broker before moving forward.

Account Types and Conditions

While regulatory status is the most important factor, a detailed look at IMPERIAL's account structure and trading conditions shows how the broker tries to attract clients. This analysis is not an endorsement, but gives a complete picture of what it offers, always keeping in mind the extreme risk involved.

Account Levels Explained

IMPERIAL offers a four-level account system, which is common to separate clients by how much they deposit. However, the structure itself has red flags. The best trading conditions require a very high $10,000 minimum deposit. Trusting such a large amount to an unregulated company registered in Saint Lucia carries an extremely high level of risk.

The level system creates a problem for traders. The lower-level accounts (Micro, Standard) have relatively wide spreads, making profitable short-term trading harder. To get the advertised “from 0.1 pips” spread, a trader must deposit $10,000 and accept lower borrowing power of 1:100, all while taking the full risk of the broker's unregulated status.

Borrowing Power, Spreads and Fees

The maximum borrowing power of 1:400 offered on three of the four accounts is a powerful marketing tool. It lets traders control large positions with a small amount, increasing potential profits. However, it cuts both ways. For new traders, and even experienced ones, such high borrowing power can lead to fast and terrible losses, especially in volatile markets. Without regulatory oversight, there are no controls on how this borrowing power is marketed or whom it's offered to.

Also, the advertised low spreads need careful analysis. The Premium account's “from 0.1 pips” spread looks attractive. However, it comes with a $10 fee per standard lot traded. On a currency pair like EUR/USD, a $10 fee equals an additional 1 pip in spread cost. Therefore, the true cost is not 0.1 pips, but closer to 1.1 pips, which is much less competitive and similar to the fee-free Classic account.

Trading Options and Payments

IMPERIAL's product list is limited. It offers trading in Forex and Commodities but lacks other major asset types.

· Available: Forex, Commodities

· Not Available: Stocks, ETFs, Bonds

The broker accepts deposits and withdrawals through various methods, including e-wallets like Skrill and Neteller, cryptocurrencies, and bank transfers. While the variety of options provides flexibility, it's important to remember that with unregulated brokers, the most common problem is the withdrawal process. Delays, unexplained fees, or complete refusal to process withdrawals are frequent complaints against such companies. The ease of putting capital in is never a guarantee of the ease of taking it out.

The variety of account types and payment options can make a broker seem legitimate, but these are surface features. The true test of a broker is its honesty and regulatory standing. To see how IMPERIAL's offerings and, more importantly, its safety warnings compared to verified brokers, we recommend checking a comprehensive database like WikiFX.

User Reviews and Support

User reviews can give insight into a company's operations, but they must be read carefully and analytically, especially when dealing with offshore companies. The user feedback available for IMPERIAL presents a mixed and deeply troubling picture that needs careful examination.

A Group of Questionable Praise

On the surface, IMPERIAL has several positive reviews. However, a closer look reveals major red flags that question whether they are real.

· Impossible Dates: Several positive reviews are dated for later in 2025. As of early 2025, it's impossible for these reviews to be real. This is a major sign of fake or manipulated feedback designed to artificially boost the broker's reputation.

· Wrong Information: One glowing review from a user in South Africa clearly states IMPERIAL is a “Regulated broker.” This is factually wrong. Whether this is a deliberate lie by a fake reviewer or a genuine misunderstanding from a misinformed client, it is dangerously misleading to potential users trying to research the company.

· Vague Praise: Many positive comments use generic, overly enthusiastic language such as “lightning-fast,” “genuine broker,” and “top-notch service.” They often lack specific, verifiable details about trade execution, withdrawal times, or customer service interactions. This pattern is common in fake review campaigns.

The More Believable Voices

Hidden among the questionable praise are more realistic and believable comments. A neutral review from a user in the Philippines perfectly captures the primary worry of dealing with such a broker. They state, *“I don't know if my funds can be withdrawn quickly. You know, many people say offshore brokers are not that safe.”* This feeling is much more realistic and valuable than the group of generic praise. It reflects a genuine and well-founded concern that every potential user should share.

Even a positive review from a user in Singapore contains a warning, mentioning that when they had a problem, the support “response was not good.” This small detail is telling, as it shows that even in a seemingly positive experience, service failures are present.

Some User Feedback Screenshots

A Final Believability Check

The combination of fake reviews with impossible dates, factually wrong claims, and vague praise, mixed with genuinely concerned user comments, makes the body of user feedback for IMPERIAL an unreliable and confusing source of information. It's impossible to trust this feedback alone to make a safe decision. This is exactly why an independent, combined source is essential. Before exposing your capital, we urge you to visit WikiFX to read verified user feedback and check for official complaints against IMPERIAL.

Final Decision: Stay Away

While IMPERIAL markets itself with features like the MT5 platform, different accounts, and high borrowing power, these are a thin cover over unacceptable risk. These features are easily available from hundreds of reputable, well-regulated brokers who also provide the essential protections that IMPERIAL lacks.

The broker's unregulated status, its offshore registration in a weak jurisdiction like Saint Lucia, the misleading “MT5 license” badge, and many suspicious user reviews combine to paint a clear picture. This is a company that operates outside the established systems designed to protect traders. Working with such a broker exposes your money to a level of risk that simply cannot be justified.

Our final decision is clear: We cannot recommend IMPERIAL. The risk of losing money is extremely high, and traders should stay away.

Protecting your investment is the most important part of trading. A few pips saved on trading costs mean nothing if your entire investment is at risk. Always put safety and regulation first over tempting but empty offers. Before working with any broker, do your research on a trusted, independent platform.

You can verify the regulatory status and review user alerts for thousands of brokers by visiting WikiFX.

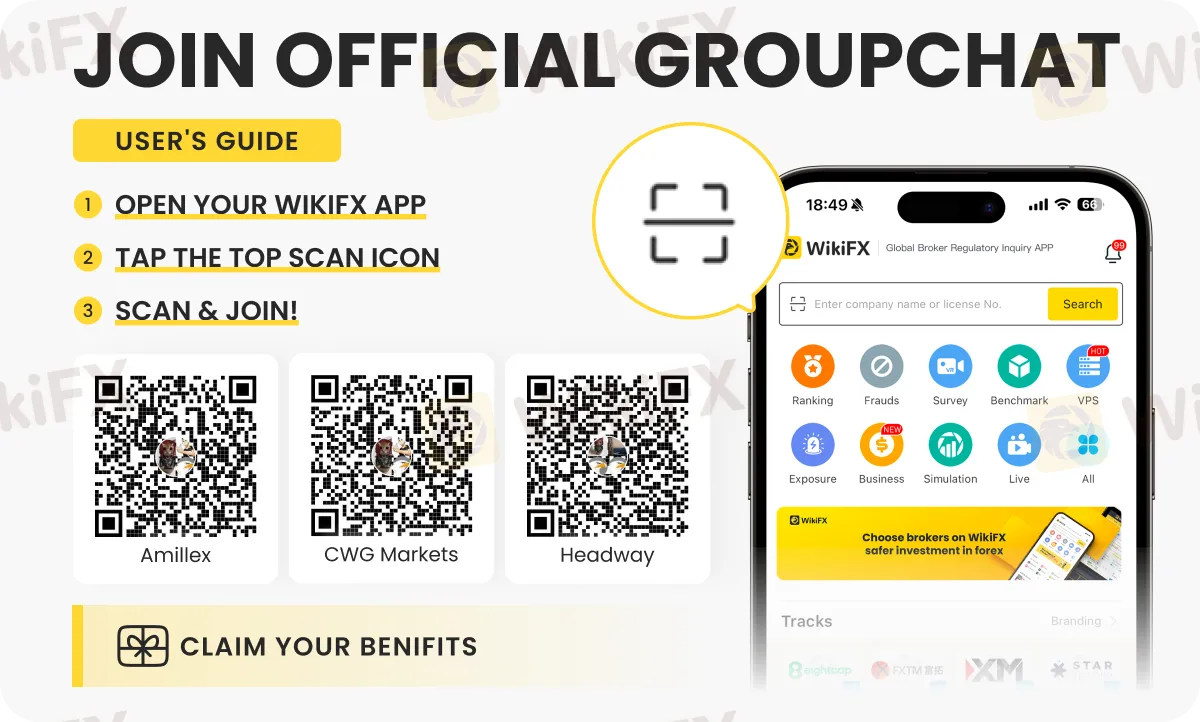

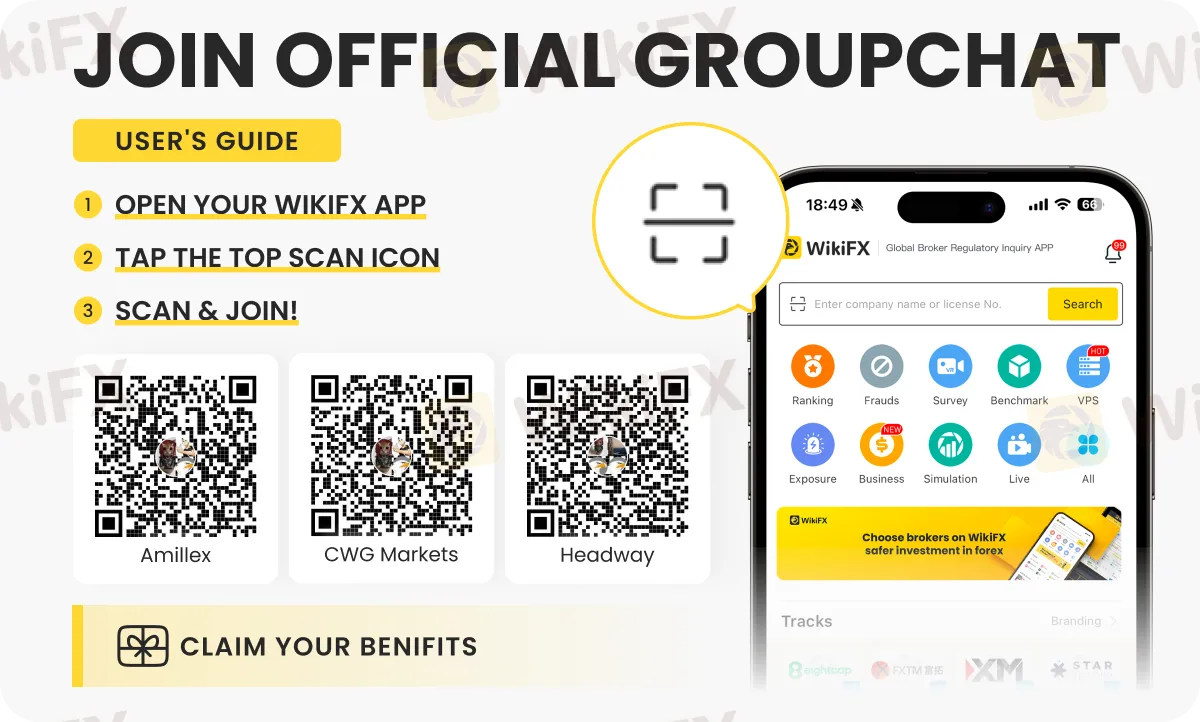

For regular updates on forex brokers, visit our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.