HIJA MARKETS Scam Alert: Forex Trading & Investment Risk

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

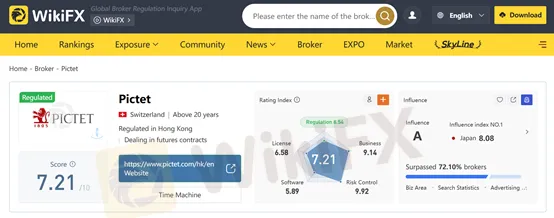

Abstract:When evaluating financial service providers, trust, regulation, and transparency are key. In this review, we examine Pictet — a well-known Swiss financial institution — and assess whether it is legitimate or a scam, highlight its core services, and compare it with other brokers in the market.

When evaluating financial service providers, trust, regulation, and transparency are key. In this review, we examine Pictet — a well-known Swiss financial institution — and assess whether it is legitimate or a scam, highlight its core services, and compare it with other brokers in the market.

Pictet is a Swiss investment firm and private bank established in 1805, with a long history of wealth management and asset services. It operates globally with offices in Europe, Asia, the Americas, and the Middle East. https://www.wikifx.com/en/survey/8794408d6e.html

The companys core offerings include:

Pictet is structured as a partnership, meaning it is privately owned by its managing partners rather than external shareholders, which the firm says allows for long-term focus rather than short-term profit pressures.

| Feature | Pictet | Interactive Brokers | Saxo Bank | eToro |

| Business Type | Private bank & wealth manager | Online multi-asset broker | Investment bank & broker | Social trading platform |

| Target Clients | High-net-worth & institutional | Retail & professional traders | Retail & professional | Retail traders |

| Regulation | FINMA (Switzerland), SFC (Hong Kong) | SEC, FINRA, FCA, ASIC | FCA, FINMA, MAS | FCA, CySEC |

| Minimum Deposit | High (often six-figure USD) | Low (no fixed minimum) | Medium | Low |

| Trading Style | Advisory & discretionary | Self-directed | Self-directed & advisory | Self-directed & copy trading |

| Asset Classes | Wealth, asset management, alternatives | Stocks, forex, options, futures | Stocks, forex, CFDs | Stocks, crypto, CFDs |

| Fee Structure | Management & advisory fees | Low commissions | Tiered commissions | Spread-based |

| Suitable for Beginners | ❌ No | ⚠️ Medium | ⚠️ Medium | ✅ Yes |

Short answer: No — Pictet itself is not a scam.

Pictet is a legitimate and regulated financial institution:

Regulation & Licensing

This level of oversight from established regulators like FINMA and the SFC indicates that Pictet operates under strict compliance standards, with requirements for capital adequacy, governance, and client asset protection.

Scam Warnings to Be Aware Of

There have been scam operations impersonating Pictet (e.g., “Pictet Private Wealth Management” clone firms), which are unauthorized and should not be trusted. These scams often lack regulation, office addresses, or legitimate contact information.

Key takeaway:

The genuine Pictet Group is credible and regulated.

Be cautious of fake firms using the Pictet name without proper licensing.

1️. Wealth Management

Pictets wealth management division focuses on high-net-worth individuals and families, offering tailored strategies for wealth preservation, growth, and succession planning. They emphasize bespoke solutions over product-led sales.

2️. Asset Management

The firm provides diversified investment solutions for institutional and private investors, from traditional equities and bonds to complex multi-asset portfolios.

3️. Alternative Investments

Pictet has a dedicated alternative investment platform that includes private equity, real estate investment, hedge funds, and private debt strategies.

4️. Asset Services

Through its asset servicing arm, the group supports fund administration, custody, and related services across global markets.

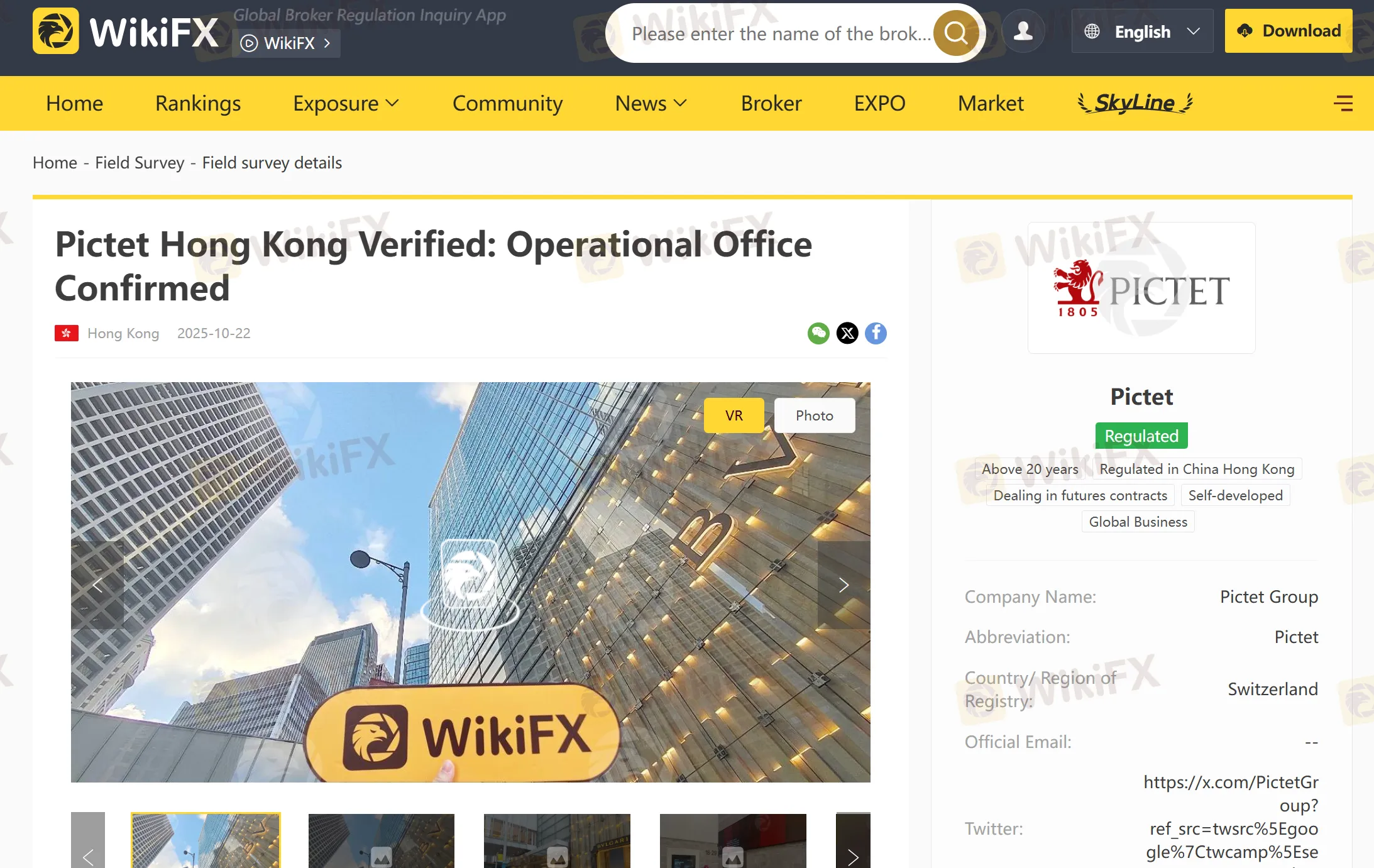

WikiFX has sent a investigation team to make an on-site survey. The on-site inspection team visited the forex broker Pictet in Hong Kong, China as planned. According to public information, its office address is 8-9/F, Chater House, 8 Connaught Road Central, Central, Hong Kong. The company name and other information were visible at the location, confirming the existence of a genuine business premises.

| Pros | Cons |

| Long-standing history (over 200+ years) and strong global reputation. | High fees for bespoke wealth management and alternative investments. |

| Regulated in Switzerland (FINMA) and Hong Kong (SFC). | Not designed for retail self-directed traders or online forex trading. |

| Diverse services for affluent and institutional clients. | Limited transparency on service fees for the general public. |

| Emphasis on sustainability and responsible investing across portfolios. | Scam clones can confuse potential clients — caution required. |

Pictet is Legitimate:

Not Suitable for Everyone:

Avoid Scam Clones:

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

HIJA MARKETS is unregulated and unsafe. This scam alert exposes the risks of forex trading & investment—read now to protect your funds today.

When you look up things like "Is Vida Markets Legit" or "Vida Markets Scam", you're asking an important question that affects your capital's safety. You need a clear, fact-based answer to figure out if this company can be trusted with your capital or if it might be risky. This article gives you a complete check on whether Vida Markets is legitimate. We won't just repeat its advertising claims or random opinions. Instead, we'll do a deep investigation using facts we can prove, including whether it is properly regulated, its business history, real complaints from users, and reports from people who checked its offices. Our goal is to give you the facts clearly so you can make a smart and safe choice.

Picking a broker is one of the most important choices a trader can make. Beyond costs and trading platforms, the main protection for a trader's capital is the broker's regulatory status. A careful check of licenses, company registrations, and compliance history is not just smart; it is necessary. When it comes to Vida Markets, our review of public information shows major regulatory warning signs and a high-risk profile that should make any potential investor very careful. The main question of whether Vida Markets is a safe and regulated company is complicated, with an answer that points strongly toward a negative result. The broker's business structure is a mix of offshore registration, a license being used beyond its legal limits, and a recently canceled license from another country. This is made worse by an extremely low WikiFX score of 2.16 out of 10, a number that serves as an immediate and clear warning. Also, many serious user complaints create a worrying picture of the real tra

This 2026 Vida Markets review gives you a complete, fact-based look at this broker to answer one important question: Is this broker safe for traders? We looked at public information, government records, and many user reports to give you a clear and fair assessment. The most important finding is that this broker has an extremely low trust score of 2.16 out of 10 from WikiFX, a global financial regulation inquiry app. This score comes with a clear warning: "Low score, please stay away!" This poor rating isn't random - it emerges from serious problems with regulations, including a canceled license, and many customer complaints. These complaints claim serious wrongdoing related to keeping funds safe, canceling profits, and unfair trading practices. This review will break down these warning signs in detail, giving you the information you need to make a smart decision about your capital's safety.