简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MTB Capitals Review: Regulatory Warnings and Indications of Identity Fraud

Abstract:MTB Capitals displays major regulatory logos, yet WikiFX rates it 1.08/10. Investigations reveal official warnings from BaFin regarding identity fraud and alerts from CySEC.

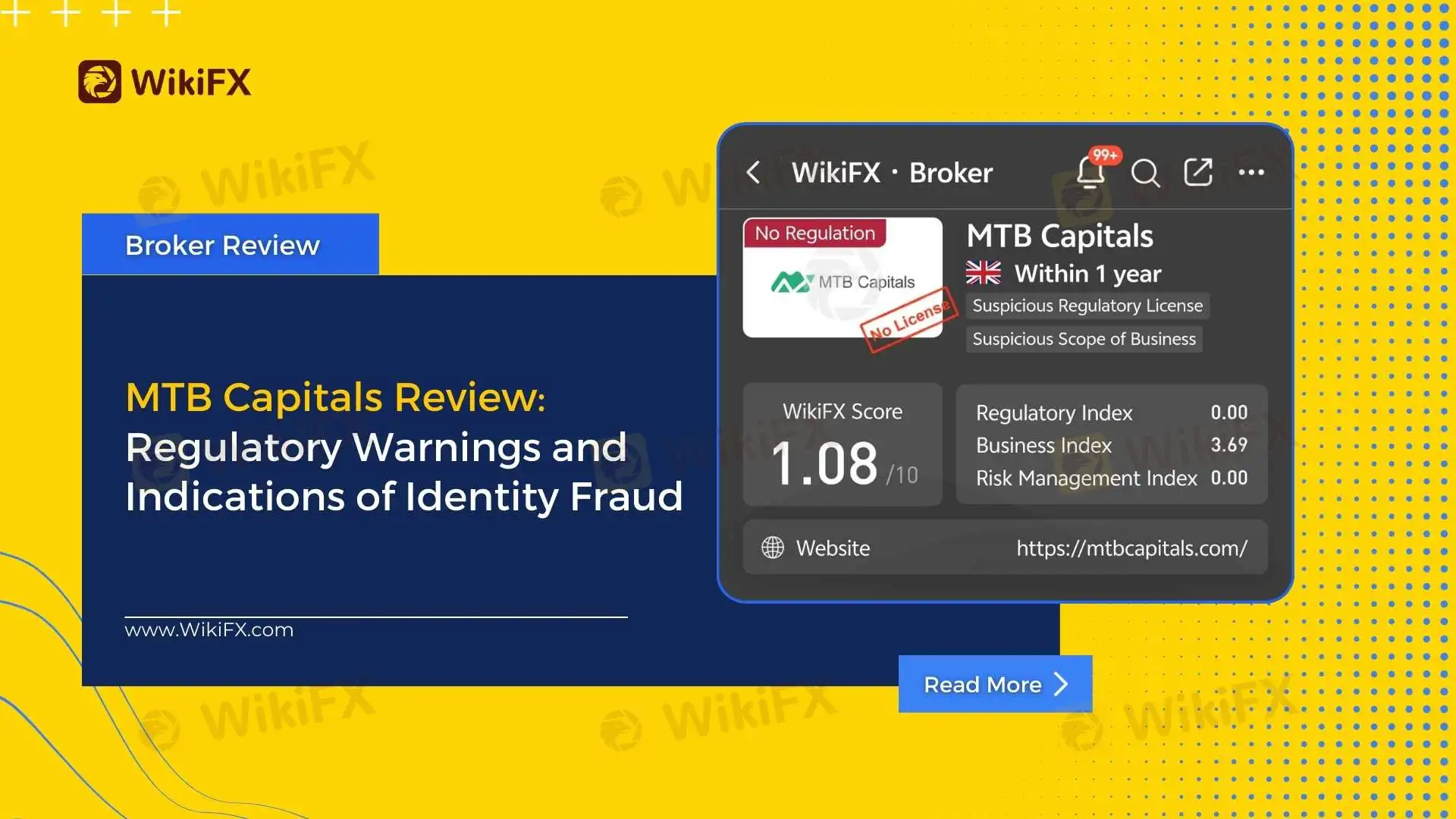

Risk Detection and System Rating

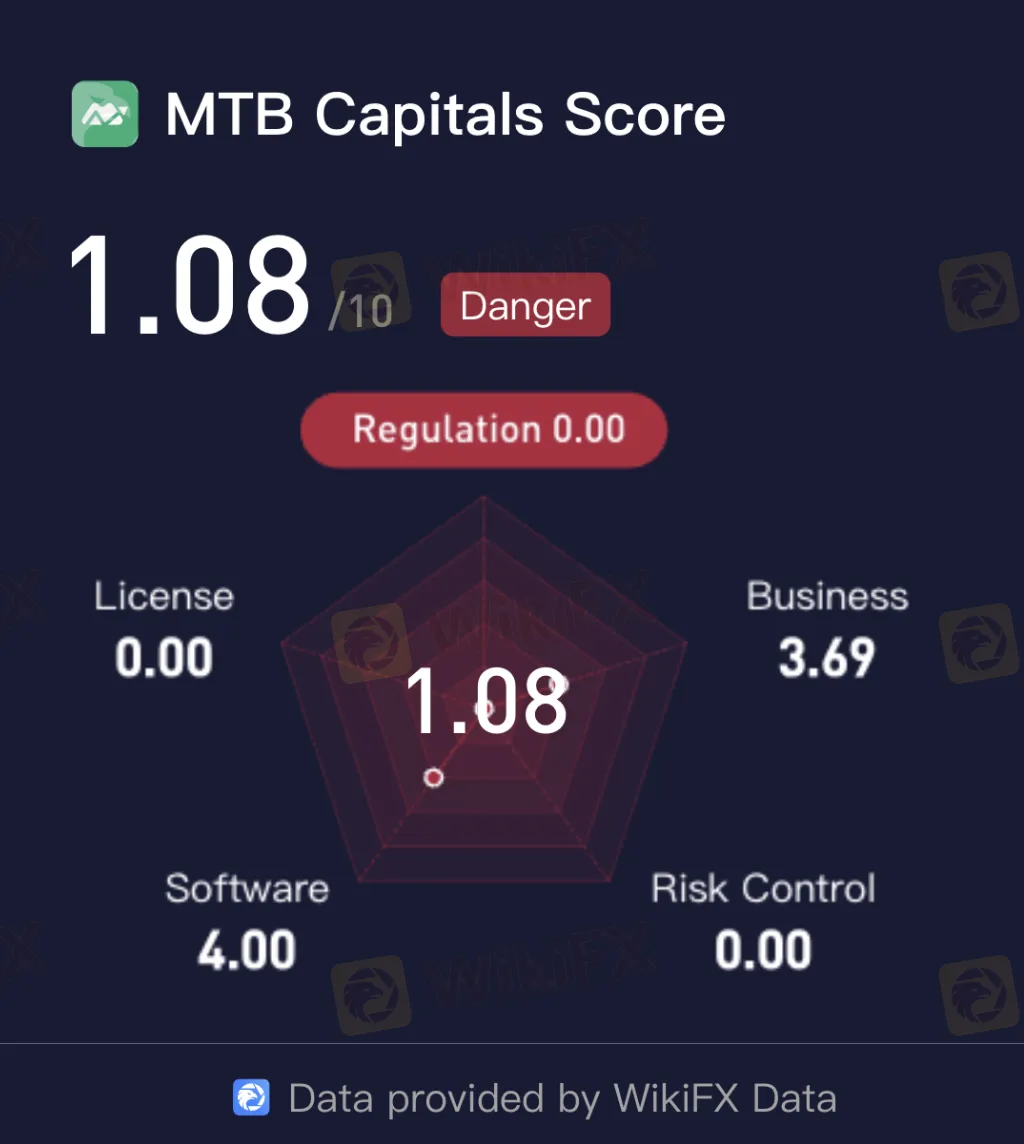

According to the latest assessment by WikiFX, MTB Capitals (mtbcapitals.com) has been assigned a comprehensive score of 1.08 out of 10. This low rating places the broker in the “Danger” category, reflecting a lack of verified compliance data.

The system shows scores of 0.00 across the Regulation, License, and Risk Control indices. Furthermore, technical analysis indicates that the broker does not currently possess functional trading software. This absence of a trading terminal is often a critical indicator regarding the operational legitimacy of an entity soliciting funds.

Discrepancies in Regulatory Claims

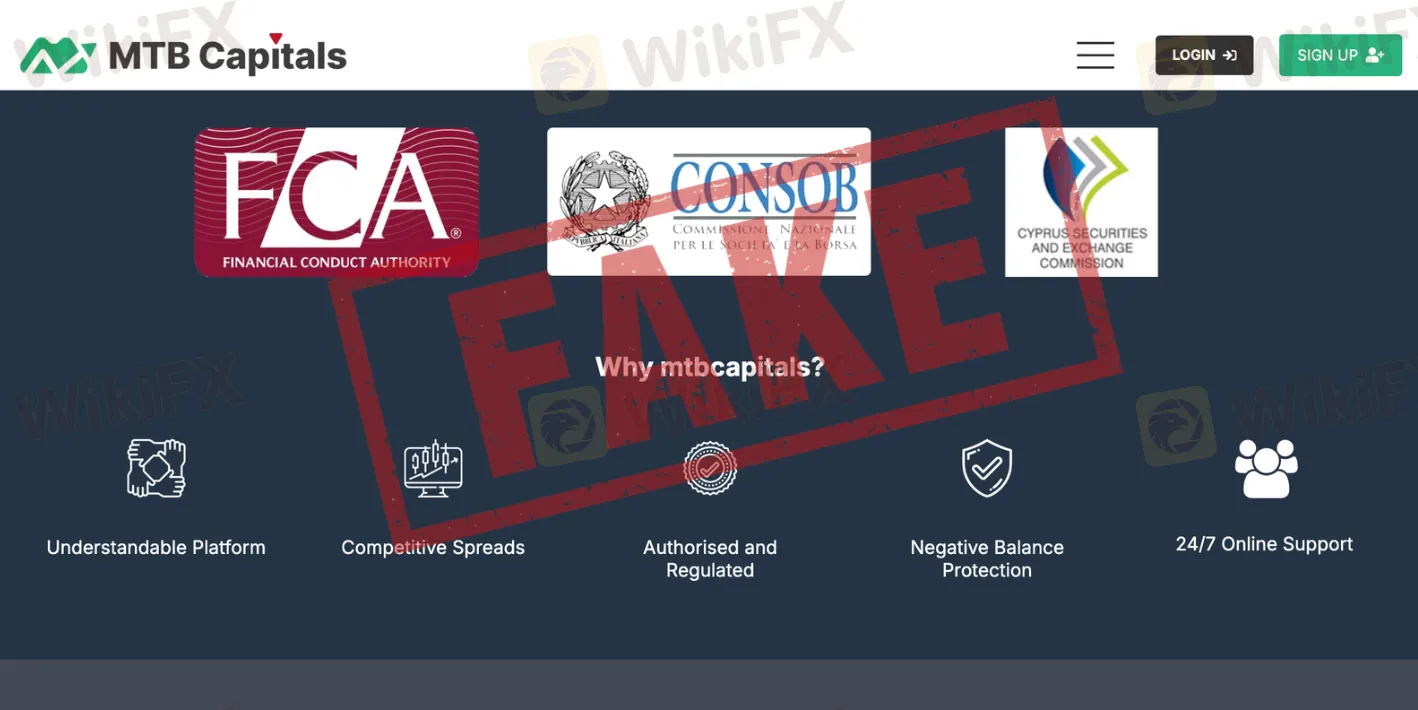

A review of the MTB Capitals website reveals significant inconsistencies between its claims and its actual regulatory status. The homepage prominently displays the logos of three top-tier financial authorities: the UK's FCA, Italy's CONSOB, and Cyprus's CySEC.

However, cross-referencing these claims with WikiFX data shows that the broker holds no valid forex regulation. The display of these logos appears to be intended to project an image of compliance that does not align with the broker's actual legal standing.

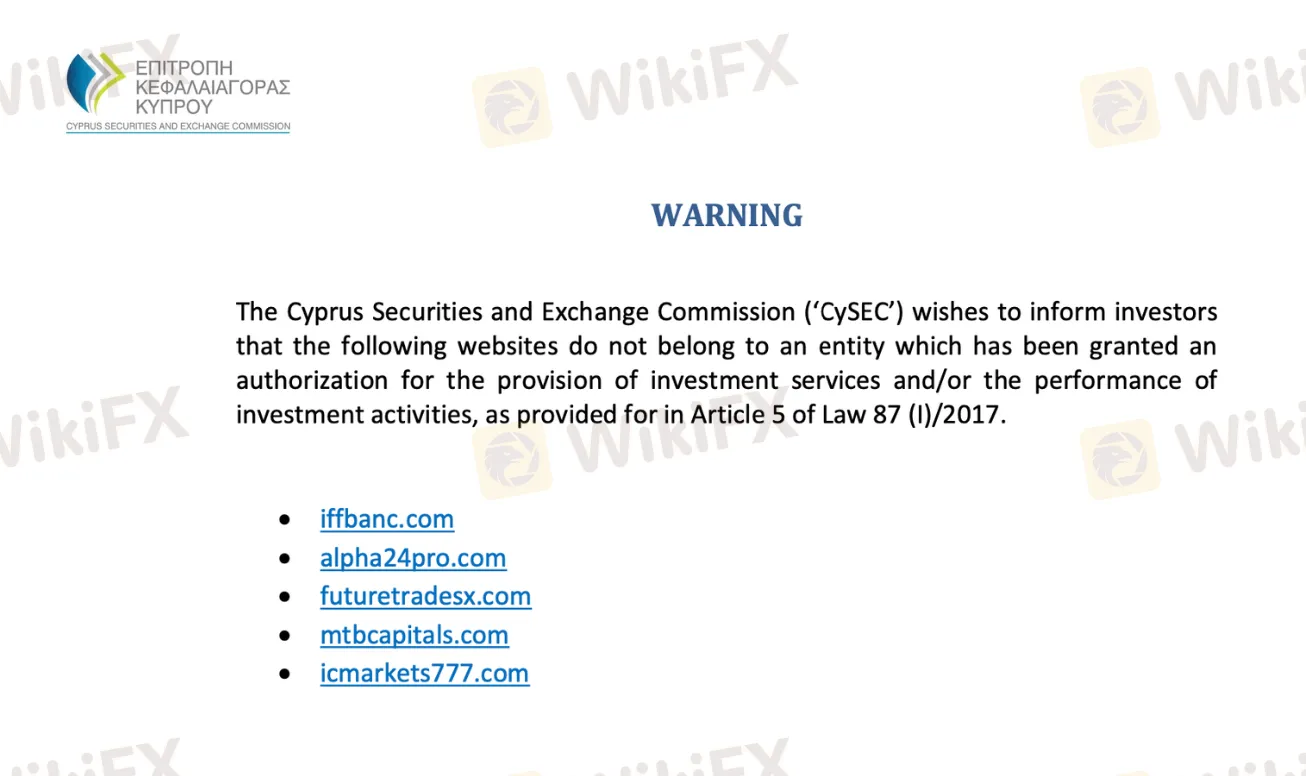

Regulatory Actions by BaFin and CySEC

European financial authorities have issued specific warnings regarding this entity, though the nature of their alerts differs.

The German Federal Financial Supervisory Authority (BaFin) has explicitly flagged the operator of mtbcapitals(.)comfor identity fraud. In its release dated November 4, 2025, BaFin stated that the site is using the details of a legitimate, authorized company—Asset Finance Solutions (UK) Ltd—without permission. This tactic involves misappropriating the license number and address of a regulated firm to mislead investors.

Separately, the Cyprus Securities and Exchange Commission (CySEC) has included mtbcapitals.com in its warning list of websites that do not belong to an authorized entity. While CySEC focuses on the lack of authorization, BaFin provides the specific context regarding the impersonation of a legitimate business.

Inconsistent Branding and Digital Identity

Further analysis of the broker's digital footprint reveals visual discrepancies that raise questions about its operational continuity. Search engine results for the brand display a specific logo icon that does not match the branding currently present on the website's header.

Such inconsistencies are uncharacteristic of established financial institutions, which typically maintain strict brand uniformity. In the context of unregulated entities, mismatched assets often suggest that the operators may be recycling website templates or frequently changing “skins” to evade detection, neglecting to update external metadata in the process.

Incomplete Legal Documentation

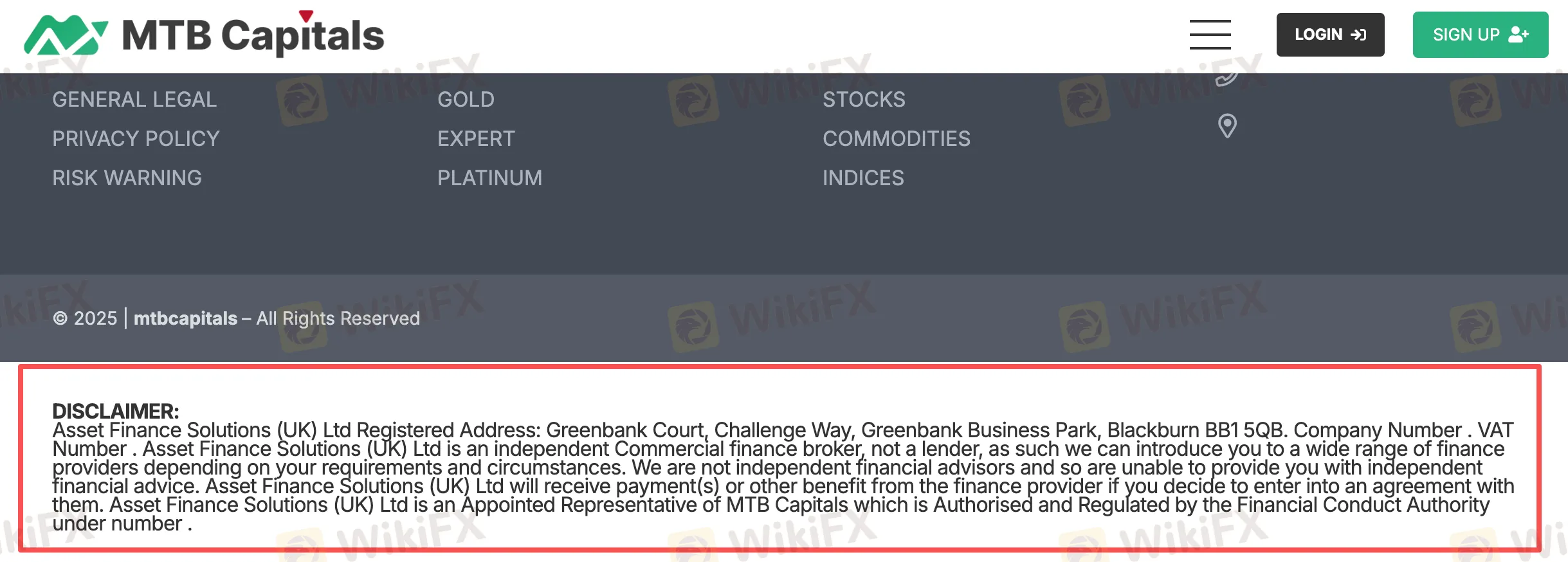

Further examination of the website's footer suggests a lack of professional oversight in the platform's setup. The disclaimer section identifies the operator as “Asset Finance Solutions (UK) Ltd”—the company BaFin confirmed is being impersonated—but fails to provide the corresponding legal identifiers.

As shown in the screenshot above, the text reads “Company Number .” and “VAT Number .”, with the actual registration digits missing. This omission indicates that the legal text may have been copied from a template or another source without being properly finalized.

Conclusion

The WikiFX system has assigned MTB Capitals a low score of 1.08, indicating significant risk due to the absence of valid regulation.

Deeper investigation supports this assessment. The discrepancy between the displayed regulatory logos and the platform's actual status, combined with conflicting branding and incomplete legal text, raises serious questions about its credibility. Most critically, the explicit warning from BaFin regarding identity fraud suggests that the platform is misappropriating the information of a legitimate UK firm, while CySEC confirms it operates without authorization. Investors are advised to exercise extreme caution.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

Amaraa Capital Scam Alert: Forex Fraud Exposure

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Currency Calculator