Abstract:FXCL Review shows revoked VFSC license, no valid regulation, and multiple withdrawal complaints. Traders should proceed with caution.

FXCL Markets Ltd., a brokerage claiming to have been established since 2006, offers a variety of trading instruments and account types targeting both retail and institutional investors. However, this FXCL review reveals critical regulatory issues, client complaints, and trading features that traders must consider carefully. This investigative evaluation draws exclusively from verified data in FXCLs official documents and market intelligence to provide an expert and balanced perspective.

FXCL Review: Regulatory Status and Legitimacy Concerns

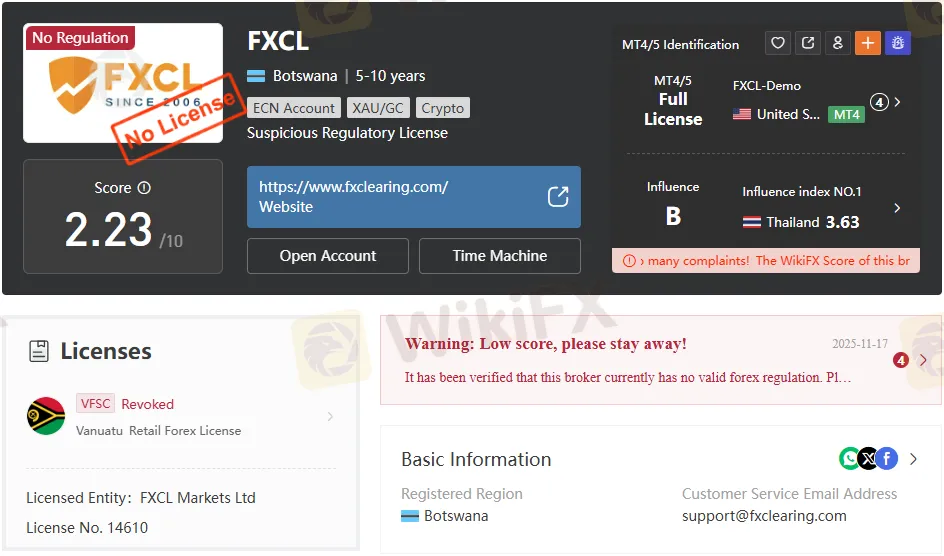

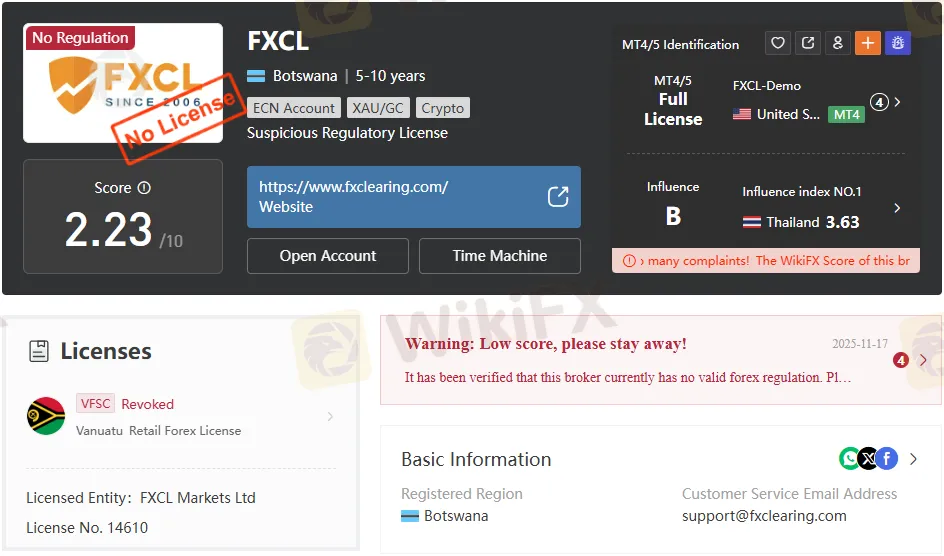

FXCL‘s regulatory status is a primary red flag. The broker held a retail forex license from the Vanuatu Financial Services Commission (VFSC), license number 14610, but this license has been revoked. There is no current valid forex regulation covering FXCL Markets Ltd. The company is registered in Botswana (UIN BW00005716042), not a typical financial regulatory hub, which contributes to the firm’s low trust score.

The lack of valid regulation has manifested in numerous complaints about unresponsive customer service, blocked withdrawals, and operational opacity. Reports indicate FXCL‘s refusal to disable Managed Account Manager (MAM) services, continued blocking of withdrawal requests, and failure to address client queries through official communication channels. The broker’s support emails and live chat are often unresponsive, with no verified phone support accessible. FXCLs active trading license, previously issued by VFSC, expired with no renewal or alternative licensing obtained, severely undermining its credibility. Given these factors, traders should exercise extreme caution when considering FXCL.

Account Types and Trading Instruments Offered by FXCL

FXCL provides a diverse portfolio of account types segmented by trading style and spread preferences:

- Cent and Standard Accounts: These come with fixed spreads starting from 1 pip, leverage options up to 1:1500, and accept a wide range of currencies, including USD, EUR, MYR, THB, ZAR, CNH, and JPY. Position sizes range from 0.01 to 200 lots.

- Floating Spread and ECN Pro Accounts: Spreads start as low as 0.1 pips (for ECN accounts) with leverage up to 1:12000 for forex, metals, indices, and cryptocurrencies. These accounts offer market execution and accommodate hedging. Position sizes can reach up to 500 lots depending on the instrument.

- Special Accounts: Including volume and live contest accounts tailored to high-volume traders or competitors.

Trading Instruments:

- Forex pairs

- Precious metals

- Commodities

- Indices

- Cryptocurrencies

MetaTrader 4 (MT4) is the primary platform offered, featuring multiple servers across regions for stability. FXCL also supports MetaTrader 5, expanding options for advanced traders seeking automated strategy capabilities.

FXCL Regulation: Risks Highlighted by Trader Complaints

Without active regulatory oversight, FXCL exposes clients to considerable risks. Verified client testimonials document:

- Multiple withdrawal delays or outright blocks

- Impossibility of revoking third-party MAM arrangements despite contractual provisions

- Non-responsiveness to emails and absence of live support

- Use of untraceable phone numbers by supposed representatives pressuring clients

Such practices raise alarms about potential fund safety and ethical conduct. The brokers low rating on third-party platforms and a WikiFX score of just 2.23 reinforce the warnings against engagement.

Deposit, Withdrawal, and Fee Structures

FXCL enables deposits and withdrawals through a broad spectrum of popular payment methods tailored to various regions, including:

- Help2Pay (local banks, QR, mobile payments in Malaysia and Vietnam)

- AsiaBank (local banks and QR)

- Dragonpay and Nganluong in the Philippines

- Alfacoins for cryptocurrencies like BTC, TRC20, LTC

Clients transact directly from their Traders Cabinet dashboard, allowing monitoring and cancellation of pending transactions.

Fee coverage is a promotional feature in place, limiting deposit fees coverage to $500 and withdrawal fee coverage to $100 per client monthly. However, FXCL reserves the right to reclaim these costs from client accounts via reverse compensation.

Withdrawal requests require profile verification and are processed within one business day, although delays up to 48 hours on deposits are noted, advising clients to keep a reserve balance to avoid disruptions.

FXCL Review: Pros and Cons Table

The Bottom Line

Despite FXCLs wide offering of trading accounts and instruments, the revoked VFSC license and the absence of regulatory oversight significantly compromise its trustworthiness. Multiple client complaints about withdrawal problems and poor support underscore operational risks. Traders seeking regulated, transparent, and dependable brokerage services should be highly cautious with FXCL. The lack of active regulation, coupled with the history of unresolved disputes, suggests prioritizing other brokers with recognized licenses and better client feedback.