Abstract:A 44-year-old man from Kuching has become the latest victim of an increasingly common online investment scam after losing RM333,576 through a website known as GINKGO-my.com.

A 44-year-old man from Kuching has become the latest victim of an increasingly common online investment scam after losing RM333,576 through a website known as GINKGO-my.com.

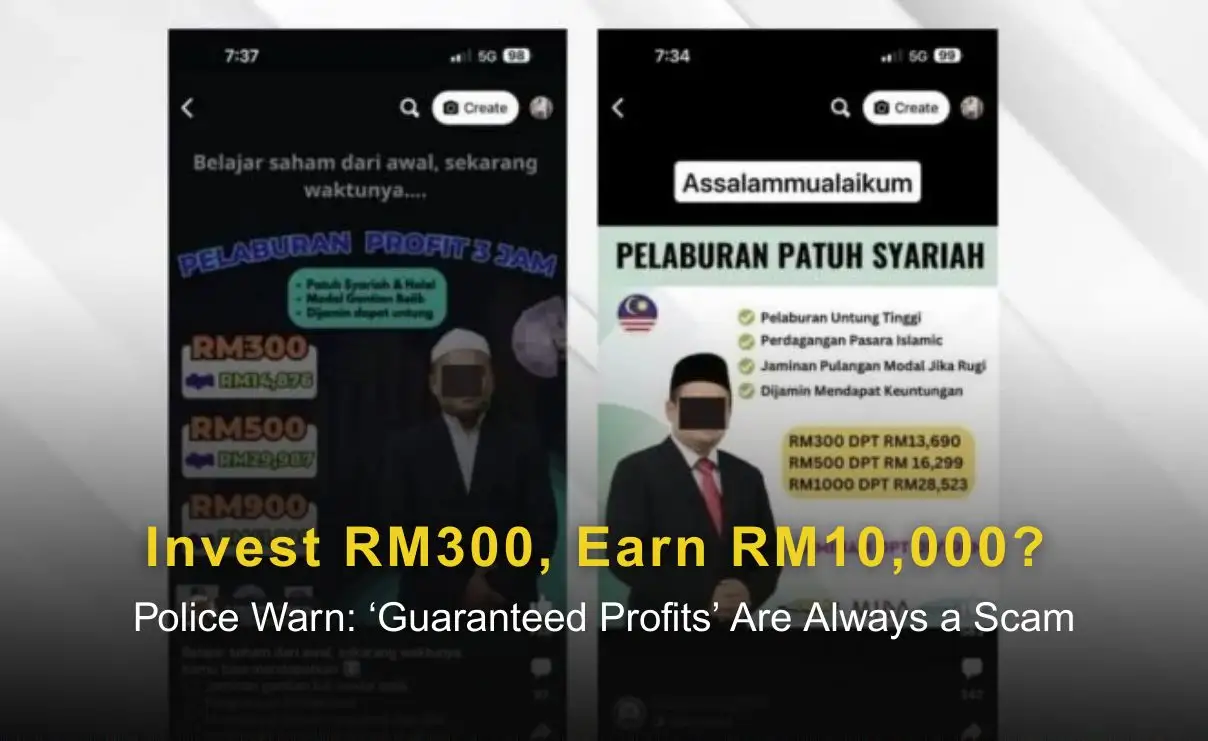

According to Kuching police chief ACP Alexson Naga Chabu, the incident began on 16 September when the victim noticed an investment advertisement on Facebook while he was at work. The promotion appeared convincing enough that he proceeded to register an account on the website that was being advertised.

From there, the scam unfolded in a familiar pattern seen across many recent cases in Sarawak. The victim was led to believe that he was placing funds into a genuine investment platform. Over the following days, he made 26 separate fund transfers into six different company bank accounts, with each transfer presented as part of the investment process.

Remember to never transfer in such a situation:

For a while, everything appeared normal. The online platform displayed rising profits, showing figures that suggested the investment was performing well. But when the victim attempted to withdraw part of his gains, he discovered that the system would not allow him to do so.

That was when he realised something was wrong.

ACP Alexson said the victims inability to withdraw any of the returns shown on the GINKGO-my.com platform prompted him to lodge a police report. The case is now being investigated under Section 420 of the Penal Code, which covers cheating and dishonestly inducing the delivery of property. If found guilty, offenders can face between one and ten years in prison, along with caning and a fine.

The police chief also revealed that this case is far from isolated. Between 1 January and 12 November this year, the Commercial Crime Investigation Department (CCID) at the Kuching District Police Headquarters recorded 101 similar online investment scams. These cases followed the same pattern of social media advertisements, fake trading platforms, and staged profit displays designed to lure victims into repeated transfers. The total losses from these cases have reached RM23.31 million.

ACP Alexson warned that social media remains the most common gateway for such scams, with criminals frequently using polished advertisements to create a sense of legitimacy. He urged the public to verify the status of investment platforms through the Securities Commission Malaysias official website before committing any funds.

He also reminded the public that anyone who believes they have been deceived or notices unusual withdrawals, suspicious account activity, or fake investment invitations should act immediately. Victims are advised to contact the National Scam Response Centre (NSRC) Hotline at 997 within the first 24 hours, as swift action can improve the chances of freezing transfers or tracing the suspects. Suspicious activities can also be reported directly to the Sarawak CCID or by email to the department.