简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Stonefort Securities Review: A Fair Look at Safety, Rules, and What Traders Say

Abstract:Traders looking into Stonefort Securities often feel confused because they find different types of information. The main question everyone wants answered is simple: is Stonefort Securities a safe broker or a risky choice? This question is not easy to answer. Some sources show the broker has serious rule problems and a very low safety score. But other sources show positive reviews from users who say it's reliable and helpful. This big difference creates confusion and means we need to look more carefully.

Traders looking into Stonefort Securities often feel confused because they find different types of information. The main question everyone wants answered is simple: is Stonefort Securities a safe broker or a risky choice? This question is not easy to answer. Some sources show the broker has serious rule problems and a very low safety score. But other sources show positive reviews from users who say it's reliable and helpful. This big difference creates confusion and means we need to look more carefully.

This review aims to clear up the confusion. We will not give a simple yes or no answer. Instead, we will do a careful study based on facts. By looking at the broker's rule status, company setup, user experiences, and trading conditions, this article wants to give you the clear information you need to understand all the risks and possible benefits. Our goal is to help you make your own smart decision about whether to use Stonefort Securities.

Main Findings and Warning Signs

For traders who need a quick summary, the evidence shows a very mixed picture. The broker's operations and rule framework has serious warning signs that go against reports of positive user experiences. To show this conflict clearly, we have organized the main findings into an easy comparison.

Stonefort Securities: Possible Good Points vs. Major Warning Signs

| Possible Good Points | Major Warning Signs |

| Reported Positive User Experiences: Several user comments praise the broker for smooth, easy withdrawals and helpful, knowledgeable customer support, specifically naming agents like Hassan and Jack. | Very Low Rule Score: The broker has a very low score of 3.07 out of 10, with a direct and serious warning: “Low score, please stay away!” |

| MT5 Full License: The broker uses the MetaTrader 5 platform and has a full license, which suggests a standard and stable technical setup for trade execution. | Serious License Problems: The broker's UAE SCA license is only for “Investment Advisory” and is called a “Non-Forex License.” It is flagged for going beyond what this license allows. |

| Specific Account Options: For its Elite account, the broker offers clear conditions, including leverage up to 1:200 and spreads starting from 0.1, giving some clarity on trading costs. | Offshore Registration: The main registration is in Saint Lucia, a place known for less strict financial oversight and weaker investor protection rules. |

| Short Operating History: With only 1-2 years in operation and a related company started in 2024, the broker lacks a long-term record of stability and reliability. |

The main point is that Stonefort Securities presents a high-risk choice. The facts that can be checked point to basic problems with its rule authority to offer forex trading services. These structural problems are much more important than the unverified positive reviews, creating a risk level that most careful traders would find unacceptable. For the most current score and to personally check any new rule warnings, traders should always look at the broker's current profile on WikiFX.

The main point is that Stonefort Securities presents a high-risk choice. The facts that can be checked point to basic problems with its rule authority to offer forex trading services. These structural problems are much more important than the unverified positive reviews, creating a risk level that most careful traders would find unacceptable. For the most current score and to personally check any new rule warnings, traders should always look at the broker's current profile on WikiFX.

Detailed Look at Rules

The most important factor in judging a broker's safety is its rule standing. This is not just paperwork; it is the entire system that protects client money and ensures fair practice. In the case of Stonefort Securities, the rule picture is not just weak—it is alarming. A detailed look shows critical mismatches and a reliance on offshore places that offer minimal protection to traders. This section breaks down the three main parts of its rule status and explains the serious risks each one means.

UAE SCA License

At first look, a license from the United Arab Emirates Securities and Commodities Authority (SCA) might seem reassuring. However, the details are what matter. Stonefort Securities LLC holds an Investment Advisory License, No. 20200000226, valid until November 3, 2025. This is the first major warning sign. An investment advisory license is basically different from a brokerage license that allows a firm to execute trades, hold client funds for forex, and act as a counterparty. An advisory license typically allows a firm to provide financial advice, not to operate as a full-service forex broker.

This difference is clearly confirmed by the warning that comes with it: the broker “exceeds the business scope” of its license. This is a critical point. It suggests that Stonefort Securities is offering services, such as forex and CFD trading, that it is not legally allowed to provide under its UAE regulation. Operating outside the scope of one's license cancels the supposed rule protection. A regulator cannot enforce rules for activities it has not licensed. For a trader, this means that if you are doing forex trading with them, you are likely not covered by the SCA's oversight, leaving you without help in case of a dispute, withdrawal problem, or bankruptcy. This is a non-forex license being used to attract clients for forex trading, a classic trick seen with high-risk operations.

Offshore Company Setup

The broker's company structure adds another layer of risk. The main registration is listed in Saint Lucia, a popular offshore place. Offshore financial centers are often chosen by brokers precisely because they offer minimal rule oversight, low capital requirements, and a company shield that is difficult for wronged clients to break through. Should a dispute happen, trying to take legal action against a company registered in Saint Lucia is an expensive, complex, and often hopeless exercise for an individual trader.

Furthermore, the situation is made more complex by the presence of related companies. The data shows a Stonefort Securities Ltd in Mauritius, which was just started in June 2024. The MT5 servers are also linked to Mauritius and a demo server to Singapore. This multi-country, offshore setup creates confusion. When you open an account, which company are you making a contract with? Is it the UAE advisory firm, the Saint Lucia company, or the new Mauritius company? This lack of clarity is often intentional, making it difficult to assign blame and seek help. Good brokers typically offer clear legal terms that specify which regulated company the client is dealing with. The complex and offshore nature of Stonefort's structure is a significant warning sign.

Read Stonefort Broker in India: A 2025 Complete and Fair Review- www.wikifx.com/en/newsdetail/202511072594703374.html

Official Warning

Beyond the license problems, the broker's profile comes with one of the most direct warnings possible: “Warning: Low score, please stay away!” This is not a subtle hint; it is a clear instruction to avoid the broker. This warning is a result of the low overall rating index of 3.07 out of 10 and a very low influence score, which is given a “D” rating. These scores are calculated based on factors including rule quality, business practices, risk management, and software setup.

A score this low, combined with such a clear warning, shows that the broker has failed to meet the most basic standards of safety and legitimacy. It reflects the serious risks identified in its licensing and offshore structure. While traders may be tempted to dismiss such warnings, they are put in place to protect the public from companies that show the characteristics of potentially fraudulent or dangerously mismanaged operations. Ignoring such a clear red flag is a gamble that few can afford to take.

Looking at User Experience

In sharp contrast to the damaging rule evidence, there is a collection of user-submitted reviews that show Stonefort Securities in a positive light. These twelve reviews, all positive, create the central conflict for anyone researching the broker. They speak to a smooth operational experience, which is what every trader hopes for. However, it is crucial to analyze these comments with a healthy dose of doubt, especially given their verification status.

Common Positive Themes

The positive feedback, gathered from users in India, Indonesia, and the United Arab Emirates, groups around several key themes. These reported first-hand experiences touch on the most common pain points in the retail forex industry.

· Smooth Withdrawals: Several users clearly state that withdrawals are “very smooth” and “hassle-free.” One user from Indonesia notes that while withdrawal problems are common with other brokers, their experience with Stonefort has been seamless. This is a powerful testimonial, as withdrawal issues are a primary complaint against fraudulent brokers.

· Responsive Customer Support: Specific account managers, “Hassan Abdulla” and “Jack,” are mentioned by name multiple times. They are described as knowledgeable, professional, responsive, and supportive. Users report that these agents take the time to explain market movements, provide daily updates, and are readily available to answer questions. This level of personalized, proactive support is a significant selling point.

· Platform Performance: The trading platform, which includes the Stonefort Trader app and a dashboard, is described as “user-friendly,” “smooth,” and having “fast execution.” One user praises the dashboard for its clear, real-time charts that help track performance.

· Transparent IB Program: An Introducing Broker (IB) praises the partner program for its transparency, real-time commission tracking, and reliable, fast payouts, noting these are features every IB values.

Warning About Reviews

While this feedback appears compelling, it comes with a critical warning: all twelve reviews are marked as “Unverified.” This is a vital piece of context that must not be overlooked. The “Unverified” status means that while the comments have been submitted to the platform, their authenticity has not been independently confirmed. There is no way to know for sure if these reviews come from genuine, distinct clients of the broker.

This lack of verification opens the door to several possibilities. The reviews could be from legitimate, satisfied customers who have had genuinely positive experiences. Alternatively, they could be part of a coordinated marketing effort, sometimes known as “astroturfing,” where a company creates fake reviews to build a facade of credibility. The fact that all reviews are positive, with no neutral or negative feedback, is statistically unusual for any business and can be a red flag itself. Therefore, while this social proof should be noted, it cannot be given the same weight as the facts that can be checked concerning the broker's regulation. To see if any new, verified reviews have been posted or to read the full comments for yourself, you can explore the user reviews section for Stonefort on WikiFX.

Trading Platform and Accounts

For traders still considering Stonefort Securities despite the rule risks, a look at the practical trading conditions is necessary. The broker provides some details about its account structure and technology, which can help in judging a part of its operational capabilities. However, the information is incomplete, which is another point of concern.

Account Levels and Costs

Stonefort appears to offer a tiered account system, with “Starter,” “Advanced,” and “Elite” accounts. However, concrete details are only provided for the top-tier account.

The Elite Account is specified with the following conditions:

· Minimum Deposit: $10,000

· Maximum Leverage: 1:200

· Minimum Spread: From 0.1

· Commission: $7

A $10,000 minimum deposit places this account firmly in the premium category. The 1:200 leverage is relatively standard, though high leverage from a lightly regulated broker magnifies risk significantly. A spread from 0.1 plus a $7 commission per lot is a competitive pricing structure, comparable to many established ECN/STP brokers. The significant issue here is the lack of information for the “Starter” and “Advanced” accounts. This lack of transparency makes it impossible for traders with smaller capital to know what conditions to expect, preventing them from making a fair comparison with other brokers.

Technology and Setup

On the technology front, Stonefort Securities uses the well-known MetaTrader 5 (MT5) platform. The broker holds a “Full License” for MT5, which is generally a positive sign. A full license is more expensive and comprehensive than a white-label solution, suggesting the broker has invested in a stable technical setup. This can lead to better execution speeds and more reliable service compared to brokers using cheaper, less robust white-label platforms.

The server setup provides further technical details. There are two MT5 servers identified: “StonefortSecurities-Server” and “StonefortSecurities-Demo.” Both are located in Mauritius, aligning with the location of their newer company. An additional demo server is also noted in Singapore. The physical location of servers can impact latency and execution speed for traders, depending on their geographic location. While the presence of a full MT5 license is a point in the broker's favor from a technical standpoint, it does nothing to reduce the far more serious rule and safety concerns.

Final Decision on Stonefort

Our deep dive into Stonefort Securities reveals a broker defined by a dangerous contradiction. On one side, we have a series of unverified but glowing user reviews praising its service, support, and withdrawal process. On the other, we have a mountain of facts that can be checked pointing to serious rule problems and an operating model that relies on a weak, offshore legal structure.The final decision must be based on weighing this evidence. The positive reports, while appealing, are unverified social proof. They cannot and should not override the hard facts. The broker's primary license is for investment advisory, not for forex trading, and it is clearly flagged for operating outside this scope. Its registration in Saint Lucia and Mauritius offers clients little to no meaningful rule protection or legal help. The extremely low safety score and the direct, public warning to “stay away” are the clearest indicators of unacceptable risk.

While it is possible that some users have had positive experiences, these experiences exist outside of a proper rule safety net. The decision to trade with Stonefort Securities is a decision to accept this basic risk. The evidence strongly suggests that the potential for smooth operations is overshadowed by the potential for catastrophic loss with no one to hold accountable. Ultimately, the evidence points to substantial risks that cannot be ignored. We strongly encourage all traders to conduct their own thorough research, and a vital step in that process is to carefully review the broker's complete and up-to-date profile on WikiFX before committing any funds.

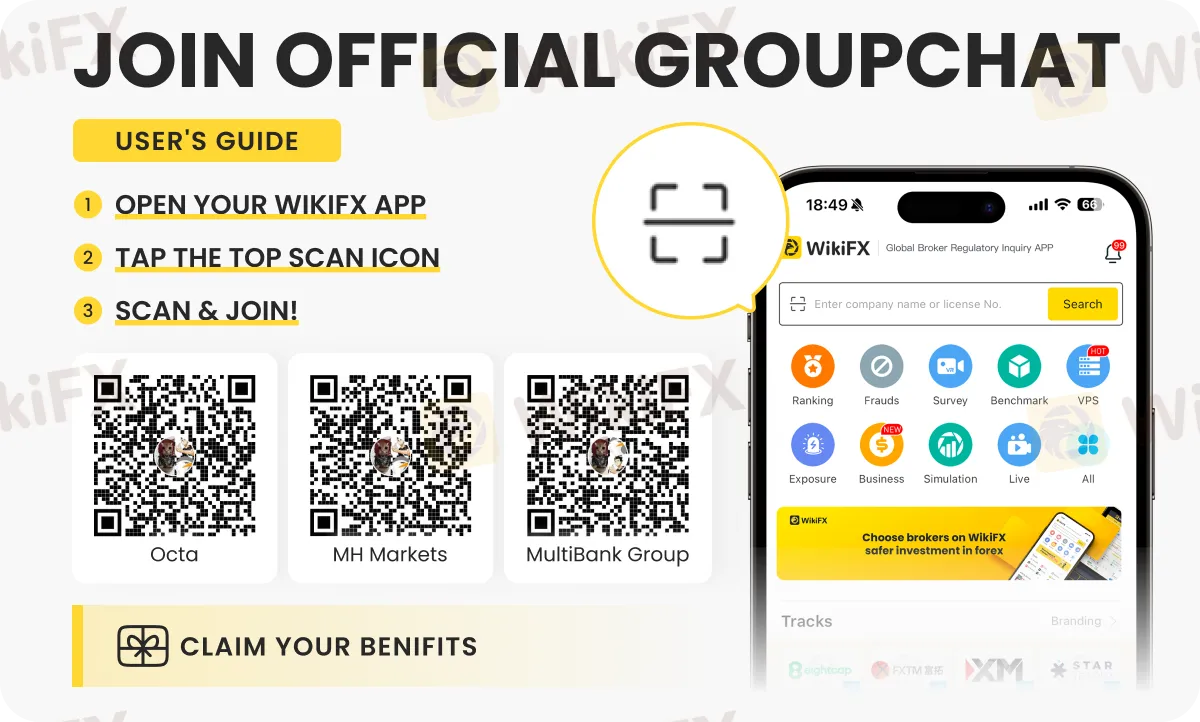

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

RM115 Million Lost in a Month: Are Malaysians Underestimating Investment Scams?

Invest RM300, Make RM10,000? Police Say It’s a Scam

XBTFX Review: Beware of Offshore Regulated Forex Traps

FX Markets: King Dollar Reigns Amid Chaos; BoJ Eyes "Neutral" Rates

War in the Middle East: Oil Spikes and Stocks Tumble as Conflict Enters "Uncharted Territory"

Geopolitical Conflict Drives Gold Rally as Insurers Cut Gulf Coverage

Middle East Tensions Rattle Risk Sentiment: Airspace Closures Signal Supply Fears

Oil Markets Rally as Escalating Middle East Conflict Threatens Supply Lines

Investment Scams That Could Be Targeting Malaysians Right Now

Currency Calculator